Here is Paul Krugman responding to the latest economic data:

While we shouldn't make too much of one month's report, pretty clear that economy is still running too hot, which isn't really a shock given everything else we know. The puzzle — and I'm genuinely puzzled, without strong priors or a political axe to grind — is why it's so hot 1/

— Paul Krugman (@paulkrugman) February 24, 2023

At the risk of sounding like an idiot, is the economy running hot? The usual answer is that unemployment is at 3.4%, which indicates a tight labor market and therefore economic hotness. But what about all the other economic data available to us?

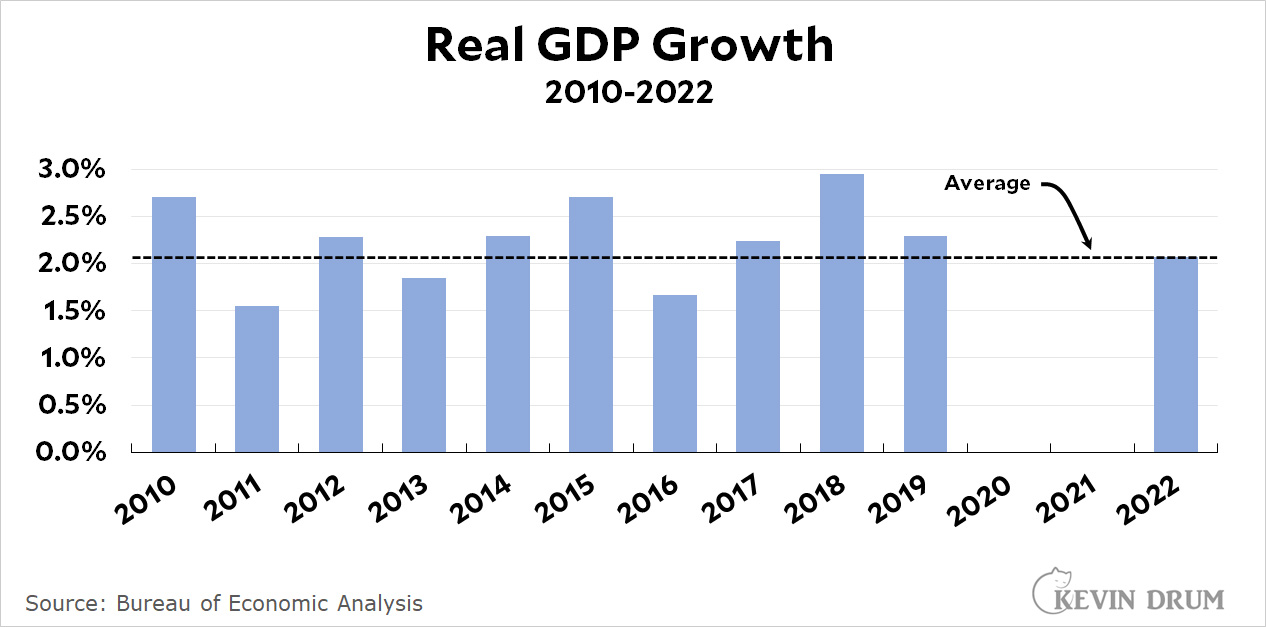

- GDP increased 2.1% in 2022. This is precisely average for the past decade.

.

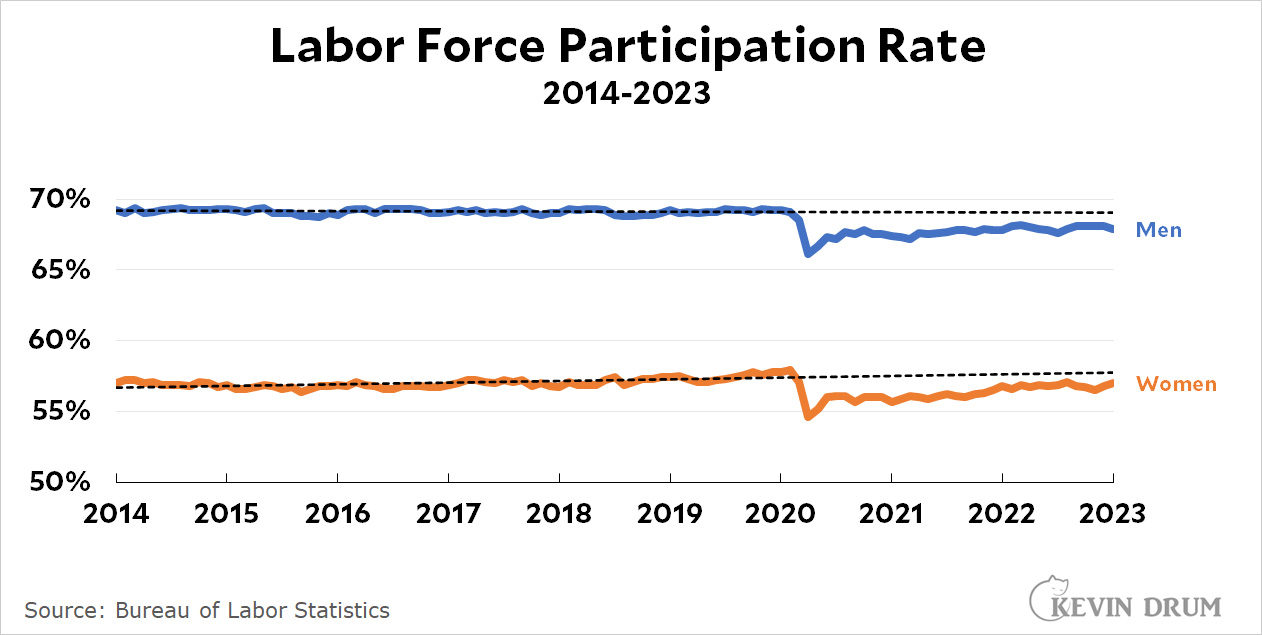

- The Labor Force Participation Rate is currently at 62.4%. That's one percentage point lower than it was just before the pandemic. Over the past year it's been flat for both men and women. Prime age LFPR has grown a bit over the past year, but is still lower than it was before the pandemic.

.

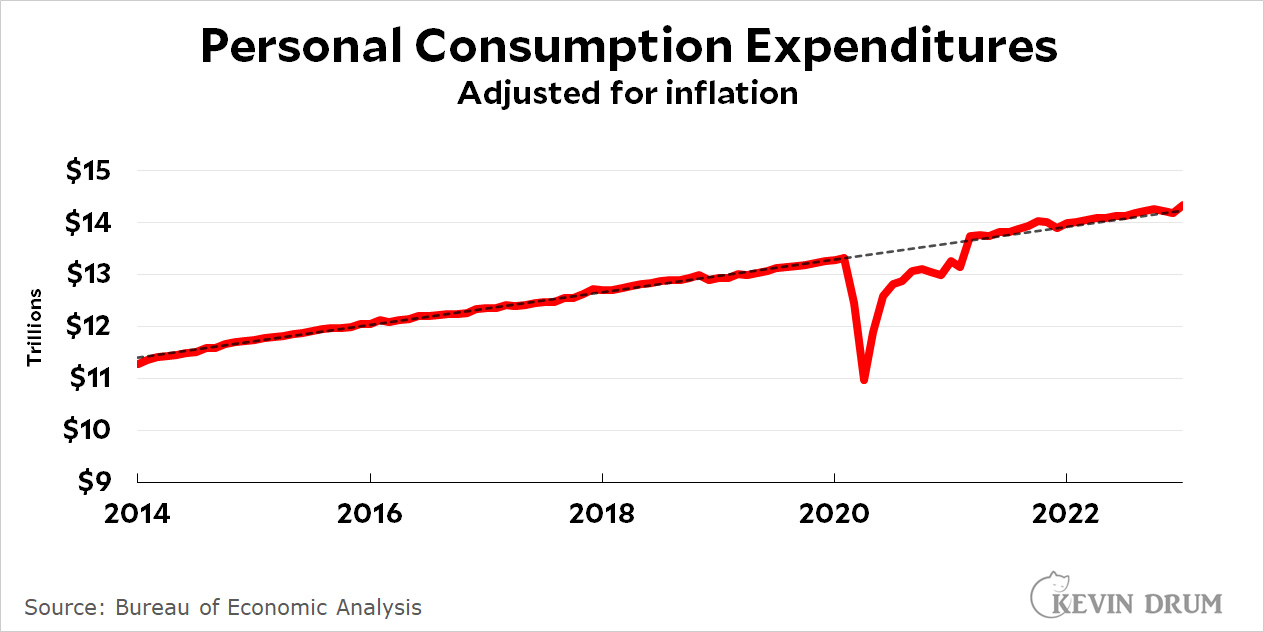

- Personal spending is on the same trendline as before the pandemic:

.

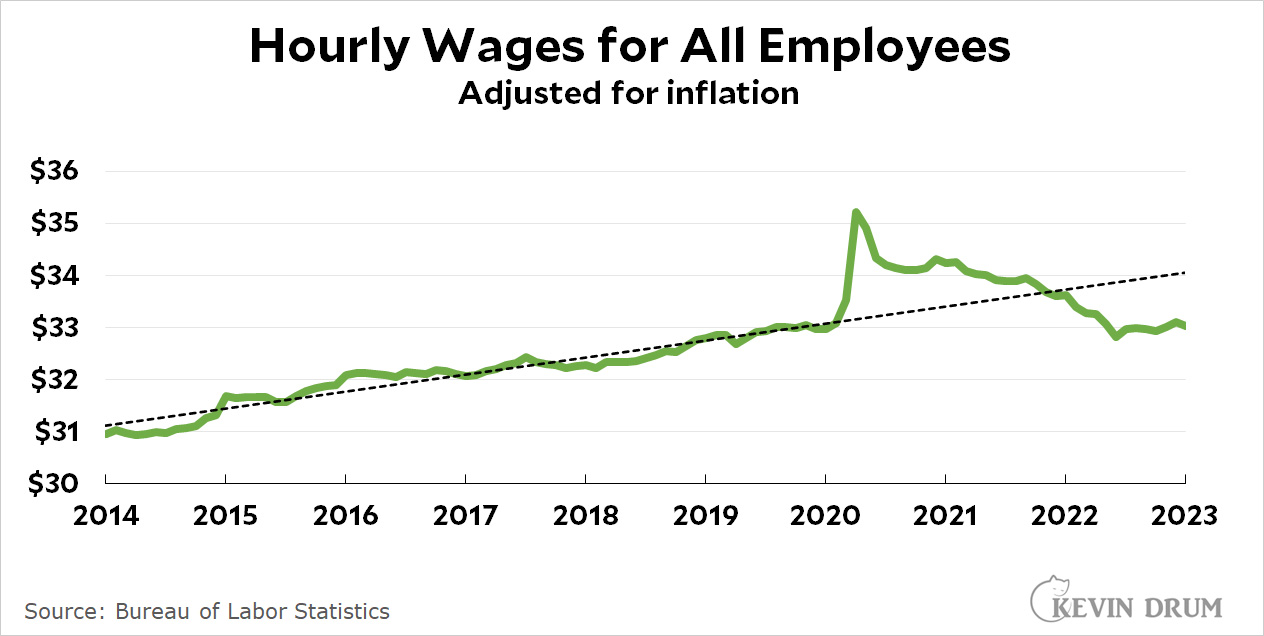

- Real wages spiked when the pandemic hit, then fell for two years, and have been flat since mid-2022. The average hourly wage is now exactly the same as it was just before the pandemic. In other words, real hourly wages have increased 0% over the past three years and are not increasing now.

.

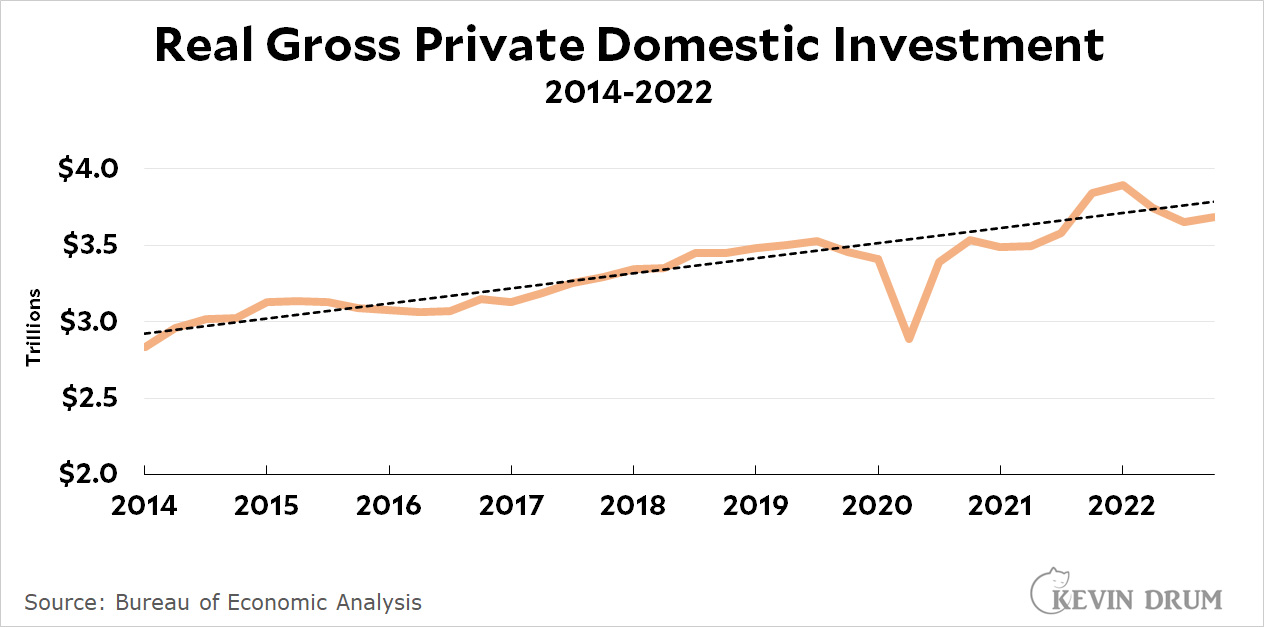

- Gross private investment is generally on its pre-pandemic trendline. However, it declined 4% over the past year.

.

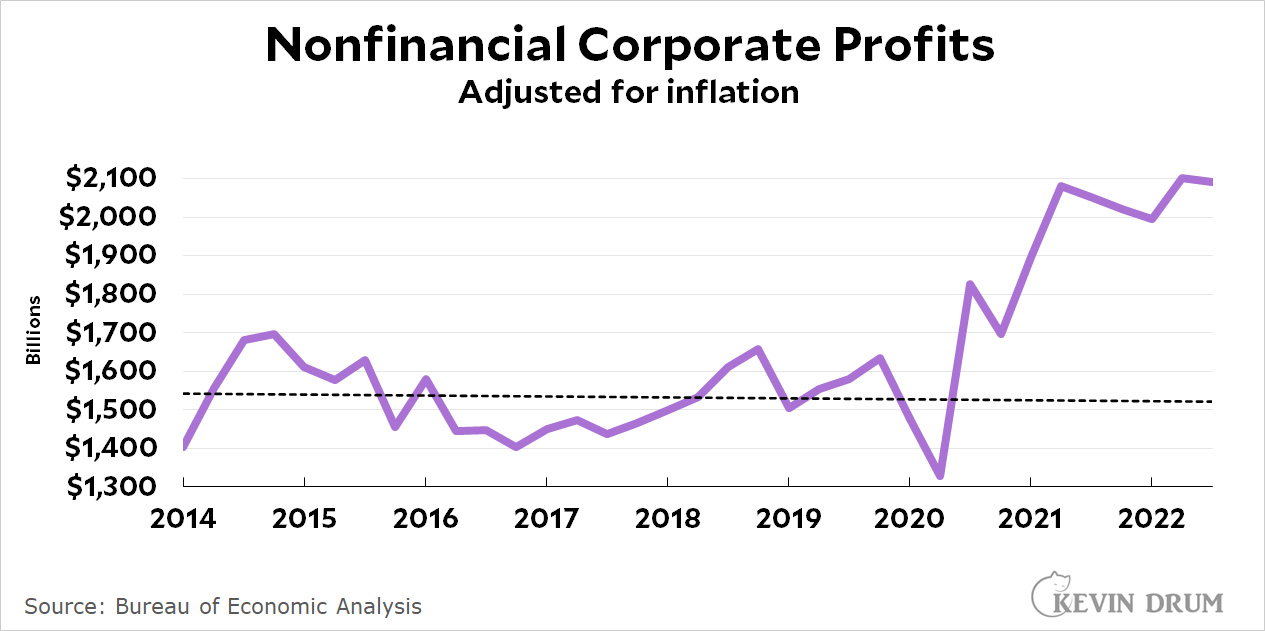

- And then there's this:

.

The only thing that seems especially hot right now is corporate profits. Everything else is firmly in the "OK but not great" category.

So please: go ahead and school me. Aside from a low unemployment rate—which is an iffy measure of the labor market—what exactly is it that's convincing the Fed and so many others that our economy is running too hot?

POSTSCRIPT: And to make the obvious point: If the economy isn't running especially hot, then high inflation is due to temporary artificial factors like a bit of remaining supply-chain stress, mounting credit card debt, and the modest amount of excess savings still left in consumer bank accounts. Those are all going to fade away on their own within the next few months.

NOTE: As usual, the trendlines are all based on data through February 2020 and then extended to the current month. This gives you an idea of where we'd be if we had simply continued on our pre-pandemic trend.

Ruh Roh…. There’s that darn transient thing again. Luckily it’s transient like it has been for the past year and a half.

Yeah. I love Kevin and find most things he's said about this persuasive. Yet everything he's predicted has been totally wrong. At some point: Who are you going to believe, Kevin or your lying eyes?

Not sure I agree with that. I still believe the “transitory” argument is likely to prevail over the “persistent” side, but that inflation will take some time (2 1/2 to 3 1/2 years) to fade rather than just a few months (or a decade-plus).

As far as predictions go, the Fed’s track record leaves a lot to be desired. They continue to talk about a return to 2% inflation, which is not just a bad prediction but bad policy. It’s too low for the kind of long-term growth we need to see in the economy. We don’t want a rerun of the past decade.

Time will tell, but my guess is we’ll look back on this period and conclude the Fed waited too long to hike rates from zero, then went too far in the other direction.

A note on the Jan inflation number: There’s some evidence the “hot” reading came because of the warm weather much of the country experienced. A much colder late winter could be the cure that inflation worriers need to see.

I’m too lazy to go back and confirm (actually I’m too embarrassed to admit that I don’t know how to go back and confirm) but I’m pretty sure that at the start of this inflationary period Kevin and TeamTransitory were talking in terms of months and not years. I really don’t know much about this but sometimes I just like to “poke the bear” (Kevin). Mostly I enjoy the cat blogging….

I've posted several excerpts from 2021 (below)

Anything that is exogenous requires the externalities to be fixed/eliminated. The longer they take to be addressed, the more inflation expectations become entrenched, or at least appear that way to the Fed and therefore will result in a strong response. All within the last 12 months:

- War, causing disruptions and reallocation of wheat, fertilizer, creating downstream cost increases to flour, bread, produce. Additionally, fuel prices affected downstream production with shutdowns in Germany for the second half of 2022. You can see this in fertilizer prices -- https://bityl.co/HLg0

- Avian Influenza resulting in the culling of millions of birds affecting chicken, turkey, and egg prices, that will continue through the first half of this year unless another breakout occurs.

- COVID, specifically China's continued total lockdown policies (which only just ended last month) resulting in ongoing production disruptions of export goods. Even with China being mostly open throughout 2022, Feb shipping price Shanghai - Los Angeles remains 33% higher ($2000 vs $1500 per 40' container) than before the pandemic.

Some externalities don't involve too much disruption. Baby formula, for instance, was fairly quickly addressed within a month. Others take a while to figure out, and doing so will involve higher prices -- that's Capitalism at work, after all.

There’s no law of nature that says exogenous economic ‘shocks’ can’t co-occur, or arrive in close succession.

Unless words have no meaning, "transitory" "side" - as Krugman himself said has been wrong. To say it will "prevail" is to engage in motivated reasoning and reframing to avoid acknowledgement of error.

As for Fed: .... a target is not a prediction so your comment here is just utterly confused and incoherent. Now, 2% inflation target is a highly discussable target however Fed will not openly change that target (which is anyway approximative) while in the midst of inflationary episode. There are many reasons not to including political. There was a wide sense during the whole Zero Bound period that 2% wasn't the right choice and it is likely to be revised, but like things political - the 2% target is a political item as much as a econometric and financial one - it won't be revised in hot moment.

This is wrong.

You're mistake is in combining the argument that inflation is 'transitory' (ie based on temporary conditions that will resolve without requiring higher interest rates, slowing demand and raising unemployment) with predictions of when those temporary conditions will be resolved.

Yeah. I love Kevin and find most things he's said about this persuasive. Yet everything he's predicted has been totally wrong

With regard to inflation, I've been pretty tough on Kevin myself. However, when did the current spike in inflation begin, about mid-late 2021? Does that sound about right?

Well, the classic example of "transitory" inflation was right after WW2, and that episode lasted just about two full years. So, what we're going through now may not be an example of "team transitory is wrong" so much as "the transition is longer than I'd like."

Or maybe not. But it's far from clear Kevin's wrong about any of this. We'll probably know definitively by autumn.

Agree. When you’re old, a couple of years is ‘transient’. 🙂

Well, the charts he shows say that there is little to no inflation, if you subtract the corporate profits. I'd like to see a straight across comparison that matches real dollar amounts for "inflation" and corporate profits (which I admittedly am not able to do). If it's just corporate profits justifying raising prices for more corporate profits, is "inflation" the right word without an adjective in front of it?

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article... https://createmaxwealth.blogspot.com

I think the phrase “running too hot” is usually an assessment of the nominal economy. I am a supporter of adjusting data for inflation, but in this case, I think the whole point is that price increases are eating up the benefits of our large *nominal* economic growth, so if you adjust for inflation, of course it will look like weak growth.

And it’s an assessment that says “people want to spend money but we don’t have any more productive capacity so instead of selling more goods and services we’re just charging higher prices for our goods and services.” The best solution to that would be to increase the productive capacity of the economy, but another way to deal with it is to make people want to spend less.

The second tool is the one that is controllable by the Fed so that’s what they’re doing.

Increasing production costs money. Raising prices doesn't--much better for the bottom line.

Real competition might drive more production if someone tries to grab market share.

Businesses gonna business. For-profit companies will charge the amount for their goods or services that maximizes their profits. This has been true forever, and does not explain the recent inflation. Or are you suggesting that businesses only got greedy in the spring of 2021?

Increasing our productive capacity includes allowing more legal immigrants to lessen the labor pool imbalance. It includes removing barriers to investment like restrict zoning and environmental review laws. And yes, it includes stricter antitrust enforcement, so that we have robust competition that ensure maximal efficiency.

Businesses have been getting more concentrated in recent decades. They aren’t any more greedy than they ever were, they just have more pricing power. And price increases driven by Covid, bird flu and war give them cover to raise prices just to goose profits.

But the question here is whether or not the economy is running too hot...ie, is there too much demand and our ability to increase capacity cannot possibly keep up? I dont think anyone would describe fast nominal growth as 'running too hot'. If that were true then all growth would be too much growth because it shows up as nominal growth.

Its not at all clear that we cannot increase capacity and the does Fed plays a huge role in how expensive it is for public and private entities to fund capacity expansion projects.

What you think has literally no basis in actual analytics.

Fast nominal growth that is generating inflation - which is the acceleration of nominal prices as the market mechanic reflecting demand running ahead of capacity to respond to demand, this is literally what the running too hot phrase refers to. Your conclusion arises from a fundamental lack of understanding of the subject.

You arent correcting or disagreeing with anything i said.

But it is clearly important for you to declare victory by calling others stupid. Way to win the internet. lol

Correct: it's nominal view relative to inflation - deflating the metrics in such a case is hiding the issue

Back to linear trendliness? ....

I wonder if what Krugman is trying to say is that the economy should been affected more by rates rise and thus is “hotter” in a relative sense. Of course we all know that it takes a while (6 mos to a year) for rates to have an impact so maybe the fact that we are not really feeling too much of a detriment is the cause of his comments but I think it was too early to come to any conclusions. Unemployment is low because the participation rate is low, inflation is waning and it really was not that high (corporate profits are a big tell here). Government spending is certainly having a stimulative effect so it would seem the economy should be growing at the current modest pace. If somehow we were able to end a lot of the uncertainty out there (e.g., recession expectations, interest rates, war, rare earth sourcing, construction), I would then expect expect the economy to grow above average but we are one or two years away from that potential scenario.

In other words, the public looked at inflation measures, looked at their own experiences, and said, "Meh... let's go on vacation again!"

And the so called poor people who actually noticed? No one really gives a crap about them.

How about looking at restaurants as a measure?

https://www.cnn.com/2023/02/25/business/restaurant-closures/index.html

Apparently not doing well at all.

Nope nope nope. Krugman says the economy is running hot, so it’s just that there is an epidemic of bad restaurateurs. Obviously.

Tedious straw men

We don't all take ourselves as seriously as do you.

And to make the obvious point: If the economy isn't running especially hot, then high inflation is due to temporary artificial factors

That's the most likely explanation if the economy isn't running hot, sure. But I think "obvious" is a bit strong. One other possibility is stagflation: structural, longer term changes have occured, and perhaps calcified in the form of expectations and widespread behavior, and so merely "cooling" the economy won't be enough, because inflation will be persisitentely, uncomfortably high even with lower growth and possibly (for an extended period, in any event) even with recession. If so, we'd all better hope Republicans nominate a non-insane person.

re: "high inflation is due to temporary artificial factors.... Those are all going to fade away on their own within the next few months"

July 12, 2021

[US news industry] will simply take any opportunity, no matter how trivial, to hoist the red flag of high inflation right around the corner.

--------------------

July 13, 2021

THE ONLY ADJUSTMENT THAT REALLY MATTERS IS TO GO FORWARD IN TIME and see if inflation settles down once the economy adjusts to its grand reopening. But that's one adjustment we're just going to have to wait for.

--------------------

August 27, 2021

So while it's still high by historical standards, IT'S PLUMMETED TO HALF OF WHAT IT WAS JUST A FEW MONTHS AGO. This suggests that the momentum behind high inflation is starting to ease.

--------------------

September 14, 2021

Since the headline number usually follows the core [CPI] number, this SUGGESTS THAT INFLATION IS LIKELY TO HEAD EVEN LOWER over the next few months.

--------------------

October 13, 2021

As always, THIS IS JUST ONE MONTH OF DATA AND NOT SOMETHING TO BE PANICKED OVER.

[I tracked Kevin's posts about inflation throughout 2021. This is just a subset. I quit tracking the following year because it was mostly the same kind of commentary.]

The "next few months" has become Drum's "Friedman Unit" - he has literally fallen into the same reasoning as Friedman in the Iraq War.

Leaving aside the utter vacuousness of a statement that calls anything in human economy artificial - as of course all of our economy is 'artificial' in the usual sense.

If you redo the GDP but using nominal figures, you see that the economy *is* running quite hot relative to the prior decade, though Fed action has definitely slowed it down. Again, if you believe inflation is temporary, nominal data will give you a better sense of what's going on.

Recall, a half year ago people were claiming we were in a recession because there were two straight quarters of negative real GDP even though it was clear that the problem wasn't lower GDP but higher inflation, and strong employment reflected that we weren't in a recession.

Don't be dogmatic just because you learned things one way.

>nominal data will give you a better sense of what's going on

Ah, no. There are three measures here, real GDP growth, nominal GDP growth and inflation rate, but only two 'degrees of freedom'. So if you know any two, you can calculate the third, but if you know only one, you have no information about the other two.

High inflation persists because of corporate price gouging, now; other factors resolving provide further opportunities for it. I say let them have all the price-gouged profits they can steal. They deserve it. Let them gorge themselves and choke on their profits. They worked hard for it. They earned it. And they deserve to fail stuffing themselves with it.

Everything Kevin posts is accurate. Also, I think he's neglecting market and consumer expectations. If people anticipate inflation, they create inflation by purchasing now and postponing saving. Companies increase prices because resistance to higher prices is relaxed.

I mean, that's the whole reason "consumer sentiment" is an economic indicator, isn't it?

Literally noone is going to make significant purchase decisions based on a wild guess between 1%, 2%, 3.5% and 6% inflation over the mext few weeks or months.

Who would buy $100 widget to avoid paying $101 to $102 a few months in the future? Especially when you dont have any certainty that prices will increase.

You cant really buy ahead and store the major inflation items (housing, fuel, food) anyway.

This is one of those textbook ideas that has no bearing in the real world.

That is like most of your bald assertions false, inflation expectations are not a "text book idea" with no real world bearing but rather an observation and insight arising from multinational comparitive cases and time-series. Point expectation numbers are not important as magnitudes, but the impact of expectations on broad behaviour of groups of actors emerges clearly in data, most clearly of course in sustained high inflation economies but broadly.

There is extensive econometric research and data that have laid the basis for insights on the broad impact of inflation expectations on market actors behaviour - which really in the end in the world of Behavioural Economics is not a surprising result given actors, consumers, businesses typically try to use simplifying heuristics and plan the present into the future, or rather their image of the present. Broad expectation of future inflation changes internal calculations.

Of course the over-simplified journalist or Econ 101 course understanding people have led them to ignorantly assert things.

The point is, whether expectations-driven inflation is a real thing, or not, this is not it, because the categories that have been showing the highest rate of price increases cannot be purchased in advance, either because they are perishable, or because storage capacity is limited.

You did assert that “the impact of expectations … emerges clearly in data”. Please cite some research, TIA.

We know you are super smart, probably super double (or even triple!) smart....but my point still stands.

I do respect that you have based your argument on the long- standing economic theorem of 'you are dumb and i am smart!

Kudos. Youre winning the internet.

I’ve said this before, but I’ll say it again - expectations-driven inflation should show up as a higher increase in prices of durable goods, relative to perishable goods. Is there any evidence of that? (No!)

I see jdubs has noted this, also. Thumbs up!

An underappreciated/discussed factor is that Americans werent impoverished when worldwide capacity restrictions occurred.

The normal course of business is that many, many billions in cash and assets disappear when capacity restrictions force people out of work. This new lack of capacity is offset by a new lack of money to buy assets.

But that didnt happen. We can see that capacity has not sprung back as quickly as originally thought as housing and auto supply chains have taken forever, drought/bird flu dont fix easily, war hasnt ended and sick/dead people are still sick or dead. None of these are areas that higher rates will improve quality of life.

Taking a longer term view, 5 to 15 year inflation rates back to the 2010's are not higher than the Feds stated target. Its not clear that there is an inflation problem in need of solving. Perhaps the low inflation in the years prior to covid created a fragile economy that wss unable to deal with capacity problems and we should be cautious in recreating those problems.

Telling consumere and business that they will be smacked with higher rates every time demand slightly outpaces supply isnt a way to create an ability to ramp up supply. But it does discourage investment and create a situation that closely resembles where we are now.

Business investment does not occur in the way your ignorant just so complaint goes...

How are business investment decisions made?

You spend a lot of time focused on how dumb others are. Please try to break out of your mental trap and wow us with some insights.

As noted in another comment: running too hot is a comment on Nominal economy - and inflation directed. Deflating and looking at real growth is entirely misunderstanding and missing the point that is normally meant, which that demand in some forms and fashions is running ahead of supply (generally, for sub-sets of demand categories), and pushing up prices more than real economic activity.

Drum's posting is a long non-sequitor misunderstanding what Krugman is reflecting on.

Ending with yet another strange assertion about next few months (and weird usage of "artificial" relative to the entirely artificial activity of human economies).

The ongoing posting by Drum mixing nominal and real subjects reflects essentially a fundamentally misunderstanding of the subjects.

For example: "Real wages spiked when the pandemic hit, then fell for two years, and have been flat since mid-2022. The average hourly wage is now exactly the same as it was just before the pandemic. In other words, real hourly wages have increased 0% over the past three years and are not increasing now."

This is simply wrong-headed relative to inflation analysis. If Real Wages kept up with nominal inflation, inflation would hardly be a nasty political subject nor such an issue relative to economic distortion at elevated levels (normally understood to be the high single digits onwards to double digit etc). They don't, so it's ... "not even wrong" as an observation. It is exactly what one expects in inflation that real wages fall, as wages are much stickier by mechanics - contracts, etc- than service or goods prices all things being equal. This is not new, not surprising and is irrelevant to diagnosis or if the economy is "running too hot" except to the extent that falling real wages in a condition of elevated inflation are a symptom. If real wages were rising then generally speaking there would not be inflation as a problem as it would generally indicate rising productivity and returns, which would indicate productive economy has the capacity to respond to demand in a healthy productive way (as price rises are a response to supply-demand mismatch).

If Drum wants to do a pure real analysis (i.e. deflated analysis) he needs to do that ALSO relative to Fed reference rates, borrowing rates, to see Real Rates. Nattering on about Fed Rates on a Nominal Basis and then turning to deflated Real metrics is fundamentally incoherent (reflecting either poor understanding of the subject or dishonesty, here I have to believe it is rooted in Drum have a poor and superficial grasp of the econometrics with a large dose of politically motivated My Team reasoning). A deflated Real Rate (i.e. nominal rate less a specific inflation metric) tells one something at least coherent to the overall analysis in Real Terms - mix -and- matching criticism of Fed nominal with real is just fundamentally incoherent.

via American Prospect:

" ..the study, by Randal Verbrugge and Saeed Zaman of the Cleveland Fed, found that, using the Fed’s own projections, inflation would still be at 2.75 percent by the end of 2025—moderate by historic standards—and reducing it all the way to 2.0 percent would require an unemployment rate of 7.4 percent, more than double the current rate."

Sort of off topic…. The money companies spend on ads could be cut to almost nothing. That would cool the economy. Let’s do that. From Ezra at The NY Times today.

Tim Hwang, a former director of the Harvard-M.I.T. Ethics and Governance of A.I. Initiative, argues that the dark secret of the digital advertising industry is that the ads mostly don’t work.

I have to agree. They certainly don’t work on me. Let’s spread the word! Kill off the ad supported internet (and AI too) by demonstrating that the ad spends are a waste of money.

Well, I guess we settled that. Let’s see what problem we can solve today.

Kevin has been asking the right questions. Also see Dean Baker at Beat the Press Blog. Krugman has also usually been looking at the factors which have actually caused inflation, but like most economists and the Fed he is obsessed with unemployment and whether uppity workers are getting too much in raises. There have been many actual times since the 80's (and earlier) when the economy was running "hotter" than it is now and there was no high inflation. Many supposed experts have predicted high inflation many times and for many reasons and have usually been wrong.

If inflation does rise again it won't be because the economy is too hot, it will be because of supply factors, especially oil price. And natural gas shortage is still affecting the European and world economy. The Fed can't control these things so it and its supporters tend to cast the matter in terms of things that that the Fed supposedly can control.

Federal spending also plays a role in inflation, but there won't be more of that in the near future. The pandemic involved a hopefully unique combination of supply problems, contraction from the shutdown and huge stimulus payments.

Who does this benefit? With the last graph it should be apparent. Crush Labor every chance you get, mumbled the Capitalist, never let it be comfortable, always place another crisis in its view. And so the Pet does its job.

So, question. At what point does 2020 and on become the trendline? It's now into the 4th year of a new normal when should we start msking projections based on that?