The LA Times writes today about the vast army of Twitter bots that fly into action whenever Tesla has some bad news and could use a little PR help. They've been doing this for the past decade:

Over that period, Tesla lost an accumulated $5.7 billion, even as its stock soared and Musk became one of the richest humans on the planet; his net worth is estimated at $275 billion. Operational results can’t justify anything close to the company’s $1-trillion market value, based on any kind of traditional stock-pricing metric.

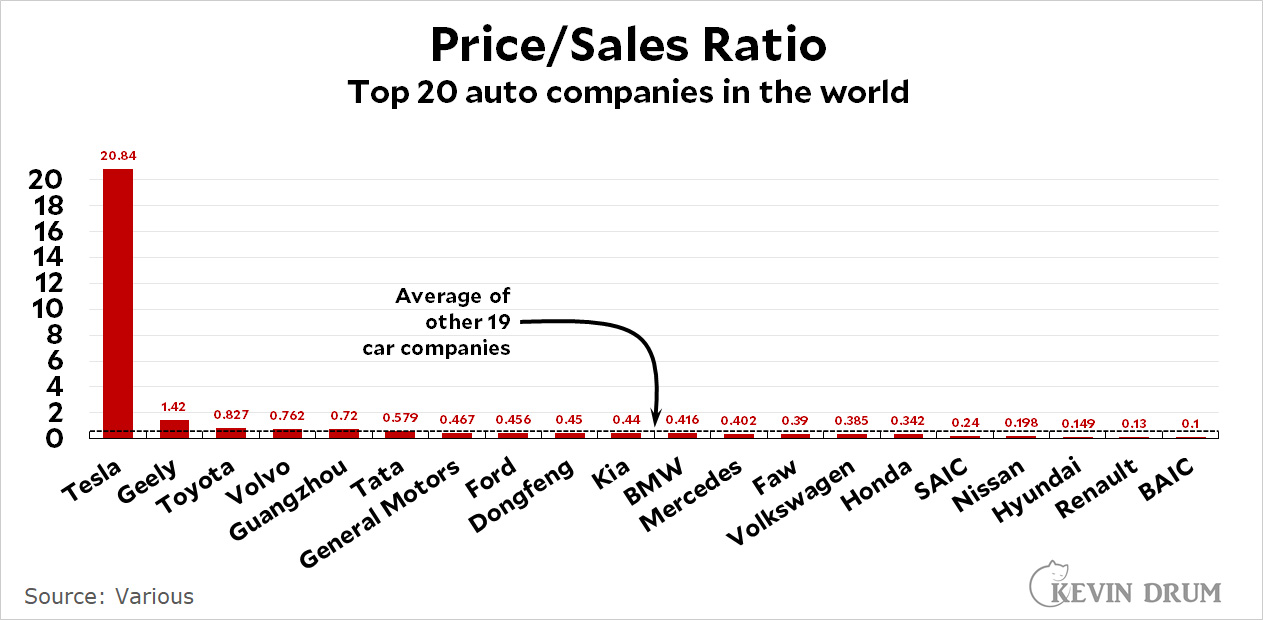

It's hard to judge Tesla based on earnings since it's still in startup mode—although that story is getting long in the tooth after 13 years. But it's fair to value it based on revenue, which is what the PS ratio does. Here it is for the world's top 20 car companies:

Tesla's PS ratio is 45 times higher than the average of the other 19 biggest car companies. Needless to say, this makes no sense. It might make sense for a company that has some kind of patented product that it has monopoly or semi-monopoly power over, but Tesla doesn't. Quite the opposite: Every car company in the world is building electric cars and Tesla stands to face intense competition over the next decade. Even if they can keep a top position, that wouldn't justify a PS ratio of more than 2.0 at the most.

Tesla's PS ratio is 45 times higher than the average of the other 19 biggest car companies. Needless to say, this makes no sense. It might make sense for a company that has some kind of patented product that it has monopoly or semi-monopoly power over, but Tesla doesn't. Quite the opposite: Every car company in the world is building electric cars and Tesla stands to face intense competition over the next decade. Even if they can keep a top position, that wouldn't justify a PS ratio of more than 2.0 at the most.

In other words, Tesla stock is overvalued by at least 10x even on a conservative basis. And for what it's worth, that means Elon Musk's wealth is probably overvalued by about 10x too. That still leaves him with $20-30 billion in Tesla wealth, which is a lot! But it doesn't make him the richest human in the world.

POSTSCRIPT: If there's a car company in the chart that you've never heard of, it's probably Chinese. Tata is Indian.

I traded by Gongfeng for a Geely and never looked back.

On Tesla's stock price? No idea what's going on there, but it is insane. I do remember, though, back 20 odd years ago, the stock of this crazy little e-commerce company called Amazon just kept going up and up despite never making anything close to a profit for years. Back then a share was like $50. I actually had a few hundred shares at one point that I think I dumped around the time the tech bubble burst or something. Sigh. Could have been retired on a beach in Mexico or something by now.

Amazon always had at least a semi-plausible explanation for why their stock was priced so highly. A lot of things had to go right for it to pan out, but the plan was there.

I can't see what Tesla's plan is.

Amazon didn't make a profit in the early years because they invested most of their revenues into infrastructure.

An army of twitter bots or an army of deranged groupy-like super fans? A lot of companies attract a devoted and somewhat fanatical fanbase. Just go to any Apple support site and complain about anything and you will swarmed with super fans telling you your problem does not exist and there is never any issues with Apple products. Tesla and anything related to crypto have a dedicated and somewhat deranged following.

You mean sales are not about to jump 20 fold???

I'm shocked...just shocked!!!

They're not really a start up. Nor are they Amazon. Their "self driving" car is still aways away. More people are getting the self driving bugs worked out and components are getting cheaper, so Tesla is losing what ever advantage it might have had. And EV's are about to go mainstream. If Build-Back-Better was passed, and chargers were everywhere, then Tesla would probably fade away. Manufacturing capacity will be at ca. 2 million annually at the end of this year. To bring P/S ratio down to "normal", they'd need 10 to 20 million per year (using ca. 0.5 million for the chart's P/S ratio--but that could be off a bit). The other thing --with regular car manufacturers going EV, they might not have to buy as many carbon/MPG credits from Tesla (yes, I'm presuming that's still a thing).

The reason for the valuation is that its the only company in the world which (a) has revenue of $53 billion and (b) has sales growing at a crazy rate (first quarter deliveries up 87% year on year).

I would add (c) and for a variety of reasons, the company's apparent natural competition (the legacy auto makers) cannot get it together.

It doesn't justify any particular price, I mean what stock price is justified? But its getting near Amazon and Apple territory in terms of "oh, its just a BS company."

Exactly. Legacy auto makers cannot and will not produce enough EVs over the next 5 years to Mount any kind of challenge to Tesla. They can’t make a profit on them, and their business model of selling ICE cars through dealers for a small markup (while making their money on parts and financing) will not work with EVs. They will have to reinvent their manufacturing process to begin competing with Tesla, which they can’t do while supporting their existing business. This is what gives Tesla a 5 year head start.

This.

And, they're also profitable. Highly so. At least according to my recent googling. They look to be in the vicinity of $10 billion annually in net income, which would give them a PE ratio of 100. Which is pretty dear, but investors are no doubt banking on that profit number rapidly increasing in the years ahead as the decarbonization movement gathers steam and (I'd bet) as the EV business consolidates. And Tesla has established itself as the brand-leader. Not yet in Apple's class, but it's not out of the question they could get there in terms of their brand's strength in the years ahead.

To my eyes Tesla looks overvalued, but not (necessarily) hugely so.

"

getting near Amazon and Apple territory in terms of "oh, its just a BS company."

"

Hmm. Your dismissal of Apple as "just a BS company" somewhat destroys your credibility.

As one of the people who has looked most closely at Apple tech, there is real there there; Apple Silicon has potential way beyond what most people are primed for, and no other company seems competent to compete.

(If you look, for example, at Tenstorrent, which is Jim Keller's new crowd, the CPU they have in mind their next product is about as sophisticated as the competition can muster, and it's lousy competitor to an Icestorm, let alone a Blizzard, let alone an Avalanche.)

It reads wrong, I was pointing out that at one point everyone "accused" Apple of being a BS company and now they are hardly that.

Same with Amazon.

I remember years of "oh, Apple, its all nonsense, just cult of personality with Jobs." They were very wrong about Apple and anyone that dismisses Tesla is making the same mistake.

I think Kevin, and some of the folks here, are looking at a wrong metric. Traditionally, stock price is driven (in the long run) by profits, not by sales. There is a simple phrase for that relationship: Price-to-Earnings Ratio.

Tesla has had astonishing earnings the past two years. This is copied from an ABC News story of Jan 16, 2022:

The Austin, Texas, company made $5.5 billion last year compared with the previous record year of $3.47 billion in net income posted in 2020. Musk said the annual profit pushed the company's accumulated earnings since its 2003 inception into profitable territory.

(Copied from https://ABCnews.Go.com > Business > WireStory > tesla-posts-record-profits-deliveries-soared-2021)

To estimate price-to-earnings ratios for typical companies, the website SeekingAlpha.com gives this thumbnail summary:

"Some suggest a rule of thumb where mature companies should have a P/E ratio of 5-10, moderate-growth companies should have a P/E ratio of 11-20 and aggressive growth companies should have a P/E ratio of 21-40 depending on where they are in the growth cycle."

So (1) the accumulated $5.7 B loss is obsolete old news, and (2) the current earnings of Tesla, as an aggressive growth company, probably suggest a market capitalization of somewhere in the range of $100-200 B.

So yes, it's highly overpriced based on current performance. But nowhere near what Kevin's chart looks like.

Agree with this. And I wonder how much of the overvaluation is starry-eyed wonder regarding SpaceX spilling over into Tesla. I have no idea what kind of future business SpaceX has and neither does most of the public, but it does look consistently amazing.

Tesla is a car company? And all this time I thought it was a religion. A religion where Elon fans worship a God that sent Elon to save the world. Anyone who doubts Elon is guilty of blasphemy (not to mention on the payroll of the oil companies) and will be cast into hell.

People criticize Tesla because of its financials? And all the time I thought they criticized it because a certain type of incompetent human cannot stand the existence proof of people out there who actually are competent, who make it clear just how much their whining about the unfairness of the world is to protect their fragile egos.

This random inventing up reasons why people post what they post is fun, isn't it?

"If there's a car company in the chart that you've never heard of, it's probably Chinese. Tata is Indian."

Chinese? You mean like Volvo? Indian? Like Jaguar?

Yep, like those. At least Kevin doesn’t seem to be trying to perpetuate the myth of the Big Three US automakers since Chrysler/Dodge/RAM is now FrancoItalian or some such.

I miss the day I could call my K-Car a Mercedes....

It's Stellantis now...incorporated in the Netherlands?

https://en.wikipedia.org/wiki/Stellantis

Ah the K-car. My mother wanted a convertible, so she bought one of those early conversion convertible K-cars. Even with the angle-irons welded to the underside the thing was always creaking and groaning.

Volvo is now a Chinese brand.

By the way, before Tesla was listed on the S&P 500, its stock was the wild west of investors, including an army of short sellers.

Joining the S&P 500 means many index funds now have to buy and hold, reducing short v. anti-short volatility by quite a bit.

The pro-tesla bots were likely there by long traders, to counteract the anti-tesla bots of the shorts. Kind of surprised the article missed this angle completely.

Being listed is not some guarantee against a stock collapse. WeWork's been listed since 2020.

Wework is not part of the S&P 500. Its not whether a stock is publicly trader or not.

Its that many index funds, with huge amounts of money, track the S&P 500. Tesla is an actual member of the S&P 500.

WeWork is not. I mean, any company can fail, but the huge advantage to being in the S&P 500 or the Dow 30 is that there is a ton if institutional money which buys your stock whether they like it or not.

My point is that prior to its inclusion in the S&P 500 tesla was just a big, speculative company with a loud mouthed CEO and tons of people dissing it all the time, which led to volutility.

It's especially overvalued because there's not really a "bull case" here that could justify such a valuation. Tesla doesn't have a lock on the EV market, nor does it have some insurmountable head start. It does have a strong, devoted fanbase of buyers, but that's not getting them up to GM or Ford levels of auto sales. There's no "network effect" when it comes to selling cars, like how Netflix got itself a huge head start in streaming.

Essentially, the stock has risen so much for so long that it's basically kind of a self-perpetuating hype thing now. Whenever it starts sagging, money starts flowing in because people think it will get hyped back up (and because the stock is so valuable for its major holders that it's worth dumping some capital back into Tesla to keep it high). I'll give Musk his due in that regard - he might be the best corporate hype man in the startup scene.

"Tesla doesn't have a lock on the EV market, nor does it have some insurmountable head start."

Tesla doesn't need either to have optimistic valuation. It just needs growth, which it is delivering like no other car company.

Does this mean it can't be overvalued? No, it certainly still can be. But not by 10x.

I haven't studied their stock price. I invest in indexes not individual stocks.

However,

If this happens, in volume, that will not be a failure for Elon Musk, it will be a success. His reason for involving himself in Tesla, and the mission that most of the employees understand themselves to be signed up for, is to get rid of fossil-fueled automobiles as a way to address climate change.

Now, he happens to also believe that if you want to do something that will change the world, it has to be profitable, because that's what's sustainable. But let's be clear, making money was not the core reason he did this. There are much easier ways to make money.

I don’t think Tesla is as overpriced as Kevin or many other commenters believe. To be clear, I’m neither a Musk/Tesla fanboy, nor own (yet) a Tesla. Musk is clearly a jerk, but he is revolutionizing the car business….it is good for him, financially (if you think being worth $300B is good - which I don’t, but Musk certainly does), but also good for the world in moving away from gas-fueled vehicles.

From a financial point of view, comparing Tesla and GM is illuminating. The last quarterly reports (Q4, 2021) showed GM generating twice the revenue of Tesla, but two quarters prior to that their revenue was triple. It seems likely that Tesla will generate more revenue per quarter than GM before 2022 is out, and will greatly out revenue GM on an annual basis starting in 2023.

More importantly for the stock price, Tesla generated a greater profit in the last quarter than did GM, and the quarterly profitability of Tesla doubled between Q2 and Q4. Tesla will almost certainly generate more profit than GM this year, and perhaps more than double.

Of the 3 big U.S. car companies, outside of Tesla which is now the 4th big car company, it seems like GM is most advanced with EV and they are years behind Tesla. Ford and Chrysler are really lagging.

Thé auto industry will be completely changed in the next 10 years and Tesla will out-revenue and out-earn every other car company in the world during that time and will be a strong #1 entering the 30s.

"To be clear, I’m neither a Musk/Tesla fanboy, nor own (yet) a Tesla."

It sucks you even have to say that. The troll envy brigade is strong.

Are you sure you aren't a fanboy?

Tesla sales volume grew 87% but electric car sales volume grew over 110%. GM more than doubled its sales. The auto industry will completely change in the next ten years and not all of the other 20 companies that have car production and electric car production know how will stumble and fall.

As other manufacturers cut into tesla's market share , a significant source of revenue will dry up. Tesla is looking to exploit their subscription services for their software and battery components to offset the decline. It remains to be seen if consumers will go for that model.

From 2020:

* Tesla revenue hit $6.04 billion during the second quarter of 2020, with about 7% of that, or $428 million, coming from sales of regulatory credits.

* CFO Zach Kirkhorn said during the company’s earnings call Wednesday that Tesla expects revenue from sales of regulatory credits to double in 2020 versus the prior year but to decline over time.

*Without zero-emission vehicle (ZEV) and other regulatory credits, Tesla would not have been able to report a four consecutive quarters of GAAP profitability, a milestone it reported Wednesday that meets the qualifications for Tesla to join the S&P 500.

https://www.cnbc.com/2020/07/23/teslas-sale-of-environmental-credits-help-drive-to-profitability.html

You get zero-emission vehicle credits by selling zero-emission vehicles.

If this were all about market share, Apple would be massively overvalued. They're not.

The bull case for Tesla is that they will produce two million electric cars per year in 2022 and that GM is targeting one million by 2025. Similar for all the legacy manufacturers. If Tesla is selling a lot of cars, profitably, and legacy automakers are selling fewer cars at low profitability, it won't be long before Tesla and a few Chinese companies dominate global auto sales.

Because Tesla controls their whole supply chain, makes its own batteries and has no dealer network and is ahead of Ford/Volvo/Daimler/Toyota in electric vehicle production and design, the legacy automakers might simply never catch up.

Maybe that won't happen, but it's plausible and it's why Tesla value is so high. The upside is that Tesla will have some of the sales but *all* of the profits in the auto industry, similar to Apple and the iPhone today.