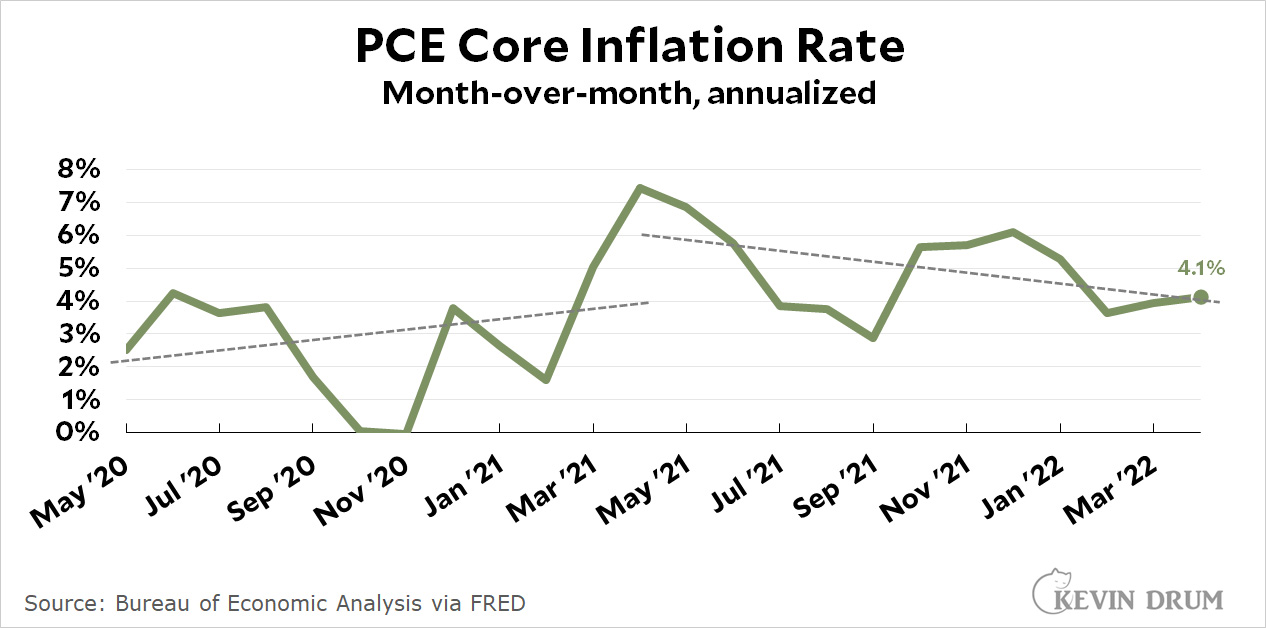

Over and over I hear that the inflation metric preferred by the Fed is the PCE core chained index (the PCE measure of inflation excluding food and energy). Here it is:

I'm not saying this is the inflation measure everyone should put on their front pages. Overall CPI inflation is a good measure of what people see in their daily lives, which is why it's the one that shows up in headlines.

I'm not saying this is the inflation measure everyone should put on their front pages. Overall CPI inflation is a good measure of what people see in their daily lives, which is why it's the one that shows up in headlines.

Still, for analytic purposes the Fed claims that PCE core is a better measure of underlying inflationary pressure in the economy. And if that's the case, it's been on a downward trend for the past 12 months. Hell, even CPI core inflation has been going down for the past couple of months.

So why the widespread panic over inflation? Why doesn't anyone pay attention to the PCE core metric? And in particular, why doesn't the Fed seem to pay much attention to the very metric they say is the best?

When would the current/recent trend line hit the 2% level? Is that “soon enough?”

For that matter, what does a trend line covering the entire timeframe of the chart show? Trend lines may not be fruit themselves, but they can have a hint fresh-picked cherry flavor.

Choppy downline. If you can't see the next move down......

"... hint fresh-picked cherry flavor."

Yes, talk about cherry picking a start point. If this were a graph of global average temperatures would Drum conclude the world was cooling?

Not an appropriate comparison. We have actual mechanism models of global climate which have predictive power.

When would the current/recent trend line hit the 2% level?

In about a year.

For that matter, what does a trend line covering the entire timeframe of the chart show?

It probably would be up, but not by that much on a monthly basis.

I think it's completely appropriate for Kevin to question the level of hysteria that most of the media is exhibiting in regards to inflation. If the FED uses PCE core as a better measure of underlying inflation - the kind that is not necessarily connected much with the last vestiges of the deformations caused by a pandemic (huge drop in employment and demand followed by a recovery with under 4% unemployment stressing the supply chains) - then perhaps the sky is falling crowd needs to get less attention. And PCE has dropped considerably in the past year, has it not ? Is anyone reporting this in the MSM venues ? Has anyone even mentioned unemployment ?

I think the true concern / wild card in this is not the Fed or anything Biden can directly affect, it's the war in Ukraine. But even there the media seems reluctant to connect the dots. It's just more screaming "inflation" at the top of their lungs.

Destroying oil prices globally is a large key to ending it. It takes balls and some wheeling and dealing.

Gas prices are up--so people notice.

Egg prices are up--bird flu, but people don't care why--so people notice.

Republicans want to scare people to hurt the Democrats (and apparently democracy in general).

Some increase was good--it punctured bubbles. And if that drives out investors from the housing market so they are not competing with families, so much the better.

Gas prices are up--so people notice.

People notice, but for The People That Run The Country (i.e., Wall Street, investors, etc.) it's a minor annoyance.

What really worries TPTRTC -- which includes virtually everyone reporting the news at a national level -- is the stock market. All those fat gains the past couple of years are evaporating quickly. It's plunging 401(k)s and the negative wealth effect that's driving many of the panicky headlines on economic and political stories.

The market is still about 9% above its pre-Covid highs, though it hardly feels like it. That's subpar (and a little worse considering inflation) but it's hardly 1929.

TPTRTC seem to be worried about the Fed underreacting. I think overreacting may be the bigger danger.

Swings in 401K's are scary....

The stock market has been bubblicious for a while, so this is needed. Unfortunately the average investor can not really do market timing. The GOP's tax cuts for the rich feeds into the boom-bust cycle which also increases income inequality.

Not really. 401k's are long term instruments. Unless your retiring now, they mean little.

"The market is still about 9% above its pre-Covid highs, though it hardly feels like it. That's subpar " In a rational universe it should be subpar. Covid caused a lot of damage.

Not that much damage.

They were up......gas prices that is. By end of summer???? Not so much.

Your trend line is weird. To me it looks like it is basically flat or slightly up if you compare March 21 to March 22, which is about where it ends. And if you draw a line for the entire period it is definitely trending up. This is a great example of data that can show almost anything depending on which specific period you choose to illustrate.

The PCE excludes food and energy to avoid the "volatility caused by movements in food and energy prices to reveal underlying inflation trends."

Removing food and energy provides insights and avoids certain, inter-year, cycle trends. To use a analogy, one does not want to evaluate annual retail sales based just on December performance.

The problem, if gas and energy are not having inter-year volatility, rather if they are just increasing, then this measure has more limited value.

https://www.bea.gov/help/faq/518#:~:text=The%20%22core%22%20PCE%20price%20index,to%20reveal%20underlying%20inflation%20trends.

Because it is an election year.

Absolutely. Unemployment is low, EPOP is up; employers were faced with the horrible prospect of having to raise wages to attract workers. Whatever can be done to sabotage the economy so as to drive Democrats out of power, and make the country safe for huge tax cuts for the wealthy, again? Financial writers, inflation hawks, etc. are practically giddy over the prospect that the Fed will bring a recession. Win for ‘our’ side! Pain for everyone else ….

Lol, nope. That isn't how it works.

"Because it is an election year."

And the Democrats are going to get hammered. They need to write 2022 off and hope things are getting better by 2024.

Hammered??? Why?? Pure nonsense. Congressional elections are about who you know. Which is why using affirmative action to pick candidates fail.

Democrats aren’t going to write 2022 off. If we’re headed for a sweep by the party of racism and authoritarianism, at least we’re going to go down fighting. And if we do, I’ll get hammered then.

From the consumer's standpoint the Analysis of Variance says the critical measurement of inflation is based on FOOD and ENERGY - given the "if it bleeds it leads" level of innumeracy in the target audience of Fox news et al, then you have reporting of a massive inflation. Until meat and gas come down in price and some other shiny object gets thrown up for attention.

Noting, also, the rather disastrous effect on cattle in the heatwave, you can expect the price of meat to be pretty interesting for the duration. And gasoline is in summer travel season pricing mode which has always been a price gouging event. Whose to say the energy producers can't take profits when they see them. After all, the depletion allowance says it is a declining resource.

What a wonderful time to be awake. /s

Heat wave????? Not where it counts.

Energy is starting to get hammered. As I predicted.

Perhaps my eyes deceive me, but it looks like a single line with a slight positive slope is a better fit to the data.

You are correct. I did a linear fit for the entire series and it is a line with a rather large positive slope of 0.13/mo. Correlation isn't great (R-squared is 0.22).

Denying inflation is Kevin's hobbyhorse for some unfathomable reason.

KD: So why the widespread panic over inflation?

Answer: Because it is here, it is big, and it is hurting people. Poor people the most.

What inflation has there been ex energy this year???? You better hope the Biden/Saudi business deal falls through. But people are tiring of Russia's war. More now than 2 months ago. Destroying oil prices is part of a painful end game.

graph is here

https://twitter.com/theDanaDecker/status/1537501626298032128

He's not denying inflation. He's simply giving an accurate representation of how bad it actually is. And it is very bad relative to what anyone under 50 has experienced but not even in the same league as what we experienced in the late 70s and 1980.

He’s not denying it, he’s arguing that it would decline without drastic Fed action. It’s not an unreasonable argument, given that the inflation hawks haven’t identified a mechanism that would continually force price increases, as for example a wage-price spiral, or an expectations-driven feedback loop. By contrast, there is plenty of evidence of exogenous factors causing price increases: supply problems caused by the pandemic, transportation bottlenecks, the war in Europe. Solving those problems would relieve pressure on prices, but raising the Fed funds rate isn’t going to improve supplies of anything.

May 12, 2021

As expected, the headline inflation rate rose 4.2% in April. MY BEST GUESS FOR THE REAL RATE of inflation, based on ignoring the artificial drop a year ago, is 266.832 ÷ 259, or about 3%:

--------------------

July 8, 2021

The first thing to notice is the enormous inflation in used cars. All by itself, this category boosts the overall inflation rate by about 1.5 points. If you're in the market for a used car this is bad news, but FOR THE REST OF US IT MEANS the overall inflation rate is closer to 3.5% than the official rate of 5%.

--------------------

July 12, 2021

The endless preoccupation of the US news industry with inflation is truly spectacular. They will simply take any opportunity, no matter how trivial, to hoist the red flag of high inflation right around the corner.

I'm not even saying the stuff in this particular piece is wrong. Rather, IT'S ANCIENT. IT'S A BUNCH OF TRENDS THAT INFLATION HAWKS HAVE BEEN WARNING ABOUT FOR YEARS.

--------------------

July 13, 2021

[Re 5.3% increase in CPI]

That's pretty high! However, IF YOU USE KEVIN'S HANDY INFLATION CALCULATOR, WHICH ADJUSTS FOR BASE EFFECTS (that's the dip in mid-2020) the real-world rate is more like 4.4%. And if you eliminate the distortion of used cars, the inflation rate for everything else is probably less than 3%.

I know, I know, that's a lot of adjustments. Take 'em for what they're worth. THE ONLY ADJUSTMENT THAT REALLY MATTERS IS TO GO FORWARD IN TIME and see if inflation settles down once the economy adjusts to its grand reopening. But that's one adjustment we're just going to have to wait for.

--------------------

August 11, 2021

Inflation in July remained high at 5.4%, LARGELY DUE TO HUGE INCREASES IN THE COST OF GASOLINE AND USED CARS. However, the increase from the previous month was MUCH LOWER THAN IN JUNE:

The inflation rate for food remained pretty reasonable at 2.6%. Whatever people may say, A TRIP TO THE SUPERMARKET JUST ISN'T A LOT MORE EXPENSIVE than it was a year ago.

--------------------

August 27, 2021

The New York Times says inflation rose "sharply" last month using the Fed's preferred measure, and I suppose that's true. But AS USUAL, CONTEXT IS EVERYTHING:

Core PCE inflation peaked in April and has been dropping ever since. So while it's still high by historical standards, IT'S PLUMMETED TO HALF OF WHAT IT WAS JUST A FEW MONTHS AGO. This suggests that the momentum behind high inflation is starting to ease.

--------------------

September 14, 2021

The headline CPI index in August clocked in 0.27% higher than the previous month, an annualized rate of 3.3%. THIS IS QUITE A BIT LOWER THAN THE 9%, 7%, 10%, AND 5% RATES OF APRIL THROUGH JULY.

Core CPI, which excludes food and energy, came in at 1.2%. Since the headline number usually follows the core number, this SUGGESTS THAT INFLATION IS LIKELY TO HEAD EVEN LOWER over the next few months.

--------------------

October 13, 2021

The headline CPI index in September clocked in 0.41% higher than the previous month, an annualized rate of 5.1%. This is a tick higher than it was in August, though still QUITE A BIT LOWER THAN THE PEAKS OF EARLIER THIS YEAR:

Core CPI, which excludes food and energy, came in at 3.0%. Compared to 12 months ago, the inflation rate for food rose to 4.5%.

As always, THIS IS JUST ONE MONTH OF DATA AND NOT SOMETHING TO BE PANICKED OVER.

"... for some unfathomable reason."

It's not unfathomable. Inflation is hurting the Democrats so they have an incentive to try to minimize it. But this this doesn't work too well when people are reminded every time they go shopping.

Quash demands for hourly labor wage increases.

So why the widespread panic over inflation?

Because a Democrat is in the White House, Democrats barely control the legislature and it's an election year.

Why doesn't anyone pay attention to the PCE core metric?

Because it's nowhere near as scary as the headline writers and talking TV heads need it to be to grab eyeballs.

And in particular, why doesn't the Fed seem to pay much attention to the very metric they say is the best?

Because similar to how some in the FBI are holdovers from Republican administrations and want to see Hillary Clinton crucified, some people in the Fed are holdovers from the previous Trump regime and would like to see it return. Others in the Fed just simply hate the idea of non-rich people having it too good and mouthing off to their economic superiors.

I mean seriously Kevin, were you just hatched yesterday in a lab? It's like you have zero experience living in America or even on planet Earth.

"some people in the Fed are holdovers from the previous Trump regime and would like to see it return." Actually it is 100%. Not sure why Biden reappointed Powell unless he thinks the only person he could get through congress would be much worse.

Headlines are one thing, but the real issue now is the run up in fuel and food prices, and anything else that is transported (like almost everything except services). Democrats, republicans (aka MAGA assholes), and everyone else is experiencing real pain at the pump, supermarket, electricity costs, and when the fuel truck delivers oil to your house. This is a real issue and not a made up headline / clickbait source of outrage. People on a fixed budget or living paycheck to paycheck are suffering for real.

Republicans can scream about it and make it a successful campaign issue, but I would like to hear the solutions they plan on enacting through legislation besides, lower taxes for corporations and the wealthy. I don't see them enacting wage and price controls like Nixon did in the 70's, which didn't do much except help him get reelected in 72.

"when the fuel truck delivers oil to your house"

I realize that this is an issue for like 4% of households, but nobody should be heating their houses by burning *oil* of all things. Expensive, dirty, inefficient, and absolutely horrible for air quality. KJK, if you're in that tiny slice that still uses fuel oil for heat, I sincerely hope that you're able to switch to like a heat pump or something soon.

Equity prices were overvalued badly by the end of 2021. They were overvalued in December of 2019, but not as bad as you may think. Making stocks cheap is a virtue.The last squeeze put them back to average which was a value test.

Inflation ain't going up this summer, it going down. Gluts are everywhere. Energy traders priced 3 months of gains in one month. People won't pay 5$ gas. Opec withdrew the caps and banks are boosting mining........again.

The most dangerous game is lending standards dropping very low, boosting leverage. This is what creates future bubbles.

So we shall now be treated to a series of Drum and other Left commentators over and over again trying to argue inflation is not the issue becuase from their party-political PoV they don't want it to be. Somewhat a mirror image reversal of the Right and seeing inflation where it was not.

(the real technical responses with respect to Central Bank inflation tracking and decisions is that econometric models draw on multiple indicators, and not one metric. Goods inflation is challenging as a lagging indicator. Of course global evidence of broad acceleration across multiple types of inflation measures, including lately Asia makes myopic American provincial analysis based on politics an recipe for wrongness)

Come back to me by Labor Day: in the words of Jack Nicholson, oh I have a little surprise coming to you.

Inflation driven by energy morons ain't real inflation. It can be turned off anytime. Do you need a nostril rip to understand that???

Thats not the argument that Drum makes in this post. But I realize that inventing and attacking strawman is more fun than addressing the issues that are being raised.

Carry on!

Your argument cuts both ways: if inflation is a global phenomenon, is it likely that the cause is the US Federal funds rate being too low?

Gas and grocery process are up, yes indeed-- luckily I work from home and I can bike most local places I need to go. Who still heats with oil? many rural people I suppose-- in fact who's doing much heating period right now? It's June. As for electricity I must be living a charmed life as my electric bill is within a couple dollars of the bill at this time last year.

"Prices", not "process" (auto correct is the Son of Satan!)

Lots of homes use oil heat here in the Great Northeast. Close to 25% in Massachusetts. More than 50% of homes in Maine. https://energyathaas.wordpress.com/2021/11/01/the-geography-of-heating-oil-and-propane/

What Zephyr said, plus, many homes in the Northeast that heat with oil also use it for domestic hot water - it’s just an extra coil in the ‘boiler’ - so are burning oil year-round.

Pingback: The inflation rate has been declining for the past year | Later On

Gas prices -- that's what everyone pays attention to. And TV pundits, who set their hair on fire every night claiming inflation will destroy us all. Nobody cares that the price of, say raw rubber, has fallen by 30% over the past year and a half. It's that twice-weekly fillup costing $100.

Compare and contrast Mean trimmed PCE, Core PCE, and Core CPI (https://fred.stlouisfed.org/graph/?g=QF6p).

My preference is mean trimmed PCE, showing inflation slowing but not yet peaked. Each indicator is a useful tool to understand different aspects of the economy.

Once the drivers of headline inflation are mitigated, we're going to head back down to the ZLB. After all, the Feds held the rate at zero for the vast majority of the last 14 years (https://bityl.co/CkFC). I think that point has been lost in all the discussions about the need to quell persistent high inflation expectations.

Nope.

Pingback: Links 6/17/22 | Mike the Mad Biologist

Don't ask "why panic", just ask "when panic"

Easy money starts inflating stock prices: no panic

Easy money starts inflating home prices and rent: no panic

Easy money starts pushing up growth and jobs: no panic

Easy money starts inflating a crypto bubble: no panic

Easy money might end up funding public investment so at least a few of the freshly printed dollars might end up in working class pockets: close call but crisis averted, thanks Joe and Kyrsten!

Easy money, growth, the statistical illusion of a fluke -$30 to +$120 oil move and opportunitistic monopolistic price fixing start to inflate consumer prices: no panic

Easy money after finding every route to billionaire pockets finally starts finding its way to wage growth with some people even starting to whisper the U-word (unions): EVERYONE PANIC, haven't you seen the 12 dollar a gallon milk this poor mother bought just when CNN totally didn't find trough her GOP dayjob!?! Now all of the wall street billionaires sing in perfect unison: "Won't someone please think of the poor working class consumer children"!

The fed is using what is mostly a pandemic oil price statistical fluke as cover to crack down on high employment and wages. Thats bad enough but in the EU things are even more cynical. There inflation has been much lower except for one thing: natural gas prices.

For oil prices people try to blame Russia but if you look at oil tanker movements and sanction fineprint Putin has been shipping roughly the same amount of oil as usual. For gas there have been cuts in exports in the last few weeks but the unprecedented price explosion actually happened early last winter long before the 24th of February.

This just so happened to be right after the effects started of Brussels deregulation of the gas sector. This included a ban on the long term fixed price contracts that had created global price stability for decades. It also created a whole bunch of smaller players that could only underdercut their big competition by gambling away our collective energy security and Ukrainian national security and just not spend any money to prepare the stocks before wintertime. They were also going all in on cheap Russian gas rather than diversify. Brussels galaxy brain energy strategy during the years while Putins fighting was still limited to the East of Ukraine had Europes percentage of importants from Russia actually going up!

It's like Brussels saw Enron and the Texas electricity markets and went: hold my beer.. and repeated every mistake on a global scale.

And because of that political mistake a single extremely out of whack price in the price basket is throwing off the entire inflation statistic. So now the ECB is throwing Europe into a recession and risking a return to the Euro crisis...