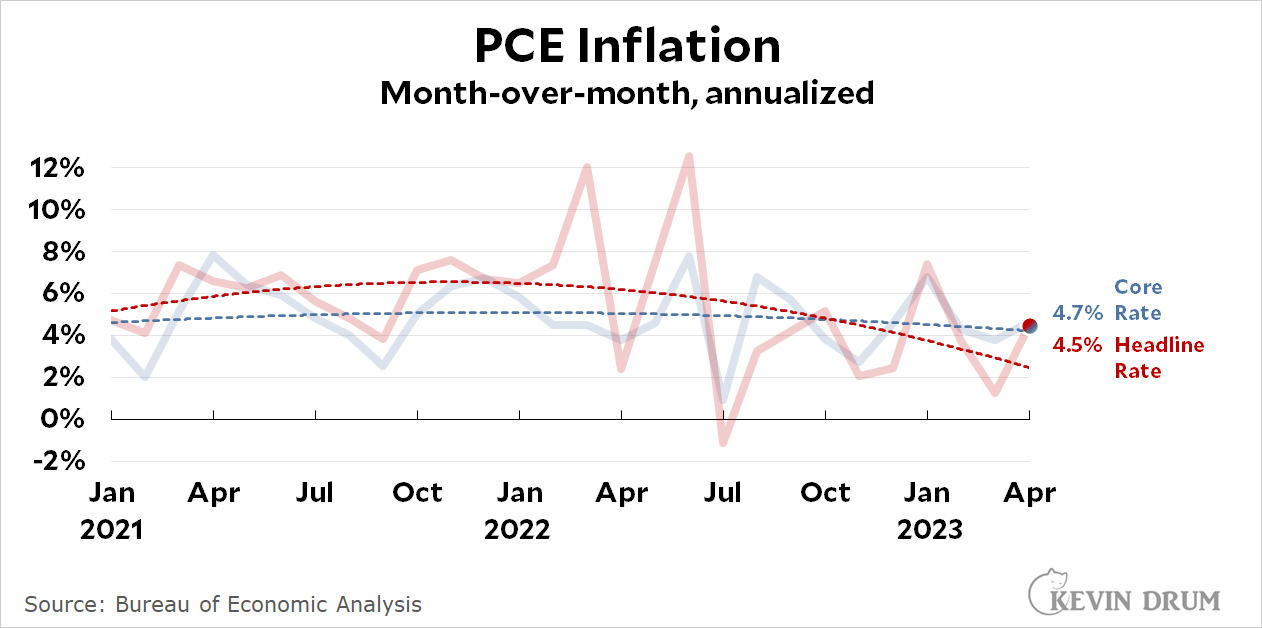

It's inflation day, and the news is once again so-so:

Both core and headline PCE inflation clocked in at around 4.5%, though the headline rate continues to be considerably lower on a trendline basis. Overall, though, it was mostly sideways movement in April. PCE inflation has stayed pretty steady since the end of last year.

Both core and headline PCE inflation clocked in at around 4.5%, though the headline rate continues to be considerably lower on a trendline basis. Overall, though, it was mostly sideways movement in April. PCE inflation has stayed pretty steady since the end of last year.

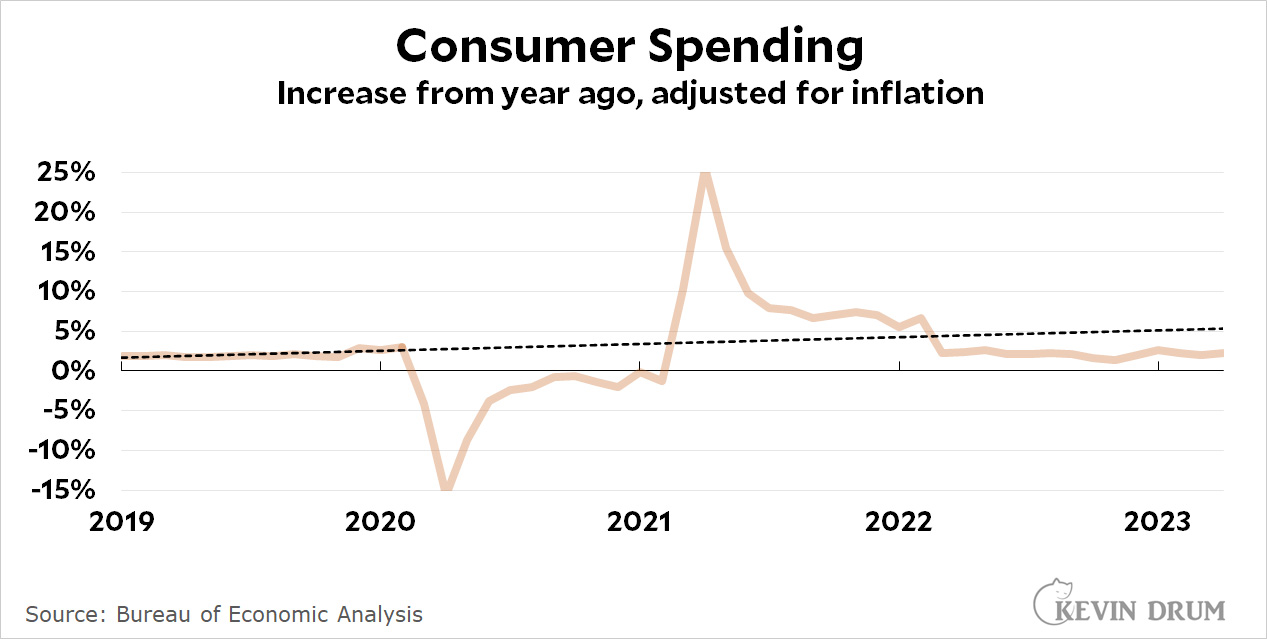

In other news, the BEA also released consumer spending data:

Adjusted for inflation, spending ticked up from 2% last month to 2.3% this month (compared to a year ago), but it's still well below its pre-pandemic trendline.

Adjusted for inflation, spending ticked up from 2% last month to 2.3% this month (compared to a year ago), but it's still well below its pre-pandemic trendline.

Kevin - did you *really* draw a linear trendline on an annual rate of change?

It seems like you're saying "Consumer spending grew 1% from 2018 to 2019, but then grew 2% from 2019 to 2020, so now it should be growing 5% per year."

Follow that logic out a few more years and I guess consumer spending would be growing 10% each year by later this decade. I can't wait until 2118, when consumer spending will be doubling every year.

I get that you are trying hard to make the point that the economy is about to crash, but this chart doesn't even make sense. Lots of folks (rightly) quibble with your "I'm going to draw a concave trendline on inflation because I believe it is going down" bit, but at least there's an argument to be made there. You can't possibly believe that an inflation-adjusted annual rate of change in consumer spending should grow linearly.

Yes, Kevin is going wild with trendlines again. The growth rate of spending looks about the same since early 2022 as pre-pandemic, which is good as indicating steady but non-inflationary demand.

As for inflation, at this point the story is best told with the year/year trend, which shows the overall decline since June 2022, and also the low month/month average since then. There was a fairly sharp turn between June and July 2022. Kevin's arbitrary curves have no particular value.

Unskewed trendlines....

Monthly data always contains some noise. When looking at the inflation figures for the last six months a trend is emerging:

- The transitory explanation, while interesting, is not supported by the data

- The idea that we are on a clear path to steady 2% inflation is also not supported by the data

- The idea that the Fed has already overshot on rate increases, at best, is unclear /likely not supported by the data

Yup. Kevin is so dug in on this, I don't know what would break him out of it. But if food and gas prices aren't lower, Tangerine Palpatine will be signing the national abortion ban in two years. (And don't tell me the Dems will filibuster - the Rs will kill the 'buster so fast it will make your head swim.)

Actually engaging with his readers for once

At the rate … things are going, Kevin’s Kurvy Trend Lines will end up flat …

So if Housing is still inaccurately pushing up PCE inflation a bit, are we looking at an actual current PCE of around 3.5+?

3.5% is not a bad rate. 2% is an arbitary target that was on the low end of desirable.