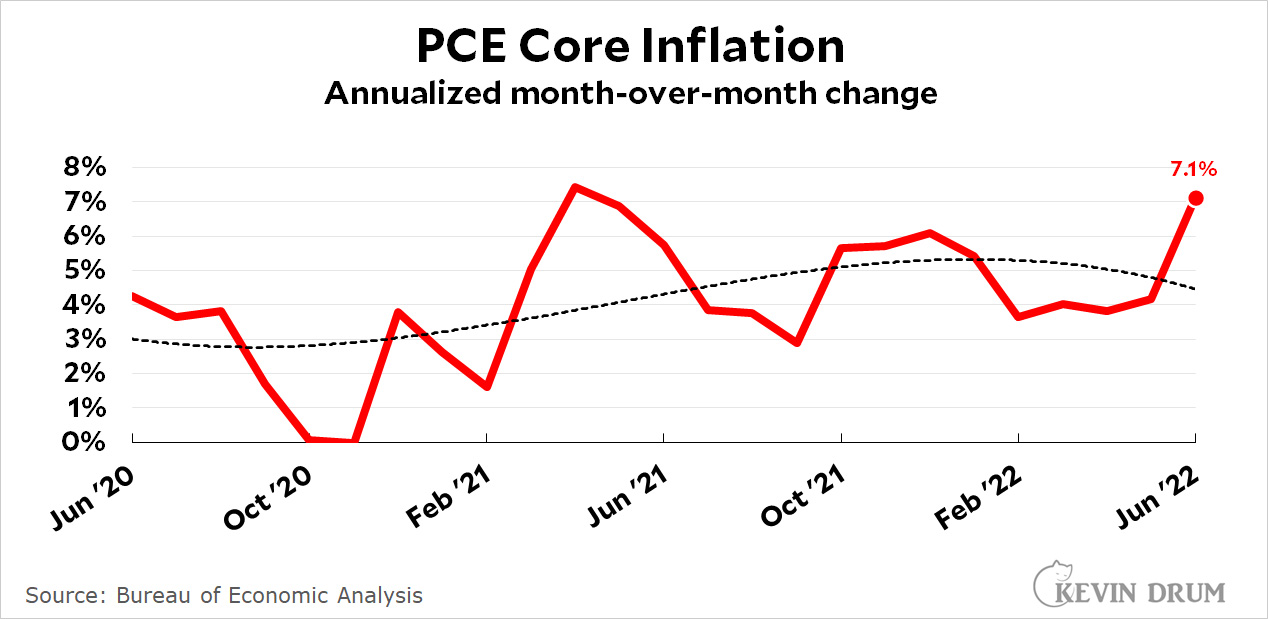

Uh oh:

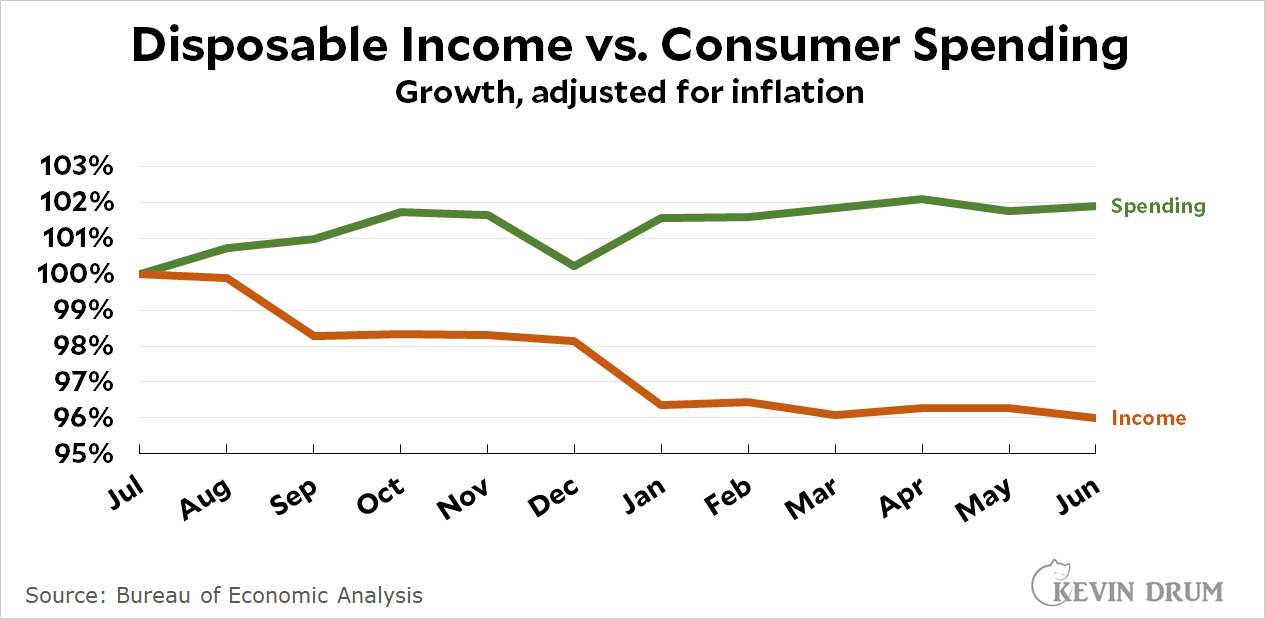

As usual, monthly changes are volatile and no single month should be taken as definitive of long-term inflation trends. Still, this isn't good news. I'm not sure what suddenly happened in June, but the core inflation rate nearly doubled compared to May. In addition, disposable income dropped 3.6% on an annualized basis, while consumer spending increased 1.4%. This keeps happening:

As usual, monthly changes are volatile and no single month should be taken as definitive of long-term inflation trends. Still, this isn't good news. I'm not sure what suddenly happened in June, but the core inflation rate nearly doubled compared to May. In addition, disposable income dropped 3.6% on an annualized basis, while consumer spending increased 1.4%. This keeps happening:

Perhaps today's accompanying story about record Oil Company profits has some correlation.

https://www.bloomberg.com/news/articles/2022-07-26/big-oil-set-for-record-profit-as-world-reels-from-high-fuel-cost

Are they also at record profit margins?

June is when schools let out and families can go on vacation. And there was a lot of pent up demand due to covid.

And they could go to movies, and concerts, and....

I am a bit surprised that inflation went up considering stores are back to offering (some) discounts, but....those discounts might not show up in the numbers yet and there have been hikes in streaming services, phone plans, etc. Probably the last set of increases that companies can get away with without strong consumer backlash. The consolidation of the markets will mean hikes are easier to sustain and the DOJ should be looking for anti-trust (collusion) violations.

With one month, could it just be a mismeasurement?

Well, the ‘core’ measurements are obtained by omitting volatile commodities including food and energy. However, this will always overestimate core inflation, because it still includes downstream impact of exogenous price increases for those volatile goods.

Kev as much as we all want it not to be true, I think it’s time to admit the Fed is right to raise rates. We’re past grasping at straws and have moved on to grasping at stray dust motes

Let’s just take our medicine

And we should be raising taxes rather than, or with interest rates.

We’ve allowed simplified narratives to govern our country rather than good policy.

“With” is good with me

If Congress voted on interest rates you can guarantee it’d be as contentious as a tax hike. Let’s be thankful the Fed is basically apolitical and we can do at least this much

Fuck off troll. Corporations are making record profits, especially on things considered necessities (food, housing, transportation, utilities, etc.). Raising rates does nothing to fix that... people still gotta eat, sleep, leave the house, etc. no matter what it costs.

I don’t consider xi a troll. But I agree with you that raising rates has little effect on the exogenously-driven price increases in food and fuels, which are very ’inelastic’ (price changes have little effect on demand).

Xi absolutely is a troll. He's two parts Atticus to one part Mac Gruber, with a soupcon of overt Shooterian racism (the Winnie the Pooh avatar).

I always thought my avatar came across as anti-communist rather than racist. Then again I don’t know what Shooterian is and neither does Google

I always thought Monty was a GPT3 bot or something but I guess the reference to my avatar proves me wrong. Don’t think GPT can process pictures

10%ish inflation is no better for the consumer. Especially if wage gains are not commensurate

I’m not trolling, I don’t know why you think I was. I honestly believe a strong Fed that hits its inflation targets is a prerequisite to a stable economy. Stability is good for people who don’t have a lot of money to live on

Should the benefits of a strong economy be rebalanced away from corporations? Well, yeah, duh. But stabilizing the economy is a bit of a prior question in my mind

I think it’s time to admit the Fed is right to raise rates

Democrats should be thankful the Fed didn't wait any longer. I think there's a pretty good chance given the tightening already undertaken, inflation numbers will look a lot better next year, though probably at the price of a recession. But I also believe there's a pretty good chance that recession will be mild.

In terms of busincess cycle timing this would be very far indeed from the worst posible news for Joe Biden and the Democratic Party.

Sort of a first term Reagan-esque business cycle timing, I agree with you. The first half of his term, the economy was crap under Reagan. Then picked up the second half and he got the credit

I think we were nuts to ever expect the post COVID economy to pick up where it left off without any hiccups. Let’s hope it’s a mild recession

Reagan had his recession in 1982, the equivalent of 2022 for Biden. Reagan presided over quite robust growth in 1983, and by the end of that year there was very little doubt he was going to be hard to defeat in 1984.

Biden's cutting it closer, I'm afraid. But on the other hand it doesn't look particularly probable the coming recession will be anything near in severity the bruiser that descended on the country in 1982* (with unemployment reaching nearly 11%). So, again, I do think there's hope the structural picture has brightened by 2024, though that's still a long way off, and in any event the floor for either party is a lot higher than it was 40 years ago (so the GOP nominee will have a chance even if we're seeing a low-inflation boom in the summer of 2024).

Powell was explicit about this. He's getting what he wants - crushing wage growth while crashing the economy with a (D) president.

The interest rate spike is nuts. If you disagree, you need to explain why inflation in the U.S. is unique among western economies, and no longer have recourse to pointing to the only real difference (helicopter drops early on which have long-since been spent down).

I assume you meant “explain why inflation isn’t unique” since most countries are seeing some

A lot of countries (read, I can’t think of any that didn’t) followed the Keynesian playbook during COVID, which I think is probably good. Now we are seeing the results of that

In the absence of another explanation for inflation, I think monetary expansion is a fair bet (especially since we expect cash payments to everyone to be more inflationary than, say, a corporate tax subsidy)

To tamp down inflation, this is what you do. I guess I don’t know why the economic playbook goes out the window as soon as the prospect of paying the piper for crisis spending is incipient. Like, yeah it sucks when you’re the ones in charge, but these things are touchy. Better to deal with it now rather than later I say. At the very least it’s not nuts, kind of obvious

The interest rate spike is nuts. If you disagree, you need to explain why inflation in the U.S. is unique among western economies,

Paul Krugman and I disagree with you that it's "nuts" to tighten monetary policy when inflation heats up. Not sure what you mean with your "unique" comment. Inflation is bothering other economies, too, and many of them have likewise begun to tighten.

Of all polynomial trend lines to plot (1st to 5th order), Kevin picked the only one - 3rd order - that shows it dropping at the right side of the chart.

Kudos!

Put your inflation worries aside because "this can't keep up forever."

I see it is now time for a new, narrative-supporting trend line…

as always--wait a few months to see how it plays out...

Up on monthly basis, flat on a yearly basis....we definitely need to throw millions of people out of work to resolve this puzzle.

The best way to solve my pain at the pump is to impoverish my neighbors.

It's the modern version of "my crops are failing, let's burn some witches."

Sam Alito said as much on his victory tour of Italy.

Yes, using arguments from someone prosecuting witches reflects a stable opinion, that is for sure. /s

+1!

If unemployment goes up, you'll lose those votes. If inflation goes up, you lose everyone's vote.

Sadly true.

Is it though?

This is certainly the conventional wisdom from the political 'experts' whose past ability to accurately predict voting patterns is pretty shaky.

The resistance to the idea of inflation on this thread over the past couple of years has been hilarious. Also, viewing Manchin and Sinema as enemies of the Democratic Party instead of as saviors because this could be so much worse.

Question: Is it inflation if a higher PCE is the sole result of price gouging at the pump? Yes or no?

haha. I won't be led down a path to answer a question that I don't agree with the premise on in the first place. We'll have to disagree that the "higher PCE is the sole result of price gouging at the pump?"

It's naive to think that gas companies just discovered the concept of price gouging. There's a lot going on here from dumping trillions into the economy (from Bush to Obama to Trump to Biden), relationships with Saudi Arabia and Russia, coronavirus, not working for two years, Ukraine, Biden's vs. Trump's energy policies, etc.

Do you really mean to imply that this is entirely price gouging?

Nope. Seasonality pushes up June inflation numbers. 3rd quarter inflation goes the opposite way.

Since you refuse to answer an if-then hypothetical, FOAD troll. Thank you for self-identifying in just one question; saved me a lot of time. And ... into the rolodex you go.

Lol. I've been to junior high, so I know how this yes-no game works. Let's try, "yes or no, does your mom know that you paid Epstein for underage prostitutes?" Answer my question or you're an Internet troll!!! It's so stupid, and I'm the troll? Grow up.

Simple fact, many people saw inflation coming and profited nicely from it. I was late to the game, but at least I got there in eventually.

People got 7k once, now they get to pay an extra $400+ a month in rent for perpetuity. Giving them money did not help them!

The people in this blog that have argued for years that inflation will not happen... err... it's not that bad... err.... still not that bad ... errr... up again... err... I'm right but Putin.... err... I'm right but Trump, etc. don't get the point and aren't living in the real world.

Inflation was coming, it came, and it's here. Are we going to help it leave?

Do you really mean to imply that this is entirely price gouging?

I mean, I don't blame Democrats for going with the "price-gouging" line if it helps them. Heck, I urge them to use it if it helps them. But it's a very small part of the inflation picture, which should be easy to see if one simply asks oneself: "Why don't firms always engage in price-gouging?"

What part of 'hypothetical' do you not understand? Seriously; this is subpar even for you.

Interesting that you suddenly inject "hypothetical" after it was missing from your original question. I clearly asked if you were implying something. You could've said "no, this is a hypothetical" instead of calling me a troll and telling me to fuck off and die! What a world we live in.

Anyway, I'll fuck off now, but only to go get some more of those freshly printed dollars that you don't seem to think exist! 😉

Why do I have so much money with so little effort? Because dumb people like you make it SOOOO easy. By the way, I'll admit that I'm clearly trolling now. And, quite frankly, I didn't really come here to argue with jackasses (I'd have loved a legitimate conversation though).

"…at the pump".

It appears you have little knowledge of what constitutes, "…at the pump".

While "the people" are aware of price gauging "at the pump", to think that that is the only "gauging" going on is silly. Truckers are paying increased prices that are passed onto all markets, not just grocery stores. Gas prices affect everything that is transported, from raw materials to the finished product.

Then when deflation happens.........don't lay the data.

> The resistance to the idea of inflation

You know what's really funny? Trolls who pretend to be Democrats maliciously misstating what people were actually saying while pretending to be "friends".

> viewing Manchin and Sinema as enemies of the Democratic Party

Absolutely. Which is why the Republicans are so angry at Senator Houseboat right now.

We got used to the idea that we can spend as much as we want and never trigger inflation. Let’s hope that we’re paying up for recent spending only. If we have to pay back the ungodly amount of debt we have accrued anytime soon, we’re screwed

I’d be happy if Biden is the president who really reigned in deficit spending. If I was an old fart I wouldn’t really care, but I’m a young guy. Even a 2070 comeuppance would suck for me

Sorry you got trolled by others. It was a fair point I thought

I don’t have to accept the mistake that economists make, of applying one label to a wide range of situations which differ in causes, mechanisms, time courses, and resolutions. In a number of contexts here I have argued the importance of analyzing disaggregated data; this is one. Our present difficulties are the result, not of a general loss in value of the dollar, but by easily identified exogenous disruptions of supply of two fossil fuels (natural gas and petroleum), fertilizer, and wheat, all of which trade worldwide. Since energy is a factor in the production and delivery of almost everything, the price increases propagate downstream to almost all goods and services. Fertilizer is a factor in the production of many agricultural products, so many more than wheat prices are impacted. The solutions include a) expanding production of the supply-constrained commodities, and/or b) substituting alternative goods. But since the FRB doesn’t drill for oil or raise cereal grains, it’s doing the one thing it is able to do. I believe that will be singularly ineffective, because food and fuel are quite inelastic (price doesn’t affect demand as much as for other goods). The majority of employed Americans drive cars to work, so, we’ll just have to see to it that a lot of them get laid off to cut demand for fuel.

I’m not sure, I thought that inflation predated even the stirrings of the Ukraine War. Are there any other disruptions? Maybe general post COVID supply issues?

Yes, forgot to mention the pandemic as disrupting supplies. (!)

Just so. Reification is not explanation.

I've heard plenty of Republican office holders yelling about inflation and gasoline prices lately, paired with "and why is the Democrat Party screwing around with gay marriage, abortion, voting, and that environment thing, instead of fixing inflation!!! Regular Americans are SUFFERING!"

It would be enlightening if every reporter would then ask these guys "Well, that said, where is YOUR bill to address these problems? What strategies are YOU proposing?"

Any answer, beyond the usual "more guns!" "lower taxes on the rich!" "stop regulating Our Job Creators! [aka big corporations]" "personal responsibility!" and the ubiquitous (iniquitous?) "thoughts and prayers" would be ... interesting. Also unlikely. Those guys have only three goals: disruption, revenge, and power/money.

I would say it's enlightening that practically no reporter asks them that question.

cutting taxes on the wealthy will magically cure everything...

dump the safety nets for the poor (not bailouts for the rich)...

Exactly!

Nope, come back in July. A much different picture will be had. Total income is being understated due to unsold inventory as the port clog completely unwound in the 2nd quarter creating a massive bulge. These price cuts will be noticeable in July and will expand in scope by Labor Day. Furniture, cloths, electronic goods.

Considering wholesalers panicked last fall when the port clog occurred when they were slamming the computer pad. Deflation is likely. White women are especially to blame considering their concentration in this business nowadays. I have my own experience with eh, a girl who wholesales consumer durables. I warned her......

Regarding disposible income dropping, I believe this is a statistical mirage due to higher capital gains tax payments in 2022.

Capital gains don't show up as income, but cap gains tax payments reduce disposable income.

If you look at income plus taxes paid, there is no reduction.

That sounds ... interesting. Do you have a citation?

It is just one month so take it for what’s worth. On core inflation, the number is below 5% YTY? For some reason I thought it was higher, I also thought the core number for the prior months was higher. Is there another set of numbers from another agency? Except for the sudden increase last month, the overall numbers are not that bad. On unemployment vs inflation, I think higher unemployment numbers are more damaging politically as long as the inflation numbers are just moderately high.

And so not a peep that US Fed (like other Central Banks who are also looking at extensive data sets) was quite right and the inflation denialist wing of the Left was yet again wrong.

Most people, including the Fed, thought inflation would be transient. The fact that Republican inflation hawks continued grumbling about inflation doesn’t mean much, they were wrong the past few hundred times why should they get credit for being right once

Not that inflation shouldn’t be dealt with now

It is quite funny that the political knee-jerk to a comment regarding Central Banks, making not one comment about "Republican inflation hawks", generates the strawman party political reply about said "Republican inflation hawks."

Quite the illustration of the ideological party-political distortion goggles worn, and the illustration of how so much of the Left is unable to understand inflation except as reacting to historical right-wing inflation scare-mongering. The comment I made said literally nothing about such people being right (in fact no, they were wrong for decades as like the Left now, they have had on party-political distortion field blinders and have not been based on data, but ideological and party-political reaction).

Most professional non-ideological observers moved from "transitory" a year ago (and more, as Summers). The inflation denialist / minimisation wing, including Drum have been trying to deny and hand-waive away inflation as a fundamental issue. See Drum's calling the Fed idiots.

Structuring all your thinking around party political leads to the same kind of delusion (except inverted) as long characterised the right-wing inflation scare-mongerers over the past two decades.

_You're_ quite funny, in a capering, innumerate fool sort of way. Tell us all again how you know math plenty good.

Who? Names and citations, please.

Pathetically amusing pretention.

Send this kid back to the troll farm team. Maybe then in a few years he'll be merely obvious, as opposed to what he is now, namely pathetic. I mean really, could your reply have been any lamer?

"Who? Names and citations, please."

Kevin Drum. Numerous previous posts to this blog minimizing inflation. Including some ridiculous curve fitting on inflation graphs to make it look like the trend is down.