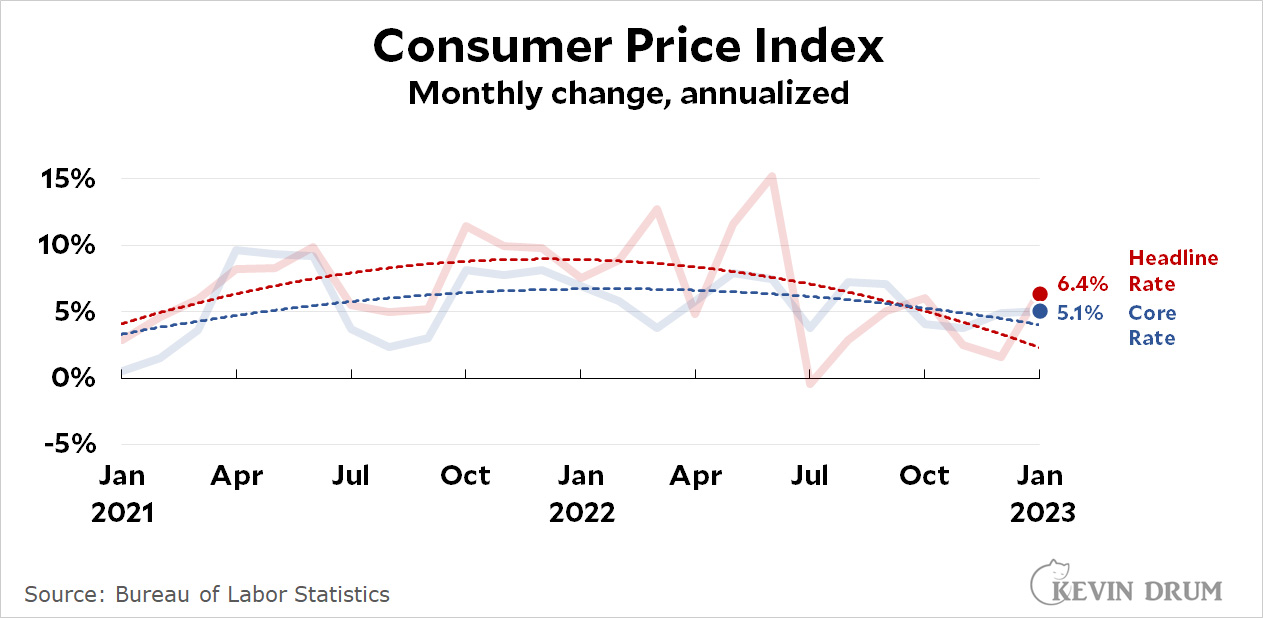

There was no good news on inflation today. According to the latest BLS figures, headline CPI jumped to 6.4% in January while core CPI increased slightly to 5.1%.

As usual, monthly data is volatile, so the trendline is the better thing to look at. It's still moving in the right direction.

As usual, monthly data is volatile, so the trendline is the better thing to look at. It's still moving in the right direction.

Measured year-over-year—which is the way it's usually reported—headline CPI dropped to 6.3% and core CPI dropped to 5.5%. This means that most news outlets will report that inflation "eased" in January, but that's not really true. In terms of what's happening right now, CPI was up.

The reason for the big change in headline CPI is higher energy prices. Compared to December, gasoline rose at an annualized rate of 33% and natural gas was up a whopping 118%. Overall, energy prices were up 27%.

Maybe too many Chinese workers are actually seriously sick and/or dying of Covid now (no matter what Xi's official stats show), driving up prices again especially in countries (like the US) that consume lots of stuff made in China. It has been about 3 months since China threw away all their strategies for controlling outbreaks... and 3 months after the US gave up our weak attempts to control outbreaks in 2020, we had a lot of hospitalizations too.

I don’t think so. I’m in the middle of a leisure trip down the East Coast of China. I’m not saying I’m privy to the internal reporting of manufacturing firms, but I’m pretty sure disruption of the kind you are referring to would be more noticeable. Also, prices don’t seem to be rising much here in China.

Impressive.... inflation goes up, and it gets unskewed down by a simple curved line plopped into the chart as a "trend"

Using an average or a trend line isnt that impressive.

But people often only like the stats that confirm their priors. Stats that tell me what i want to hear are good. Stats that tell me anything else....are suspicious!

I read that a major contributor to inflation was "housing". As measured, that is very much a lagging indicator, and should drive the numbers for a couple more months or so.

One of the frustrating things about your charts is that you selectively cut it off to draw trendlines, rather than show the bigger picture(s) which don't require trendline in order to see trends.

Core, annualized: https://fred.stlouisfed.org/graph/?g=100F7

Core, Y/Y: https://fred.stlouisfed.org/graph/?g=100Ft

Headline, annualized: https://fred.stlouisfed.org/graph/?g=100Fd

Headline, Y/Y: https://fred.stlouisfed.org/graph/?g=100Fk

Those are indeed generally more strategically useful and at least not painful examples of motivated reasoning and bizarre blinkered distortion (sadly in all likelihood the author utterly blind to it).

Should one wish to have a critical but not blinkered view on inflation, at least read Krugman (whose capacity for self-correction is good, and has at least economically well-founded views on why it seems more likely to avoid inflationary rebound than not, while allowing that the messiness of post-pandemic economic data and rebound from those distortions are making it very difficult to ascertain trends and risks).

Drum's "trendlines" are not any example of anything but a painfully embarrasing descent into skewed polls type reasoning.

“In terms of what's happening right now“ we have noisy month-over-month data.

Gasoline was up because crude was up, I suppose, but why is natural gas up so much? There isn’t a world price because capacity for ocean transport of LNG is limited. If I’m using this page correctly, this was a very warm January in the US: https://www.ncei.noaa.gov/access/monitoring/climate-at-a-glance/divisional/mapping/110/tavg/202301/1/anomaly

Natural gas prices in CA skyrocketed. Not sure how much impact that had on national averages.

Average bills for PG&E residential customers in Northern California shot up to an estimated $195 in January, compared to $151 the year before; SoCalGas customers got hit with $300 on average, compared to $123 last year...

https://calmatters.org/economy/2023/02/gas-prices-utilities-commission/

That's a CA thing as prices have fallen off their highs elsewhere.

China has also seen some blisteringly cold temperatures. In fact, I think in January all-time national record was set in the northern tip of Manchuria.

Broadly stated, I am reading two category of folks, when discussing inflation:

1. Inflation is not longer a significant problem, and or, the target of 2% inflation is unnecessary. Generally, this line of argument is from media and strongly partisan Democrats.

2. Inflation is a business problem and a US recession is a material risk. Typically, this is coming from business, especially Finance related, folks.

What ‘media’ are you reading/hearing whose hair isn’t on fire over inflation?

We are both posting to an example....lol

Kevin Drum standing in for "media" ? I think KenShultz's point is that the vast majority of the media has been reporting on inflation in very dire terms for over a year now.

FWIW, I think Paul Krugman's take of cautious optimism that inflation is headed in the right direction is the closest thing to "sober" analysis right now.

Everyone just stop buying shit please. 😂

Anyway… this is all just a way of saying the whole democratic agenda is completely dead. I am a bit confused by the state of Michigan wanting to send me more money to help me with the cost of living since so many believe it was sending money to people which caused inflation to begin with. Wouldn’t that just make it worse?

Anyway… it’s all pointless since:

https://www.lawyersgunsmoneyblog.com/2023/02/without-fundamental-judicial-reform-progressive-politics-in-the-usa-are-a-series-of-dead-ends

“None of the policies that Democrats (and frankly a majority of this country) support can survive judicial scrutiny when our judiciary is stacked with FedSoc rubes.”

Stop promising that which you cannot deliver.

https://www.fox2detroit.com/news/what-it-will-take-for-michigan-residents-to-get-180-inflation-relief-check-other-tax-breaks

Since 1972 oil price has been the main driver of inflation so no surprise that it is still a factor now. Natural gas is also a factor now.

The people who run the Fed - indeed most economists - seem unable to comprehend this simple fact.

General law, when internet commentator asserts that a "simple fact" (so asserted) is not understood by some maligned group of policy makers, experts or the like, it is absolutely the factoid is neither simple nor a fact as such.

"Since 1972 oil price has been the main driver of inflation"

No, this is not true--oil consumption has been increasingly decoupled from global economic growth for decades. Oil intensity in terms of $ of GDP per barrel of oil consumed has declined since its peak in 1973 by over 60 percent. In the US alone, oil consumption peaked in 2005 and our GDP has nearly doubled since then, without consumption increasing.

It's pretty easy to see what likely drove inflation in 2022: the pandemic, droughts and bird diseases, and a stupid Russian war in Europe. Oil prices just aren't high enough to be driving economy-wide inflation at the moment.

Well, you give the comment more merit than it needed.

However, in respect to inflation drivers, it is not of course entirely clear how to weight the drivers - although without doubt they are and were multiple combined factors, from inputs and goods relative to shortages, excess money from overshooting on stimulus to avoid recessions from lockdowns, to indeed last year's global droughts which indeed for many regions were the worst in 30-50 years constraining food supplies, to the multi-impact of the Russian invasion and added disruptions including an energy price spike to add to the food.

Although the phrase 'perfect storm' is horridly and tediously overused in media, in this instance 2021-2022 one does see a perfect storm of multiple factors that in collective combination probably can be seen as The Driver - whereas if one tries with excessivley simplistic binary thinking (either this or that) analysis, none seem explanatory in and of themselves.

Regardless, indeed for all developed markets, energy intensity has fallen drastically since the 1970s so the foolish statement you replied to is indeed pure bollocks.

I don't disagree--I was coming at it more from the standpoint of looking for a single root cause/unification theory of historical and present inflation is rather silly when there are a number of recent significant disruptions that altogether are likely big parts of the problem.

I mean, just the pandemic and its follow-on impacts on trade, savings, consumer preferences, shipping, housing, health care consumption, etc. are the sort of global multi-sector Big Deal that it would be very strange if they *didn't* drive a lot of inflation.

"There was no good news on inflation today."

Well, there is some.

Core CPI ex-Shelter declines to 3.9% YoY

https://www.calculatedriskblog.com/2023/02/core-cpi-ex-shelter-declines-to-39-yoy.html

Core CPI ex-Shelter has increased at a 1.3% annual rate over the last four months.

thanks for the link!

As usual an embarrassingly blindered post.

Well, an illustration that Motivated Reasoning and My Team blinders can afflict anyone.

Motivated Reasoners are quick to dismiss info and analysis that they dont like. The easiest way to dismiss something is to brush past the argument and instead dismiss the person making the argument.

Motivated Reasoning 101. It makes the internet a wonderful place.

I think Kevin has not been at his best on this topic but in fairness the supposed experts have not been too reliable of late either, have they ? Motivated reasoning seems to have occurred in many corners. Take Larry Summers supposedly expert warning that we may need 10% unemployment to curb inflation. I suppose it's possible . Or his rather broad comment that we may be in for "turbulence" . I mean, Duh. Does anyone think the past few years have been normal or that they have suddenly become normal ?

FWIW I think Paul Krugman's (very) cautious optimism is the closest thing to a sober take.

Krugman's economic comments on inflation are quite decent - he is after all a proper macro-economist and a very good one at that (and unlike Drum was able to admit analytical error in re temporary). Martin Wolf is another (although of course British).

Sobriety of analysis does not equal of course inflation poo-pooing - one can not that Krugman right notes that while one can be cautiously optimistic, their is it a clear thing either.

The issues of broad distortion from the quite nearly unique and certainly one can say virtually unprecedented global Covid lockdowns and distortions over 2 year period along with massive stimuli programmes (which on one hand were prudent and necessary, and should have been done, but on the otherhand overshot significatly, a reasonable risk to have taken) certainly have made it hard to judge as there are so many countervailing currents.

Not reasonable, Drum's foolish, ill-founded and just often malignant smearing of inflation policy makers. Quite uncharacteristic of him, a serious disappointment (never mind those ridiculous "trendline' graphs).

You know, comments can be edited now. Lately you have frequently been victimized by autocomplete, e.g. "one can not that" -> one can note that? "while one can be cautiously optimistic, their is it a clear thing either." their -> neither?

Anyone care to tell the rest of us what they think 'inflation' is? And whether or not they think it's a real thing in and of itself or merely a convenient reification or something else? I get the sense here that any two given commenters replying to each other are arguing from a different internalized sense of what that term means.

Me? Personally, I think 'inflation' is an ill-defined term. Saying it's an increase in the 'general price level of goods and services in an economy' is vague at best, misleading at worst, and in any case horribly imprecise for a discipline that fancies itself a science, doubly so when it insists that it's a math-heavy one.

Inflation is a perfectly defined term - whatever unlearned innumerates hand waiving.

There is nothing misleading in the least about the term, nor vague.

Entirely separate from the quantifiable aspect of inflation is the discussion and analysis of what drives inflation and what in particular causes significant changes in the rate. But that is like confusing evolution with abiogenesis, two different if related topics.

I'm with SoV on this one. You can Google this and find quite a few disparate definitions, including by well-known economists. A general rise in prices? Too much money chasing too few goods? A decline in the purchasing power of a currency?

There is in fact only one accepted way of measuring inflation; i.e. by pricing a broad package of goods and services - a 'market basket'. But there are several such baskets used by the BLS for the United States. Further muddying the water, housing is one of the goods included in the price indices, but it is determined in a unique way, and lags the rest of the basket.

In my opinion, using a single term for episodes with different causes, different remedies and different characteristic behaviors is wrong-headed, and likely to lead to misdirected actions.

Scent is 100% correct here.

I see 4 broad areas of general confusion and disagreement-

1) What is the concept and definition of inflation.

2) How is the stat calculated and why is that method relevant to an individual.

3) What is causing inflation and what should be done now to influence inflation in the future.

4) Why is inflation so critically important to individuals and the general economy.

In all 4 areas, you see general confusion and disagreement from economists, media (and the experts presented by the media), politicians and the general public.

In all 4 areas, vagueness abounds and confusion reigns. Often the causes of inflation are mixed up with the definition, sometimes on accident, sometimes to sew confusion.

Inflation is a powerful boogeyman that can be used to sell clicks and misleading policy. Vagueness and confusion are key.