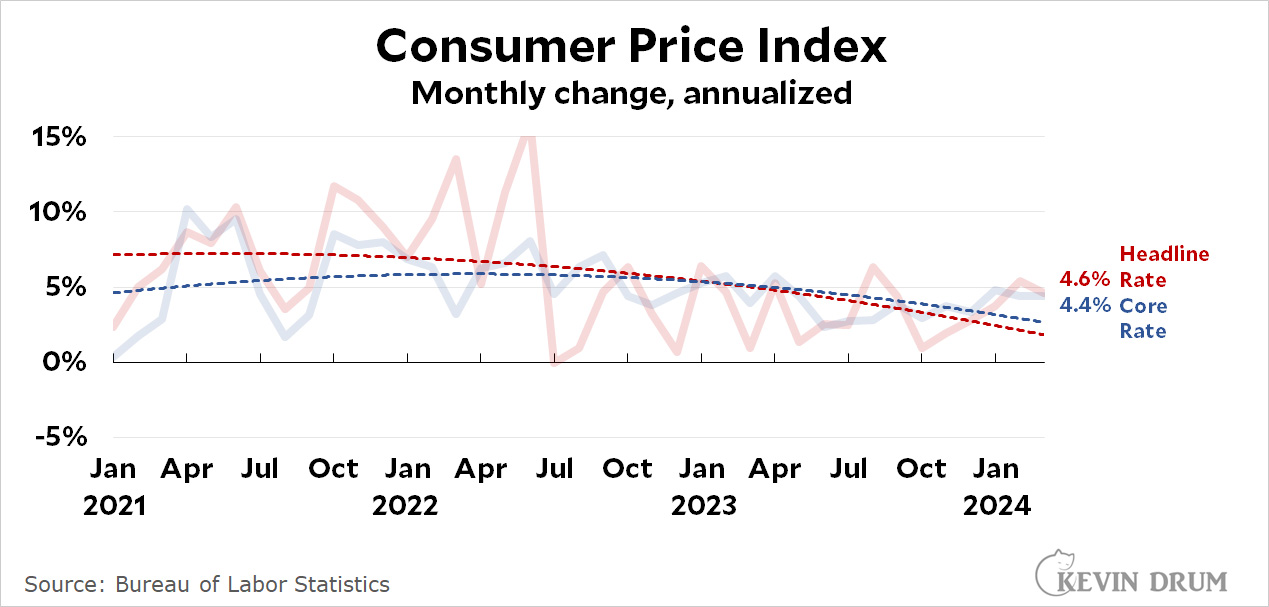

Inflation slowed a bit in March from its February surge. On an annualized basis headline CPI inflation came in at 4.6%, down from 5.4% last month. Core CPI was unchanged at 4.4%.

Groceries continued to show zero inflation in March. Transportation and medical care were up sharply. As usual lately, inflation in services was high and inflation in goods was negative.

Groceries continued to show zero inflation in March. Transportation and medical care were up sharply. As usual lately, inflation in services was high and inflation in goods was negative.

On a conventional year-over-year basis, headline CPI was 3.5% and core CPI was 3.8%.

NO...inflation is out of control, DOW is DROPPING!!!

Housing is causing problems--though people would hate it if the price of their house dropped....

I'm guessing earnings will still be strong, maybe not so strong once inflation corrected...and DOW will be back.

Because the report was not positive it is considered negative, but I would call neutral as the numbers haven’t changed the last few months. I have posited in these pages before that the 2% inflation target is unrealistic and the first part of this century represented a historical anomaly regarding inflation. A more realistic target would be between 2-3% and in this sense the current rate is just barely above that. The current Fed rate ironically is compounding inflation and should be cut to accurately reflect the current situation. The Taylor rule indicates that the rates are too high.

If we disregard Kevin's silly curvy lines and also the noise in the month/month numbers, taking the average of those numbers since inflation broke in July 2022, the average is 3.25%, which is (not surprisingly) what the year/year numbers have been giving - a few tenths one way or the other are not significant.

There are obvious reasons why headline inflation has not come down more, such as housing/rent (see Dean Baker for example) and relatively high profits. But there is no reason why inflation should stabilize at 2% or any other chosen number. The Fed does not have a magic wand or any real tool to control inflation to this degree. There is actually no good reason to think that it has much control at all over inflation - it certainly did not control inflation in the 70's and 80's.

"a few tenths one way or the other are not significant."

According to Wall Street, one tenth one way or the other is catastrophic.

CPI (year over year) peaked at 9.1% in June of '22. In June of '23 it dropped below 4%. Every month since then it's been between 3.0% and 3.7%. It's now at 3.5%, a few ticks up from 3.2% a month ago, and one percentage point above where economists had forecast this month's number would be (auto insurance a big factor).

Wall Street is down and it looks like we're about to have a freakout about scary inflation ("Oh no!") all over again. The headline for the lead story at the NY Times is "Hot Inflation Report Is a Blow to President Biden." ("Oh good! Some bad news we can blame on Biden again!") Someone was writing today's CPI report is the death blow to the "transitory inflation" narrative and demanding people like Yellen and Krugman need to apologize to the nation.

Another way to look at it is that inflation was transitory. Nobody claiming inflation was "persistent" in 2022 was predicting that inflation would be steady between 3% and 4% for the past 10 months. We are in a much better situation than any of the doomsayers had forecast.

The delusion is expecting that we're headed for the Fed target of 2% inflation anytime soon. We can have a robust, growing economy with inflation over 3%, or we can have inflation at 2% (or even lower) with a deep recession or worse.

The delusion persists because no one (esp. the Fed) wants to admit the ultra-low inflation of the last decade is not a realistic or worthy goal. But those are the choices. I hope we pick the "robust economy" door because the alternative leads to dire outcomes, economically and politically (and much worse than we've seen in recent memory).

In an ideal world, we would have a robust growing economy with an inflation rate of zero or slightly less. However, it appears that the people in charge are so convinced that can't be done that they're making no effort at all to figure out how to do it. To paraphrase Arthur C. Clarke "if a distinguished and elderly economist tells you something is possible, he is probably right; if he tells you something is impossible, he is very likely wrong".

Good thing transitory has elasticity to it.

Too son to tell I would say but Team Persistent is not looking very good , is it ? Especially the folks who warned about inflation for a decede before the aftermath of a wordlwide pandemic finally made them (briefly) right . Going back to the '70's is just around the corner, yes ?