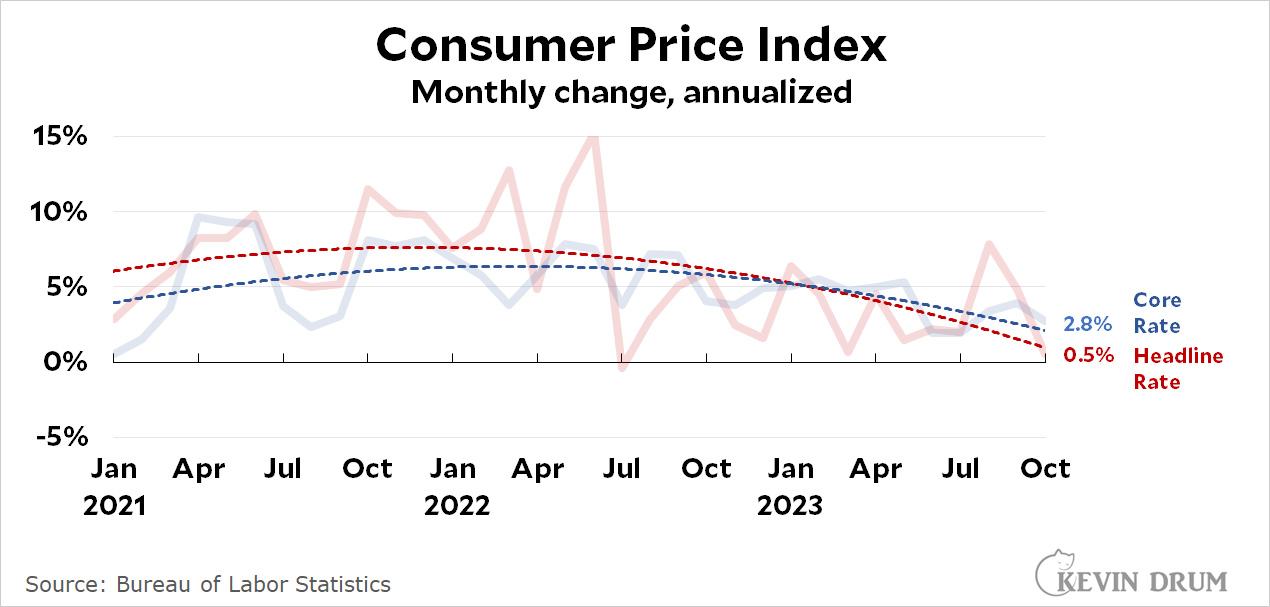

CPI was down a lot in October:

Headline inflation was down almost to zero thanks to lower gasoline prices, but core inflation was also down. On a trend basis, we're already down to the Fed's target rate.

Headline inflation was down almost to zero thanks to lower gasoline prices, but core inflation was also down. On a trend basis, we're already down to the Fed's target rate.

On the conventional year-over-year basis, headline CPI was down to 3.2% and core CPI was down to 4.0%.

Wait till March, when it's slightly below zero.

The Federal Reserve can deliver a recession, reliably, when one is called for. But it can't time them very well, unless the 'when' is basically 'now', and it stands on the brakes.

I think the record of what happens to incumbents who have a recession during the first quarter of their election year makes one a certainty.

Surely there is some way to report this as terrible news for Biden.

The economic issue hurting Biden is higher prices. For non-gas/food those usually don't go down.

Bravo. Perfectly done!

The lack of deflation is terrible news for Biden!

If deflation occurs, we immediately pivot to deflation being terrible news for Biden.

The circus never stops!

Did you dig down into the data? Air fares have dropped significantly. I might need to take a flight.

Dr Paul Krugman's latest discusses the disconnect between actual economic numbers and the public's "perceptions" and concludes that it's overwhelmingly Republicans (and the ref-worked media) who are so down on the economy.

His good news: Let 'em. These are the people who would never, ever have voted for a Democrat anyway.

Team Transitory is now spiking the ball. In reality, deflationary pressures currently present a greater danger to economic health than inflation. Falling oil prices may seem acceptable for most but if the current trend continues for a few more months, it will have deleterious long term consequences just about everywhere. It’s $77/barrel today, which is fine, but at a certain point ($50?) you would have rig contraction and so forth. And that’s just one example of the impact of deflation. Students of history know the Great Depression represented a deflationary spiral. As of now there aren’t any data points to show this to be a real concern but it is worth paying attention to.

Last time oil prices reached $70, Biden began refilling the strategic reserve. Not sure how much they bought (or if they are buying now), but it seems likely prices won't collapse.

Of course, I could swear that prices at the pump are much higher than in the past when oil was this price. In fact, I could swear for the last 2 years prices have been much higher at the pump than in the past when just comparing it to the price of oil. Maybe I'm wrong and the prices match closer then I think. I don't find $3.50 a high price in 2023, but I could swear that in the past oil prices needed to be much higher to reach that price.

oligarchy pricing

There's limited deflationary pressure (although there is significant disinflationary pressure) for the time being.

With the Fed rate so high, they have lots of room for accommodation to prevent deflation. And even then, when we hit the ZLB, they still have the ability to expand their balance sheet (quantitative easing) -- the point being, as Dean Baker recently pointed out, comes with the (desired) risk of inflation.

Also, it's unreasonable to include energy prices as signs of deflation. Or put it this way: there's a reason why the Fed relies on core prices, not headline.

"On the conventional year-over-year basis, headline CPI was down to 3.2% and core CPI was down to 4.0%." Always remember the year over year numbers are a measure of where inflation was 7 months ago.