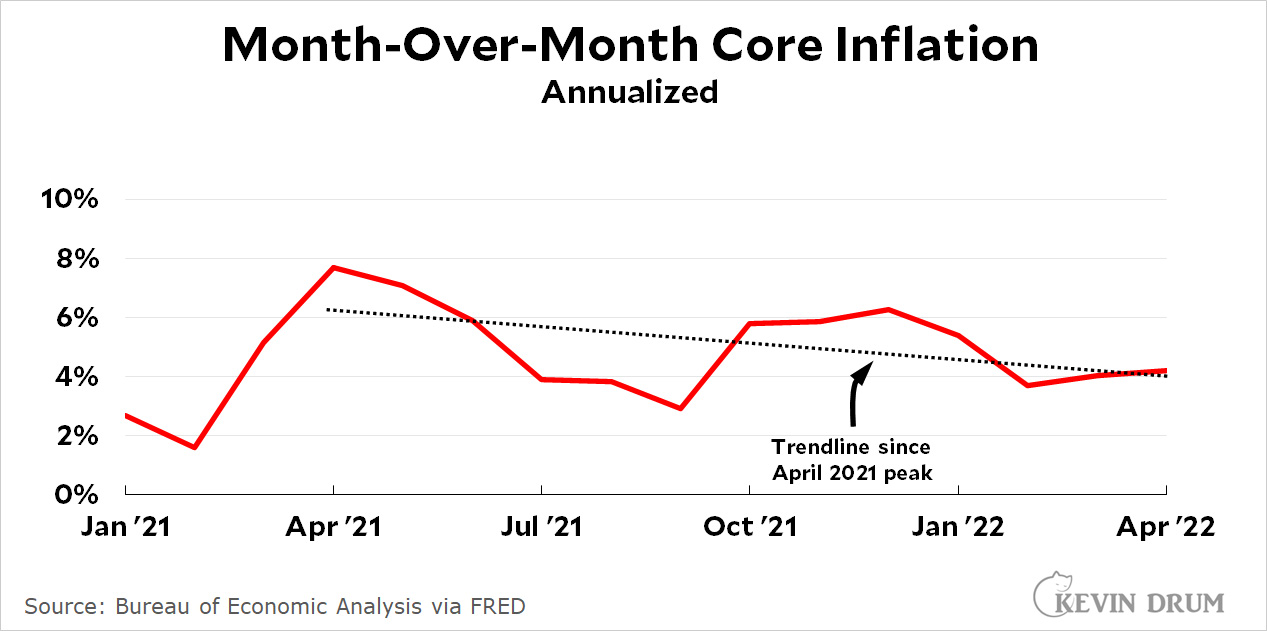

While we wait for new inflation numbers to be released on Friday, here's a quick look at the inflationary pressure facing the economy right now:

This is based on core PCE inflation, the Fed's preferred measure. However, instead of showing year-over-year inflation, it uses month-over-month in order to get a sense of how inflation is rising or falling at any given moment. Unfortunately, because month-over-month figures are volatile, the number for any single month is pretty meaningless. The only way to extract anything is to look at the longer term trend.

This is based on core PCE inflation, the Fed's preferred measure. However, instead of showing year-over-year inflation, it uses month-over-month in order to get a sense of how inflation is rising or falling at any given moment. Unfortunately, because month-over-month figures are volatile, the number for any single month is pretty meaningless. The only way to extract anything is to look at the longer term trend.

So that's what this is. Since core inflation peaked in April 2021, the trendline has gone down from about 6% to 4%. This represents, I believe, the fading away of fiscal stimulus and the recovery of supply chains, both of which should continue.

Food and energy, though, will probably remain volatile, and that's what most people care about. Unfortunately, there's nothing much the Fed or anyone else can do about that. Monetary policy mostly affects core inflation, which is already trending down, and presidential policy doesn't affect much of anything at all.

If the bird flu epidemic passes, then egg and chicken prices should drop.

War in Ukraine means grain prices will go up and oil prices will stay high.

Retailers are starting to do some discount pricing--people are going out and not spending as much to get another new TV.

People are going out, so travel costs are up (and don't ask about car rentals).

The crash of blockchain digital currency, e.g. bitcoin, frees up microchips for other goods.

In other words, Kevin is right. Just expect news stories on what price is spiking now, with obligate picture of a gas station show >$10/gallon gas, and not so many on what prices have fallen back down.

golack

Chicken and egg pricing is already returning to normal. 8 - 12 weeks to grow a chicken to "prime" eating weight. Another 12 weeks to grow hens to egg laying.

As soon as bird flu was detected the chicken "farms" went into over drive. The chicken/egg situation is almost over.

Oil on the other hand is far FAR different. First it's a global commodity so we don't set the price. Second we use very little US oil for gasoline because it's dirty oil. But whats happening in oil is being caused by labor shortages, parts shortages, port back logs when multiple refineries are "down" for maintenance or shut down completely. Drill baby drill won't fix this part of our inflation problem but the markets MAY fix it for us. Already demand for gasoline has slackened a little. But our Gulf Port refineries are now turning away Canadian oil for refining and shipping due to no excess storage capacity. (Not for gasoline but for bunker oil etc).

A serious wave of COVID may be just what we need to scare people into staying home right now. Couple that with even the small increase in OPEC exports of oil and gasoline pricing SHOULD come down.

But labor shortages which cause parts shortages are here to stay until demand goes down permanently - like when all the boomers die off.........

Nom, nom, nom, nom....but, is there enough time for Tom Turkey for Thanksgiving?

It's all fine and dandy that core inflation is moderating. But, as long as gas and food prices stay high nothing else matters. These products are seen and paid for every week at least, so the pain is real and hurts everyone who isn't rich (aka, the rest of us) all the time.

> Food and energy, though, will probably remain volatile, and that's what most people care about.

I think people are shockingly sanguine about food, and are in for a very rude shock relatively soon.

Putin's Big Adventure is going to bite hard for some core staples, and I don't know enough about substitution patterns around the globe to have any guesses as to what else is going to spike, but I expect a huge big ugly mess.

(Also, ugly headlines about pocketbook issues heading in to the midterms... wonder what the expensive big brain strategery thinkers in the campaigns are doing to prepare?)

Considering China is no longer buying Russian oil, even their capital controls won't work. Production is collapsing.

Oh yeah, wanna know why oil has gone up by the financial elites????? There is your reason.

Don’t worry. Like the caravan stories that ramp up right before an election and then vanish, the inflation story will also magically go away once the GOP is confirmed to take control of 1 or both houses. The actual problem may persist but the media will move on to the next Republican sponsored talking point, probably Hunter’s laptop or something.

Probably? Lol.

So...no need for more interest rate hikes???

I would hope the Fed governors agree.

The Fed's goal is 2% inflation, yes? When does the trend line intersect 2%? Mk I eyeball suggests April 2023...

Krugman argues in a recent wonky article that "2%" is actualy a pretty arbitrary number and evidence suggests that 4% would be just fine, too. Which is about where it is.

Of greater concern, in my opinion, is how high gasoline prices have to get and for how long before Americans break off our love affair with big-ass pick'em'up trucks and SUVs. And/or start to consider public transportation.

I see that Kevin, in his mad attempt to deny inflation as a problem, is having us look at the second derivative of price change.

Try that on the general public and see how persuasive it is.

COMING UP: Kevin demonstrates that the third derivative is getting smaller, ergo gas and food prices are not high.

Dude, real inflation has been dropping for 6 months now. Many of the underlying supply issues are over. Indeed, we have oversupply.

If you are too retarded to understand that, you need your brain bashed in until your head is mesh.

I've been thinking lately that both primary measures of CPI can sometimes be the exactly wrong measures of microeconomic actions to drive political macro decisions. For instance, you can't substitute eggs; you either buy eggs or you don't. Other items can only be substituted to a certain point, and when that lowest priced item goes up in price, you're SOL.

Maybe there needs to be an CPPPI -- consumer price political pain index -- that solely tracks food (and energy), specifically the average lowest price of each category of goods.

Yet gas prices keep rising despite “inflation” falling. We have crises on top of crises, and Congress because of the filibuster and the two fake Democratic Senators won’t and can’t do anything about any of them. The populace regardless of gerrymandering playing a roll will vote the nazis (seriously, let’s finally stop calling them “far right” and instead call them what they are) into power this November in both houses, and we won’t have to worry about this polarization anymore as they will push this country in a direction many states simply cannot and will not follow. It might even begin happening as soon as the Supreme Court rips up Roe v. Wade.

Nazis??? Nope. Are you even trying?l They represent bourgeois globalism at its finest. You need killed.

Clearly many of the price increases that are pushing up the indexes are due to supply issues. Fixing supply issues often requires investment to bring more production capacity online, or to upgrade infrastructure in order to speed deliveries of goods and services. Given that, if raising interest rates to bring prices down actually did restrain investment, it would be almost guaranteed to bring a recession. Fortunately the data seems to show that interest rates have minimal impact on business investment.

Here's 8 oz of vanilla at Walmart,

https://www.walmart.com/ip/Simply-Organic-Pure-Vanilla-Extract-8-Fl-Oz/190961850

And then, Friday came along and we get: https://www.cnbc.com/amp/2022/06/10/consumer-price-index-may-2022.html