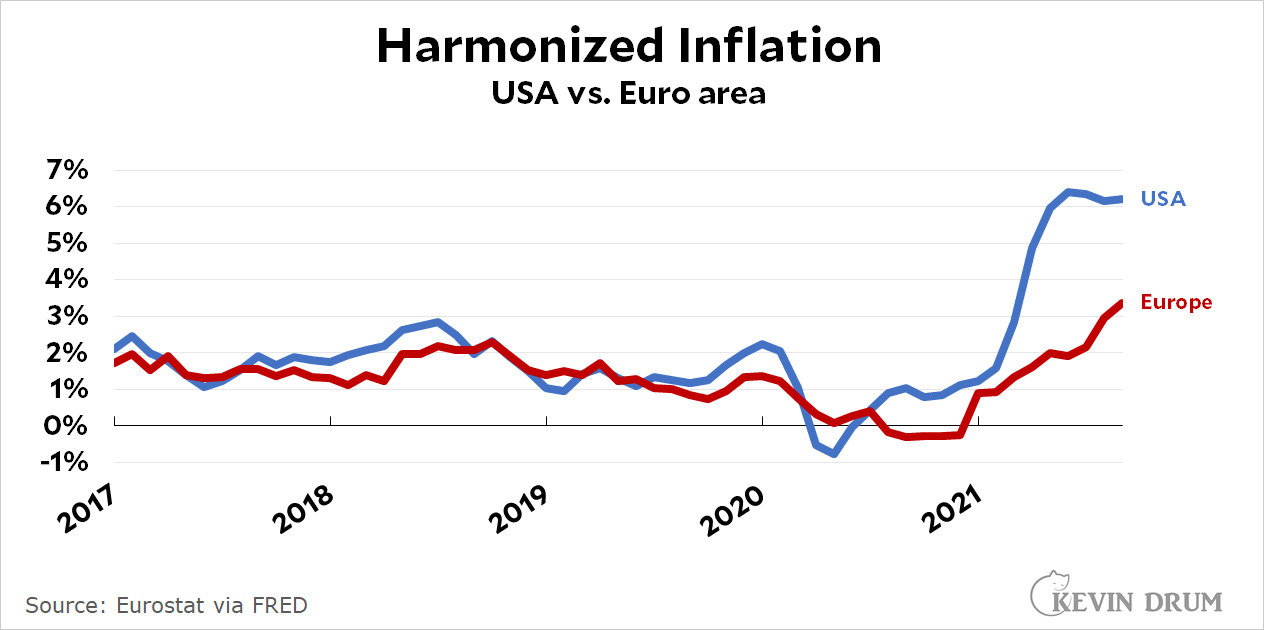

As long as we're on the subject of inflation, a reader emails to ask whether high inflation is a global problem or a purely American one. For starters, here is inflation in the US and Europe:

One thing to notice is that this is "harmonized" inflation. Every country has a slightly different way of calculating inflation, so Eurostat performs some statistical magic to bring them all into line and make them comparable. That's why the US figures look a little different than the ones you usually see. Eurostat thinks the US hit a 6% inflation rate back in May and has been pretty steady ever since. Euro-area inflation, by contrast, is still low but appears to be climbing.

One thing to notice is that this is "harmonized" inflation. Every country has a slightly different way of calculating inflation, so Eurostat performs some statistical magic to bring them all into line and make them comparable. That's why the US figures look a little different than the ones you usually see. Eurostat thinks the US hit a 6% inflation rate back in May and has been pretty steady ever since. Euro-area inflation, by contrast, is still low but appears to be climbing.

Take that for what it's worth. A few months from now things might look very different.

The main takeaway, however, is that in March US inflation started to pull away from Euro-area inflation. Why? Paul Krugman dedicated an entire column to this question and concluded that it was a mystery. And if it's a mystery to Krugman, who am I to have an opinion?

But let's throw caution to the wind and offer up the obvious answer: in the US we passed a $900 billion stimulus bill in December and then followed it up with a $1.9 trillion stimulus bill in March. That's a lot of money to dump into the economy, and seems plenty sufficient to touch off a round of inflation. European countries mostly didn't do this because they already have safety nets that take care of people during things like recessions and pandemics.

So that's my answer, anyway. It's also why I continue not to be too worried about high inflation. We pumped $2.8 trillion into the economy, and it's no surprise that it produced some inflation. However, that was a one-time event. Once that money works its way through the economy, inflation will fade away naturally.

That's just my two cents. Remember, though, I Am Not An Economist.¹

¹Not that economists seem to be doing any better on this question...

"We pumped $2.8 trillion into the economy, and it's no surprise that it produced some inflation. However, that was a one-time event. Once that money works its way through the economy, inflation will fade away naturally."

I HOPE inflation is a short term/one time challenge related. I look at the charts (Consumer Price Index Components) and think the reality is more complicated.

Housing, Education, Medical Care are all rising rapidly: these three items are more than 50% of the whole index.

Landlords raised rents approximately 11% this year: is that going to go down to 2% raises next year? Do you see universities lowing their tuition because the Federal stimulus is over? Same goes for your local hospital or prescription drug.

I THINK higher inflation (compared to our sub 2% average) is likely for the next several years....

https://farmfolio.net/articles/cpi-not-accurate/?gclid=CjwKCAiAp8iMBhAqEiwAJb94z1hc7TiQggz3yZ2TWvJoQpDkYiaHt0VpyCCukXCrnv-xnjGo2Z2RVxoCs24QAvD_BwE

Medical care isn't rising that rapidly nor is a largly.part of CPI, which was the complaint from before. Lazy post.

True but misleading. There was a significant postponement of optional medical procedures. Therefore, the current figure is misleading. Given that inflation is future expectations, I hold to my comment: medical inflation is above historic norms.

Nope. Medical inflation has been irrelevant to this ramp. It's more relevant for understating total inflation for years.

While we can debate my inclusion of medical inflation in my comments above, my broader point stands. Items such as real estate, education, domestically produced commodities are all rising rapidly in terms of price.

The aforementioned, are not primarily driven by supply chain issues and also its far from certain they will return to 'normal' in the near term.

The Federal Reserve doesn't like to keep inflation under 2%. it wants it to average 2% over the long term, and therefore says:

"To address this challenge, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation modestly above 2 percent for some time. By seeking inflation that averages 2 percent over time, the FOMC will help to ensure longer-run inflation expectations remain well anchored at 2 percent."

https://www.federalreserve.gov/faqs/economy_14400.htm

Five or six percent is probably not their idea of "modestly above 2 percent," though. I would expect them to try to manage it down to 3% or so within the next year.

Landlords raised rents approximately 11% this year: is that going to go down to 2% raises next year?

Maybe. It partly depends on what wages do. You can't get blood from a stone.

If you look at history the causes of inflation in economically sound countries like the US are clear - mostly it's war, but there was also the oil-price shock of the 70's (inflation went up when oil price did and down when oil price stabilized - it's really almost that simple, although grain price was also involved at the beginning). We don't have either of those things now, but obviously there are temporary factors because of the pandemic.

In theory massive government spending in peacetime could also cause inflation, but there was a major test of this in Japan after 1991. The government spent enormous amounts on infrastructure and other things, running up debt over 230% of GDP, but inflation never rose - in fact there was deflation for some time. So even if the BBB bill passes without being fully paid for (which is probably how it would be) it is by no means certain that it would cause inflation.

I wonder what would have happened if the Japanese government had just given people money. Maybe it would have just been saved.

I am not an economist, either, but I am skeptical of non-economist KD’s explanation. The more-generous social-insurance programs of EU countries affect the economy pretty much like the US’ relief/stimulus acts - they dump more money into the economy when a negative shock occurs. Europeans who lost working hours or jobs due to the pandemic received benefits which let them continue essential spending, even while they were unable to produce goods or services to be purchased. So both regions had a disparity between supply and demand; to explain the difference, one would have to assume that the US stimulus was proportionately more generous than the EU automatic stabilizers (as economists term the social-insurance programs). It’s not impossible - Republicans voted a generous first package, trying to buy re-election for their unpopular President.

Dean Baker is an economist and he disagrees with Kevin. If you look at inflation in European countries their rate doesn’t track with how much stimulus spending they did. For example France and Japan had larger stimulus spending packages than Germany did but they now have lower inflation.

https://www.salon.com/2021/11/14/take-a-deep-breath-putting-current-inflation-in-the-proper-perspective_partner/

It is more complicated than Kevin suggests. Yes, a lot of money was pumped into the economy, but that is because a lot of people were out of work and small businesses were closed or open for limited hours or with limited access.

On a net basis the stimulus was not that large.

"So that's my answer, anyway. It's also why I continue not to be too worried about high inflation. We pumped $2.8 trillion into the economy, and it's no surprise that it produced some inflation. However, that was a one-time event. Once that money works its way through the economy, inflation will fade away naturally."

And in the process we prevented an economic meltdown and have a growing economy once again with unemployment at 4.6 percent and wages going up. I think that's a damn good trade-off, don't you?

Many/perhaps most economists would agree the inflation is about expectations for the future. For many items, the collective wisdom appears to be that the near term future is going to be much more expensive...

https://www.brookings.edu/blog/up-front/2020/11/30/what-are-inflation-expectations-why-do-they-matter/

I didn’t get past “If everyone expects prices to rise, say, 3 percent over the next year, businesses will want to raise prices by (at least) 3 percent, and workers and their unions will want similar-sized raises.”

On wages: A little over 6% of private-sector employees are represented by unions. That’s not much clout.

On prices: My favorite economics paper is Asking About Prices by Blinder, et al. They identified 11 hypotheses as to how private unregulated businesses set prices. All 11 were found to be incorrect. I think we have found a twelfth incorrect hypothesis.

The more plausible explanation for expectation effects is that consumers advance their purchases, buying before prices rise further, and that causes demand to exceed supply, which exerts upward pressure on prices.

What you are describing is basically a change in money velocity.

And that can be dangerously accelerating inflation simply by expectations.

Money supply is not just the money the govt supplies, it is multiplied by how fast it circulates. As people expect future inflation ( of more than they can get holding their money), they can rush to try to spend it or buy something real before it's value erodes. And that additional velocity expands the effective money supply thus causing that expected inflation. A self fulfilling prophesy.

This can feed on itself and get out of control.

Actually I was being (and am) agnostic between velocity and credit expansion as the source of excess demand. If buying ahead is actually a significant phenomenon, then both could be factors.

KenSchulz - perhaps think of it this way. Imagine you decide you want to take a holiday in a few months. A factor in how you proceed is pricing: do you buy your tickets now? Do you think tickets will be cheaper in the new year?

Basically, you factor in a guess about the cost of an item, in the future into your current behavior.

Suppliers, signing year long large contracts to provide a good or service should/generally do factor in an assumption, or even an actual adjustment vehicle, for inflation. For large dollar value contracts or long term decisions (build a plant, five year contract etc) sophisticated people often have embedded assumptions about inflation.

Note, some items price, for example the price of oil flocculate rapidly. However, many items/companies can't rapidly change prices and have significant fixed cost: rent, wages, insurance etc. The challenge really is inflation uncertainty. IF you knew, with certainty, that next year there would be 12% inflation (yes, I pulled a crazy number on purpose) companies could operate: its not ideal but this was the challenge in say Brazil for many years. The problem now, in the US, the uncertainty about inflation next year or two....

No. Businesses have specific inputs, and to a lesser or greater extent, they need to plan for projected changes in the prices of those.

Agreed assuming projected inflation is an input....

No, inputs such as feedstocks, raw materials, business services - stuff you have to pay for, as was clear from my comment.

Economists have always said that a shortage of goods for which there is strong demand causes inflation. It’s econ 101. The supply chain is causing a shortage at a time that people are demanding more now that they are starting to return to normal. It doesn’t help that there is a serious shortage of truckers because of the low pay and working conditions. That should be discussed more.

That is a generous grade of D in an econ 101 class and is a real poor understanding of economics. But the type of thinking you see all the time in the media .

Show your work.

To the extent that govt programs prevented an " economic meltdown " from pandemic distortions if the free market could not adjust prices and wages fast enough, OK.

But you seem to think that magically the govt could somehow keep the economy from suffering at all or not have most Americans have to tighten their belts and take a hit in consumption ( i.e. get a bit poorer ) . Nonsense.

When you have a pandemic, and harsh restrictions to try to control it , that inevitable just have to cause a decline in production, expecting the American public to not have to decrease consumption correspondingly was insane.

The idea of an economic stimulus is that the economy is not at producing at capacity due to some free market distortions or inefficiency. So tweaking demand might get production up to capacity by forcing that supply.

But when economic capacity is reduced, at least temporarily, by an event like a pandemic, all you might do is try to keep demand high enough to keep economy at that REDUCED capacity. Which still means a decline in consumption.

But somehow the American public were sold on the fantasy that we can impose harsh economic restrictions, even pay people not to work , but no cut in consumption. Utter fantasy.

No. Nobody was promised a normal level of consumption of restaurant meals, Broadway shows, air travel, sports events, etc. No state paid 100%-replacement UI to every unemployed worker.

Not sure if this is the right comparison…

https://tradingeconomics.com/united-states/retail-sales

If retail sales can act as a stand in for demand then it’s really not demand driven inflation at all. Supply constraints are the whole story?

Is the 2021 rise in inflation the beginning of a long-term problem for the economy?

Economists and bloggers and journalists and politicians all have opinions. TV talking heads, Facebook friends, soccer moms and dads on the sidelines -- ditto. Everybody has an opinion, even the guy at the end of the bar who can explain it all for you. Some of those opinions try to be fair, others are made with an axe to grind. Some are informed, others not so much. Who are you going to believe?

I would say the best source for answering the question is none of the above.

The best source for answering questions about the future of the economy are the markets. It's what they are designed to do. The record of the markets isn't perfect, but they're a better predictor than any other source.

The answer from the markets right now: NO.

Long-term inflation should not be a major concern. If the outlook changes, the markets will change. But the answer today remains NO.

For more detail, here's one view of the markets re inflation:

https://youtu.be/De-3_ud17V0?t=536

(There is a different question markets don't answer. Will inflation worries be a political problem for the president? That has less to do with the economy and is one reason that many axes are ground.)

Watched the video segment: interesting to see the stocks-based comparisons. The bond market’s expectations haven’t gone up dramatically either, so far.

Link: https://fred.stlouisfed.org/series/T10YIE

10-yr. looks relatively "normal."

Throughout the year Kevin said he was not worried about inflation.

Now he's saying:

"I continue not to be too worried about high inflation"

Look at those qualifiers! *too* worried, and *high* inflation.

And of course, Kevin gets to define what's high. Is 5.9% high? I think so, but apparently Kevin does not.

Here's a run down of Kevin's previous posts on inflation: (special pleading in ALL CAPS)

July 8, 2021

The first thing to notice is the enormous inflation in used cars. .. FOR THE REST OF US IT MEANS the overall inflation rate is closer to 3.5% than the official rate of 5%

July 12, 2021

The endless preoccupation of the US news industry with inflation is truly spectacular. ... I'm not even saying the stuff in this particular piece is wrong. Rather, IT'S ANCIENT. IT'S A BUNCH OF TRENDS THAT INFLATION HAWKS HAVE BEEN WARNING ABOUT FOR YEARS.

July 13, 2021

[Re 5.3% increase in CPI]

That's pretty high! However, IF YOU USE KEVIN'S HANDY INFLATION CALCULATOR, WHICH ADJUSTS FOR BASE EFFECTS (that's the dip in mid-2020) the real-world rate is more like 4.4%.

August 11, 2021

Inflation in July remained high at 5.4%, LARGELY DUE TO HUGE INCREASES IN THE COST OF GASOLINE AND USED CARS.

August 27, 2021

The New York Times says inflation rose "sharply" last month using the Fed's preferred measure, and I suppose that's true. ... Core PCE inflation peaked in April and has been dropping ever since. ... So while it's still high by historical standards, IT'S PLUMMETED TO HALF OF WHAT IT WAS JUST A FEW MONTHS AGO. This suggests that the momentum behind high inflation is starting to ease.

September 14, 2021

The headline CPI index in August clocked in 0.27% higher than the previous month, an annualized rate of 3.3%. THIS IS QUITE A BIT LOWER THAN THE 9%, 7%, 10%, AND 5% RATES OF APRIL THROUGH JULY.

October 13, 2021

The headline CPI index in September clocked in 0.41% higher than the previous month, an annualized rate of 5.1%. This is a tick higher than it was in August, though still QUITE A BIT LOWER THAN THE PEAKS OF EARLIER THIS YEAR: ... As always, THIS IS JUST ONE MONTH OF DATA AND NOT SOMETHING TO BE PANICKED OVER.

The time frame is what's important. Everyone acknowledges that we are experiencing relatively "high" inflation (i.e., based on the trend of the last decade, but not compared to the 1970s-90s). The important economic question is: Will this "high" inflation last?

Scenario A: Let's say 5.9% inflation continues for the next decade

Scenario B: Let's say this year's inflation is even higher -- 10% -- but soon drops off to a persistent level of 3% (still higher than the previous decade)

Here's what happens to a $100 grocery bill.

Scenario A

2020: $100.00

2021: $105.90

2022: $112.15

2023: $118.76

2024: $125.77

2025: $133.19

...

2030: $177.40

Scenario B

2020: $100.00

2021: $110.00

2022: $113.30

2023: $116.70

2024: $120.20

2025: $123.85

...

2030: $143.53

Those two scenarios are quite different economically (and politically). Even higher short-term inflation is less a problem if the long-term trend falls to a more manageable level -- which is what many smart people, and markets, predict.

BBB remains an unhatched chicken (or turkey I suppose, depending…) but isn’t that yet another stimulus?

Not really. I argue the opposite, at least on consumption.

Depends on how much confidence you have in the pay-fors.

BLS data is always flawed. It overstated inflation for years on the consumption side and understated inflation by health care or housing. But since consumption inflation wasn't that high, inflation never looked high.

Consumers are spending too much money, creating cost push inflation to fill orders with a surge in retirement aiding the problem. It seems simply to me, slow consumption in core spending while auto catches up in 2022. It gives you the smell of deflation and rebalancing.

This is all bizarre. At the beginning of the year a lot of people were predicting higher inflation this year as the economy went back to normal. 6% is not some shock that came out of nowhere. The supply chain bottlenecks have been more severe that anyone thought, so maybe the inflation will last a little longer than expected, but having 6% inflation for one year to get an economy with below 5% unemployment seems a great trade off. Compare this to 2008, 2001, or 1991 when it took forever to get back to low unemployment and things look great. No one who had a hard time looking for work back then would have hesitated to trade their economy for ours.

It is highly likely that things will be back to normal a year from now. So unless we continue to see high inflation well into next summer, I'm not worried and I'm amazed that anyone else is.

Sorry, but 6% inflation is yry. around 4.5% looks like total amount for 2021.

High govt social spending itself does not cause inflation. It is how you structure it and pay for it that can by effectively increasing the money supply.

If you really did raise taxes to pay for all the spending, then it should only effect inflation by differences in velocity as you move money from one hand to another ( probably from richer to poorer presumably) . This might have some effect but not huge.

But when you effectively pay for the spending by creating money, like giving people stimulus credit cards that functioned effectively like money, yes you can get inflation.

And if the pandemic basically lowered velocity of money, when people just kept the money in bank accounts as not going out and spending, that would keep inflation low . But then velocity increases as people get out and spend, so that increases effective money supply.

And, as I have said, just not possible to actually have consumption stay constant when production is forced lower through pandemic and restrictions , without destroying necessary investment ( which is supposed to be going up with infrastructure bill?) Or borrowing more from other nations ( and their production is down too so are they supposed to slash their consumption so we do not have to decline at all?).

The pandemic stimulus programs basically promised the impossible. We could all produce less but not have to cut consumption. Which was ridiculous and you see reality forcing itself in with this result.

And some will still argue that what I am saying is cruel and heartless and want to make people poorer. But it is simply not believing in a fantasy.

A decline in prices followed by an offsetting rise was to be expected due to the pandemic as it affected velocity ( basically decreases velocity temporarily). But we are past that and now seeing effects from unrealistic policies.

Consumption isn't being cut moron. It's actually the reverse.

Prices go up because they can.

The pandemic provides an excuse.

The Trump tax cut and increase in monopolies combine to raise prices. The stimulus money and the pandemic means that customers may be upset, but there's no strong push back. And no one is willing to risk lower ROI to increase market share.

Oil and gas production has not gone up a lot in the US despite higher prices. Why? The companies are making more money now and don't have to spend a ton more to up production.

There are only a handful of meat packers. As ranchers culled their herds because of drought, the packers paid out less money to them, if they bought at all--it's not like they could sell the animals to someone else--but didn't really increase output nor lower prices they charged. Maximize return with little new investment.

The supply chain issues are also a case of maximizing short term ROI--see freight shipping. The companies at the root of some of these issues are also the ones benefiting from these problems. See Enron?

The supply chain crises should pass in a couple of months, and that will let some prices drop. But those brought about by monopolistic power will hang around.

Of course P/E ratios are a bit irrationally exuberant as one might say.

Europe, particularly southern Europe, also has much higher unemployment generally than the US, which keeps inflation lower. Greece and Spain are running at something like 15% right now.

That is just how they measure "unemployment" . It's understand your error.

% change from a year ago is not as useful as aligning the different economies to an index and setting Jan 2020 as the matched starting point. This is the closest measurement I can find: https://fred.stlouisfed.org/graph/?g=IWge

Average CPI:

12 months- 6.2%

24 months- 3.6%

36 months- 2.9%

9 years -1.9%

Actually averaging near 2% is difficult if we have a panic attack everytime we go above 2% in the short term to bring the average up to 2%.

These are CPI numbers, not PCE, but you get the point. The only way to average a number is to occasionally go above it.

Summers predicted the fiscal stimulus would drive up demand, Krugman thought Summers would be proved wrong. Krugman is now admitting there is an inflation surge he didn't see coming.

Maybe, but inflation was rising No matter what. It also looks like Christmas shopping was abnormally early creating a false inflation spike in October. Most likely nonpce spending slows noticeably by January.

Seems unlikely that Krugman ever said that stimulus spending would not drive up demand. Thats the point of stimulus spending, to increase demand. Also unlikely that he claimed there would not be temporary price increases.

************OT COVID***************

Yet another off shoot of the Delta variant.

And we just relaxed travel restrictions for people travelling here?

https://www.newsweek.com/ay-4-2-delta-variant-cases-update-us-uk-sequencing-data-40000-mutations-1649216

{snip}

At least 40,000 cases of the Delta AY.4.2 COVID variant have now been detected worldwide, according to sequencing data.

AY.4.2 is a sub-lineage of the Delta variant that appears to have mutated a growth advantage compared to other Delta versions.

However, AY.4.2 also does not appear to be any more vaccine-resistant than Delta and has failed to gain much of a foothold in the U.S., current data shows.

The variant is found almost entirely in the U.K., where it has accounted for around 15 percent of samples sequenced per day recently.

The total number of AY.4.2 sequences found worldwide was 40,215 according to variant tracking tool Outbreak.info as of November 14, of which 37,883 were in the U.K.

The latest worldwide figure marks a rise of nearly 10,000 cases in a week.

Two mutations notably associated with AY.4.2 are called Y145H and A222V, both of which affect the spike protein that the SARS-CoV-2 virus uses to enter human cells. Scientists have previously told Newsweek that not a lot is known about the two mutations.

The U.K. government has acknowledged that the AY.4.2 has a small growth advantage over other Delta variants and has designated the variant a VUI, or variant under investigation.

At the same time, a government study suggested that the variant does not seem to have mutated any further resistance to vaccines than Delta already had.

Including the U.K. and the U.S., AY.4.2 has been detected in a total of 39 countries worldwide, with Romania and Poland recording some notable prevalence, Outbreak.Info shows.

Most countries have very few cases, including the U.S. which had only reported 25 sequences from 13 states as of November 14.

It is not unusual for a virus to mutate. They do so all the time as they spread from person to person.

{snip}

When we are dealing with a disease NEW CASES are very important to determine just which variant is in circulation.

We are almost at a year since vaccines rolled out. Get your boosters. Get them often. DO NOT RELY on post infection immunity.

We dumped $2.8T into an economy that had fallen 10%. So, suddenly we really only dumped $2T into the economy. And we don't have a closed economy.

Basically: inflation is due to a bottleneck in supply, not to increased demand. When the bottlenecks clear up, the inflation will stop.