Did the Biden stimulus package produce our current inflation? Over at Vox, Madeleine Ngo says the evidence is against it:

Some economists say that recent research and new data have reaffirmed their belief that the stimulus package did not significantly fuel inflation.

....Dean Baker, a senior economist and co-founder of the liberal-leaning Center for Economic and Policy Research, argued that new research on housing inflation helped support the idea that price gains were mostly driven by a mass shift to remote work and not the stimulus package.

....As more people started working remotely, they sought out additional space at home....Researchers estimated that remote work resulted in house prices rising by about 15 percent from November 2019 to November 2021, which accounts for more than 60 percent of the overall increase in house prices.

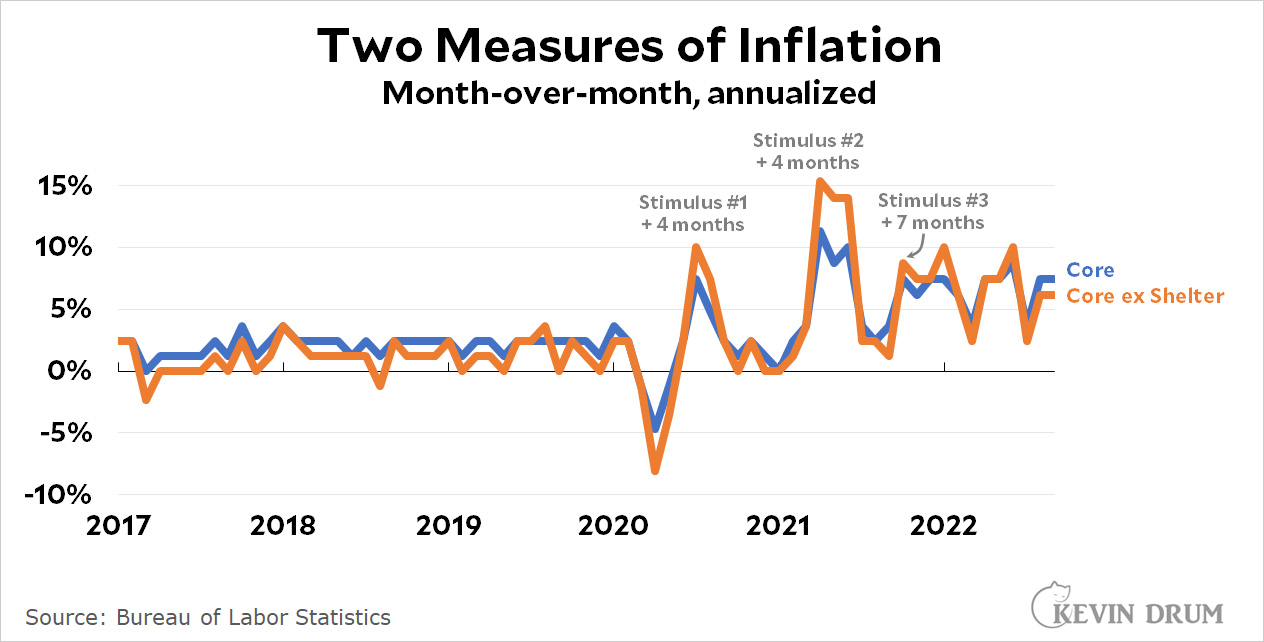

Hmmm. I've looked at the idea that housing and rent increases have significantly affected inflation, and it sure doesn't seem like they did. At the same time, the three stimulus packages of 2020-2021 do seem to have produced inflation—though with a caveat:

Two things are obvious here. First, when you exclude shelter from core inflation, almost nothing happens. It simply doesn't have much effect. Second, the three rounds of stimulus were followed like clockwork by bouts of inflation.

Two things are obvious here. First, when you exclude shelter from core inflation, almost nothing happens. It simply doesn't have much effect. Second, the three rounds of stimulus were followed like clockwork by bouts of inflation.

Wait—make that three things: all three bouts of inflation seem to have lasted about three or four months. So the Biden stimulus in early 2021 might explain inflation through the end of last year, but something happened around January 2022 that reignited it.

In other words, if we're speaking about now, inflation remains mysterious. The impulse from the stimulus packages obviously dissipated long ago, and housing has done nothing to push core inflation higher. What's more, housing inflation has abated and certainly isn't producing an inflationary impulse now regardless of whether it did last year.

And as Paul Krugman points out:

A quick note: Anyone who is both predicting a nasty recession *and* calling for big rate hikes isn't making sense. We don't need a major recession to end a wage-price spiral, because we don't have one 1/ pic.twitter.com/ms1KVXW2Il

— Paul Krugman (@paulkrugman) October 17, 2022

So inflation now isn't about shelter. It's not about wages. It's no longer about stimulus. It's not about expenditures or savings. And supply chains seem to be in tolerably good shape these days. The answer lies somewhere else. But where? To anyone who predicted high inflation throughout 2022, I'll give you credit for being right—but only if you can explain why inflation has remained so high. Let's hear it.

As I referred to before, there is apparently a lot more "high-powered" money now than there was before 2020. For example in Household Checkable Deposits:

https://fred.stlouisfed.org/series/BOGZ1FL193020005Q

This shows up also in demand deposits and M1 and M2 aggregates. There was an increase of about $3.5 trillion in these deposits, which works out to about $10,000 for every man, woman, child and other in the US. But which households have my share? I got some covid checks but they didn't amount to $10k. The money seems to be distributed about as you would expect among the wealth percentiles.

There is no sign that this money is being spent down. Has it been contributing to inflation, or will it be doing so in the future? This is a mystery to me. Kevin should look into this. Anyone drawing conclusions from the M1 and M2 aggregates should be aware of the nature of these deposits, whatever it may be.

Inflation is still high because of commodity prices and continued supply chain kinks. The Ukraine war and Russian sanctions have messed not only with oil prices, but with just about every other commodity price in the world, from lumber to palladium, and especially seed-oils, feed and grain. In the US, drought and a bird flu epidemic have sent prices of beef, eggs, and poultry skyrocketing. A lot of these commodities are off their highs from six months ago, but those price spikes are still working themselves through the economy. China's still a mess with its zero-Covid policy and rolling lockdowns of various cities and ports. Finally, there's an acute shortage of immigrant labor in agriculture and construction, delaying projects and driving up prices.

This is messing with prices around the world, not just in the US.

Yeah, that seems the obvious answer to me.

At kindergarden level, price=(money available)/(stuff available). Money available has not obviously changed much, but stuff available seems down, whether it's China issues, Ukraine issues, or on-going weirdness in the US labor market (ie number of people producing stuff).

"Inflation is still high" Except it's not. Annualized inflation over the last three months was 2%. As far as the year over year inflation, the most recent number for that is a measure of inflation 7 months ago (This is a 12 month moving average and the correct time index for a moving average is the mid point along the time line. Delayed by an additional month since it's now nearly the end of october. And yes, inflation was high 7 months ago.

Corporate profits are down as well IIRC.

I think we're just in High Inflation Expectations Land right now, and it's going to take more to get us out of it.

Uh, no they're absolutely not. What propaganda have you been injecting into your veins?

https://tradingeconomics.com/united-states/corporate-profits

https://fred.stlouisfed.org/series/CP

And expectations, from the U Michigan survey and TIPS, are not very high either, certainly much lower than inflation itself.

Companies raised prices because they could, and now no one wants to be the one to lower them? I don't know much of anything about economics, but if someone was buying what I'm selling, why would I lower the price? Especially if whoever is selling me the materials to make what I'm selling hasn't lowered their price? And why should they, if I'm still buying them?

As seymourbeardsmore noted: companies raised prices simply because they could. Big landlords did, too.

Monopolies and oligopolies are a major reason why.

https://ilsr.org/inflation-true-monopoly-story/

That's right. With anemic antitrust enforcement, monopolists are quite open about this. Look at the stated logic behind the Kroger-Albertson's deal. They claim that a big reason to support the merger is that it will give them more pricing power, and there is no reason to doubt them. Just about every business in the US has a handful of big players who have massive pricing power at both ends.

High inflation may already be over. The average yearly inflation rate over the last three months, based on month/month values, is 1.9%. Is that scary?. If we assume that the rate will continue at 2%, then the year/year number will decline slowly from its current 8.2% and will only reach 2% in about June of next year - that is a year from when the CPI stopped rising rapidly.

This is not a prediction - all kinds of things could cause the rate to change. This is an illustration of how misleading the fixation on year/year numbers can be. That number is just not representative when there is a major change in rate.

The most recent year over year inflation numbers are a measure of inflation 6-7 months ago. It is a moving average and the time index for a moving average is the midpoint in time.

If people have been moving out of their apartments and into houses, why are rents also going up? Some people blame higher house prices on big investors buying up houses and turning them into rentals, but this also should reduce rents.

If you need more space in a hurry, why buy a house instead of renting? Why would you assume that work-from-home would be permanent?

Are people actually moving from apartments into houses?

My sense, based on local trends, is less now than before. Why? Interest rates. Fewer people are buying homes with rates double what they were last year. High rates now contribute significantly to the higher cost of housing. That's true for rents too. If fewer people can afford to buy, the pool of renters is bigger and rent prices go up (rental index was up 0.8% in Sept.).

A conundrum: The Fed's higher rate policy that is supposed to fight inflation is also a contributor to higher inflation in the housing market. If the Fed wants to make housing more affordable (Powell has said as much), it's damn near impossible to get that with ever-increasing rates.

Starting around 2001 the Fed tried to make housing accessible and boost the economy out of the recession that way. It was not through interest rates (although federal funds rate was reduced), it was through letting banks run wild and offer mortgages to any live body. Of course everything came crashing down in 2008. Why does anybody believe that the Fed knows what it's doing after that?

As a bonus, when rent prices go up, it also pushes up homeownership cost for units with monthly costs around the rent price - y'know, the whole replacement goods thing.

The phrase "big investors" doesn't mean what some people think it means. Big investors are NOT buying up SFH rentals, duplexes, triplexes, and quadraplexes. If they were, it's something I would notice given the nature of my work. Its not happening.

Big investors are mainly buying, selling and developing large apartment complexes. Big developers are buying up derelict golf courses to build tract housing, they are buying up relatively small mobile home parks to build apartment complexes and condos. Big investors also buy and sell MHPs but I have seen a lot of that lately. I still see buying, selling and refinancing of strip malls, but I don't expect to see any more mega malls (thankfully).

have NOT seen a lot of MHPs changing hands.

Rents track real estate prices with a significant delay.

As I've said before, inflation is world wide. American spending measures may have contributed to the problem but most certainly did not create it. Remember that the US is no longer the world's biggest economic entity; that honor belongs to the Euro bloc. If you must put the blame for inflation somewhere, put it in Brussels.

Remember that the US is no longer the world's biggest economic entity; that honor belongs to the Euro bloc.

Not so. The EU in its entirety has only about a $17 trillion GDP (remember, they took a $3 trillion hit when the UK left). And several countries don't use the Euro, so the "Euro bloc" is smaller still.

Indeed, in PPP terms the EU's economy is smaller than both the US and the Chinese economy.

US GDP was about $23 trillion last year.

https://en.wikipedia.org/wiki/Economy_of_the_European_Union#

"American spending measures may have contributed" Milton Friedman would point out to you that spending measures mathematically cannot contribute to inflation

Won't a general expectation of instability worldwide, in every area, inspire general price increases, instability with little prospect of going away for at least a generation?

Why would it? What is the mechanism or causal chain? Just as plausibly, “a general expectation of instability” could cause people to hunker down, stifling demand.

Drought in western US.

Bird Flu

Oil shock.

Invasion of Ukraine.

Lockdowns in China.

Still residual supply chain issues...

Raising rates won't affect these.

We also have Trump's give away to the wealthy via taxes....creates bubbles in stock market, helps mergers but not main street, and helps set up monopolies--now set up to suck in the money. Systems are not resilient--and that profits the companies that set the up that way. Why add a third shift if your profits have doubled the way things are? Maybe demand will be down by the time that is up and running.....

He keeps saying that supply chain issues are gone but half the stuff is still out of stock on a given day.

Nothing is out of stock where l live.

Don't forget the stimulus packages included things that were spread out, e.g. child tax credits, reduced Obamacare payments, etc.

No, not main drivers of inflation. Helped keep local economies running

So, this happened,

Roger Stone throws MAGA under the bus,

https://www.rawstory.com/roger-stone-election-fraud/

!!!

Did we decide to forget that we have a war that has driven up prices for agricultural inputs, grains, and oil, and has incurred sanctions that hurt all sides?

Also, are we also choosing to ignore the flirtation with protectionism? Last month, India banned certain food exports while adding tariffs to others. The last few days, the US has banned exports of chip technology to China. And we still haven't lowered tariffs on various metals and other imported goods that were imposed by Trump.

Yes apparently indeed ignoring those factors is now de rigeur from Left and Right politically driven comment in a bizarro world politics-myopia.

And all those factors collectively feed through price channels in multiple ways (and with different time delays). A combined and ongoing / sustained multi-channel food and energy supply shock in combination with lingering pandemic distortions in supply chains, and markets. Focusing on a single or narrow set of inflation transmission channels one by one (labour, no now housing, no now retail petrol prices, etc) is like trying to conclude the nature of a forest from examing one species of tree at a time in said forest. It's wrong-headed and doomed to analytical failure.

Since housing/shelter is the biggest part of the inflation calculation, it will always play a big role in inflation. Kevin's charts show that housing inflation tracked overall inflation and since housing is a big part of the total, we know that housing is the biggest single piece of the puzzle.

But it isn't the only piece. Although, I suspect that the housing wealth effect played a significant part in the inflation see in the other parts of the economy.

Anecdata warning.....many friends and acquaintances sold their homes, remodeled or refinanced when rated bottomed out. Refinancing and selling creates a lot of extra cash flow that can be poured into other spending. Remodeling is a large expense that doesn't necessarily show up in shelter CPI but certainly reverberates through several other categories.

"So the Biden stimulus in early 2021 might explain inflation through the end of last year, but something happened around January 2022 that reignited it.

No, it was February, when Russia invaded Ukraine.

The stimulus #1,2,3 labels on the first chart are kind of silly aren't they? The stimulus created dramatic inflation in month 4, but not 3, 5 and 6? The third stimulus showed up in month 7 instead of month 4?

Lol. Ok. CHARTZ!

"Supply chains are in tolerably good condition." Yet store shelves remain under-stocked. A Toyota dealer in Roseville CA recently offered to sell me a Sienna for $17.5K over MSRP - about 40% markup. There are none to test drive; you can only order one yet to be manufactured.

People are still largely working from home. They are saving tons of money in gas, vehicle costs, lunch costs, etc. I've calculated by own family's savings to be close to $1000/month. That's not a small number, and for many younger people they're saving close to 15% of their income.

Since price = (money available)/(stuff available), if we all suddenly have 10% more money to spend but the same amount of stuff we can buy, we're either going to save that money or inflate our currency. Would be interesting to see if savings rates have gone up, but I think people are not hard-wired to save if they have a few extra bucks they probably just buy more stuff.

The good news is that this situation should equalize very soon. And it explains some of the strangeness of the inflation ... impacting some things but not others.

That's a good point. WFH wasn't just about getting one's life back, it was also a pay raise.

Some peope, largely professionals / white collar.

As it happens the very profile that is prolific in internet commentary.

But gets via this a highly distorted appreciation of what larger Labour picture looks like.

You're ignoring that you have extra money because you stopped by certain things. So yes you are buying certain things you dind't used to buy causing their prices to rise and stpped buying thing you used to buy causing their prices to fall resulting in zero additional inflation.

You have more money to spend because you aren't spending it which is causing inflation because you are spending it. Yeah, that makes sense.

Drum: running through various Monocausal effects (as in "not housing", and simplistic "supply chains are fine" nature) one by one and writing them off is a perfect way to do analysis of a missing the forest for the trees.

Non-ideological forecasters foreseeing sustained inflation through 2022 - and who were right were you have been wrong and wrong and wrong again - have been looking at multiple transmission channels.

There is really literally no point to your analyses in the nature you're doing them. It's really making me sad as I have for years rather liked your commentary and analysis, but you simply are lost here flipping from one single cause to another.

"To anyone who predicted high inflation throughout 2022, I'll give you credit for being right" Annualized inflation for the last three months. 2%. Anyone who made this prediction was an idiot who was 100% wrong.