In the New York Times today, economist Glenn Hubbard says, "We Need to Do Hard but Necessary Things to Tackle Inflation." Uh oh, I thought. What horrible things is he proposing?

The Fed must begin tapering asset purchases more aggressively now. In recent weeks, Mr. Powell has signaled a willingness to double the pace of the taper to $30 billion a month — a move he should make in this week’s meeting of Fed officials.

....The Fed should also raise its benchmark federal funds rate in early 2022. This is a short-term interest rate at which banks borrow and lend reserve balances with one another. He should also be prepared to make further adjustments should macroeconomic conditions, including broader and longer-lasting inflation, demand it.

That's it? Reduce asset purchases—something the Fed is already likely to do—and raise interest rates by a quarter point or so a few months from now? If this is all Hubbard thinks we need to do, he must not think the current bout of inflation is very serious at all.

Larry Summers, bless his heart, at least puts his money where his mouth is. He thinks we've set off a permanent and dangerous increase in the inflation rate to 4% or so, and he recommends two or three sharp interest rate increases next year. That's a good deal more serious, though still hardly Paul Volcker territory.

I'll confess I've never understood Summers's argument. I know it's trendy in left-wing circles to write off Summers as little better than a Republican-lite hack, but that's stupid. Summers is, and always has been, a mainstream liberal and a brilliant economist. You'll notice, for example, that Paul Krugman never writes him off. This is why I wish I understood his argument better. Summers says our current round of inflation was caused by the $1.9 trillion rescue package passed in March, and that part I get. But if that's the case, wouldn't the resulting inflation be transitory almost by definition? By now that money has all been spent, and wages clearly haven't spiraled out of control (Real earnings are down about 2% from a year ago.). So what's the mechanism for generating many years of inflation unless we stomp on the economy?

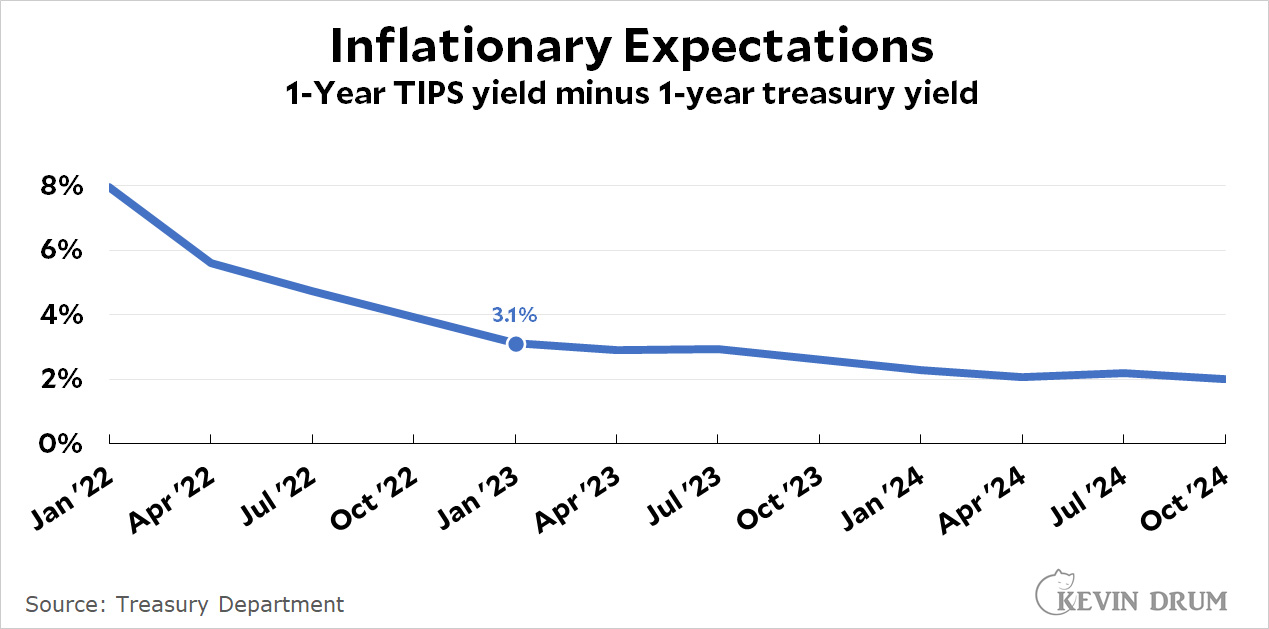

For what it's worth, here's the (very approximate) inflation rate predicted by current TIPS yields:

Don't take this super seriously, but it suggests that investors think inflation will be down to 3% by the end of next year and then keep dropping.

Don't take this super seriously, but it suggests that investors think inflation will be down to 3% by the end of next year and then keep dropping.

I dunno. Maybe there's more here that I don't understand. IANAE. But as savings get spent (which has already happened) and spending becomes normal (also already happened) and real wages continue to drop (also already happened) and investors are expecting that TIPS yields will be about 3% at the end of the year (also already happened) and supply chains get untangled (very likely to happen in the first half of next year)—

Given all that, what's the story for high inflation being permanent? Inquiring minds want to know.

> By now that money has all been spent

The velocity of the money supply is still low, suggesting that cash is still being hoarded somewhere and didn't get spent.

Not really.

Kevin's inflation denial is remarkable, I thought he'd change his mind after the CPI report last week. But no.

You mean the midmonth report it is??? It's part why it was out of whack with price levels of November. Yes retail sales is similar. Most likely December consumer spending and inflation will decelerate.

Maybe a couple of finger snaps will grow you a brain by the pain method.

I have my share of disagreements with Kevin, but inflation is one item he has been very right about. No one is "denying" inflation has happened this year -- prices have indeed gone up this year. The issue is whether today's higher prices mean we are destined to see high inflation for years to come. The balance of the evidence says no.

Glenn Hubbard, on the other hand, may be right on occasion but not often enough for anyone to notice. When he says do X, do the opposite.

Kevin denied inflation was serious throughout 2021. It was often by saying that this-or-that part of the formula was either a brief outlier if it was large, or if it was not changing, a better indicator of the "true" inflation rate.

Interest rates are going to take rise because unemployment mandates demand it.

Agree with Kevin. Another indicator: the 10 year treasury yield is 1.44% at this moment, which is down from about a month ago, when it was closer to 1.8%.

AFAICT, this should be an upper bound on what people think inflation will be over the next decade (why would you lend money to the US at X% if you think the real yield would be less than zero?)

I'd be on instability for a solid 12-18 months as supply chains sort themselves out. I don't see how these are permanent problems, however, leading to permanently increased inflation.

What I was going to point out.

It should be noted that due to "quantitative easing," treasury yields are a bit artificially depressed.

But almost certainly not artificially depressed enough that 10-year yields are 1.44% when people are expecting 6%+ inflation to persist.

ProbStat - I agree with your point and would even take it a step further. US Treasury will are impacted by global markets. The ECB, the Japanese Ministry of Treasury etc have ALL been doing a form of quantitative easing.

12-18 months of fear mongering will do a lot to enshrine fascism in power.

10 year yield is a fake distortion

The rap on Larry Summers is not that he’s a hack, but that he uses his considerable powers for evil.

Yeah, this. Or at least that he actively sabotages what we should be trying to do. He pre-compromises the Democratic position rather than starting from a true first offer in negotiations. Or he did, back when there were negotiations with Republicans and not intra-Democratic negotiations. I'm not sure which is worse.

But there isn't really an argument that inflation is "high" (4% can barely be called high) and permanent.

Yeah, he wants the Dems to scale back their BBB because he knows it increases taxes on the wealthy so he screams "INFLATION!" to scare folks. He's serving his masters.

"Paul Krugman never writes him off. This is why I wish I understood his argument better. "

I agree Summers is smart and Krugman takes him seriously, but as far as I can tell Krugman doesn't understand his argument either. Even the drivers of inflation that inflation hawks point to seem transitory, but somehow the inflation itself is not. It seems like a basic "Animal Spirits" argument. I get how that can work for reducing demand and driving recession/depression, but no idea how it would work for long term inflation if there isn't real excess income to drive it.

+1

Yes, the expectation that prices are going to rise, could cause consumers to make certain purchases sooner than they otherwise would, which will temporarily spike demand, putting upward pressure on prices. But that is clearly self-limiting; the money you spend today won’t be available to spend tomorrow; and eventually you have to pay off the credit cards.

Common thread to Summers' previous harmful arguments (which were political and not economic in nature): they both screw regular people but work out just fine for people above the median.

Some economists have been predicting inflation!!! for years and are now wetting themselves with excitement that it's here.

While conveniently ignoring the reasons they predicted inflation were all wrong, and it is driven by a completely unexpected global pandemic.

With regard to Kevin’s wondering, can there be an inflationary tipping point in an economy?

Yes, especially if their are effectively cartels in multiple sectors. Each will try to maximize their pricing power--individually a small effect on inflation but collectively a large one. The double down on pricing as inflation goes up.

sorry, "they're", not their....

That still won’t create a persistent inflation. Companies with pricing power can raise prices, but monopolistic concentration doesn’t lead to higher personal income (probably the reverse), so consumers will still have only so much spending power, and will ultimately substitute less-expensive products, and/or limit their consumption of the more-expensive ones.

Summers says our current round of inflation was caused by the $1.9 trillion rescue package passed in March, and that part I get. But if that's the case, wouldn't the resulting inflation be transitory almost by definition?

I'm with Kevin on the likelihood of a long-term, serious increase in inflation (I think it's unlikely), however, Summers's logic may be that the burst of spending power enabled by federal largess has triggered long-term inflationary expectations, which has resulted in a wage/price spiral.

Also, I think it bears mentioning that even if (as I think likely) this current bout of inflation is transitory, that word isn't synonymous with "brief." The post-WW2 episode Paul Krugman has frequently mentioned lasted a full two years, I believe.

As you note, expectations only lead to inflation insofar as they create a wage-price spiral. I see no evidence that that could possibly occur in the modern economy, with only 6% of the private-sector workforce organized into bargaining units, and most public-sector workers constrained to some degree by law. Workers simply aren’t in any position to demand raises. The evidence is right in front of us: employers complain that they can’t hire enough workers, but the vast majority have not raised wages to attract more applicants.

You see no evidence? https://www.wsj.com/articles/companies-plan-big-raises-for-workers-in-2022-11638889200

You don't need a union to get a raise. It's helpful, but employers are seeing the ass end of supply and demand workin on them right now. If those wages do get locked in, then there we are.

‘Plans’. I’ll wait to see what materializes, and for whom.

If Larry Summers had a good argument (or better, a coherent line of reasoning from theory or data), he would make it. If he was a good communicator, everyone (Kevin Drum) would understand it, and if not, only economists would follow his reasoning. He hasn't made a good argument. Instead, he has made an assertion.

He was right about the bill causing more inflation than others expected. So dismissing him because we don't like his message and because he was cancelled is a very 2021 thing to do.

Because he was right once recently is not a compelling reason to give credence to his current prediction. It has to stand on evidence and rationale.

It depends on how much wages go up. WSJ reported business is expecting the need to hike wages. If that happens, the inflation we have will be locked in at the very least.

IANAE but as Keynes said, in the long-run we're all dead. This inflation is having an impact right now and it was because the spring COVID bill was too big. I'm glad they erred on the side of relief for once, but it's hard to believe interest rates won't rise now.

Whether the spring COVID bill was too big depends on more factors than just "is there inflation now", I would think.

I mean, there's also "how much has it helped?" right? It's helped a lot.

Overall, I think the disagreement is over how much things like supply chain difficulties are contributing to current prices.

Exactly. It’s like saying “I’d rather be a household that earns $30,000 a year and manages to save half of it by settling for a lower standard of living” instead of “I’d rather be a household that earns $100,000 a year but saves nothing.”

Most rational people would prefer to be in the latter group. Yes, the frugal household gets brownie points with financial planners for prudently saving for the future… but their daily life here and now must be absolutely miserable. (How could anyone live comfortably on a “fiscally responsible” but meager $15k a year in the US?!)

What impact is inflation having right now? Unemployment is down, wages are up, demand for labor is booming. The mild erosion of savings is trivial compared to the new wealth that is being created.

People like Summers have think of 2% inflation is a target - something that we'll be able to average over time. No, 2% is a cap - below it is good, above it is bad. In a time of high demand for goods and labor, the only people who benefit from this view are bankers and their advisors.

Keep in mind that as president of Harvard, Summers ran a multi-billion dollar hedge fund with a mom-and-pop schoolhouse attached to it for tax avoidance purposes. He's got banker instincts.

Summers may be “brilliant”, but economic predictions are not limited by the intellects of economists, but by the crappiness of economic data and therefore the inadequacy of economic models. It’s mostly not different from any other social science in this regard. A problem that is specific to economics is that the phenomena it is interested in take place over long time spans, relative to which the data are sparse, noisy and contaminated by multiple factors we can’t measure independently. But economists are stuck with legacy measures just because they span decades. One might try to define better measures, but there would be nothing to which to compare them.

I'm back to take another shot to the head....I believe here and especially over at LGM, I was excoriated for saying the $300 dollar tax credit per child would be...problematic.

This is signature accomplishment that Biden frequently cites, lifting children out of poverty. Which is good, but it is inflationary and permanently inflationary in that the checks go out every month....to be spent however.

The question is, Where is this surge in demand coming from....God, I hate to even use this phrase, but from the Lower Classes.

Bloomberg had a nice confirmatory article today:

https://www.bloomberg.com/graphics/2021-us-spending-recovery-inflation/?srnd=premium-europe&sref=MIcoSLsi

I really don't need anything and people similarly situated don't have explosive "Wants," either....the lower classes, with kids, now with money also...they have wants and so this demand driven inflationary spiral.

Have at me, beat me up again...I am often wrong in my life and practice, so I am good at being corrected. Let's do this thing.

Best Wishes, Traveller (BTW, I'm not saying the Child Tax Credits are good or bad...just that these are the natural results).

The refundable child tax credit is not inherently inflationary; it depends how it is paid for. President Biden proposed tax increases for corporations and the wealthy; Congress has been reluctant. If the credit is paid for by borrowing, then, yes, it will be inflationary.

All the $300 credit does for most* households is front then the money now that they were already gonna get next year when they file their taxes.

*yes there are poor households for which it does represent an increase in income. But then your argument only makes sense if we should never do anything to help those families, because anything given to them will increase their spending power and potentially have some effect on inflation.

Somehow also we manage to shovel billions of dollars to companies and rich people through new tax breaks every few years… yet *that* is never blamed for causing any inflation.

Very curious.

Because it just piles up in their assets and they don't spend it on things in the broader economy, so...

Also consider that Larry Summers wars many hats. He is an economist, but also a hedge fund speculator, a politician, and a celebrity. So which Larry Summers predicted inflation? Did hedge fund Summers do it to move the market? Impress clients? Did celebrity Summers do it to get press attention?

For professional reasons I listen to economic forecasts: I happened to attend an internal company one yesterday.

Our speaker discussed the impact of the one way ratchet. For items such as rent, wages, transportation costs they typically move in one direction. Basically, once you raise an employee from X to X plus, that increase tend to stick. The economist zeroed in on trans Atlantic shipping costs as they have materially increased in the last year: he felt that even if the price of oil declines, an input to shipping costs, the price increase is semi permanent.

For what its worth, our firm's economist sees about 4% inflation for the next couple of years. That is not sky high but it is double the pre Covid rate of inflation.

4% is an acceptable inflation rate

I think its more complicated than 'acceptable.' I agree that companies/ the US economy can flourish with STABLE 4% inflation. In contrast, politically, the Biden Admin is clearly damaged/some portion of his poll declines if inflation remains at 4% for the next couple of years.

He is bouncing now

One of the standard dogmas is that inflation expectations get "baked in", leading to an inflationary spiral. Krugman has been discussing this in his twitter feed. But this is one of many economic dogmas that really have no basis in data. Another very strange one is that the Fed can defeat inflation by raising federal funds rate. But the Fed raised federal funds for years on end in the 70's without preventing inflation, which actually went over 14% and only came down when oil price quit rising. So there is no reason to think that the Fed could control inflation if it did keep rising for whatever (unknown) reason. Economists have been predicting inflation regularly for decades and have always been wrong before. Krugman also was predicting deflation around 2010 and was wrong about that as well.