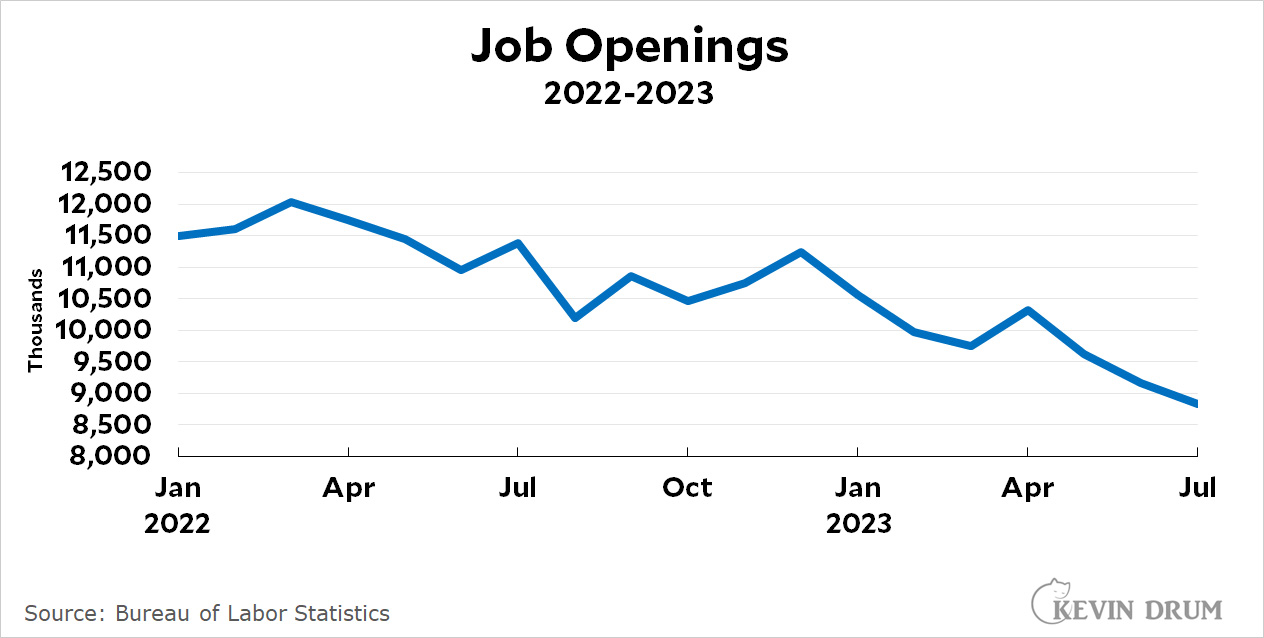

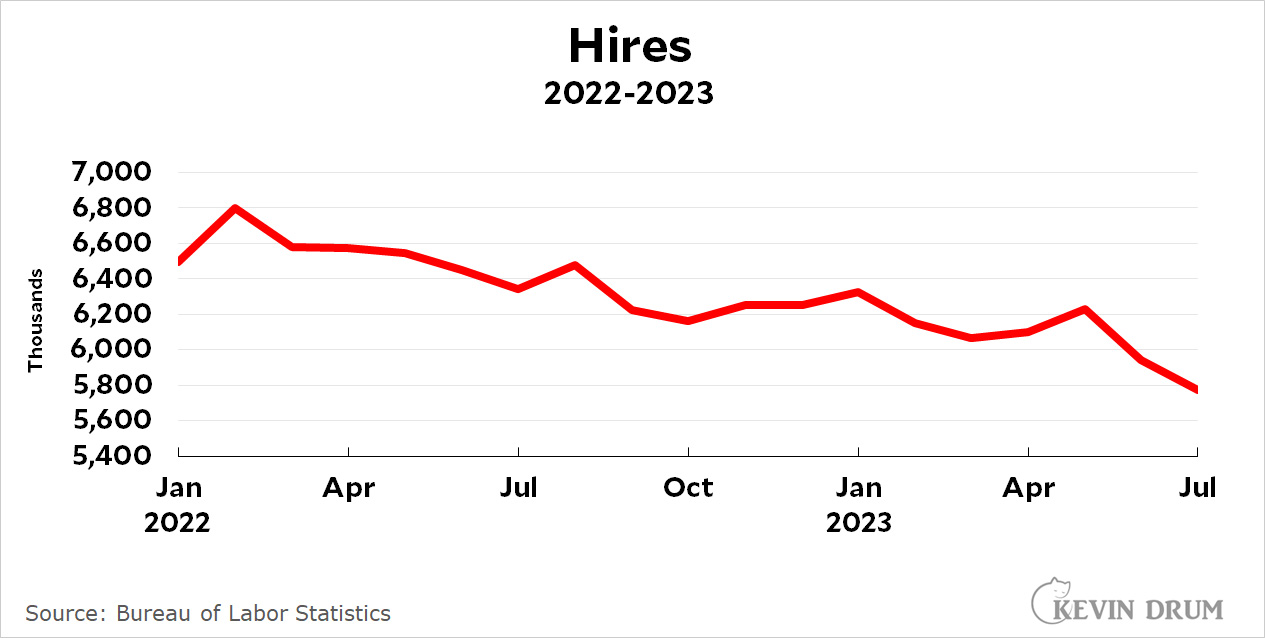

July was not a good month for employment: Both job openings and hires dropped sharply yet again. Job openings were down 338,000 and hires were down 167,000:

In percentage terms, job openings were down 22% from a year ago and hires were down 9%. Hires are now below their mid-2018 level. Quits were also down, a continuing sign that workers are a little more worried about finding a new job if they leave their current one.

As we commenters have pointed out time and again, this is a stupid way to look at these numbers. By starting the chart in January 2022, you're starting it at a high point.

https://www.bls.gov/jlt/

Job openings are still 20% higher than they were in July 2019. https://data.bls.gov/timeseries/JTS000000000000000JOL

Hires are only slightly lower than July 2019, and although they are trending downwards it makes sense (in a good way) because the unemployment rate is so low - lower than July 2019. https://data.bls.gov/timeseries/JTS000000000000000HIR

Total separations are lower - back to what was a stable level pre-pandemic going back to 2015. https://data.bls.gov/timeseries/JTS000000000000000TSR

Apropos of a comment on the recent post about retirement income for posts that remain stubbornly in the realm of nonsense in spite of available evidence, we need an opposite of a "this is fine" heading. Maybe a Recession Kevin heading?

The employment rate is still not where it probably should be despite the low unemployment:

https://fred.stlouisfed.org/series/LREM64TTUSM156S

but as it approaches a normal kind of expansion trend - after the extremely fast recovery phase - of course many employment parameters will slow down. This does not seem to be a signal of impending recession - yet.

But history tells us that when the Fed raises interest rates as it did there is a high probability of recession sooner or later - Kevin is absolutely right about this. The longer the Fed keeps raising the greater the danger.