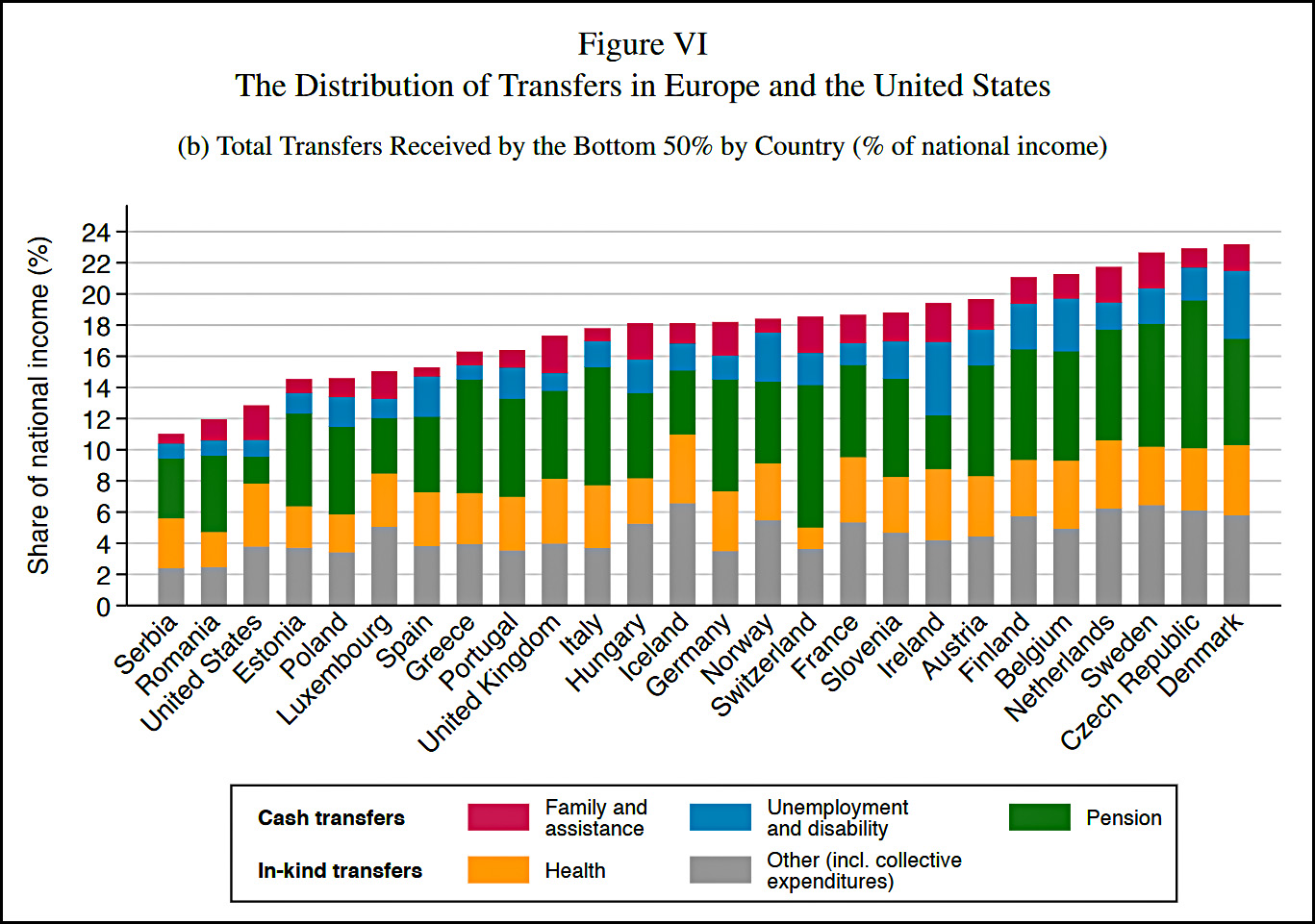

Tyler Cowen pointed today to a recent paper that says the US redistributes more to low income groups than any European country. But here's a chart from the paper:

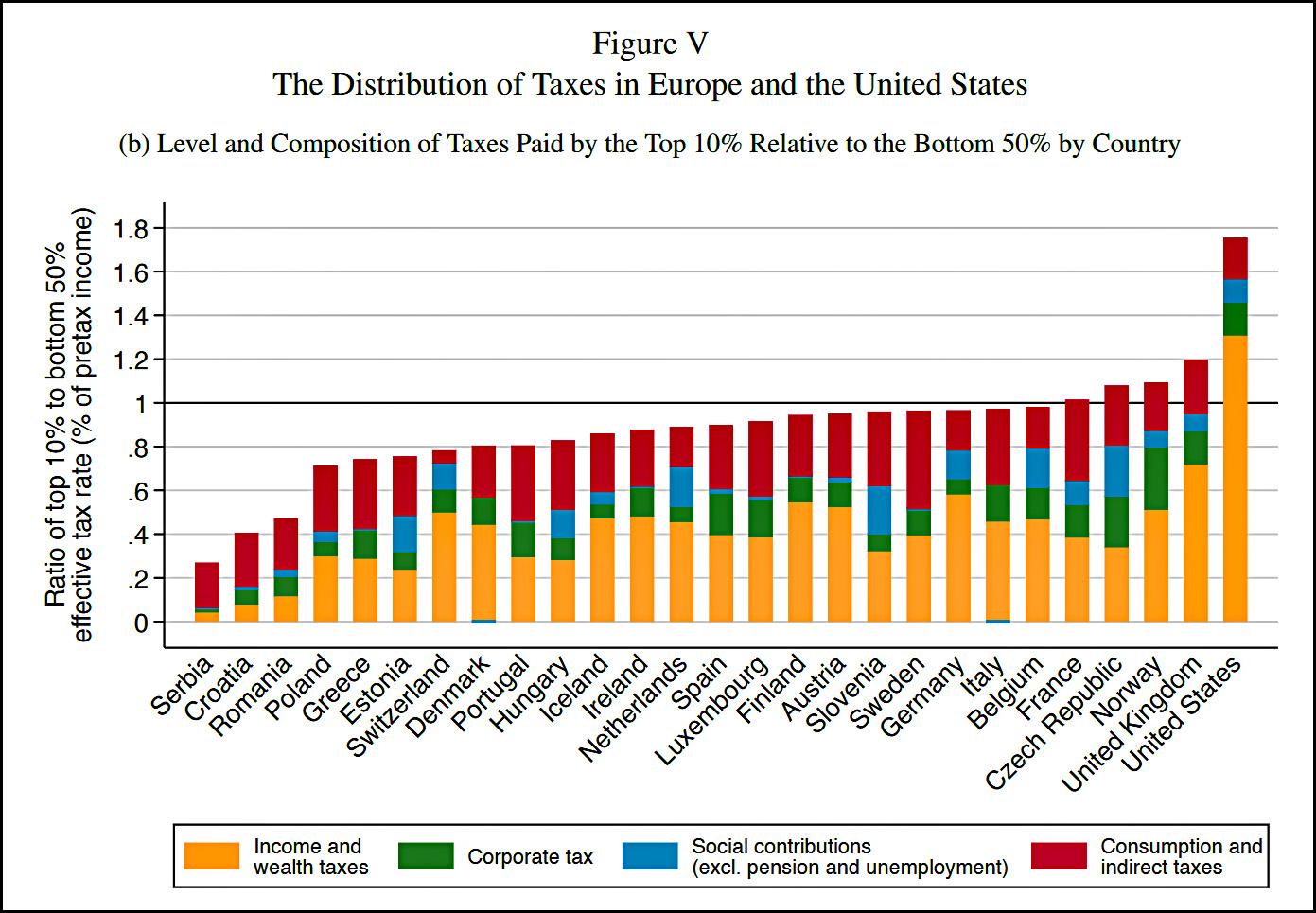

We're close to the bottom! So what's up? The answer is taxes:

We're close to the bottom! So what's up? The answer is taxes:

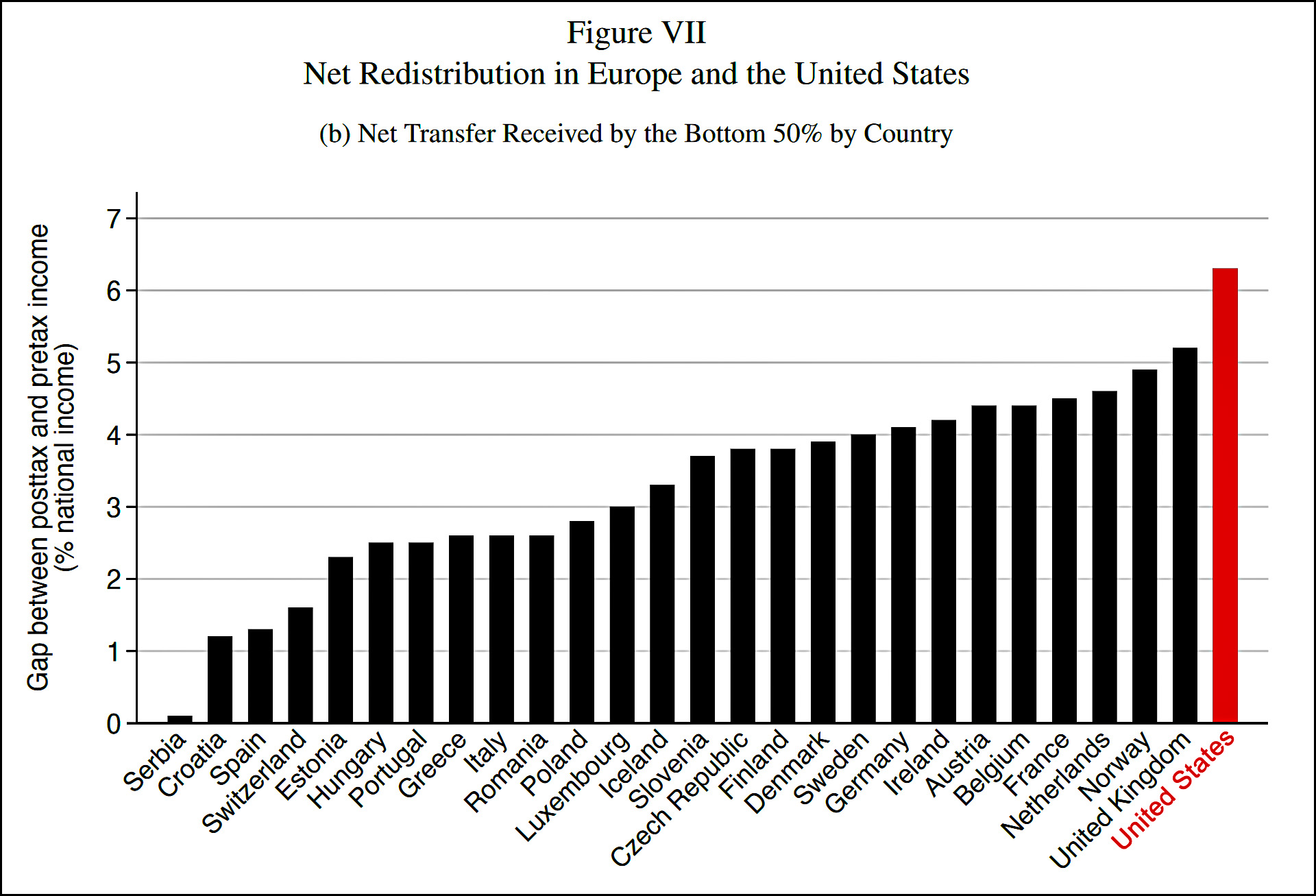

According to the authors, our tax system is more progressive than those in Europe. When you consider this as "redistribution" and add it to government benefits, the US looks very good on net:

According to the authors, our tax system is more progressive than those in Europe. When you consider this as "redistribution" and add it to government benefits, the US looks very good on net:

The authors estimate that on average, net transfers to the bottom 50% in the US are higher than net transfers in Europe by roughly two percentage points of national income. That's well and good, but the problem is this:

The authors estimate that on average, net transfers to the bottom 50% in the US are higher than net transfers in Europe by roughly two percentage points of national income. That's well and good, but the problem is this:

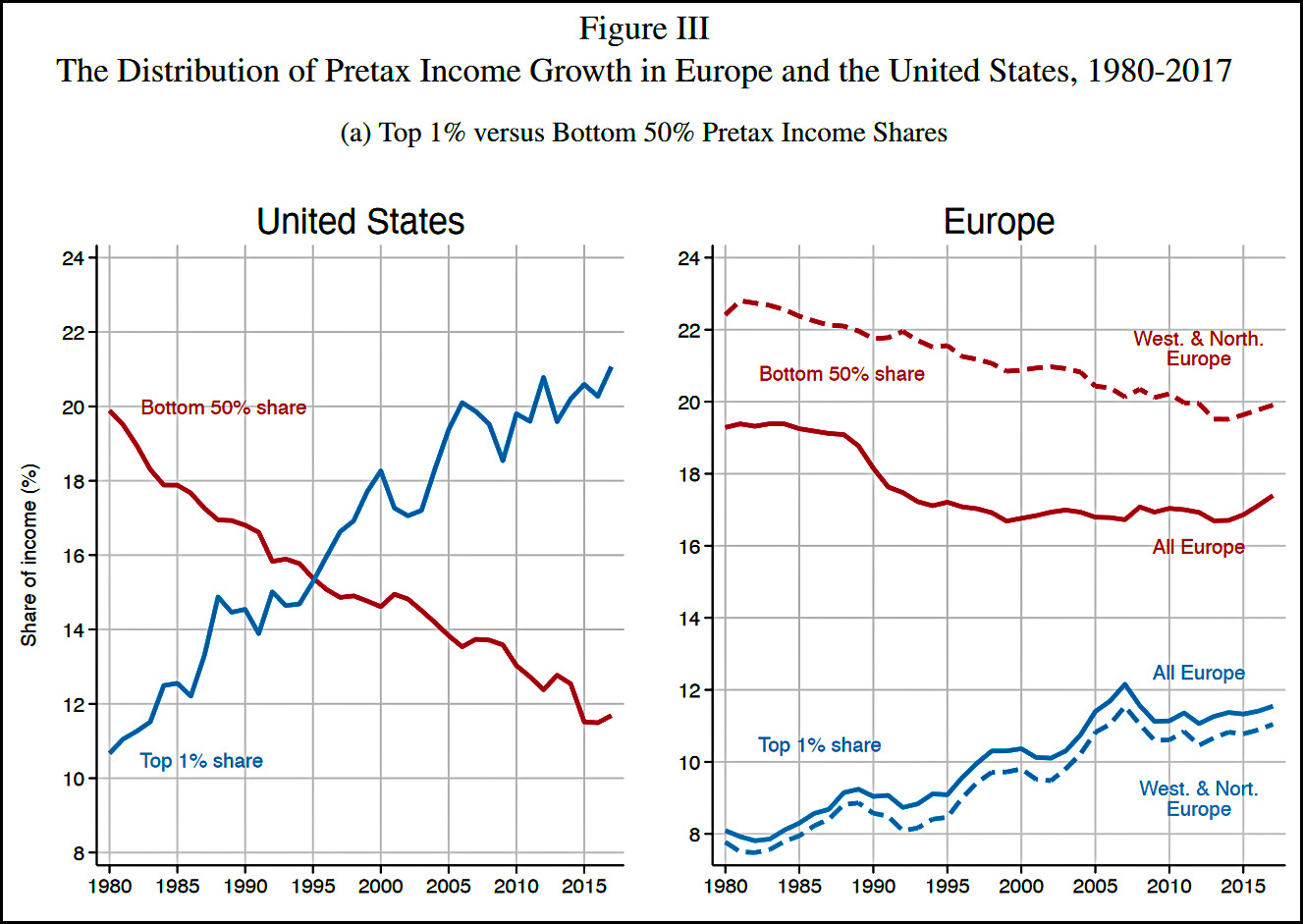

As you can see, the pretax share of income of the bottom 50% is a meager 12% of national income in the US and around 18-20% in Europe. An extra two points in transfers barely makes a dent in overall income inequality. Europe remains a much fairer society than the US.

As you can see, the pretax share of income of the bottom 50% is a meager 12% of national income in the US and around 18-20% in Europe. An extra two points in transfers barely makes a dent in overall income inequality. Europe remains a much fairer society than the US.

I'm a little skeptical of the tax stuff on two counts. First, although European countries rely heavily on VATs, which tend to be regressive, their income taxes are both high and progressive. So I'm surprised that virtually every country has a net regressive tax system. Second, when you account for state and local taxes, the US tax system is not all that super progressive. I'm surprised that we come out not just more progressive than every European country, but far more progressive.

In any case, if the conclusions of this paper are correct, we've learned two things:

- Via taxes and transfers, we give a little bit more to the bottom 50% than any country in Europe.

- Nonetheless, income inequality has grown so dramatically in the US that our higher level of transfers barely even registers. The bottom 50% has lost more than eight percentage points of national income since 1980, and an extra one or two points in lower taxes doesn't do much to fix that.

Vive la différence.

It seems like what accounts for the difference is not only inequality, but the much higher percentage of GDP we spend on the military. Does that count as a "transfer"?

I mean, we pay some salaries, and we buy hardware. I'm not sure this is a "transfer" though.

Them rich guys really like that mil spending, it would seem. So I'm happy to let 'em pay for it.

Defense budgets don't get counted in such calculations.

Higher healthcare costs distort the numbers more in favor of the US than reality suggests. All you have to do is look at the uninsured rate in, say, France (0 percent) and the USA (9 percent) to realize claims about Yank largess to the non-rich are, um, more or less bullshit. Ditto the costs for post-secondary education. Also, is the 50th percentile the best way to look at it? America is still a very rich country at the end of the day (it ought to be given the long hours worked by Americans), so, people clustered around, say, the 40-49 percentiles probably do pretty well, wage-wise, by international comparisons. I suspect the numbers from this paper might not look so rosy if we're examining, say, the bottom 35%. Which in the case of the US is well over 100 million people.

The US isn't quite the Dickensian dumpster fire many Europeans think it is (I work with quite a few, and boy are their perceptions off); and the country maintains a large and very comfortable middle class that enjoys an extraordinarily high material standard of living (you really appreciate that living in a developing country). But everything I've seen suggests that, at minimum, non-rich Americans deal with a lot more economic stress, unpredictability and financial insecurity than the citizens of other comparably wealthy countries.

Excellent points! I also have my doubts about how well such studies take into the effects of other domestic policy items like public transportation. For example, here in Germany, where we have a comprehensive and well-coordinated network of public-transportation options, the average family can get by with fewer cars. That means a typically large expense of US families is significantly smaller in those countries with good public transportation.

Last week I also read about the enormous differences of childcare costs between countries due to varying amounts of government subsidies. To use the Germany example again: whereas here a typical family spends just 1% of net income on childcare, in the US (which only subsidizes childcare for the most needy) that expenditure goes up to 23% of net family income!

Out of pocket childcare costs in the United States are utterly insane.

Interestingly, when publicly-supported free child care in the US is interrupted by a pandemic, the conservatives start haranguing school boards.

" non-rich Americans deal with a lot more economic stress, unpredictability and financial insecurity than the citizens of other comparably wealthy countries"

This is key. That "high material standard of living" can vanish pretty quickly due to a layoff, or an expensive health problem, or other disaster.

Yep.

This is key. That "high material standard of living" can vanish pretty quickly due to a layoff

Sure. It's their right to vote in whatever policies they want, but my distinct impression is Americans really undervalue leisure and financial security* compared to people elsewhere. Most of them would enjoy life more if they could trade in some horsepower off the SUV and some square footage off the house in exchange for less student debt, three more weeks' vacation, better retirement benefits and health insurance that can never be taken away. Oh, and an overall system that makes it vanishingly rare to fall out of the middle class.

*The more cynical (and likely more accurate) interpretation is most of them simply aren't aware an alternative model exists.

You are on commenting fire today ! Everything you've said is spot on. I'll double down on your last comment. Most Americans

have a very distorted view of the rest of the developed world if any view at all so it's easier for them to believe that what we have is the best of all possible worlds and if someone is failing in the best of all possible worlds well then, it's on them.

+1 and thanks

If you want that model you take a job with a blue state government. $15,000 pay cut but good cheap healthcare and job security.

"If you want that model you take a job with a blue state government. $15,000 pay cut but good cheap healthcare and job security."

That's not true at all. Blue states tend to have higher--often much higher--household incomes than red states, and lower unemployment rates.

I think the commenter means a plausible way for an America to emulate a Western European or Canadian lifestyle would be to work for the public sector in a blue state. The pay and benefits are typically higher than they would be for a similar job in a Arkansas, and, you're also likely to enjoy more job security (and therefore more financial security), less stress and more vacation time than you would if you worked in the private sector. But your salary is likely to be lower.

mea culpa. I missed the "government" bit of the statement. :-/

Thank you for realising your minor error and apologzing. That's what I like about this little corner of the internet.

+1

Or a job with the US Government, a General Service Jobs can be very rewarding and fulfilling with good pay, depending upon career path but not the huge $$$ you get in NYC or anything.

True.

You pretty well sum up my political viewpoint, which is that a main function of government is to be the ‘insurer of last resort’ - to insure citizens against risks that private insurers will not, or will not do affordably. While the benefit to the individual is obvious, society benefits from a citizenry which is less stressed, less anxious, consequently more productive and better-behaved.

An analysis that ignores things like quality of life, time off, family leave, health care provision and unionization is going to miss a lot.

Tyler Cowen is not right very often

You are correct. He's just too wedded to his libertarian views.

Yet many liberals love to love him.

Not me. I don't trust him.

Yes totally. But he was definitely on the mark about Elephant Jumps restaurant in the Yorktowne Shopping Center.

Having worked/lived in Europe I have a few observations:

- The VAT and gas taxes are significant: they hit the middle class hard.

- Middle class Europeans generally have smaller living spaces, fewer personal items (such as clothes) and less disposable cash than similar Americans.

- The lower class in Europe have a more secure lifestyle than similar Americans

I don't find the data in this article surprising. The 'floor' for the poor in Europe is higher: however, the European middle class have a lower standard of living than similar Americans....

That would depend on the country. But there is another thing apart from "standard of living": Quality of living. If you have decent public transportation, if you have available health care, if you live in a vibrant city etc. you can afford to hav fewer things and live on fewer square feet.

Of course Europe has become more "American" over the last few decades and income inequality is growing over there too with some delay: Europeans tend to adopt most of the bad ideas coming from America and reject the good ones (speed limits for example). Maybe they will correct course before they are as deep in the misery as we are. Maybe they won't.

Having lived in France and Scotland I would agree with what yqualitou say however that is balanced out by longer and (potentially) better vacations, better build quality housing (we moved from Houston to Paris and the difference in the quality of building materials was huge) to some degree, more social awareness. I think it's a choice between quantity and quality.

It's Tyler Cowen fer gosshakes, why is anyone even listening to the idiotically contrarian little git, let alone commenting on what it's spewed forth to gain attention? I'm so tired of his brand of "you didn't say your words right" bullshit.

<3

While I don't hare his ideology, Tyler Cowen is a creditable professor of economics at a major university. Lets not fall into the trap of the American right: I suggest we debate data and not discount the findings because we don't like the outcome or the messenger.

share not hare

Don't fall down the Tyler Cowen rabbit hole.

The economics profession is filled with "creditable professors" at "major universities" who are hacks. How do we know? From the host of other "creditable professors" at "major universities" who say so.

I'll bite: Can you find anything Kevin's reposted here by that contrarian little git that is remotely insightful? I sure haven't, but you're free to link to it.

BTW: You do know that you already have a reputation for being a troll, right? I suggest you work hard to rectify that perception if you want to be taken seriously.

I guess being a moderate Democrat, yes Biden was my first choice and not Sanders/Warren etc, that makes me a troll in your book.

On Tyler Cowen he questioned the effectiveness of cloth masks and school closure a long time ago: I guess this makes me a troll again, but I think Cowen was right on these points.

You're in no way shape or form a 'moderate Democrat'. You know how I know this? Because I'm a moderate Democrat, you deeply stupid troll. Your example, BTW, is yet another instance of Cowen being wrong yet again.

ScentOFViolets - I never questioned what you believe, who you voted for etc. Its interesting that you seem to believe you understand my ideology better than me...

And _you_ don't get to unilatterly redifine the definitions of quite common words, like 'moderate' and 'insightful'. I'm also still waiting for you to post something remotely insightful Cowen has said that has been reposted here. In an effert to forestall another "you didn't say your words right" on you're part, it's got to be generally agreed-upon that it was a hit instead of a miss. 'Well, _I_ found it convincing' is not in play here. But you already knew that, troll. Now FOAD you deeply insulting, discourteous piece of shite.

Mercatus Center at George Mason University makes Chicago University look like commie pinkos. It's funded by right wing hacks and the research output tilts towards wingnut viewpoints. Most of GMU is a very good research institution/commuter school but I'd never want an econ or law degree from there!

BTW the core research is not Tyler Cowen: rather the paper is written by three French professors (one is a PhD candidate).

I suspect this will become part of GOP dogma why the poor in America have never had it so good and why Rick Scott's plan to raise taxes on most Americans (except you know who) will be a policy priority for any future Republican administration.

But if poverty is a bigger problem in America (and it is), maybe "redistribution" is not the best measure for comparing us with Europe.

Has Cowen or anyone done a "distribution of transfers" study for money directed toward the top 10% or top 1%. I'd bet we beat Europe on that comparison too.

A lot of Cowen's schtick is to do a bad faith intereptation (if not outright lie) about something 'liberals' have held forth on and then proceed to attack that with some sort of highly contrived measure that nobody uses. His only job is to provide chum for libertarian fanboys who want their perception that they're smarter than everyone else confirmed. Of course, far from being smarter than anyone else -- in fact quite the contrary more often than not -- they're not inclined to look too closely on what the troll has offered up as clickbait. That's assuming said libertarian fanboys are even capable of performing such a critical analysis; as amply demonstrated here, all too often they're not.

Cowen launders plutocratic ideology to the public with just enough of the "creditable professor" schtick to sound plausible. I generally don't pay attention to him. I'd say I don't understand why Kevin does, but maybe I do.

Exactly. The common theme running through his ridiculous 'research' is that the rich are taxed too much already, of which the piece Kevin is commenting on is merely another example.

It would be interesting to see quantitatively how these things in the US now compare with around 50 years ago before the big swing to the right economically. Certainly at that time pre-tax inequality was much less and formal income-tax rates were much more progressive. Republicans claimed that high tax rates and government regulation were holding the economy down, and Democratic politicians went along. It was Democrats who passed the first big tax cuts in 1964 and acquiesced in the 1981 and 1987 cuts (they held the House). But overall GDP growth has certainly not improved since the 60's - the tide has not risen. And real wages by the CPI have scarcely risen since around 1973. Wage-earners boats have not floated up - economic growth has not trickled down.

Democrats should be talking about how conservative economics has clearly not worked as promised in this country, not so much just trying to counter Republican's mostly fake claims about Europe.

Democrats should be talking about how conservative economics has clearly not worked as promised in this country...

Yes. Attack Republicans on their policies and on their record. Those are big targets, and ripe.

I understand the desire to go after billionaires and "capitalism," but those attacks come with a political cost (like "defund the police"). Dems should be winning the eonomics debate and can help themselves by refocusing on their opponents.

It would be interesting to see quantitatively how these things in the US now compare with around 50 years ago before the big swing to the right economically.

Yes. Good point. I think if we went back even a little further (say, mid 1960s) there would've been a plausible case that the US was more or less a standard-issue, Western mixed economy with broad-based gains, rising living standards, declining poverty, an activist national government and an expanding safety net. And it likewise wouldn't have been obvious that private health insurance was an inefficient means of providing healthcare coverage.

And then we went all in for neoliberalism.

Maybe I'm missing something, but the US figures appear to include ONLY federal tax spending and tax revenues, excluding taxes paid to and spent by states and localities.

If I'm not mistaken (and I may be), at least some of the European countries used for comparison have no or little taxation below the federal level.

If true, that means we're comparing a system in which there are 2 (or even 3) significant taxing and spending levels to systems with only one.

I suspect this will skew the entire analysis and explain WHY its conclusions are counter-intuitive.

I'm not seeing how you derive that conclusion, but if so, the study is worthless.

Sheesh. I actually scimmed the damn thing and could not find a readable definition of "re-distribution." Kevin note it, they end up comparing allocation of resources a a percentage of GDP with taxes. Ugh.

Its not only "counter-intuitive" its wrong.

First off, Figure VI is the entire story. To add Figure V into it, well, I guess these guys or gals are not tax lawyers.

The more income inequality there is, the more progressive a taxation system is going to "appear" to be. Remember, what they are doing is "the top 10% of people" when they begin the analysis of whether its progressive or not.

Its the classic conservative argument "hey, did you know the top 10% of the income earners pay 60% of all taxes! Outrageous!"

Yeah, well, until you factor in that the top 10% MAKES 70% OF ALL INCOME.

In the paper, they even point out that the US is one of the worst countries in income inequality but yet fail to show how that associates with percentage of taxes paid by income segment.

Christ. Another 15 minutes wasted.

You don't have to an in-depth analysis of why some crank's perpetual motion machine isn't when you know that if it worked as advertised it would violate the second law of thermodynamics.

Its not only "counter-intuitive" its wrong. First off, Figure VI is the entire story.

Why do you conclude that?

As I lay out elsewhere in this thread, I believe it's erroneous to conclude from this study that the US operates a generous (much less an effective) safety net.

But "figure VI" shows net transfers. And such a figure would only show us part of the picture with respect to economic inequality. To get a fuller picture we'd need to see pre tax/transfer national income, and then look at how taxes/transfers modify that initial distribution. IIRC, the Nordics (to cite everyone's favorite example) actually don't enjoy a particularly equal distribution of income before taxes and transfers (not surprising in light of their very strong property rights and reverence for markets). In fact, they don't enjoy all that equal a distribution of income after taxes alone, either; but when you add in transfers—and such states operate efficient, generous public services focused on keeping non-rich families, healthy, financially secure and productive—the end result is a society characterized by much less economic inequality than the US.

Only subjects of a capitalist society would consider the reduction of income taxes for those who earn the least as a redistribution of wealth.

Living in France, I would comment that European - and especially French - systems are largely regressive indeed, if you take not just VAT but also excise taxes (gas, tobacco) and especially social contributions into account. Here even the most important cultural subsidy, the intermittance de spectacle, is paid exclusively by salaried workers in the private sector, while non-contributors like lawyers and doctors are the most likely to see the show. Child benefits, available to all parents including the rich (and in fact more for the rich, since the poor get nothing for their first child while the rich get a big tax deduction), are also paid only by workers. I could go on. Successive governments of all stripes including Socialist made it worse by reducing progressive income taxes, and increasing regressive taxes and charges. Finally, remember that the US taxes citizens, and European countries only residents. So rich French persons simply "reside" or pretend to, in low-income countries, while Americans living abroad do pay taxes at home.

So why is it still better to be poor in Europe than in the US? Because the poor do get more help there. It's just not paid by the rich but by the middle class, excluding the upper middle class. There is redistribution of wealth: from those earning two to four times the minimum wage to those earning less than it. But once you're at five times the minimum wage and above, you benefit from a regressive system that mostly favors the rentier class (especially those who don't work and don't pay social charges at all, while still getting social protection).

The paper shows:

1) In America, the bottom 50% have dramatically lower pre-tax/transfer income (as a % of total national income) than the bottom 50% in Europe. This is the key stat from which bad conclusions are drawn.

2) America redistributes very little to the bottom 50% and the inflated cost of US Healthcare overstates thus redistribution.

These facts are intuitive and probably undisputed.

Concluding that America redistributes more because the poor are very poor is counterintuitive and frankly makes no sense at all. Because the poor have less to begin with, giving them less means we are giving them more!?!?

Umm, no.

Imagine that charity A distributes 99% of all receipts back to the bottom 10% of American households in the form of cash.

Charity B distributes 10% of all receipts back to the poorest man in America in the form of Donald Trump branded silk ties.

Could we calculate this to show that charity B is redistributing far more than charity A? Of course we could, this study and Tyler Cowen would support that conclusion. But nobody should take that conclusion seriously.

Its all in chart V.

Chart V drives the conclusion, chart VII.

But its not so easy to say "what is the perecentage of taxes paid by the top 10% relative to the bottom 50%" and then use that as applied to distributions to figure out what "re-distributions" are - I mean, its sort of either half assed or craven, depending on the funding of this think tank.

If, in country Euro, the top 10% only makes 2x of what the bottom 50% makes, and,

If, in country America, the top 10% makes 5x of what the bottom 50% makes,

Then, its going to look like America is more "redistributive" than country Euro, but that's not because America actually re-distributes more, its because America's overall tax revenue is driven by its income inequality in the first place.

The dog wags the tail, if you will.

I mean, other posters are probably right that state and local taxes in the US were not figured in, and those are flat and regressive, as is Social Security and Medicare, which is totally flat, and which funds the Federal Gov anyway (every chart like this I have ever seen excludes both employee and employer sides of this because, quelle suprise, that makes our tax structure look like the rich are paying more).

What the hell, no one understands the "trust funds" anyway so I don't know why I bother. Greenspan did succeed in conning millions of otherwise intelligent people on that one, that's for sure.

I think its actually Figure III that is important. Figure III gives the pretax income.

While the US redistributes less (Fig VII), if you calculate that lower redistribution as a % of the pretax income (Fig III), you can 'show' that the US redistrubites more than other countries because the pretax income is so low to start with.

By itself, higher wages for the lower income group would reduce the US redistribution according to this study. Or a small cut in food stamps paired with a large reduction in pretax income would actually make the US appear even more redistribution.

The metric that they have created is useless as a measure of well being or even as a measure of actual redistribution.

Figure III is the most important but I should have sniffed it out right away that this purported to perhaps be the first study of "redistribution."

Well, for f's sake, why don't we do the first study on "Americafirstism?"

"Redistribution" is a dog whistle, not really something worthy of studying. Its a dog whistle because conservatives have been droning on about taking from one person and giving to another, not as economists, but as taking from a hard working person and giving it to a lazy person.

As if the US gives anyone anything. I reject the notion, for example that Medicaid is "taking" from people who can afford insurance and "giving" someone else insurance.

I mean, that's what "insurance" means -- in our screwed up system someone who can afford insurance today could be bankrupt tomorrow.

That's why I like Chart VI I mean, look at how its labeled "transfers received?" WTF, as if getting, like food stamps is equivalent to a gift. Of course the US is in there with such fantastic societies as Serbia and Romania and nowhere near Denmark.

The decision is always about what sort of social safety net a society should have. The US is like "that's a socialist question," like the bunch of true morons we are.

Of course the wealthy pay more. They are wealthy that's why.

Ugggh.

I think its actually Figure III that is important. Figure III gives the pretax income.

No, again, figure III does not give us "pre-tax income." Figure III shows growth in the shares of pre-tax income. This is a very different animal, and one that was probably chosen by the authors either because they had trouble finding absolute shares and/or because using absolute shares would weaken the case they were making.

A much more reliable and meaningful methodology would be to take average pre and post tax/transfer total income shares (not income growth) of the cohorts in question over a given time period.

It's up to the reader to decide why this approach wasn't taken.

In America, the bottom 50% have dramatically lower pre-tax/transfer income (as a % of total national income) than the bottom 50% in Europe. This is the key stat from which bad conclusions are drawn.</i

It doesn't show that. The chart only tracks which half has captured what portion of growth in income. It doesn't give us absolute shares. This is a nontrivial distinction. I suspect the authors used growth instead of absolute shares because using the latter would paint the social democracies in a better light (because they have much more pre tax-transfer income inequality than most of us realize).

In America, the bottom 50% have dramatically lower pre-tax/transfer income (as a % of total national income) than the bottom 50% in Europe. This is the key stat from which bad conclusions are drawn.

It doesn't show that. The chart only tracks which half has captured what portion of growth in income. It doesn't give us absolute shares. This is a nontrivial distinction. I suspect the authors used growth instead of absolute shares because using the latter would paint the social democracies in a better light (because they have much more pre tax-transfer income inequality than most of us realize).

Income inequality has increased greatly in the US since around 1970, not primarily because of tax policy, but because employers have been able to take virtually all the gains achieved through increased productivity. And they have been able to do that because they have relentlessly fought to weaken the bargaining power of workers; through union-busting, legislation, court appointments, NLRB appointments, and every other stratagem they could find to tilt the playing field in favor of owners and managers. That needs to be fixed first, then redistribution through the tax structure can be used to ensure that every citizen can live a life secure as to food, shelter, health care, education, and other essentials.