I happened to click today on a post about the (still) massive power of the Baby Boomer generation, something about which I'm fairly agnostic. However, before I even got to the main argument I ran across this throwaway line:

The American Dream is no longer true in the way it was for more than a hundred years: the average Millennial will earn less money than their parents.

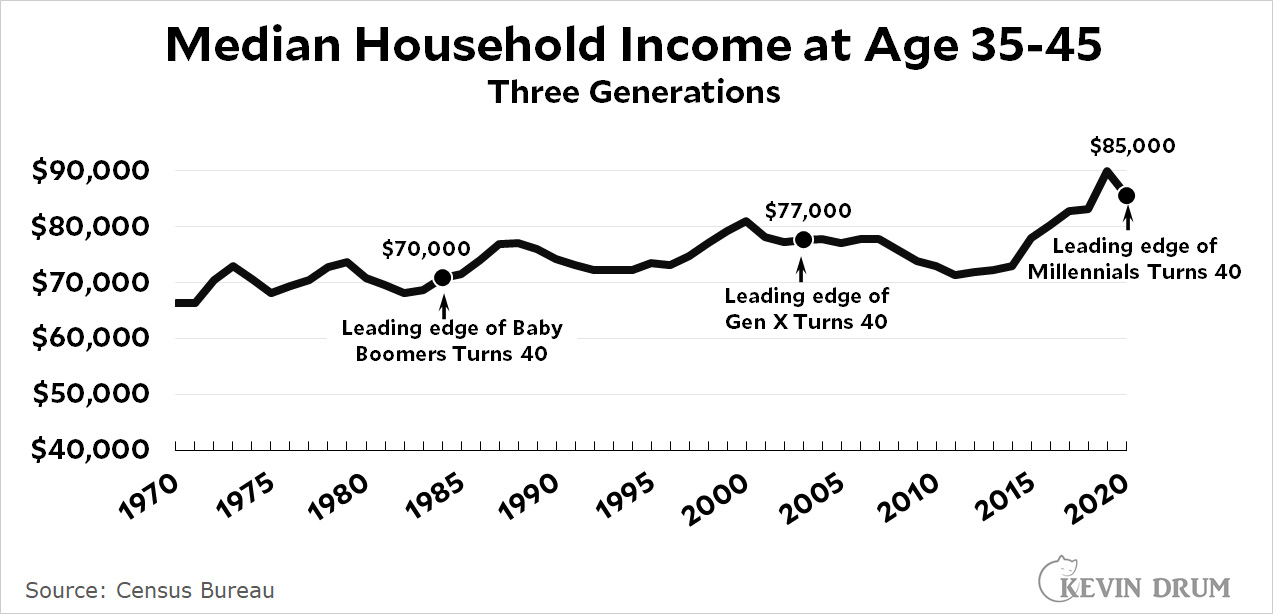

This is yet another example of conventional wisdom that gets repeated forever even when recent evidence tells us it's no longer true. Here is household income at age 35-44 for Boomers, Gen X, and Millennials:

Millennials at age ~40 earn quite a bit more than Boomers did at age 40. This is median income adjusted for inflation, so it doesn't include zillionaires and it's real dollars.

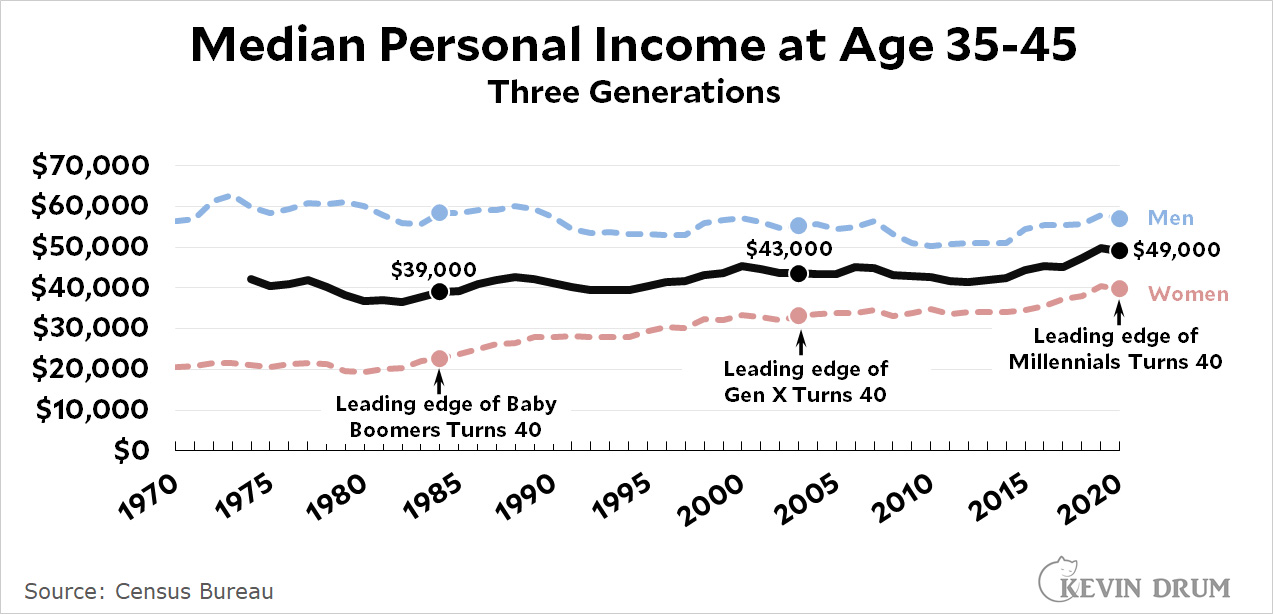

But wait. Household income may have gone up because there are more two-earner families than in the past. That's true, so let's look at individual income:

Averaged together, Millennial income at age 40 is about 25% higher than Boomers at the same age, but the earnings of men have been basically flat while the earnings of women have gone up 75%. In other words, individual earnings of Millennials at age 40 are quite a bit higher than Boomers at age 40, but the distribution of those earnings is quite different.

There are technical details here about age distribution within the 35-44 band and a few other things, but nothing that makes more than a small difference. And you can always cherry pick the data to show anything you want. But if you just look at straightforward income figures, Millennials earn more than comparable Gen X and Boomer workers.

So what accounts for the ongoing myth of Millennials being worse off than Boomers? My guess is that lots of people simply refuse to acknowledge what's happened in recent years. In 2012 you could make a case that Millennials were indeed a lost generation, and it quickly became received wisdom that this was true. But starting in 2015 incomes began a powerful run, increasing by nearly a quarter before dropping a bit during the pandemic year of 2020.

In other words, the Great Recession hit Millennials hard, but it was a temporary hit and Millennials enjoyed strong income gains during the recovery. They are now the highest paid generation in American history, but only if you look at data going all the way to the present instead of just chopping things off at 2012 and never looking again.

Now that's hitting the nail on the head....

Men's income flat, women's goes up. Ergo, men must be falling behind.

except....what the their corresponding debt burdens? Millennials may be making more money, but a higher percentage is going to pay off student loans, so after that, have less to work with....

https://www.vox.com/the-goods/22166381/hollow-middle-class-american-dream

Plus the cost of housing has gone up more than ~25% since 1985... far more... From ~82K in Q1 1985 to ~365K in Q1 2021... https://fred.stlouisfed.org/series/MSPUS

Adjusting for inflation that's an increase of 75%.

So basically this post is: "Today, in Boomer who owns his house - in California, no less..."

I used house prices instead of rent prices because owning a home is the primary mode of wealth generation in this country. Yes, the increase in rent prices is less, but if the argument is about income and wealth...

I'm curious about some of the more socio- aspects of the socio-economics here. How does wage growth among the generations compare across education levels? Does it take a Bachelor's in order to match previous generations' pay with a high school Diploma?

If you only catch up to wages at age X, you have (lost) wage potential gap.

I think you need to adjust income between Boomers and Gen X/Millennials for retirement savings though.

Most Boomers still had defined benefit pensions. I'm Gen X and I have to put the max into my 401K so I can retire someday, Since I'm over 50 that means $26K right off the top, so adjust my pay down by that. Millennials will be at $19,500 if they max out. Or adjust Boomers up to include their employers contribution to their pensions. And come to think of it add medical too, when I started working 33 years ago I paid nothing out of pocket for a great insurance plan with almost no deductible. Now I pay a healthy monthly premium and deductible.

I think overall your point is correct and Millennials are better off than they seemed during the recession, but its not quite as simple as your chart shows.

More data here!

https://www.motherjones.com/kevin-drum/2019/06/how-do-boomers-and-millennials-really-stack-up/

Doing some rough math that seems to show that the extra cost of retirement savings and insurance cancels out the higher income for Gen X and Millennials so its about even overall, but what that doesn't show is the value of pensions that Boomers were getting, you need to up their income to account for that so I think overall Boomers are a little better off, but the difference isn't huge.

Preach it! My health insurance deduction was a pittance in 1989 when I got my first real job out of college and saving 10-20 percent of wages for retirement when my dad did not have too in his professional job. But to be fair we were the last generation to experience affordable college - despite what Kevin claims, colleges around here even state schools do NOT have tuition free plans for working class kids.

yeah I graduated with only $5500 to pay off and the interest rate was 4.5% I think, which was like half of what a mortgage rate was back then.

Yeah the kids today are jealous. I did not have student loans - I went to in state school, in fact VA Tech at the time was the cheapest school so my generous parents told me they would pay my way for four years. I managed to graduate in four years via some AP credits in History and two summer sessions.

I had that after a semester.

Despite what you said, they do have such programs.

It's not enough, clearly, but they do exist.

As a boomer (born 1958), who graduated Yale and Berkeley Law School, I have had very respectable earnings, but I never had a defined benefit plan

This. Defined benefits pensions were more common 40 years ago than they are now, but it's a myth that a majority of workers had them.

As a middle of the boom Boomer I can say the majority of my peers never had defined benefit pensions. I think the high water mark - never a majority - for defined benefit pensions was the 70's when 401ks were introduced and it's been declining ever since. My employee based health insurance was quite a bit cheaper 40 years ago but it also did not include dental or eye care or other things that later more expensive plans did.

Not to be a defensive Boomer, but I think the focus on generational differences can be useful but it also can be a diversion from the real issues of economic inequality which has been a function of policy decisions and social changes that are much less tied to a specific generation than they are to specific classes.

It's all a debt bubble in the end. When it ends, banks will collapse. Corporations will default, 99% of small business will be gone outside under the table ones. The story of capitalism is ending

The pressure on today's generation to assume debt for everything is enormous.

'The American Dream is no longer true in the way it was for more than a hundred years: the average Millennial will earn less money than their parents.'

Wealth is not about how much you make- it's about what you can afford. And the cost of a house, child rearing, healthcare, etc. has skyrocketed, making a modern family almost unaffordable even with two incomes.

And no pensions to land on, ever escalating debt, environmental degradation, etc.

And the cost of a house, child rearing, healthcare, etc. has skyrocketed, making a modern family almost unaffordable even with two incomes.

For something that's "almost unaffordable" tens of millions of Americans seem to be engaged in exactly that.

I think the problem tends to be one of financial precariousness and lack of security (at last for those below the top quartile or so) more so than lack of affordability as such.

In terms of the environment in the U.S., the water and air are significantly cleaner today. And the food supply safer.

Now the future, yeah, but don't think things were great in the past.

cost of college and debt have to be a big part of the story.

I don't know exactly how you'd do it, but if you compared the median college loan and median home load burden at age 30, I think it might wipe away all those gains and more.

Maybe?

Most Americans don't go to college. If things are harder for the top half of the income distribution (the college half) and better for the bottom half (since the price of goods other than college education has not increased as much as incomes), that doesn't strike me as a monstrous injustice, although obviously the typical journalist sees things differently.

You'll want to cite that and you may be surprised that... most do go to post highschool now

I think it might wipe away all those gains and more.

My sense is there is substantial evidence college debt and housing affordability are indeed more problematic for younger people now than was the case decades ago. However, they, erm earn more. So my take from this post of Kevin's is not so much that millennials are doing objectively better than Boomers or Xers, but rather, the frequent kvetching about how poorly they're doing is unjustified. It's a mixed bag.

(Also, millennials, for all the woeful stories about their college debt levels, are the most highly-educated generation in US history, and college graduates tend to earn more. Moreover, plenty of millennials have managed to get in on the housing ladder, and many of them in turn are doing quite well in the current market).

Finally, let's not forget that millennials will likely benefit from further advances in science — I'm thinking especially of medicine — that earlier cohorts were born too soon for.

I really don't know why Kevin keeps posting this stuff, when its not all that hard to verify that in this case conventional wisdom is correct.

None of these posts illustrate how great the U.S. had it post-WWII - we were a legitimate member of the first world with second and third world land prices. End of story. Oh, how the conservatives laughed at all those Europeans who had to live in apartments! Suckers!

The average salary for postal workers was $27k in 1985. Today its up to about $60k. That increase would probably keep up with general inflation == true.

But the average house in Los Angeles County has gone up more than four times, from about $200k to just over $800k. Whether someone making $27 could figure out how to buy a $200k house in 1985 is what, maybe?

But good luck to all those postal workers making $60k trying to buy an $800k house. How are they saving the $160k down payment?

Its absurd. I really don't get what Kevin is trying to point out.

We are joining the rest of the first world, where for centuries nobody is running around buying 3,000 sq ft houses on 15,000 square foot lots.

For some reason we figured that could go on indefinitely and obviously it cannot.

Re: But the average house in Los Angeles County has gone up more than four times, from about $200k to just over $800k.

The vast majority of postal workers do not live in Los Angeles county.

YES - todays workers earn more than 20 years ago - or 40 years ago

But they bloody well should do!!

An hours labor now produces two and a half times the "output" that it did in 1970

https://www.weforum.org/agenda/2020/11/productivity-workforce-america-united-states-wages-stagnate

But wages are about 10% higher

They should be 250% higher!!

All of our hard work in improving productivity has been stolen by the 0.1%

This!

If the minimum wage had kept up with productivity it would be something like $25 an hour.

What you learn from these comments is that although incomes have increased more than overall inflation, they have not increased as much as the prices of (i) fancy educations and (ii) housing in coastal cities. Since those are the two things that members of the chattering classes want, expect to see more articles (and more blog comments) about how bad things are.

The cost of housing in any cities that are growing has been going up faster than inflation, too. I refer you to Des Moines - hardly a coastal city.

https://fred.stlouisfed.org/series/ATNHPIUS19780Q

If you don’t want a job where there are jobs and a house to live in where there are jobs, you can be a broke ass flyover meth/opioid addict just like most of middle america! And it costs almost nothing. These entitled millennials should quit whining.

Once again Kevin ignores how things have been different in the last 50 years. Before then, wages and median and lower incomes had been keeping up with GDP per capita or productivity:

http://www.skeptometrics.org/BLS_B8_Min_Pov.png

Wages had kept up with GDP through American history, and between about 1933 and 1970 inequality was actually decreasing. The American Dream was that wage-earners could do as well as or better than the "elite". Since then gains have been small for the lower half and the 1% has done far better than anybody else. The American economy has been financialized and monopolized, so without drastic government action there is no prospect of things getting better. Kevin presents sophistical arguments based on refuting technically dubious statements like "the average Millennial will earn less money than their parents". Comparing how people are doing now to the past is difficult for several technical reasons, but the way that inequality has increased in unequivocal.

Is Kevin so ignorant that he is unaware of these trends or is he so stupid as not to realize their importance? Or is he getting paid to present the rosy view that conservatives like to push about the success of American "free markets"? Anyway continual attention to claims which are not 100% correct is not constructive for someone who claims to be a liberal.

Using the PCE index instead of the CPI to correct for inflation makes things look better in terms of absolute gains for wages, but does not affect the trends in inequality, because GDP/capita and productivity are corrected by the same index, as is the income of the 1%

http://www.skeptometrics.org/BLSB8_PCE.png

The PCE is preferred over the CPI by some people because it would lead to smaller COLA adjustments to Social Security and other things. It also makes the Fed look less bad in failing to prevent inflation in the 70's and 80's.

Looking at *median* rather than average income might be helpful. 40 years ago, Silicon Valley wasn't yet a thing and Wall Street didn't have hedge funds and private equity firms that recruited hotshot quants out of Stanford or MIT for $200k starting salaries. I don't have data, but I'm willing to venture that the trend Kevin identifies is more evidence not for broader millenial prosperity, but for yet more income inequality. *Some* millennials are raking it in, which skews things upwards. A lot more I suspect are, per conventional wisdom, indeed worse off and deeper in debt than their parents at the same stage.

Also, where is debt on this list?

And while average housing price is about the same... how does that control for the millennial who's caught in a hot market (because that's where their higher wage)?

Millenials aren't basking in the glory of the 2021 economy.

This is such a weird hill to die on.

I'm an elder millenial (1984) and my income has risen 300% since 2015. This also confirms white, male privilege because I have no idea what i'm doing but my company keeps shoveling more money at me

Pingback: Millennials make more money than any other generation did at their age, but are way less wealthy. The affordability crisis is to blame. - WealthInsider | Follow The Money

Pingback: Millennials Are Highest-Earning Generation, but Hold Way Less Wealth – TechNewsMore

Pingback: Millennials make more money than any other generation did at their age, but are way less wealthy. The affordability crisis is to blame. - Minnesota Business Insights

Pingback: Millennials Are Greatest-Earning Technology, but Keep Way A lot less Wealth - Wilkinson Knaggs

Pingback: Millennials Are Optimum-Earning Era, but Keep Way Significantly less Wealth - Wilkenson Knaggs

Pingback: Millennials make more money than any other generation did at their age, but are way less wealthy. The affordability crisis is to blame. - Acropreneur

Pingback: Millennials make more money than any other generation did at their age, but are way less wealthy. The affordability crisis is to blame. – Therapy Box

Pingback: Millennials verdienen mehr Geld als jede andere Generation in ihrem Alter, sind aber viel weniger wohlhabend. Schuld ist die Erschwinglichkeitskrise. - Nach Welt

Pingback: Millennials Are Highest-Earning Generation, but Hold Way Less Wealth – all prolondon

Pingback: Millennials make more money than any other generation did at their age, but are way less wealthy. The affordability crisis is to blame. – all prolondon