Inflation figures for April will be out on Wednesday and I am not looking forward to them. The headline rate will be around 3.5 - 4%, which is not really outrageous but certainly high enough to get the usual suspects yelling and screaming.

In reality, if you correct for the artificially low base year of 2020, inflation is running at around 2.5%.

Will anyone report that the official rate is temporarily bollixed and the real-world inflation rate is 2.5%? I would like to think so, but recent experience doesn't make me hopeful. But at least the 15,000 readers of this fine blog will know the truth.

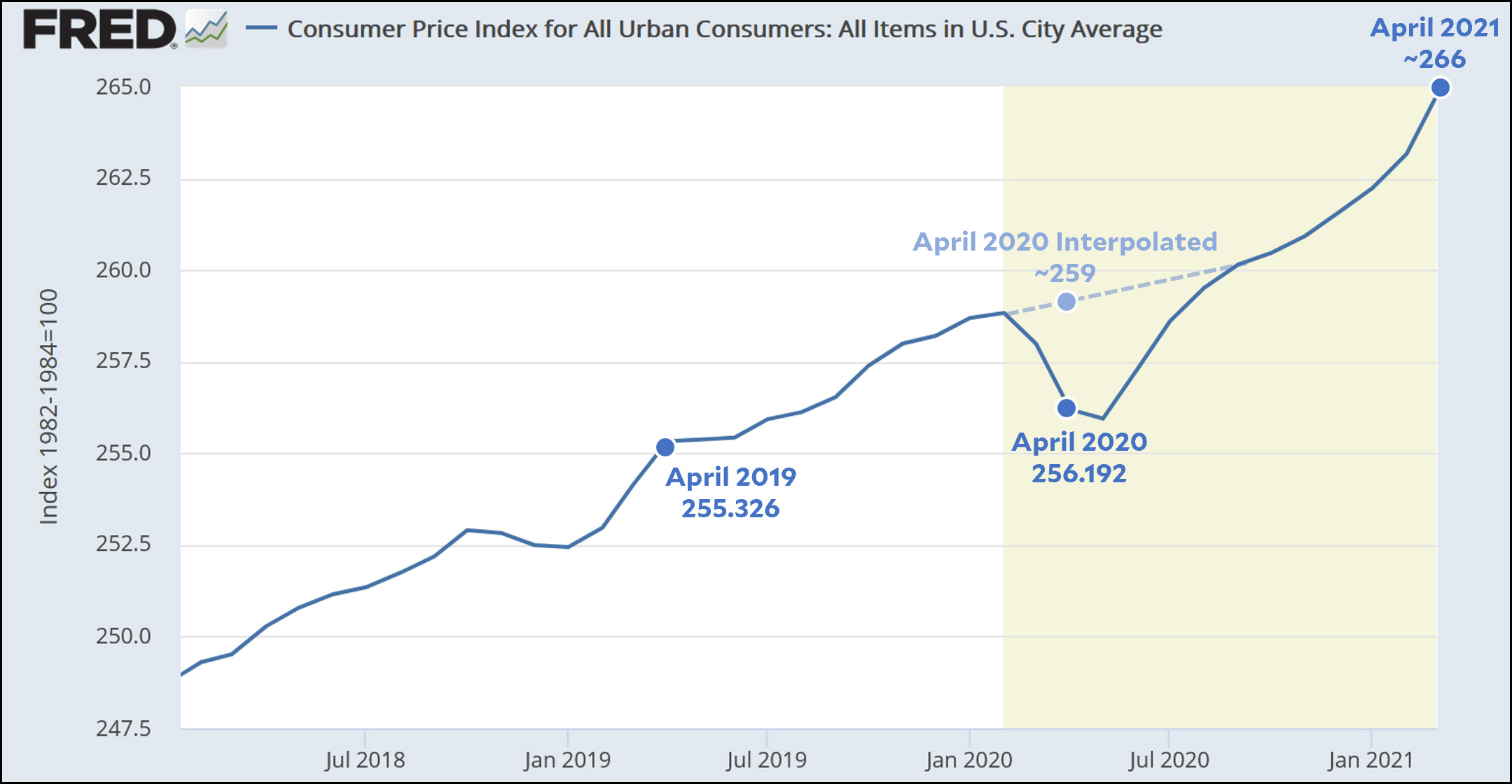

WONKY APPENDIX: This might confuse some of you, but let's take a look at the various ways to estimate the annual inflation rate in April. Here is the CPI inflation index over the past few years:

Method 1 (official): Use the April 2021 figure compared to the April 2020 figure. That produces 266 / 256.192 = 1.038, or 3.8%. As you can see, it is artificially high because April 2020 was in a temporary slough.

Method 2: Use the April 2021 figure compared to the April 2019 figure, then divide in half. This produces 266 / 255.326 = 1.042 or 4.2%. Half of that is 2.1%.

Method 3: Ignore the 2020 trough and interpolate the inflation index as if it had followed its usual trendline. This produces 266 / 259 = 1.027 or 2.7%.

Both method 2 and method 3 produce better real-world estimates of inflation than the official measure. Given the upward trend of the inflation index, my guess is that CPI over the past year has increased at closer to 2.7% than 2.1%, so probably around 2.5% or so.

In any case, definitely not 3.8%. That's the worst estimate of all.

If recent examples are a guide, they'll report about how the numbers are weird, and fairly plainly and clearly - in like the 15th paragraph, long after 90% of the readers have stopped reading. And the headline won't even hint at it.

When inflation comes to town, how are the people most affected - those not holding real assets, the poorer people who don't invest but hold cash, those on fixed incomes - how will they be made whole?

I find Kevin's lack of concern about inflation troubling. "The headline rate will be around 3.5 - 4%, which is not really outrageous"

I think that's outrageous. A "not really outrageous" rate of inflation causes cash (and fixed income vehicles) to lose 1/3rd value in a decade. That's harsh.

Poorer people don't hold cash for a decade.

No, but their pay stays the same.

Kevin omits the rawest measure of all, which is the month/month CPI change at annual rate:

https://fred.stlouisfed.org/graph/?g=DR4J

This is the truest measure of what went on over the past month, except that there is probably some noise in each month's number. But neither this number nor any other tells you what inflation will be in the future. That prediction has to be made on the basis of macroeconomic factors which at the moment are extremely complex. Kevin is right that the media make too much of the monthly numbers as well as stories about how the price of bacon or whatever has gone up, but an average over some large past interval does not give a prediction of future inflation under current conditions.

Ignoring seasonal changes is not a "truer measure of what went on over the past month".

Also, multiplying a monthly change by 12 doesn't give you the annual rate. I wonder wtf is up with that...

?? The CPI linked to is the seasonally-corrected rate. The annual rate is 12 times the monthly rate.

Kevin Drum, inflation denialist. Imagine if the world was getting warming at 3.5% a year!

Pingback: Inflation! uh and Girls! | Steve Fischer's Random Blog

> Method 2: Use the April 2021 figure compared to the April 2019 figure, then divide in half. This produces 266 / 255.326 = 1.042 or 4.2%. Half of that is 2.1%.

Strictly speaking, you should take the square root. Rounds to the same result, but...

Wait until the price of gas jumps because of the pipeline issues...It's the '70's all over again!!!

/s

Not happening. Over blown issue.

July-August yry deflation as inflation numbers will fall back. 2022 is likely to be a commodity deflation period as production ramps up globally causing a overshoot.

This article has four paragraphs discussing the caveat to the headline inflation rate. Their headline is all about the 4.2% CPI rate, but that's not surprising. Anyone who reads the article will understand that the baseline was low. The problem is that people read far more headlines than articles.

https://www.cnbc.com/2021/05/12/consumer-price-index-april-2021.html