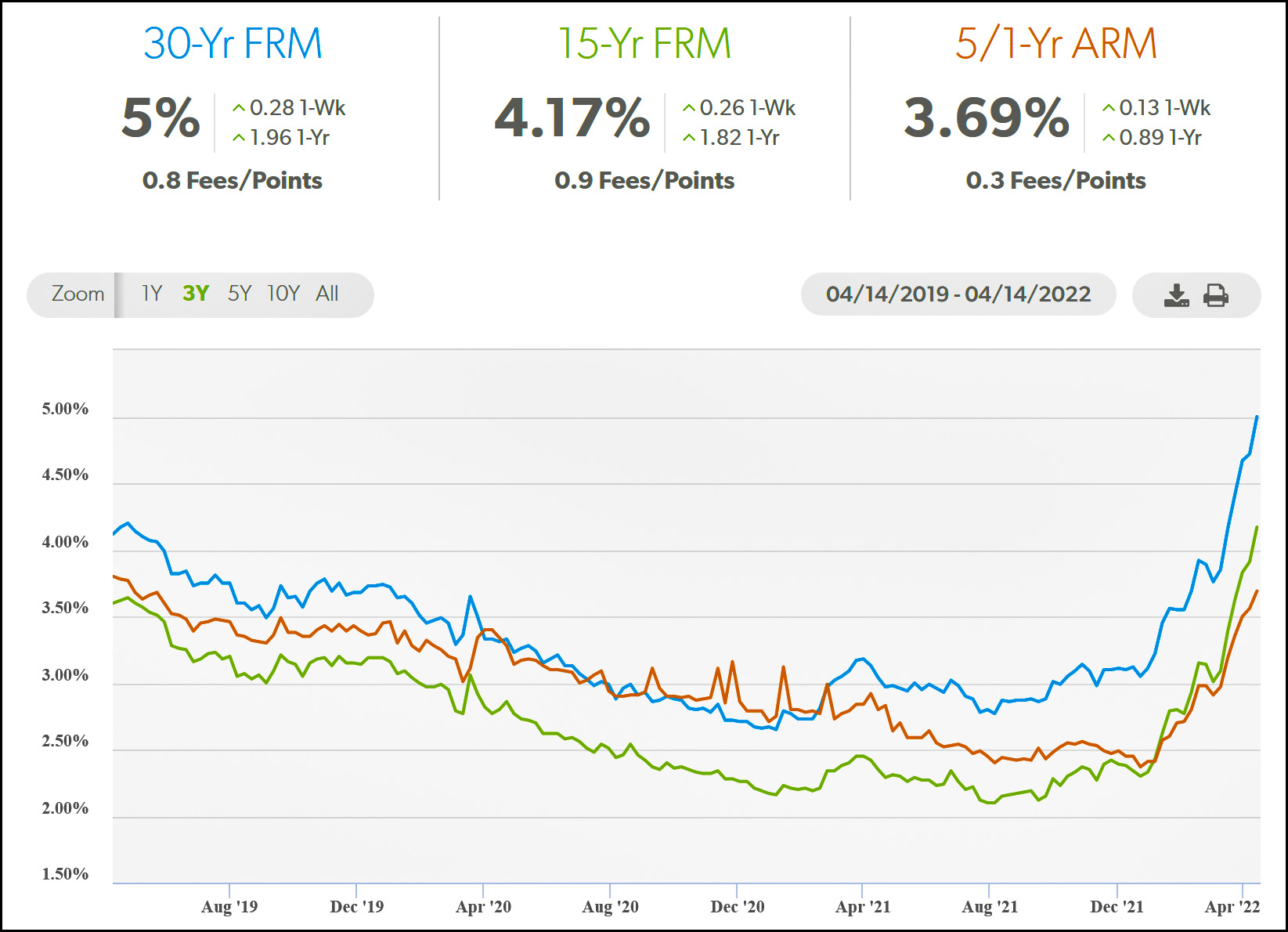

Me, three weeks ago:

We can cross our fingers and hope that mortgage rates don't go up to 5%, but that's a vain hope....The workhorse 30-year fixed mortgage is almost certain to average 5% or more over the rest of this year.

Freddie Mac, today:

This week, mortgage rates averaged five percent for the first time in over a decade. As Americans contend with historically high inflation, the combination of rising mortgage rates, elevated home prices and tight inventory are making the pursuit of homeownership the most expensive in a generation.

Lesson: Always trust Kevin Drum on interest rates.

But will home prices drop too, as I predicted? That's much less clear. People really, really like to buy homes no matter the obstacles. As with so many things, we'll just have to wait and see.

I'm torn on this one. On one hand, it will probably slow down the aggressive housing price appreciation that has happened in the Salt Lake Valley over the past two years.

On the other hand, people discouraged from buying houses due to rising mortgage rates will probably drive up rents, which have also gone up a lot in the past two years (worse than housing price appreciation!).

Higher rates drive down rates. Another I don't get it idiot.

Most house buying were by investors.

As Americans contend with historically high inflation, the combination of rising mortgage rates, elevated home prices and tight inventory are making the pursuit of homeownership the most expensive in a generation.

Good. If inflation isn't brought under control, Democrats are going to get destroyed. This year's midterms are probably already a lost cause. But there's still 2024 to think of. I don't want a recession* but A) if inflation doesn't come down soon, it's going to require a recession to get a handle on price increases, and, B) if we are going to have a recession, best to get it underway as soon as possible so that there's a fighting chance the economy will be growing again in 2024.

*The idea solution is a general slowdown in inflation accompanied by a mere "cooling" of the economy, AKA a soft landing. A weaker housing market might be consistent with such a development.

Interesting points. Say inflation drops to around 4% by August. Do you think that makes a difference in the midterms?

It would need to be 1% in August to make an impression. Impressions like this are a kind of lagging indicator, because it's complaining people have rehearsed.

Say inflation drops to around 4% by August. Do you think that makes a difference in the midterms?

Probably not. For one thing 4% will be described* by the press as still "elevated" and for another, most of the literature suggests voter sentiment wrt the economy is largely calcified over the course of the first two quarters of an election year.

*AFAIK the official target of the Federal Reserve is 2%.

Nope, but this is your ignorance.

Teaser rates and balloon payments anyone???

Likely not necessary. Going to the edge/max on an adjustable is sufficient.

5% is not a bad rate.

Especially not with 8% of inflation. Although presumably that number is going to come down. I'm not in the market for a mortgage, but if I were I'd definitely be leaning toward an ARM.

Kevin, Yogi Berra dislikes hubris.

When mortgage rates fell to 5% in 2009, people were dancing in the streets.

I'm old enough that I remember getting my first mortgage at 7.25% and thinking that was a fabulous deal! And then my second mortgage we refinanced downward 3 times (?) over the next 15 years, ending at a 15 year rate of 3.125%. Good times.

The market here in St. Louis has been pretty "vigorous" lately. Maybe not so much in rising prices, but certainly in terms of activity. It used to be that anything "fairly" priced sold at 95% of asking within ~2 months. (Very different from our experience in the New England market, where we sold our house for 5% over asking in 4 days.) Now, well-priced houses sell for 5% over asking in under two weeks. The most extreme case I've seen lately was 15% over asking in 2 days.

I'm curious to find out what this does to the market.

My first mortgage in 2003 was a 30 year fixed at 6.25%, My current mortgage after I last refinanced in early 2021 is 15 year fixed at 2.375. Nearly got the rock bottom rate but I was a few days too late at capturing the literal bottom of the rate slump in December 2020/January 2021.

The Market here in Northern VA is still crazy. The 2,300 sqf/ 2 story colonial house behind me went on the market after my elderly neighbor passed away and her house was frozen in time circa 1974 but a double lot though the extra lot is a ravine so it would be very hard to build even if the county would give it's blessing. The asking was $850,000 and had a crowd at the open house flipped to pending closing by mid week. I sure hope they don't tear down the house and put up monster houses on the lots, no other houses in that development have been torn down and my development is mostly original only one torn down house though lots of houses that have additions.

It was 5% in 2018.

What percentage of new home buyers are people, as opposed to investors? That'll determine if rising mortgage rates lead to falling home prices.

I seriously doubt home prices will fall. The rate of increase will fall and prices may plateau but they won’t fall.

In real terms they will fall.

Locked in a 2.75% APR on our mortgage back in March 2021. Conventional 30 year, no points, very low fees. It was a pain to set up, what with a lot of COVID caused glitches in the process, but I made it. I'm glad I went to the trouble at the dip - don't think I'll be seeing a better rate for a while.