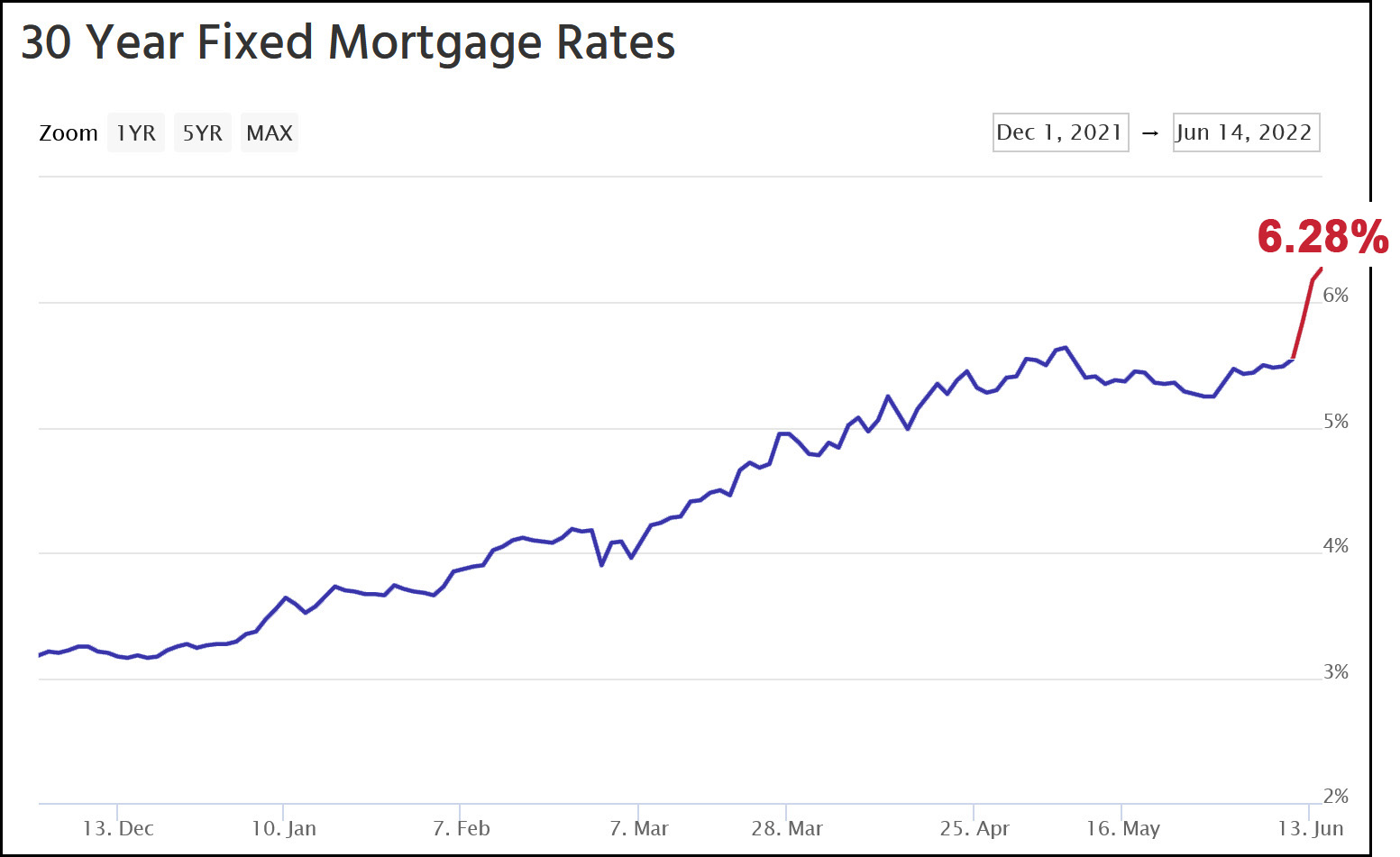

If Mortgage News Daily is to be believed, the interest rate on a 30-year fixed mortgage has jumped 0.73% over the course of just three business days. Since the start of the year rates have nearly doubled, from 3.29% to 6.28%.

If Mortgage News Daily is to be believed, the interest rate on a 30-year fixed mortgage has jumped 0.73% over the course of just three business days. Since the start of the year rates have nearly doubled, from 3.29% to 6.28%.

So what happened on Friday to cause mortgage rates to suddenly jump? That was the day inflation numbers were released, so I suppose it was that. Bankers probably figured that continuing high inflation would prompt the Fed to raise rates sharply and this in turn would make their cost of money higher.

Or maybe there's some other three-bank-shot theory at work here. Long-term inflation expectations (5/10/30 year) have been either flat or down over the past few weeks, so that's not the answer.

In any case, this will add yet another $100 or so to the average monthly mortgage payment, and this in turn will depress the housing market. That's bad news for the economy.

Housing means much to the economy????

We bought just over a year ago, and our principal/interest payment would be 50% higher at current rates. I don’t know how this won’t stop home price appreciation in its tracks, if not lead to lower prices

Incentives are coming back.

Low interest rates were causing prices to go up. Bad news!

Higher interest rates will cause prices to go down. Bad news!

Is there any financial news (other than raises in the stock market) that are good news?

If you have money to spare, stocks are on sale right now; investing now can get you good returns when things eventually recover.

Of course, if you're broke, then the sale will pass you by: bad news! So ymmv

Are they on sale now, at fair value, or still above fair value? In 2001, nasdaq fell like 80% from peak to trough.

I have no idea, but it still feels like trying to catch a knife. Otoh, it took my too long to get everything back into market after 2009 lows

Tax cuts for billionaires!

Great comment.

Interest rates were 8+% in the 90's over many periods.

Maybe this?

https://notoriousrob.com/2022/06/finally-no-bid-on-mbs/

Eh, their point is wrong. Energy driven inflation is not real inflation. It's inflation that will be wiped as quickly as it comes.

Yes, this was largely the inflation print; there were also a couple other pieces of data on Friday that taken together spooked traders. The data was pretty uniformly bad and indicated that inflation wasn't slowing, and that the Fed would need to act more aggressively than expected, with less chance of a soft landing.

Look at that chart. Forget the action in recent days. Look at how rates went from a little over 3% in December to 5.5% early-June.

The 6.28% is not anomalous, but fits right on the trendline (something Kevin likes to graph, but not here for some reason).

Mortgage rates did not "suddenly jump" (from normal-land) they suddenly went back to trend.

Mortgage rates don't really have a trend line. I mean...you can draw a line and pretend it means something, but it isnt a trend line that shows some underlying factors like inflation, population growth, aging, productivity, etc...

The Fed attacked covid with its benchmark interest rate and by purchasing gobs of Treasurys and MBS. That’s the mechanism that pushed mortgage rates down so sharply. It is currently unwinding from both (“the taper”) and that adds upward pressure to mortgage rates (and so probably do expectations of more aggressive unwinding in the future; I have no idea if anyone tracks that).

They didn't buy enough mbs to matter, nope your wrong.

Indirectly, the market is reflecting expectations of Feds raising the central rate by 75 basis points tomorrow. Ref: https://fred.stlouisfed.org/graph/?g=QAkf

You mean betting. There in lies the problem.

Home construction probably lags interest rates by several months to a year?

So this might be really bad for jobs and the economy in 3 to 9 months?

Home construction is .9% of GDP.

Certainly hasn’t been good for Redfin et al: https://techcrunch.com/2022/06/14/redfin-and-compass-lay-off-a-combined-900-employees-as-mortgage-interest-rates-continue-to-climb/amp/

Yeah, so????

" Long-term inflation expectations (5/10/30 year) have been either flat or down over the past few weeks, so that's not the answer."

This is analytically entirely wrong conclusion. You simply do not read the economic data coherently, I am afraid, for overly simplified understanding. Which is a pity, otherwise your data approach is one that is welcome.

An expectation of a sharp-short term rise in interest rates which needs to be covered in current funding is exactly in accord with a view that the US Central Bank will now drop the untenable 'temporary' view and move to inflation crushing near term rate raising. Thus long-term expectation remains anchored based on the short-term expectation of severe action. These points are in accord (in accord does not mean of course they are The Explanation, it is simply that your statement "can't be that" is nonsense analyticall.).

Maybe, but flawed inflation reporting based on market failure is not what Drum talking about. Inflation really didn't rise that much in May. It was oil and to a ridiculous move in gasoline futures especially, that had no basis in reality. March was the same con.

NEVER has a mortgage of less than 9.25%. And it never stopped me from owning free and clear today.

But then again I didn't need to have a Cell phone, cable TV, a life coach, a gym membership, purchase coffee at Starbucks, and many other things today's home buyers seem to need.

It's called incentives. It also explains the ridiculous high homebuilder index. They gotta give it back now to get sales.

Subprime is making a comeback as well, something that began in 2019. Looking at prime loans ain't telling the story.

Amen to that jmac!

I wonder when we will wake up to the fact that when our economy was great and growing like it was in the post WWII years we were not only making babies we were spending money while at the same time saving money as well.

In todays world it seems we spend spend spend. Have a few extra bucks? Spend it. Get that new laptop, get the latest and greatest iteration of the Iphone !!! Whatever happened to having a 6 month emergency fund? Covering all expenses for 6 months in the event of an economic calamity? Whatever happened to saving 25% of your paycheck each and every pay period?

I am certainly NOT wealthy but I am not saddled with the attitude of I'm a failure because I don't have the latest and greatest of this or that.....

I had my laptop repaired recently. The middle aged woman who runs the shop said "Hey Vog you know your laptop is 10 years old and very slow. Why not replace it with this new model?" I said "Sure when it breaks down to the point where it is no longer cost effective to repair it. I used to walk 9 blocks to my local library as a kid do research for school and walk home. Now I have to spend money because it takes a few moments for a page to load? Has this world gone mad? Why not slow down and smell the roses?"

She laughed but admitted that she had become so tech-centric that she herself needed to slow down a bit because she remembered "the days" before computers herself. The repair cost $125. I can get a basic laptop for a little more than that but I bought this one because it had a 17" screen which, at the time had great resolution and was easy to read,

WE have lost all modicums of personal fiscal responsibility. It is now more important to do what everyone else is doing just to put on airs.

Partially because it's a economy based on buying and that feeds dollar empire. Partially because GDP is slowing naturally with the industrial revolution 's end. It can't grow that fast anymore.

50's/60's were a unsustainable bubble itself.

Remember, your spending is somebody else's income, and vice versa. Spending is the economy.

My laptop was assembled in the U.S, and is comprised of parts made all over the world. Even Lenovo, which I am currently looking at is assembled here in NC but they have HQ buildings in Bejing, and Japan and have manufacturing facilities in those tow countries plus Mexico and others.

I am all for supporting buy American for just that reason but let's be realistic here. Not much is made here in the U.S.

The global economy means my spending helps the world's income.

Remember the car we drive to work uses oil from the North Sea not here in the U.S. for its gasoline.

Without a cell phone or internet through my cable company, I wouldn’t have been able to keep my job for the last 2 years under mandatory work from home policies.

Sometimes, new expenses that the kids want that boomers never had turn out to become necessities as the world changes. A hundred years ago, washing machines, dishwashers and refrigerators weren’t considered necessities either for homeownership, yet without them, a lot of women wouldn’t have the time to leave the household and have careers.

(And no - the company never offered once to subsidize my personal cell phone plan or buy me a computer for home. It was just assumed I had all these “luxuries” already that could be turned into necessities, at least if I wanted to keep my job to make my mortgage payments.)

Gee, how great for you.

There’s a lot of bitter boomers on Kevin’s blog these days. Take solace in the fact that you got to go to college when it cost less than a summer’s worth of work to attend, you got to buy houses during an era when only one salary could swing the mortgage payments, and at least some of you actually are promised fixed pension payments in retirement. (Anecdote: I love when this boomer that I work with remarked that it was unfair that my employer gives matches to 401k’s for people hired after her. I offered to trade my 401k match for her guaranteed pension indexed to her highest 5 years of salary that younger hires are banned from receiving. She just looked at me blankly and then asked why she can’t have both. Fck you, greedy boomer.)

Boomers got nice things because their parents paid taxes back in the day, and the wealthy and corporations paid too. I wouldn't want everything to go back to the way it was in the '50's, but the distribution of the tax burden was a bit better then. Not just income taxes, but all taxes. And by distribution of the burden, I'm mean tax rates not amount of taxes paid.

More like bitter X's.

The number one thing that needs to happen to bring down inflation is to end the war in Ukraine. The Fed raising rates won't do much.

Neither will the war in the Ukraine matter on some levels in the future.. All it did was lead to fraud.

"In any case, this will add yet another $100 or so to the average monthly mortgage payment, and this in turn will depress the housing market. That's bad news for the economy."

On the other hand, if the housing market isn't depressed, prices will continue to skyrocket. That's also bad news for the economy.

I saw in the Seattle Times this morning that Redfin Real Estate has announced a round of layoffs, anticipating a drop in home sales.

No, this won't depress the economy. It will just shift housing payments towards renting, which will further increase rents.

(Not to ignore the knock-on effects of less demand for housing-for-purchase, such as in the construction industries, but we are so far behind the demand curve when it comes to housing supply that rates in the 6% range aren't going to make a huge impact.)