The number of new one-family homes purchased ticked up at an annualized rate of 83,000 in September:

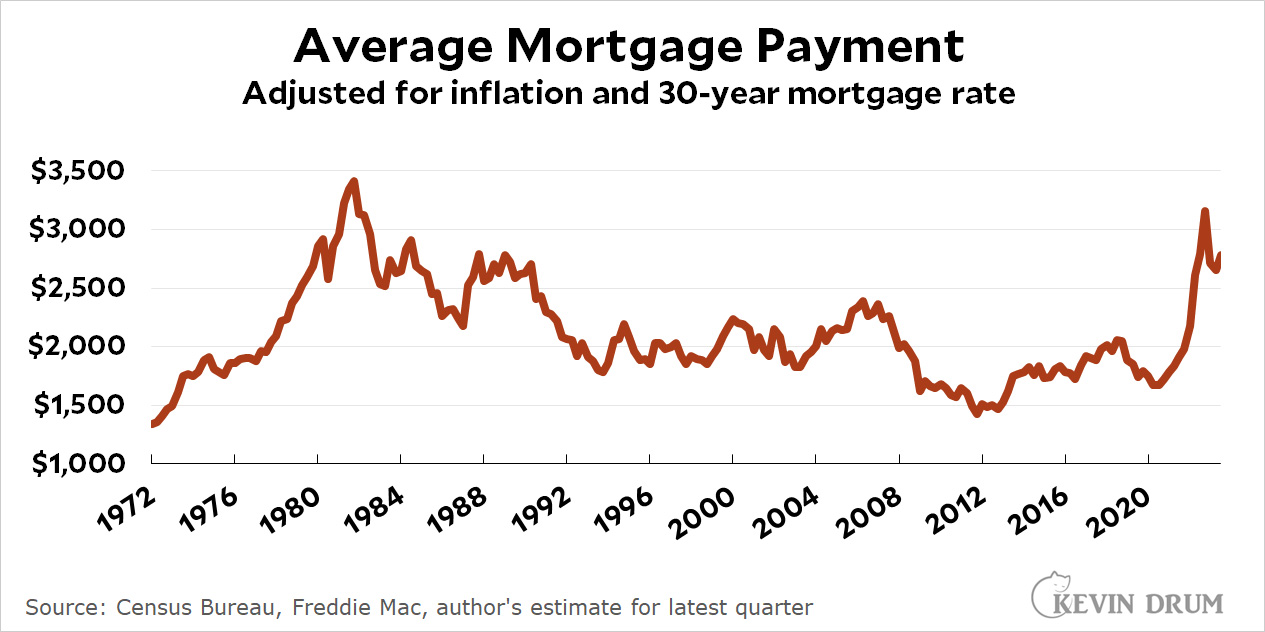

It's remarkable that new home sales have stayed so robust in face of massively higher prices:

It's remarkable that new home sales have stayed so robust in face of massively higher prices:

The last time prices increased like this, during the high-interest Volcker regime of 1979-82, new home sales were cut in half and didn't recover until rates came down. This time, sales dropped from the pandemic bubble high, but then increased when the Fed raised rates and have continued to increase even as the Fed has held rates high.

The last time prices increased like this, during the high-interest Volcker regime of 1979-82, new home sales were cut in half and didn't recover until rates came down. This time, sales dropped from the pandemic bubble high, but then increased when the Fed raised rates and have continued to increase even as the Fed has held rates high.

People just want to buy houses and apparently nothing will stop them.

"People just want to buy houses and apparently nothing will stop them."

Gotta live _somewhere_.

THIS - also in my neck of the woods the rents for the same type of property is nearly as high as the mortgage.

"It's remarkable that new home sales have stayed so robust in face of massively higher prices."

Been tellin' ya.

Is it people or corporate entities doing the buying? Inquiring minds want to know!

I do strongly believe that corporate entities buying houses are distorting the market. Kevin and others say it is only a small percent, but that is enough to change what people ask for and what someone buying a house thinks they have to pay to get any house.

They aren't distorting it as much as the cratered construction distorted (and continue to distort) it.

We underbuilt by many millions of units in the 2010s.

https://fred.stlouisfed.org/series/HOUST1F

https://fred.stlouisfed.org/series/HOUST

i'd like to see the pct of cash purchases which are less sensitive to high interest rates

(ie., even though cash purchases don't involve mortgages, high rates may push future prices lower making the purchase a bad investment)

No, this isn't right. The rate at the link you sent was 759.000. That was the highest new home sales of the year so there is no way the annualized rate could have been higher than that, let along 830,000. Plus the top rate in 2020, at the heart of the pandemic was close to 11,000. It looks like a thirty percent drop from the highest point. You have to add to that something you yourself reported which is that existing home sales are down 20%. Meaning if you combine both, home sales are down around 50% from their peak. People with homes aren't selling. Many can't see because they can't afford to lose the interest rate. No let's look at comparisons in the link. Comparing it to September 2022 there is about a 20% increase, but that was before most of the interest rate increases occurred meaning there was probably a higher existing stock of houses available. It would be interesting to go back and look.

It is true that people are paying higher prices for new homes but that it because buyers have no place to go and builders have them by the short hairs. You have to think there is a relatively stable population of people who need homes, no matter what the circumstances and they are putting themselves in terrible situations, but that is because they have to.

I feel like anybody who listened to you just before the 2008 housing crisis might have lost their shirt (and their pants).

Now do existing home sales.

The robust state of the new home market is a good sign, sure. But part of what we're seeing is an artifact of higher rates: many people with existing homes who would like to move can't/won't sell right now for fear of losing their current, low rate mortgages. So there's a dearth of inventory. New homes, to a certain extent, are filling the gap.

The number of new one-family homes purchased ticked up at an annualized rate of 83,000 in September:

Does Kevin mean 830,000? Or does he mean monthly instead of annualized?

In hindsight it is obvious that the real estate bubble of 2005-2007 wasn't really a bubble. It was real market prices reaching an appropriate level. People just didn't believe it at the time.

That's because the Great Recession was really a debt crisis, not a housing bubble. And the resulting financial shockwaves cratered the construction market and now that "bubble" looks small in comparison.

Home prices jumped about 30% from 2003 to 2006 in spite of a small increase in mortgage rates.

With hindsight, those prices and the rapid rate of increase do not appear to be 'appropriate level' prices.

That prices have increased around 4+% a year for 20 years (more than doubling over 20 years, roughly similar to price increases in the decades prior to 2003) doesnt mean the rapid increase in 2003-06 was the right price at the time. That prices have fallen over the last few months is more evidence that the bubble of 2006 was actually a bubble.

Late to this post, but I agree 100% with what jdubs writes here. Which doesn't happen that much!