Ezra Klein reminds me today of a report from the Niskanen Center that got some attention a week ago. Here is its core claim:

We are in an era of spiraling costs for core social goods — health care, housing, education, child care — which has made proposals to socialize those costs enormously compelling for many on the progressive left.

This is something that seems so obvious the authors barely even felt like they needed to back it up. But costs aren't spiraling for these things. In fact, costs in these four categories range from basically flat to "it's complicated." Here they are one by one.

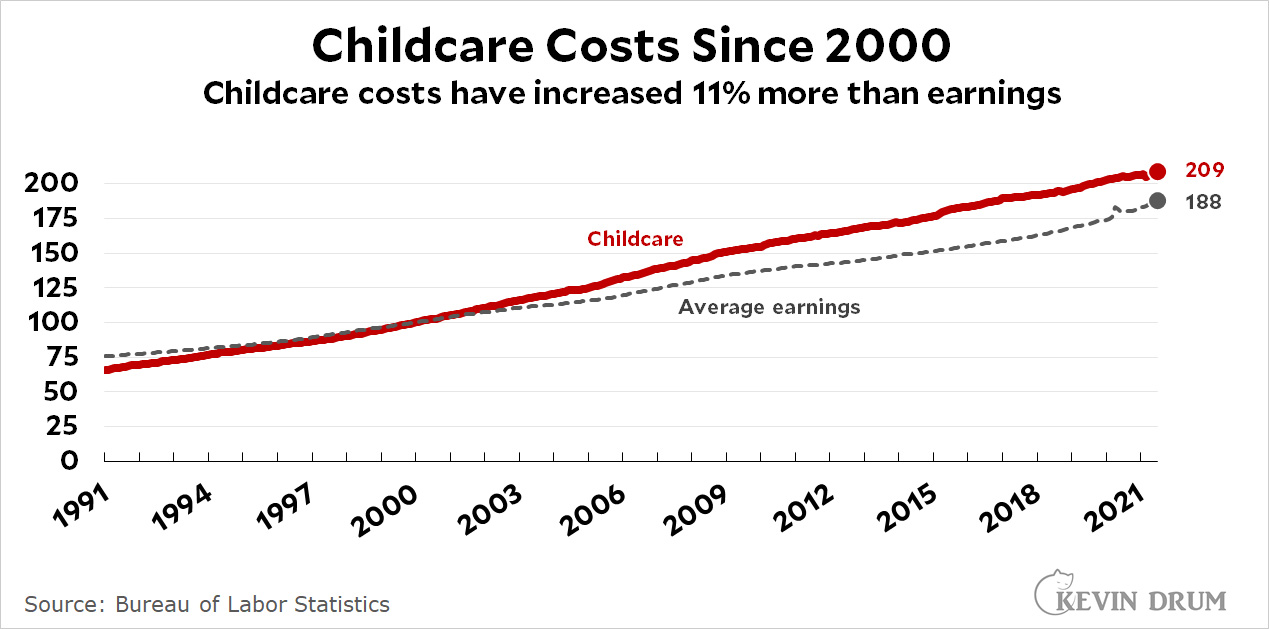

Childcare

The Bureau of Labor Statistics has always tracked childcare inflation as a separate category—though for some reason this seems to be a closely guarded secret or something since you hardly ever see it. Here it is using 2000 as a starting point:

Childcare costs have risen about 11% more than average earnings. That is an increase, but it's hardly "spiraling."

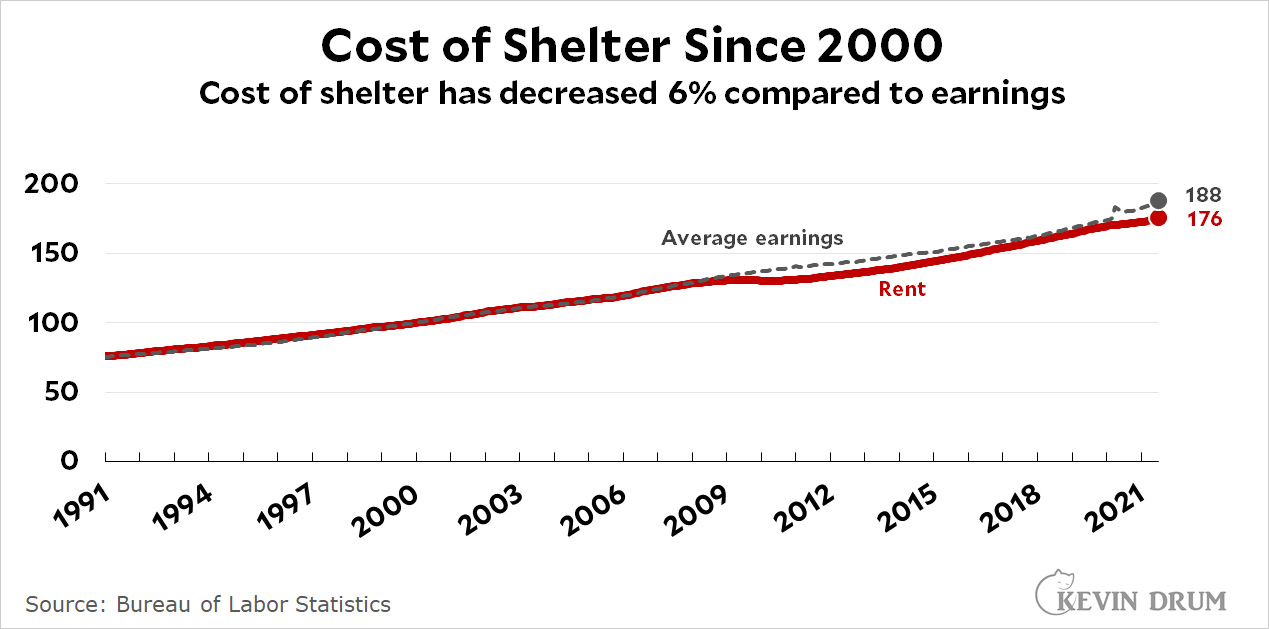

Housing

We've been though this before, but here it is again:

The cost of housing has gone up less than average earnings. If you were to account for lower interest rates, you'd find that mortgage payments have risen even less.

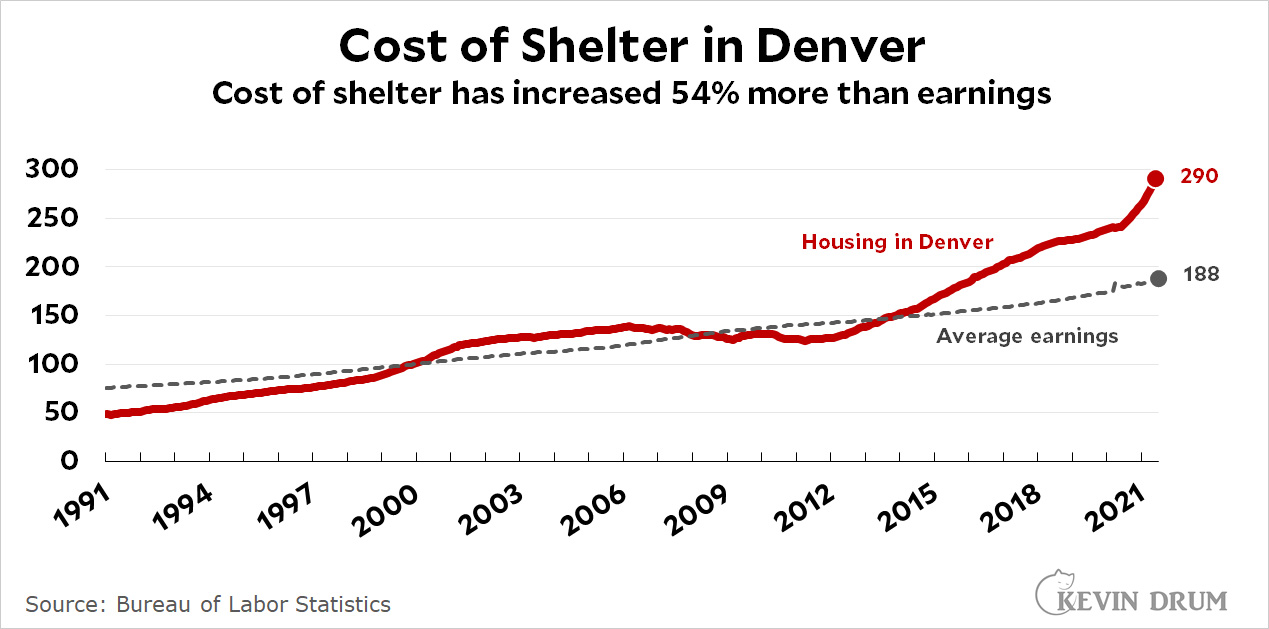

As always, however, there are exceptions. There are always trendy markets that skyrocket for a while before giving way to the newest trendy market. For example, here is Denver:

On average, the cost of housing has been pretty stable over the past 20 years. But it's a bell curve, and there are always going to be cities on both the high and low side.

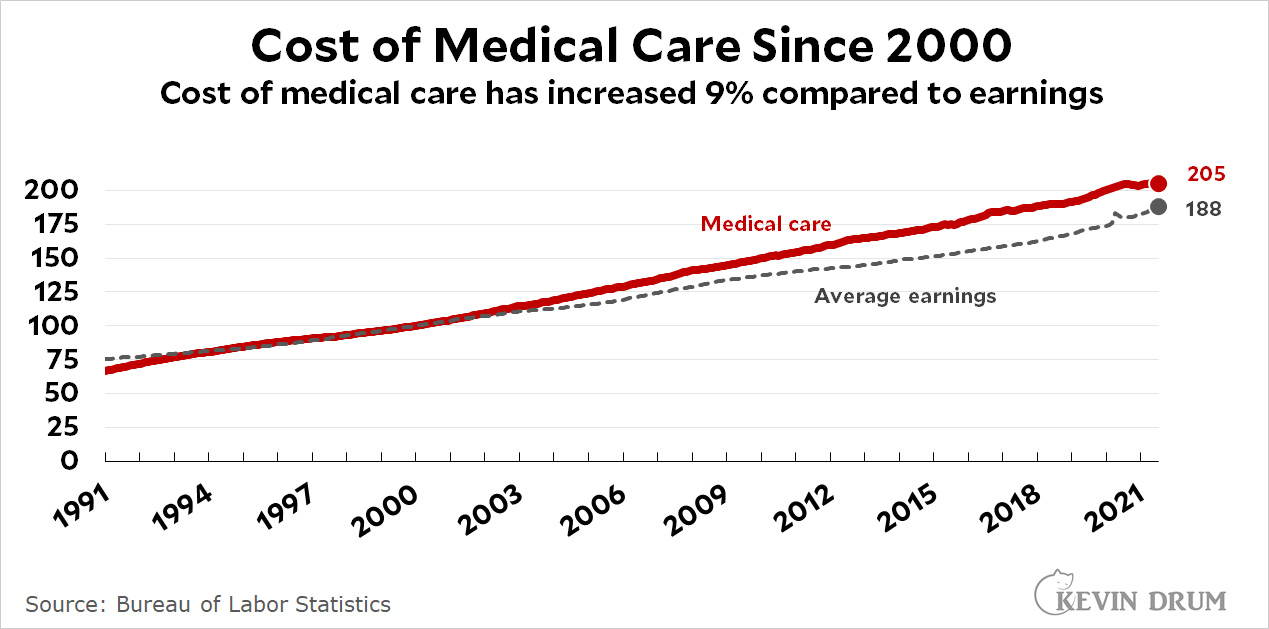

Healthcare

Now we're getting into "it's complicated" territory. The basic story of healthcare costs is that they skyrocketed in the 80s and 90s, but have flattened out over the past couple of decades:

This is a very well known trend among people who actually follow healthcare costs. Medical inflation is still a bit higher than overall inflation, but not by a lot. It turns out that the 80s and 90s were an aberration, and we've since returned to the lower healthcare cost growth of earlier years.

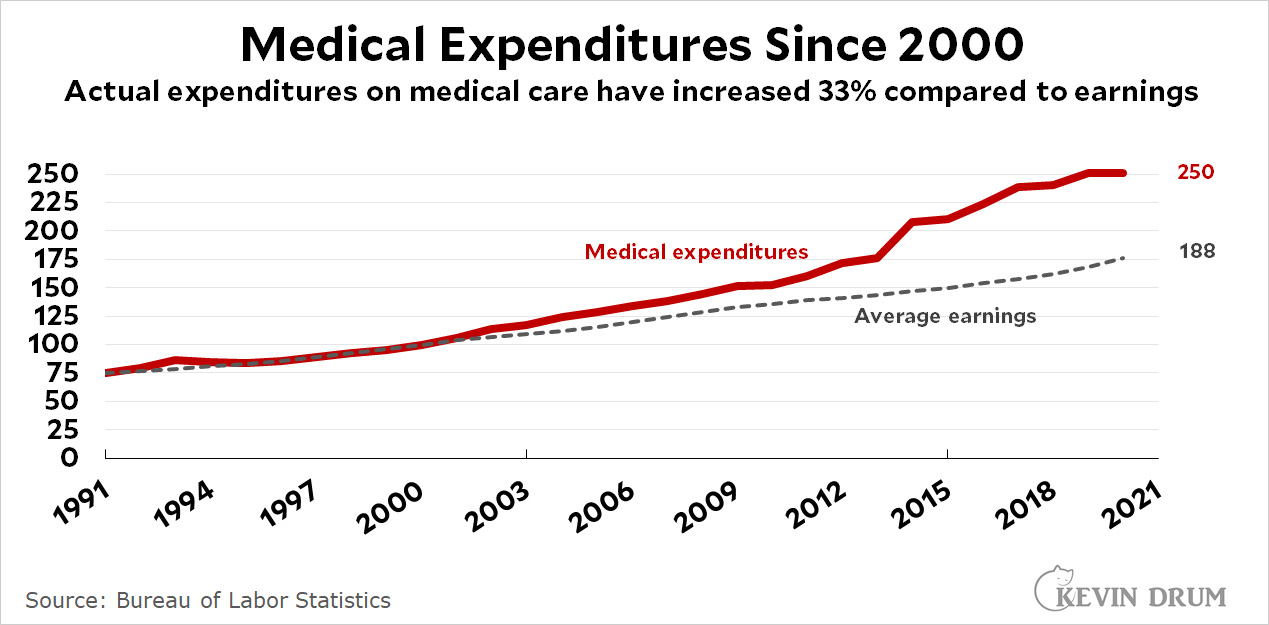

But that's not the whole story. Here are actual consumer expenditures on healthcare:

What's going on here? If medical inflation is restrained, why are we paying way more for healthcare than we used to?

The answer is that consumers are paying an increasing share of healthcare costs. Employer healthcare programs are charging bigger and bigger premiums for policies that have larger deductibles and higher out-of-pocket maximums.

There's no question that this trend is driving public sentiment toward subsidized and/or national healthcare. However, it's important to understand the underlying cause. It's not that medical care costs are spiraling, and if that's your target you're missing what's really going on.

Higher Education

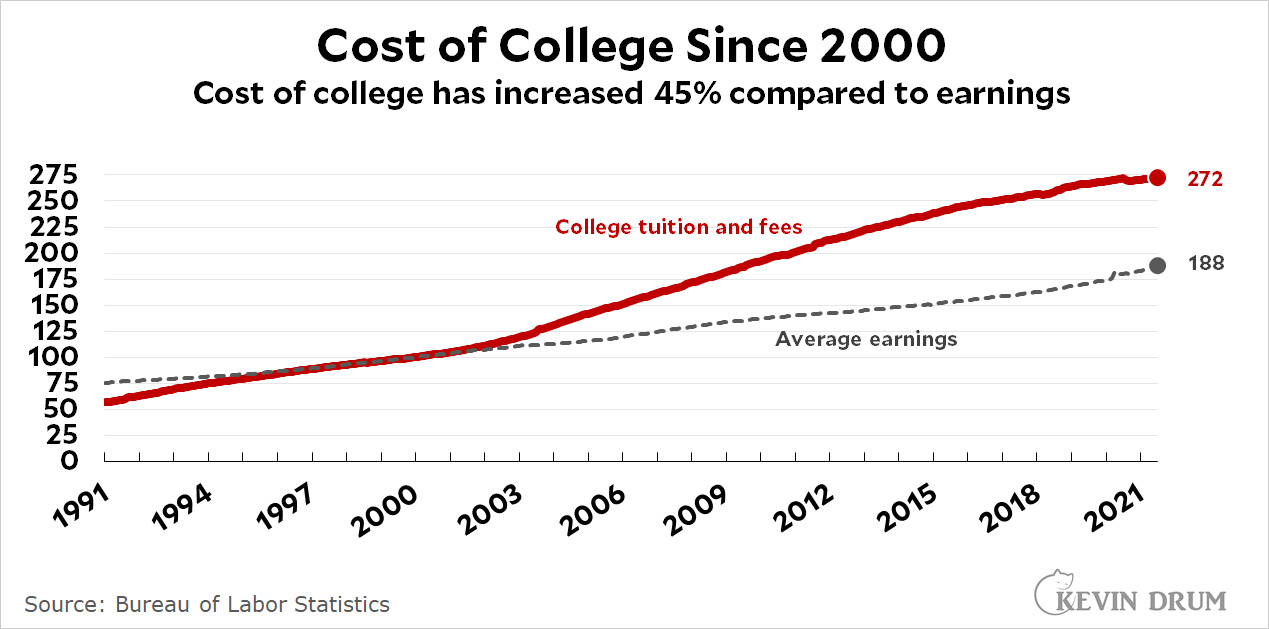

Finally we get to something where costs really are spiraling:

Even here, though, "it's complicated" rears its head. For starters, universities are the original masters of price discrimination: in the same way that the person sitting next to you on a plane may have paid double—or half—what you paid, averages mean nothing in higher education. Everyone pays a different price.

In particular, the net cost of tuition and fees for most public universities is basically zero for anyone with a working class income or less, and fairly modest for those with middle-class incomes.

On the other hand, this doesn't include housing, which is high for some but zero for kids who live at home and attend a commuter college.

On the other other hand, costs have spiraled for those with higher family incomes, and that's contributed to the explosion of student debt.

On the other other other hand, the most outrageous stories of student debt come from for-profit trade schools and graduate students (mostly law and MBA students). Student debt is truly a problem even for ordinary 4-year undergrads, but it's mostly a problem for those with decent family incomes and fairly good career expectations.

These are all details, and they're important, but of the four things mentioned by the Niskanen report this is the one that truly does fit their premise. Higher education costs really are spiraling, and that really does push public sentiment in the direction of ever higher subsidies. That's not a sustainable dynamic in the long run.

That's that. But why do I bother with stuff like this? It's because I look around and I see endless evidence of conventional wisdom that never gets questioned even though it's fundamentally wrong. It seems like I and others spend a lot of time pointing out things like this but it just never sinks in.

Don't take any of this as gospel. I may have some things wrong myself. However, I'm pretty sure I have the big picture mostly right, though it never seems to make much of a dent in public discourse.

Want more examples? A lot more? There's always this.

So,Kevin, are you willing to reside in one of the geographies where housing prices are not “skyrocketing” or is that just for others?

https://www.redfin.com/city/9361/CA/Irvine/housing-market

It is not just a question of being "willing", there is the little detail of available jobs. Sure, housing in Detroit is cheap. But that is because there are no jobs there, hence there is surplus housing.

Kevin doesn't have a job. It doesn't matter where he lives

Newb points out how Kevin is now retired. Still, even for his last two jobs: Mother Jones, and Washington Monthly, Kevin could have lived almost literally anywhere in the country rather than Irvine.

No jobs anywhere in the Detroit metro area? Really?

People don't push for change based on graphs. Many people's lived experience is that these core items are becoming unaffordable, and that they are more out of their control than more discretionary spending.

The titles on your graphs say "since 2000", but the graphs themselves start at 1991. Is that intentional?

It looks like he set 2000 levels at 100, so that the end values are compared to their 2000 levels. I'm assuming he then included data going back to 1991 to show the pre-2000 trend, though I can't read his mind.

So why aren’t the 80s (if not also the 70s) included in the chart? Because the existing chart looks pretty damn flat through the 90s, contrary to the assertion. So further support of the assertion is warranted.

Glossing over increasing income inequality by comparing against average income is not especially convincing. Clearly median income is the more appropriate comparison. Or it would be except that using income rather than the general price level makes no sense. Productivity has risen over the time period in question; why should that simply be subsumed in your comparison? "Labor has become more efficient in recent decades but the benefit has all gone to your landlord" is not the convincing argument you suppose it is.

Yes, median income and median prices are important. As are regional differences. Also difficulty for bottom half to afford rents shouldn't be ignored.

With all those other hands, I’d Kevin actually Tevye? https://youtu.be/_oSK6l24buk

I wonder if the items not mentioned above, but included in BLS CPI are actually a sign of a deeper structural problem.

Items that are not showing inflation include: food (factory farming and imported goods), clothing (imported goods), energy (oil and gas), communications and entertainment (monopolistic like huge players), and goods and services (low wage contingent workforces).

I'm curious why the charts use "average earnings" instead of CPI, which Kevin is usually berating other journos for not using.

If all costs rose in line with average earnings, that would mean that average quality of life was not improving - instead, the average person would just be "keeping up" with increased costs.

I think that most people expect economic growth to lead to improved quality of life - that over time, they should be able to buy more goods and services, rather than just keeping up.

If earnings increases are eaten up entirely by increased expenses, that doesn't improve outcomes. And if increased expenses *outstrip* earnings increases, that means life is getting worse, not better.

You're correct, things are not spiraling out of control.

But, as always, it's the people on the margins who suffer the most.

I may be able to handle a 5% increase in rent--but a 7% increase might end up putting me on the street.

Funny health care inflation getting stopped by Covid.

The cost of health care in the US is way too high - about twice as high as that in other advanced countries. This is not "conventional wisdom" it is a fact which is not complicated. The reason for the difference is simply that we have a "free market" system, while the other countries all have much more government control to keep prices reasonable. The evidence from the world is that socialization of health care is needed to control costs, contrary to what the Niskanen paper claims. Why does Kevin try to obscure this with the growth curves - they are basically irrevelant to what US health-care consumers have to pay now.

Cost of houses is also going very high:

https://www.multpl.com/case-shiller-home-price-index-inflation-adjusted

This is recognized in most places - for example California - and apparently some government intervention at a level higher than local zoning laws is necessary to get more housing constructed. Again Kevin obscures this with selected statistics. He seems bent on proving that all things are just fine and don't need substantial change.

Going very high??? Not really. Understand the choice there. Prices are not upkeep.

I would be interested to see this data with median rather than average earnings. The income of top-tier earners has been growing much faster than most of us, which skews the average higher than is experienced by most people. My bet is the difference in growth of costs is higher than shown in these charts.

Using average income is just wrong because most of the increase in GDP/capita, or average income, since around 1970 has gone to upper incomes, especially the 1%.

You mean since 1980. We will never agree on that though. You will believe in your flawed government data until the end. Pssst, notice real retail sales hit a secular peak in consumption growth not seen since.

Those caveats really undermine your basic argument.

1. 11% cost increase in childcare over earnings is a big deal, especially since child care is very expensive. That's hundreds of extra dollars out of pocket.

2. This is true. There are large areas where declining housing costs offset the areas with increasing ones.

3. Arguably it's worse that out of pocket health care costs are going up substantially compared to overall health care costs. This is not a particularly strong case for "it's fine."

4. It doesn't change the fact that overall education costs went up enormously to try and caveat that by claiming price discrimination. That's what hospitals and doctors do when people criticize them over the price of treatment - "nobody pays those costs except the rich!"

As for #1, workers with childcare costs tend to be early career, so they are likely earning an average wage that is below the median. It's also such a high percentage of income that there isn't much room to absorb increasing costs. When childcare eats up 25% of your take-home pay, even a 5% increase is unmanageable.

The problem with all these items is that the average is the wrong measure to compare costs to income. A data obsessed guy like Kevin ought to have this figured out by now. Median income must be used.

Income inequality is much larger than cost inequality with average income pushed into the stratosphere by a small umber of extreme high earners. In other words the income distribution looks nothing like a Gauss curve. In yet other words: child care costs are about the same for a 150 000 a year family and a 50 000 a year family. But guess who has a harder time setting apart that much money every time!

A large number of families live above but not far above the income level where the social safety net kicks in. Those are the ones we need to look at.

It is quite easy to make a false point with correct statistics. One of the easiest ways is to use averages when medians must be used.

How about childcare was already too expensive in 2000 and it's even worse now. Really bad + slighty worse is still really bad + slightly worse!

I think even median income is below the actually informative level of analysis here.

Running it for each quintile, and splitting urban vs suburban vs rural is probably the minimum for it to tell you anything.

But more specific targeting is also needed. Childcare expenses are almost entirely born by families with younger kids, so only their incomes are worth comparing to that.

I thought that was a strange column from Ezra Klein. (His podcast interview last week with Adam Tooze, on which the column seems kinda/sorta based, gives a fuller and better explanation of the idea, I think.)

As much as I admire Ezra Klein and enjoy listening to his careful dissection of ideas, it's increasingly clear to me there's a giant blindspot in his approach to politics: he doesn't ever account for the political power of money and the rich. (You can't, for example, imagine him interviewing Jane Mayer.) Thus, for instance, in his telling, the reason we don't have cheaper drugs is because of some complicated policy stuff emphasizing "innovation", not because Big Pharma is protecting its profits.

So now we get a taste of what Ezra thinks the answer to our gridlocked politics is: the left should subsidize the current power structure and give more goodies to regular folks.

Fine enough, but the problems in that approach seem obvious. If you believe the Big Pharma will always use its money and power to protect itself, then it's going to fight to make sure the lion's share of any new spending goes to itself rather than regular folks.

Big topic, but I smell trouble ahead for this new "supply-side progressivism".

(Or maybe this is just the usual noodling we do when it's not an election year; I remember a few months back the hot topic of the day was Tyler Cowen's "state-capacity libertarianism" [think, more parks and universities, but not paid for by taxes on the rich, I guess], which I suspect has a lot of overlap with "supply-side progressivism", and seems to have already been forgotten. Have to say, terrible slogan, "state-capacity libertarianism", no wonder it faded...)

You generally don't get a columnist gig in a paper like the NY Times if you stray too far from a "centrist" trickle-down attitude.

Disagree. Paul Krugman is by far the most powerful and influential anti-centrist writer out there. His power as a writer is equal to 10 columnists anywhere else.

Paul Krugman was hired from Slate, where he was mostly doing free-trade pieces and calling for more globalization. This was the guy the NYT thought it was hiring. He swung to the left in response to the rightward tilt of the Republicans under Bush.

He proved too popular to fire, so he's kept on as a token "leftist" (actually liberal) by the editors who vow never to make that mistake again.

What are Big Pharma’s net profit margins these days anyway?

"For pharmaceutical companies, the median gross profit margin was 76.5% (95% CI, 70.3%-82.7%), the median EBITDA margin was 29.4% (95% CI, 26.3%-32.5%), and the median net income margin was 13.8% (95% CI, 10.2%-17.4%)."

(More than the S&P profit margins

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7054843/

I’m curious if medical expenditures includes HSA money provided by employers? Like many others I now have a high deductible plan, but my employer provides quite a lot as an HSA contribution. The deductible is $2800 each for my spouse and I but I get $2800 contributed to my HSA. This works out pretty well as long as one of us is relatively healthy.

Yikes indeed, where to begin?

A. You absolutely have to ditch the average wages chart in favor of three charts: (a) average wages with a high school degree, (b) average wages with a college degree, and (c) average wages with a graduate degree.

You like a good chart, but then you need to somehow eliminate "average wages with a technical profession, such as software engineering" from, I suppose, (b) and (c).

B. You somehow have to then adjust the cost of "shelter." I would say you need to do that by (a) finding the most expensive metropolitan areas, and then (b) figure out how to draw some sort of circle outward from those areas, to illustrate the difference between Home X in 1990 and Home Y in 2021.

With those two adjustments, you will see how brutal things have become for those with only a high school degree over one generation.

Forget the other metrics, that group is going to be the first in US history to do worse than their parents, and they are not going to factor in the internet and iPhones into that equation.

That is why those pointing out that at least use median instead of average are spot on.

To be fair, although Kevin is 60 or so, he does not have kids, so he is not seeing first hand how it goes for the next generation.

Re: you need to somehow eliminate "average wages with a technical profession, such as software engineering" from, I suppose, (b) and (c).

Huh? Why? Wages for those jobs are not unusually high relative to other white collar degree-required work.

My un-scientific thought is that what is politically and socially relevant is basically figuring out jobs the relatively dumb cannot do, by process of elimination.

I am influenced by the way, by speech I heard from a professor of sociology at USC. He basically said that there have been two major upheavals in the last couple of hundred years. The industrial revolution and the current, lets call it, tech revolution.

He opined that the current tech revolution is far, far more disruptive than the industrial revolution. The industrial revolution involved, if you got caught on the wrong side of it, moving from your rural life to the city, from farming to working in a factory. But the same people could do this, regardless of whether they wanted to.

Today, the type of jobs being created are not the type a person with a minimal education can easily do or transition into.

Basically, the comparison is a cush factory job for life in the auto industry with a high-school education, vs. whatever you can get with a high school education now.

Most of these jobs, don't create many jobs.

Lol,.nope. Americans in the latter 1800's did worse than their parents and the great depression generation did worse as well. You need a nostril grip and snap. The debt based party is over.

The dumbest thing in Klein’s column was his and Niskanen’s claim that all of the ‘spiraling costs’ are due to constraints on supply. At a time when colleges are closing because they can’t attract enough students, and Ph.D.’s in many fields are so plentiful that higher-ed institutions can hire them as contract faculty or adjuncts and pay peanuts. So no, higher education still doesn’t fit the Niskanen ‘analysis’.

"colleges are closing because they can’t attract enough students"

LOL! How is that *not* a constraint on supply? The supply of tuition-paying students is what drives the business model of most colleges.

I bet you get "front" and "back" regularly confused too...

Oh, snap!

College is expensive because corporations use it as a step stone for "class". Then again, why do Democrats get called socialism???

> On the other other hand

Does this mean you never read _The Mote in God's Eye_ by Niven and Pournelle?

The Red Queen effect--running faster and faster just to stay in place....

or the Jetson's version, "Jane, can you stop this crazy thing!"

It doesn't take much that, over time, won't push people over the edge....

though I should add--this is not a problem with inflation. It is a problem with wages, esp. at the low end.

So prices aren’t spiraling out of control, they’re just outpacing average income growth across pretty much every essential field, which adds up to everybody having to spend more money just to keep up with the basics of life.

Funny that’s not how he spun these charts.

The discussion of Higher Ed costs overlooks the central factor driving higher prices, the decline in the public funding of higher ed. Much of the increase in tuition is the result of cost shifting to the student. 538 did a useful analysis a few years back that showed the share of tuition hikes explained by legislative cuts. In Wisconsin, for instance, 123% of the tuition increase can be attributed to reductions in state funding. https://fivethirtyeight.com/features/fancy-dorms-arent-the-main-reason-tuition-is-skyrocketing/

Thank you. This is always left off these discussions relating to student debt. States cutting funding. Instead of subsidizing, costs are deferred to the individual. Now the debate centers on the Feds bailing out students (e.g. progressives in Dem Party), while ignoring the causes.

Of course college costs go up faster than inflation. College is a pure service and pure services Should go up faster than CPI. Or else we are not getting richer.

I also wonder how the college spending number is reached. The list price for colleges is not what people pay, so the real number is what they pay. What is that?