Fed chair Jerome Powell is still hawkish on inflation:

In a highly anticipated speech at the Fed’s annual conference in Jackson Hole, Powell vowed that the central bank has not lost its resolve to cool inflation to 2 percent, even as annual measures of price increases have steadily dropped to roughly 3 percent.

That progress is “welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he told the audience in the room, largely made up of global central bankers and economists, but also the world.

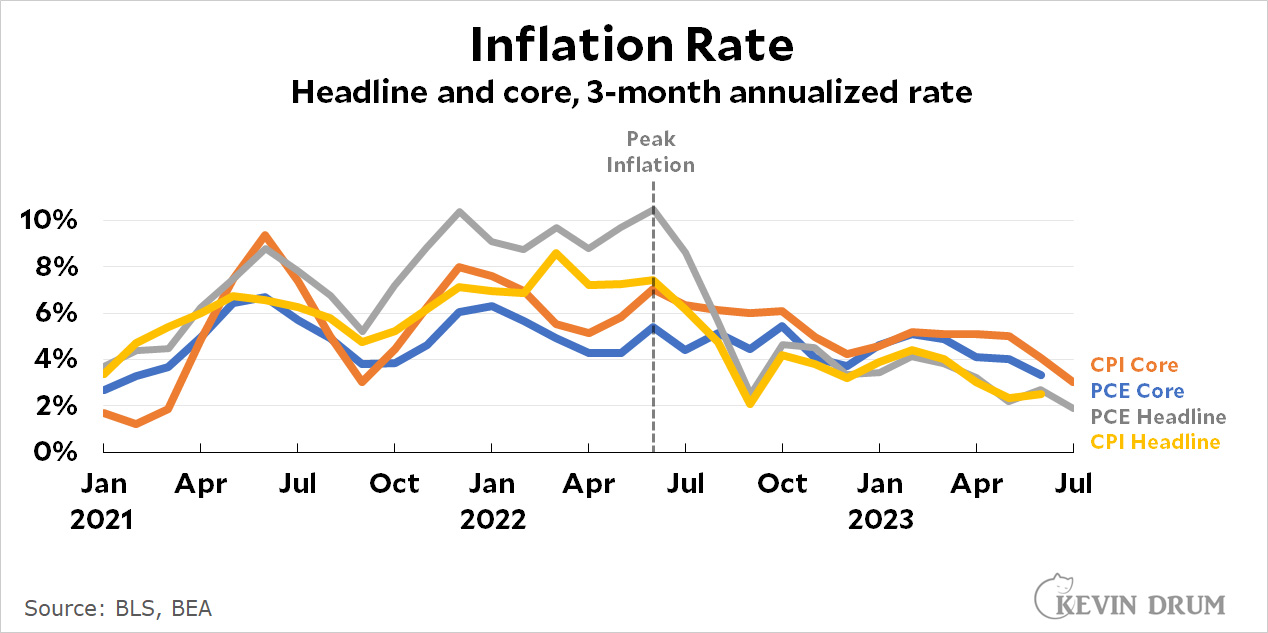

Two months? Let's roll the tape:

Every measure of inflation peaked (approximately) in June 2021. That's 12 months of good news.

Every measure of inflation peaked (approximately) in June 2021. That's 12 months of good news.

This is true no matter what measure of inflation you use. I chose to look at three-month averages in order to get a good idea of where inflation really is at specific points in time¹—and currently, this shows that every single measure of inflation is between 2% and 3%. How much good news does Powell need?

¹The more common year-over-year measure only tells us the average over the past 12 months. That's not very helpful if you want to know what inflation is like right now.

For what it's worth, if you insist on year-over-year figures, headline inflation still peaked last June while core inflation peaked in September.

UPDATE: The original chart was misdrawn and showed 2-month inflation, not 3-month. It has been corrected.

"Every measure of inflation peaked (approximately) in June 2021. That's 12 months of good news."

I assume Kevin will revise this to June 2022 as soon as he starts reading the comments. ; -)

Powell was almost certainly referring to the last two months of core inflation coming in at or below the 2% target.

I bet you knew that.

Kevin is just highlighting how misleading his comments were.

Kevin included the Core PCE line in his graph above, so we can all see that Powells comments were incredibly misleading no matter which measure the Fed apologists want to use.

I think that the focus on inflation is pointless and a mistake. The point is not to fight inflation but rather to cause a recession and help elect a Republican as president and a Republican senate. That’s what is important to Powell. And it’s why the actual amount of inflation is totally irrelevant.

Totally with you here. Companies want Rs back in power. The Saudis want TFG back, too.

Of course that is the explanation, not proper economics, thus Democratic appointees or the first black american woman as Fed Reserve President are in fact part of a Grand Conspiracy in favour of the Republicans.

Really a position of no greater quality than the MAGA conspiracy theory mongerers.

The Fed committee is roughly split between Dems and Republicans.

There is disagreement between members at each meeting as to whether or not rates should be increased.

We do not know what drives these differences in opinion, but labeling these opinions as 'proper economics' is silly and a bit delusional.

Stating that the belief that politics influences the FOMC is equivalent to believing that Trump won the election or Democrats are leading a child-kidnapping cartel is well.....a bit stupid.

But thanks for playing.

Can you describe an alternate explanation for Powell's cheerleading for continual increases in interest rates that doesn't include a desire to help Republicans? In view of the reality of the inflation situation, I can't think of any good reason for continuing to raise rates except for a desire to cause a recession. I don't think it's in any way the equivalent to the completely evidence free conspiracy theories you've compared it to.

Is Powell playing an expectations game here? Overstate the inflation risk to dampen expectations?

I don’t think that’s his game. I think he’s being surprisingly honest that the Fed’s goal is not to fight inflation but rather to cause a recession which Powell apparently believes will elect more republicans, which I gather is something he believes would be good for the country or at least good for the super rich.

This is exactly right.

It has been obvious the entire time. He's a political saboteur and hasn't been afraid of making that clear.

And he's so very good at it, he managed to bamboozle the multi-dimensional chess master Barak Obama into appointing him to the board to fill a vacancy in 2012, re-appoint him in 2014 for a full term, and then Joe Biden to reappoint him as Fed chair in in 2022.

Democrats regularly appoint Republicans to top positions in their governments and they tend to keep them in those jobs long after the foolishness and outright dangerousness of the initial appointment has become clear. For example, the FBI has never been headed by a Democrat.

... so this is what it looks like to look at the photo negative of the MAGA section conspiracy mongerers who have Biden as a communist and the like and Ms Cheney as a secret Democrat. Fun house mirror distortions

I don't recognize the username, if you're not simply a boring troll, you might notice a certain amount of verifiable evidence on one side of that bothsiding you're so hot to find.

But please do go on, such novel ideas are never voiced in this country.

Your arch little pretence at burn the witch outsider is amusing given I am a commentator at Drun blogs back to his original calpundit through to Washington Monthly then Mother Jones.

Try some less boring and petty

Powell cannot set rates on his own. I assume at least a majority of the board/committee must agree.

Only some of the members of the FOMC have a formal background in economics, but I think that most aren’t skeptical enough of it. In my opinion, economics tends to have a conservative, pro-business bias — the mainstream Econ argument for a modest level of inflation is that it lets employers cut real wages despite the downward stickiness of nominal wages. Not a pro-labor position.

I don’t think a political bias underlies inflation hawkery.

I keep thinking the same thing. I hope we're overly cynical.

Inflation rates in the US, China, France, the UK, Germany, Italy, India, Russia, and Brazil have all been falling for over a year.

Powell must be some kind of a genius, to get his inflation-fighting policies to work in so many countries, simultaneously.

While we are on this topic, I'd like to take credit for inventing the alphabet.

ECB for Euro zone is following same script so rather pathetic attempt at rejoinder. Of course IS central bank comment in public about USA as general matter as like other centra0l banks for obvious diplomatic reasons

Now UK is fun as in fact Bank of England has been six to nine months behind ECB and until recently rather dovish in comment. and UK inflation is running structurally 2 percent on average ahead of Eurozone and specifically I dustrial peers. So in fact UK is in part showing a result path of inflation doveishness and hésitent action, rather what Drum and lost or many here incoherently have desired. Certainly of course major add on is the impact of Brexit although UK is not applying any customs controls on EU goods.

Things don't happen in isolation.

Changes in interest rates affect capital flows between regions, value of the dollar, etc.

Other things play a role too, e.g. war in Ukraine.

to note that Russian inflation is not in fact falling, and Russian central bank just this week engaged in rate rises to defend rouble falling value, although as it is in a war economy the lesson here is don't start wars of aggression

Putin and his cronies/lackeys seem to have learning disabilities.

Kevin seems to have a particular fixation on Powell when it is not just his opinion which matters when the board/committee meet to vote on rates.

Indeed, it's a committee and one which Democrats appointees sit.

It's really either bad scapegoating or worse operational ignorance.

He and others rightly take to task the MAGA for aggressive ignorance. Some proper own medicine to be drunk if one wis0hes0 to continue pretence of being better than MAGA ra0ther than merely just ideological mirror image

sExiting the world of Left inflation minimisers as MAGAesque conspiracy mongerers, if one wishes to have actually factually rooted economic literate discussion of Mt Powell, you need only read the quite unbashfully Left but top tier macro-economist Krugman, as like his recent: Wonking Out: Jerome Powell, Mind Controller? https://www.nytimes.com/2023/08/18/opinion/inflation-federal-reserve.html?smid=nytcore-android-share

As well as Krugman other Wonking Out notes on inflation and central banking, etc. Critical but literate and knows how to use the indicators. While I personally don't agree with him in some part of analysis, as a mere financial economist by training and managerial class dilettante, even when I disagree with him I pay attention. No one is of course right all the time but one tends to avoid being "not even wrong" as the science saying goes for nonsense if one pays attention to rigorous and honest professional sources with proper training like Krugman (Noting I quite agree with his recent note on inflation target and revision as even in days around 08 when I sat on CB affaires outre-mer usaland a body of us felt 3% would be wiser: None Dare Call It Victory https://www.nytimes.com/2023/08/22/opinion/inflation-target-fed-economy.html?smid=nytcore-android-share)

For Fed thinking one can see from Ms Collins, the black Americawoman nominated to President of Boston Fed that the concerns of Fed decision makers, as professionals, is about entrenchment and rebound if CB policy moves to " doveish" or as one says professionally, "accomodative" which has econometric historical precedent plus observation in other countries (God forbid Americans of course think to being rigorously benchmarking with Johnny Foreigner... an Anglo-Saxon character flaw)

Senior Fed official warns US interest rates may need to rise again - https://on.ft.com/3QROS9p via @FT

While of course they may be wrong, it would not be due to moustache twirling conspirators for party political reasons, ones quietly involving Democrats appointees.

Of course the entire discours relative to looking out for the Rich relativto interest rates and inflation rather is an innumerate pretence via motivated reasoning and superficial understanding, as inflation everywhere and always most heavily penalises lower incomes, particularly hourly working class as real wages never keep up, nor do fixed income sources generally. And on the flip side the era of Zero Bound interest rates unequally benefit the income classes and entities that can use leverage (debt) extensively, that is the Rich. Private equity barons, family Trusts, leveraged hucksters like Trump etc. Its sheer innumeracy and missing yhe forest for some trees that you dupes think easy money is advantage for lowr incomes.

Rather the contrary.

Is a fixed inflation target a poor, arbitrary choice for optimal policy (of maximizing employment)?

Inflation might be considered "low" if an indexed nominal GDP outpaces an inflation index.

When did the inflation target become 2%. The last time I heard, the target RANGE was 1-3%. Changing the target from a range to a single number makes quite a difference.

No. No. No. "Inflation is running at 4%" is not good news, even if it was running at 6% three months ago. The month-to-month movements do not have inertia. They don't just keep going the way they were going. If you're the Federal Reserve, you have to focus on the latest number and judge whether it's okay. Four percent was not okay.

For month after month, Kevin's beloved trend lines have proved off the mark and got replaced with new trend lines. The new trend lines would almost invariably predict that inflation would be at close to zero in another three months. ("This time for sure!" I can hear Bullwinkle saying.) Jerome Powell would have to be an utter fool to think trend lines like those were reliable predictors.

But the point is that inflation is not running at 4% right now. It might have been around 4% over the last 12 months, but its lower now.

You say that looking at the current month or recent months is not helpful because it doesnt predict the future, but then you say that the Fed should look at the current average of the last 12 months to predict the future and set their future rates.

The comment about trendlines never being accurate is really confusing when we consider that right now inflation is at or below the 2% goal. Inflation 12, 11, 10, 9, 8 , etc... months ago might not have been at the target goal, but it is right now. If Kevin was making trendlines that predicted that inflation would be at or below the goal this summer....it looks like he was right and the Fed should have been paying attention.

A three-month average is a reasonable thing to look at, but Kevin didn't compute it correctly. During March, April, and May of 2023, the PCE index grew at an annual rate of 4%. For April, May, and June, the three-month average slipped down to 3.4%. July's change hasn't been released yet.

Things are definitely looking better now, but it's too soon to say inflation is 2%. It's even a little soon to say it's going at 3%, although that would look good to me.

Good catch on Kevins chart, its hard to see that on my phone, but I think youre right.

But this miscalculation the chart doesnt really change anything. Every piece of data that we have shows inflation is at a reasonable rate currently, has been coming down consistently as supply problems get resolved and should continue to do so for the next several months (wage growth, supply chain costs, the labor pool, power costs, new housing supply, plus the delayed effect of recent reductions in housing costs on the inflation calculation).

Powell should certainly not be looking only at many months old inflation data to set rates for the future.

I assume Powell is looking at the same many months of information that everyone else is, including the most recent encouraging reports. Also, I imagine that, in describing the Fed's stance, he has to hit the right notes, because they won't get price stability unless the financial world's psychology is massaged properly. So a certain amount of inflation hawkishness has to be maintained. That doesn't mean that the Fed is going to raise rates again in September. I think they won't.

No, no, no, no, and no. If there is no ‘inertia’ (that is, no persisting factor) in month-over-month changes, then those changes are pure noise and there is no persisting factor at any longer term. In that case the FOMC’s efforts are futile — they are trying to direct a drunkard’s walk. The only justification for interest-rate manipulation is that there is a factor (or, there are factors) driving prices which can be counteracted by rate adjustments.

Of course trend lines are not perfect predictors; the data are noisy. Trend lines can nevertheless be imperfect predictors. Perhaps more sophisticated models can be better predictors, but they will still be imperfect as long as the data contain noise.

There is inertia of the sort that says you can have an inflation rate that is more or less stable within some narrow range. The United States had about thirty years of that between 1990 and 2020, and they're going to get back to it now. What you can't reasonably expect is that the rate of inflation is going to steadily change, for higher or lower, over any span of months. The data don't show it doing that at any time during the past couple years. (Did it ever do that?)

The posted chart has inaccurate figures. It looks like the two-month differences have been raised to the fourth power, when it should have been three-month differences. Roughly, this means all the inflation rates shown are two thirds of what they ought to be.

So, to be clear about where we are, the PCE inflation rate had been running a little over 4% until the last couple months, during which it's been closer to 3%. It's only the single-month change for June that got down to an annualized change of just about 2%.

The Fed has talked themselves into a corner, and hopefully they'll figure out how to talk their way out.

Mortgage rates are at their highest since 1984 if I read that right. That's been a bit offset from the rate increases, and will have an effect on housing sales and starts. The full effect of the past rate increases has yet to be felt.

Yet they still are going off on how inflation isn't at the level they like yet, so must keep cranking Fed funds rates. The "one month isn't a trend" comment would be fine if applied to the next month when inflation bounces around a bit. I fear a tick down will be dismissed, but a tick up will be a call to arms.

One does not be a conspirationist to believe that the head of the Fed does not overtly speak about all economic and political issues in the agenda. It is impossible to know exactly what he thinks but we can gauge his beliefs by his actions. So far he has pursued a very aggressive action on raising interests when data shows that this action is of limited value. Also he exaggerates where inflation is today. So obviously he has a conservative bias in the way he speaks and acts. My guess is that he concern about unemployment and wage pressures despite the law that says defines the dual function of the role of the Fed (employment and inflation). Obviously there are legitimate concerns out there (Ukraine and China for starters) but further interest rate hike do not address any of the concerns.

Kevin likes to draw various curvy trendlines which are not predictive, but he has made two critical observations which are correct.

First is that the inflation rate over the last year has in fact been essentially normal - not alarming or in any way predictive of runaway inflation.

Second is the recognition that inflation was caused by supply issues, not uppity workers making exorbitant wage demands or an "overheated" economy. Inflation came down when the supply problems were eased, not because the Fed caused unemployment to rise - in fact unemployment has not risen at all. The evidence for this is quantitative - Kevin has mentioned some of the factors involved.

Some economists, apparently not well represented on the Fed Board, have also recognized that inflation was a supply matter. Krugman is one of them, but he also clings to the idea that wages are critical. There has been a lot of talk in the media about a "hot" job market, but whatever the temperature this has not resulted in wage gains. After a kind of blip which was mainly due to compositional effects, average real wages are back to the pre-2020 trend, which was certainly not inflationary:

https://fred.stlouisfed.org/graph/fredgraph.png?g=188XZ

If there are supply problems again inflation will rise again. Oil price, and gas price in Europe, are especially important. Wages and unemployment are not predicting inflation.

Well, Kevin’s trendlines are imperfectly predictive, in that they have predicted direction (down) if not magnitude. In the social sciences, just getting the direction of an effect right is an achievement.

Other than that, I’m with you.