This bridge was built by the Army Corps of Engineers after the 1970 flood in Silverado Canyon washed out the old bridge. It spans Silverado Creek, which is normally pretty dry but got some water during our big rains earlier this year.

Cats, charts, and politics

Over at Mother Jones, we have this headline today:

The Real Crisis Driving America’s Teacher Shortage

The article describes a real problem: in some areas of the country, housing is so expensive that teachers can't afford a place to live. But the premise is still wrong. There's no overall teacher shortage in the US:

This is overall education employment, including administrators, but teacher employment follows it very closely. Comparing August to August, the number of ed workers is slightly lower in 2023 than before the pandemic, but the number of students is also down. The ratio of ed workers to students is higher in 2023 than in 2019.

This is overall education employment, including administrators, but teacher employment follows it very closely. Comparing August to August, the number of ed workers is slightly lower in 2023 than before the pandemic, but the number of students is also down. The ratio of ed workers to students is higher in 2023 than in 2019.

As always, this doesn't mean there aren't shortages in particular places or among particular specialties. But it does mean that, for the country as a whole, things are about the same as they've always been. Unless there's something very wrong with the BLS numbers, there's just no overall teacher shortage in the US.

UPDATE: I originally combined state and local ed workers, but state workers are mostly higher education. The chart now shows only local ed workers, who are mostly K-12 teachers and administrators. I also switched to numbers that weren't seasonally adjusted so you could see the summer downturn more clearly.

Hmmm. The Wall Street Journal says that the boom times in commercial real estate loans are now well and truly over:

With the commercial real-estate market now in meltdown, those trillions of dollars in loans and investments are a looming threat for the banking industry—and potentially the broader economy. Banks’ exposure is even bigger than commonly reported. The banks are in danger of setting off a doom-loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses.

....Over the past decade, banks also increased their exposure to commercial real estate in ways that aren’t usually counted in their tallies. They lent to financial companies that make loans to some of those same landlords, and they bought bonds backed by the same types of properties.

That indirect lending—along with foreclosed properties, trading portfolios and other assets linked to commercial properties—brings banks’ total exposure to commercial real estate to $3.6 trillion, according to a Wall Street Journal analysis. That’s equivalent to about 20% of their deposits.

On the list of reasons to predict either a recession or a soft landing, I guess you can put this one in the recession column.

In Zeke Faux's new book, Number Go Up, Sam Bankman-Fried explains how cryptocurrency works:

A day before the start of the Bahamas conference, Bankman-Fried had all but admitted that much of his industry was built on bullshit. During an interview on Bloomberg’s Odd Lots podcast, the columnist Matt Levine asked a straightforward question about a practice called yield farming. As Bankman-Fried attempted to explain how it worked, he more or less laid out the how-to of running a crypto pyramid scheme.

“You start with a company that builds a box,” Bankman-Fried said. “They probably dress it up to look like a life-changing, you know, world-altering protocol that’s gonna replace all the big banks in 38 days or whatever. Maybe for now actually ignore what it does — or pretend it does literally nothing.”

Bankman-Fried explained that it would take very little effort for this box to issue a token that would share in the profits from the box. “Of course, so far, we haven’t exactly given a compelling reason for why there ever would be any proceeds from this box, but I don’t know, you know, maybe there will be,” Bankman-Fried said.

Levine said that the box and its “Box Token” should be worth zero. Bankman-Fried didn’t disagree. But he said, “In the world that we’re in, if you do this, everyone’s gonna be like, ‘Ooh, Box Token. Maybe it’s cool.’”

In other words, a guy at the center of crypto hype was not only more cynical about crypto than even I am, he was perfectly willing to admit it in public.

From crypto to Donald Trump, it's remarkable how eager people are to be bullshitted. They're so eager that it does no harm to explicitly announce that you're bullshitting them. Neither crypto enthusiasts nor Trump fans care. In fact, they revel in the bullshit. The more the better.

I don't think this is a new feature of American culture. Quite the contrary. It just happens to be more glaringly obvious than usual at this nano-moment in history.

Was our pandemic stimulus too big? Paul Krugman says yes, but doubts it would have made much difference if it had been smaller.

I'm not sure I agree. Total stimulus amounted to roughly $6 trillion. The Obama stimulus package during the Great Recession was around $1 trillion. I think it's safe to say that the Obama stimulus was considerably too small while the COVID stimulus was probably too big. However, the part that was too big wasn't the Biden stimulus that roused the wrath of Larry Summers. It was the initial $3.5 trillion stimulus from the CARES Act passed in March 2020:

Right after this stimulus we went through a manic expansion: three quarters out of five above 6% GDP growth and total growth for the period of 5.4% (annualized). It was this growth that sparked the big inflationary bubble in 2021-22.

Right after this stimulus we went through a manic expansion: three quarters out of five above 6% GDP growth and total growth for the period of 5.4% (annualized). It was this growth that sparked the big inflationary bubble in 2021-22.

And there's evidence that this level of stimulus wasn't necessary. The targeted programs were probably fine (mostly), but the broad check-writing and excessive unemployment benefits probably weren't. The two together likely could have been cut by half a trillion dollars without doing any real damage to workers affected by the pandemic. State and local aid was probably also excessive, as demonstrated by their overflowing coffers in 2021. Finally, business aid could have been more carefully rolled out. Altogether, the CARES Act probably could have been $700-800 billion less with no damage done and an economy growing at 3-4% instead of 5+%.

That's my amateur take, anyway. A smaller CARES Act would have still been as helpful as it needed to be, but would have stimulated more normal growth and a bit less inflation. How much less? I don't know. Maybe 2-3 percentage points?

It's hard to draw firm conclusions because pandemic inflation is fundamentally different than ordinary inflation. Still, even though the supply side of things was unusual (caused by product shortages due to COVID), we still wouldn't have had any inflation if we'd skipped the stimulus entirely and allowed incomes and consumption to decline. It was our determination to keep people whole that produced stable consumption desires in the face of product shortages, leading to inflationary pressure.

My guess is that a stimulus sufficient to address a recession is almost always going to produce some unwanted inflation. We just don't have the capability to fine tune things precisely enough to avoid it, and it's better to err on the side of maintaining growth even if that risks more inflation than we'd like. I like the tradeoff we made for COVID (strong growth, too much inflation) way more than the tradeoff we made for the Great Recession (slow growth, normal inflation).

I know that you probably get tired of hearing me whine about innumeracy in the media, but every time I think I'm out they pull me back in. Here is the Guardian today:

Global cases of early onset cancer increased from 1.82 million in 1990 to 3.26 million in 2019, while cancer deaths of adults in their 40s, 30s or younger grew by 27%. More than a million under-50s a year are now dying of cancer, the research reveals.

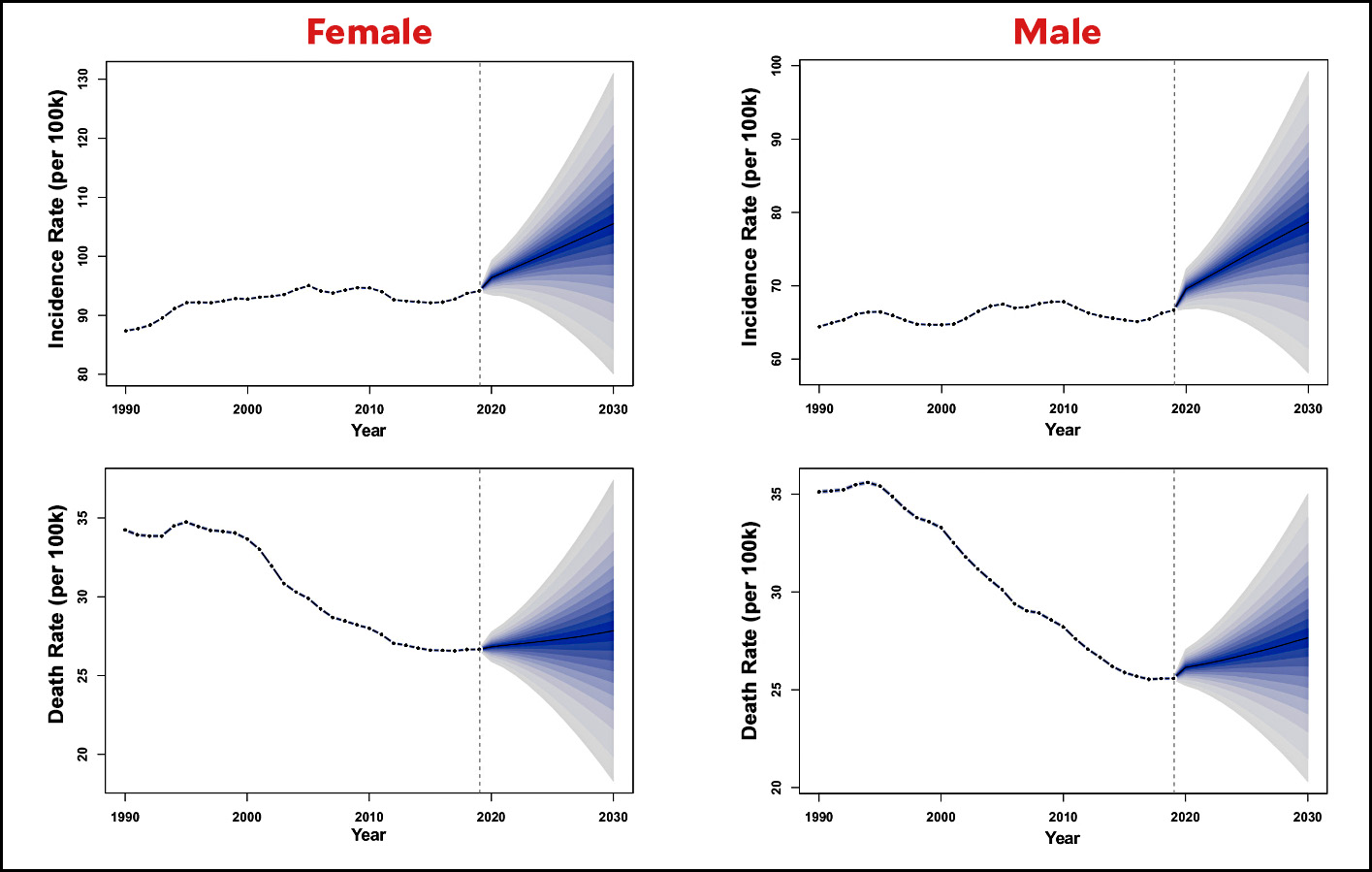

Sigh. The population of the world has grown by about 50% since 1990, and that puts a wee bit different spin on this. Here's what things look like in the original paper the headline was pulled from. It's the cancer rate for the young (ages 15-49) per 100,000 population:

The incidence rate of all cancers in the young went up a bit in the early '90s but since then has been flat among men and nearly flat among women. During the same period, the death rate from all cancers has plummeted by 20% among women and 25% among men.

The incidence rate of all cancers in the young went up a bit in the early '90s but since then has been flat among men and nearly flat among women. During the same period, the death rate from all cancers has plummeted by 20% among women and 25% among men.

I almost don't blame the Guardian for ignoring rates since the researchers themselves used raw numbers almost exclusively in their paper. You have to trudge through to page 7 before they briefly mention cancer rates, and even then they don't provide any numbers. If it weren't for those charts, I don't think rates would show up anywhere in the paper. That's bad scholarship.

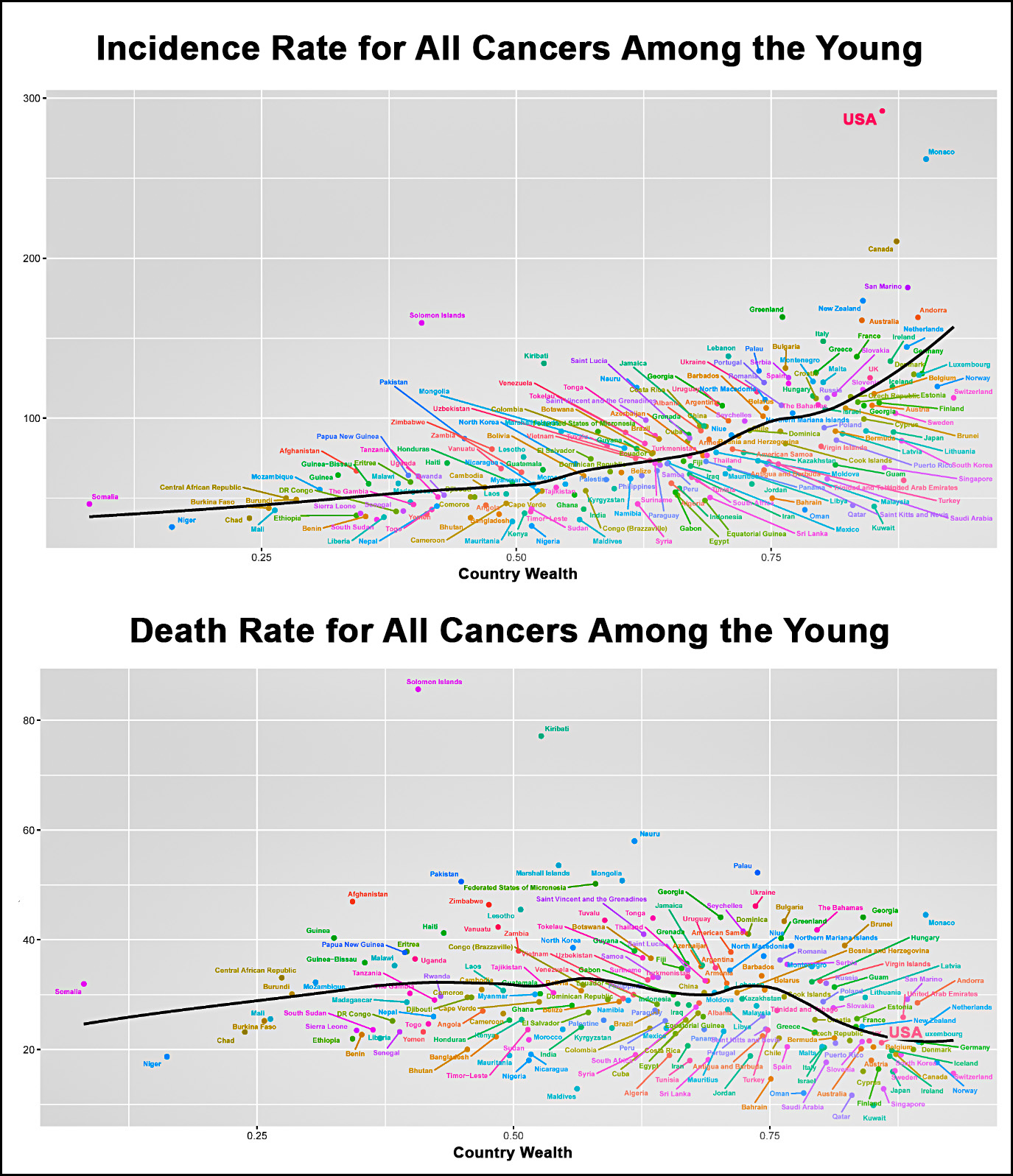

POSTSCRIPT: You might also be interested in cancer incidence and death rates among the young by country. Here it is:

The death rate in the US is pretty low, but the incidence rate is astronomic. That might be due to actual higher cancer rates or to more widespread screening among the young.

The death rate in the US is pretty low, but the incidence rate is astronomic. That might be due to actual higher cancer rates or to more widespread screening among the young.

And what's up with the Solomon Islands?

Here's the latest from the Washington Post:

Is public school as we know it ending?

Private school vouchers lost a lot of battles, but they may have won the war.

Here's the growth of vouchers over the past 30 years:

You can interpret this in two ways. First, after three decades vouchers still account for only about one-half of one percent of all school enrollment. Second, voucher use has tripled over the past ten years.

You can interpret this in two ways. First, after three decades vouchers still account for only about one-half of one percent of all school enrollment. Second, voucher use has tripled over the past ten years.

However, even if you assume the worst—namely that this tripling continues unabated—it still only gets us to vouchers accounting for 3% of school enrollment by 2040. And even that's pretty unlikely when you look at school enrollment more generally: public school enrollment has steadily risen from 88% of all students to 90% of all students over the past few decades. There's not much sign that public schools are in danger of extinction.

Last year a federal court told Alabama that its congressional map was racially gerrymandered and "it's not close." They ordered the legislature to redraw its map so it would include two majority Black districts instead of one, and the Supreme Court upheld the ruling earlier this year.

Republicans in Alabama responded very simply: they told the court to go fuck itself and redrew the map with—again—only one majority Black district:

Alabama Republicans admitted they consulted with US House Speaker Kevin McCarthy in a bid to keep the seat red. “I did hear from Speaker McCarthy,” said state Sen. Steve Livingston (R), who sponsored the new map. “It was quite simple. He said, ‘I’m interested in keeping my majority.’ That was basically his conversation.” Alabama’s Republican governor Kay Ivey applauded the legislature for defying the federal courts. “The legislature knows our state, our people and our districts better than the federal courts or activist groups,” Ivey said.

Ivey sounds just like Southern governors in the '50s and '60 confronted first with school desegregation and then the Civil Rights Act. They had very similar responses to federal court orders.

Today the federal panel hearing Alabama's case, like those older courts, finally declared it had had enough. They threw out Alabama's map and appointed a special master to take it out of the legislature's hands and draw one that was legal.

I often wonder if Chief Justice John Roberts harbors any private misgivings over gutting the Voting Rights Act in Shelby County v. Holder. In the ten years since, with preclearance no longer required, he's seen state after Southern state—North Carolina, South Carolina, Georgia, Alabama, Louisiana, Florida—revert almost instantly to its racist roots. The proposition that 50 years had passed and there was no longer good reason to keep these states under close watch is obviously in tatters.

Shelby is one of the worst Supreme Court decisions of the past century. Its reasoning was specious from the start, and time has only confirmed how arrogant Roberts and his colleagues were to cavalierly overturn a law that had been reauthorized almost unanimously by Congress only seven years earlier. Do they ever regret what they did?