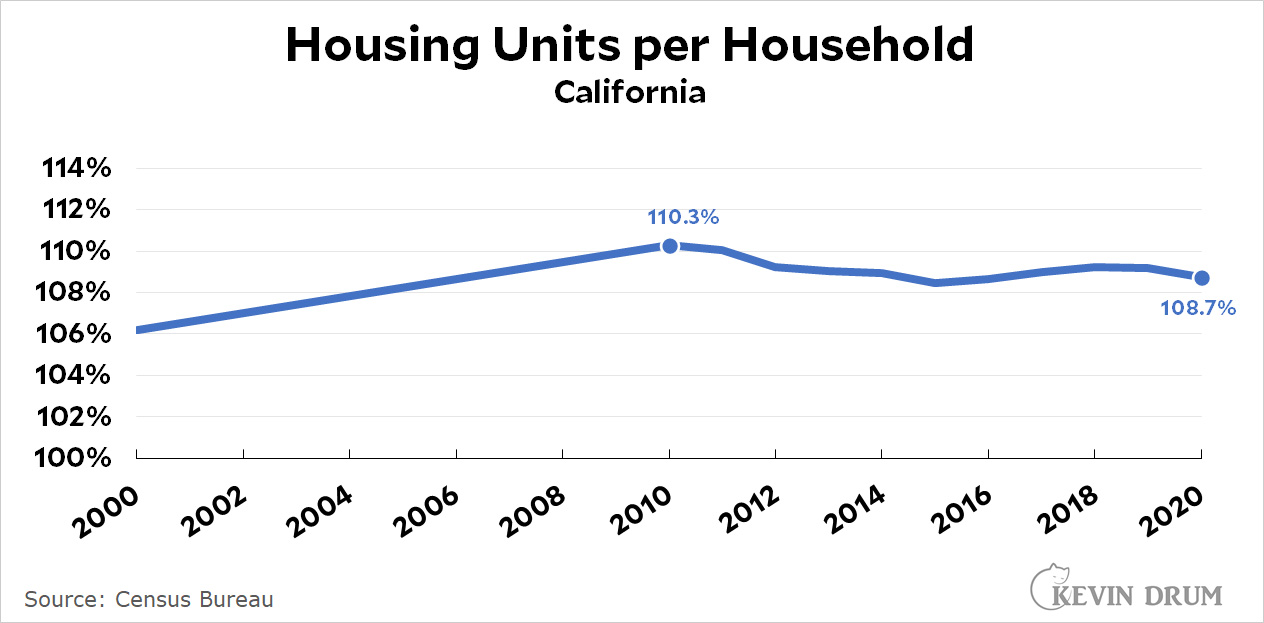

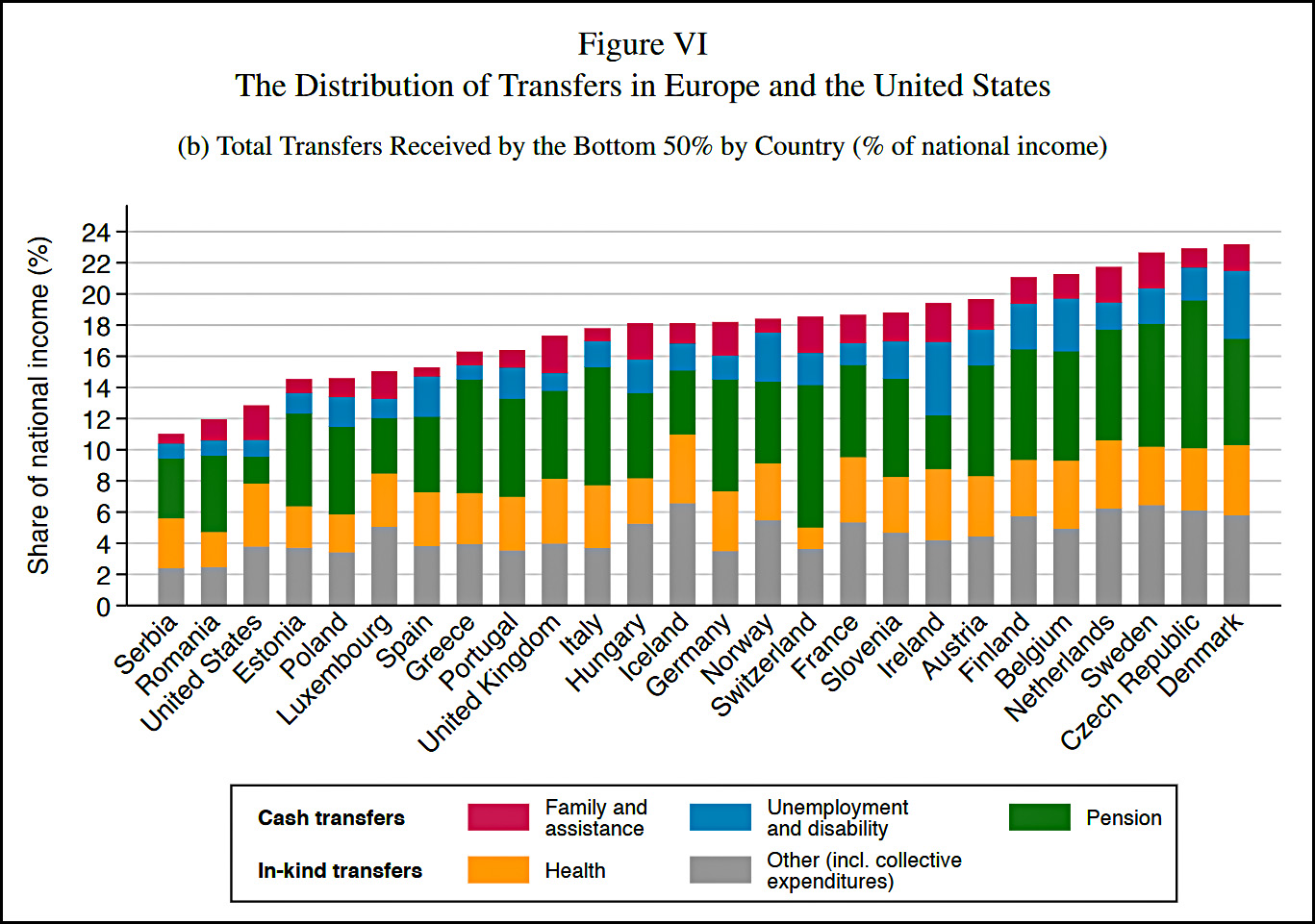

Tyler Cowen pointed today to a recent paper that says the US redistributes more to low income groups than any European country. But here's a chart from the paper:

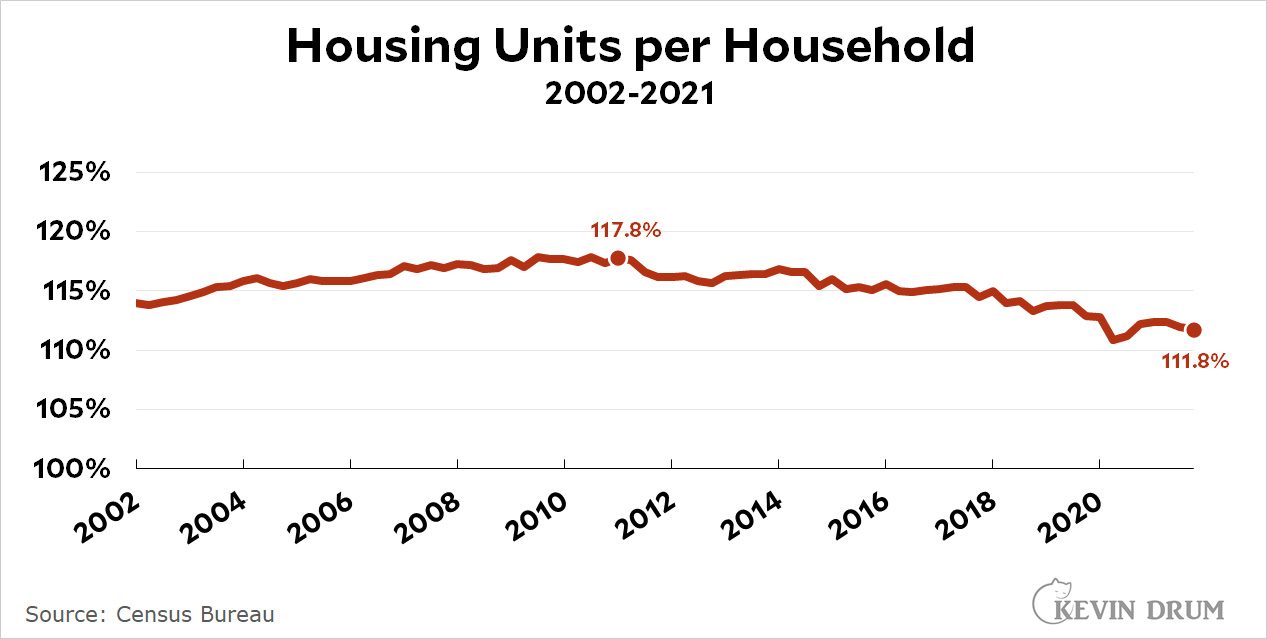

We're close to the bottom! So what's up? The answer is taxes:

We're close to the bottom! So what's up? The answer is taxes:

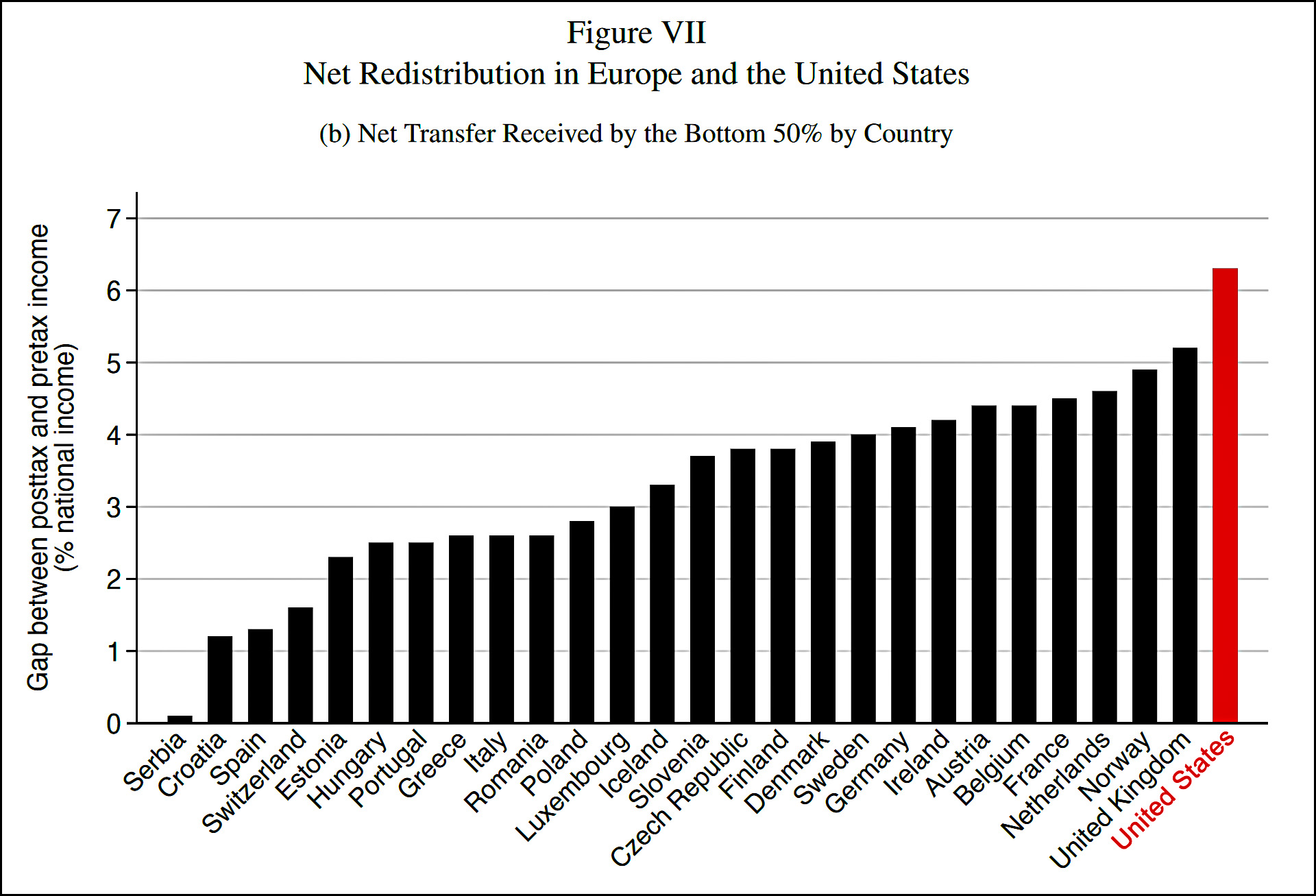

According to the authors, our tax system is more progressive than those in Europe. When you consider this as "redistribution" and add it to government benefits, the US looks very good on net:

According to the authors, our tax system is more progressive than those in Europe. When you consider this as "redistribution" and add it to government benefits, the US looks very good on net:

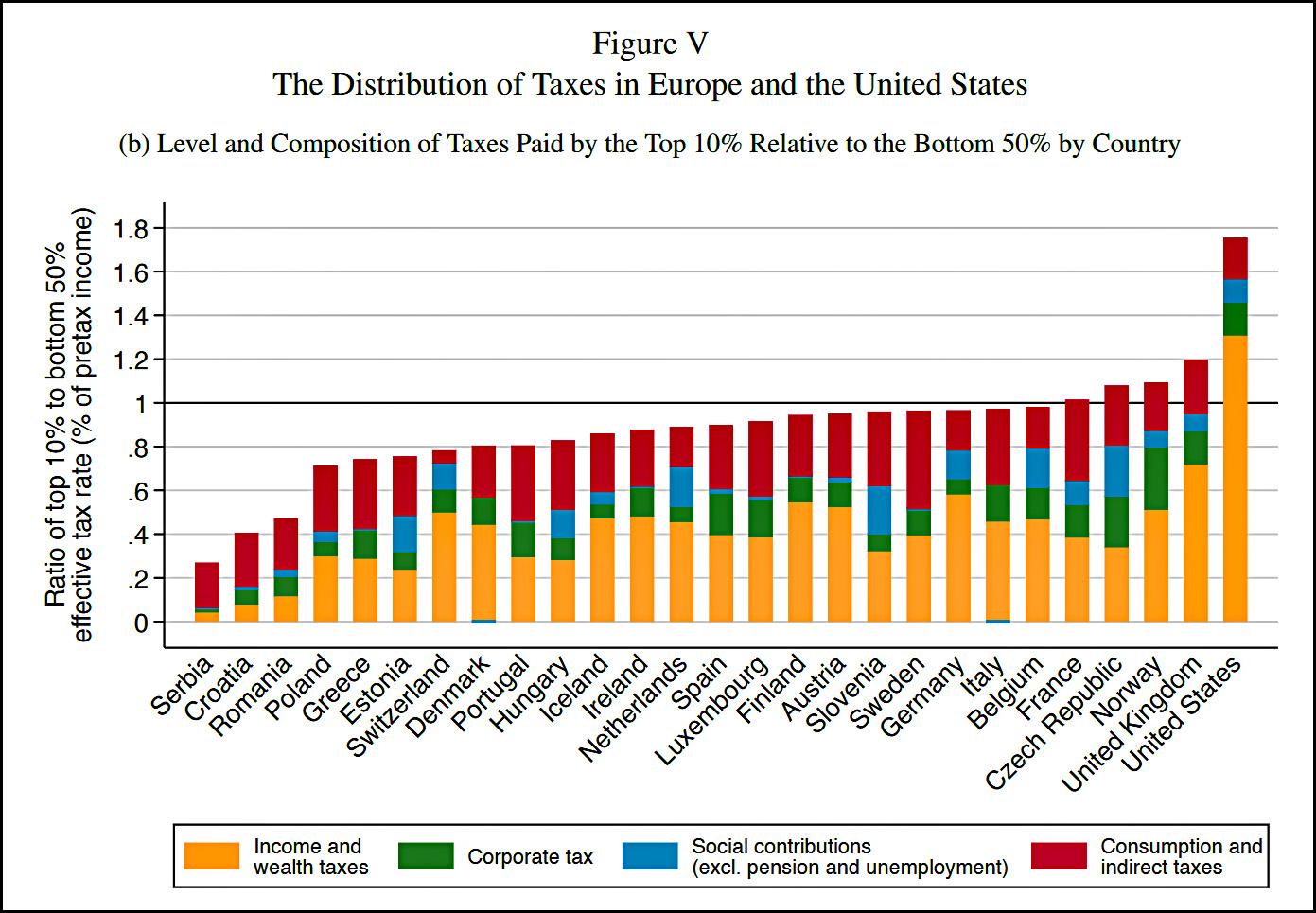

The authors estimate that on average, net transfers to the bottom 50% in the US are higher than net transfers in Europe by roughly two percentage points of national income. That's well and good, but the problem is this:

The authors estimate that on average, net transfers to the bottom 50% in the US are higher than net transfers in Europe by roughly two percentage points of national income. That's well and good, but the problem is this:

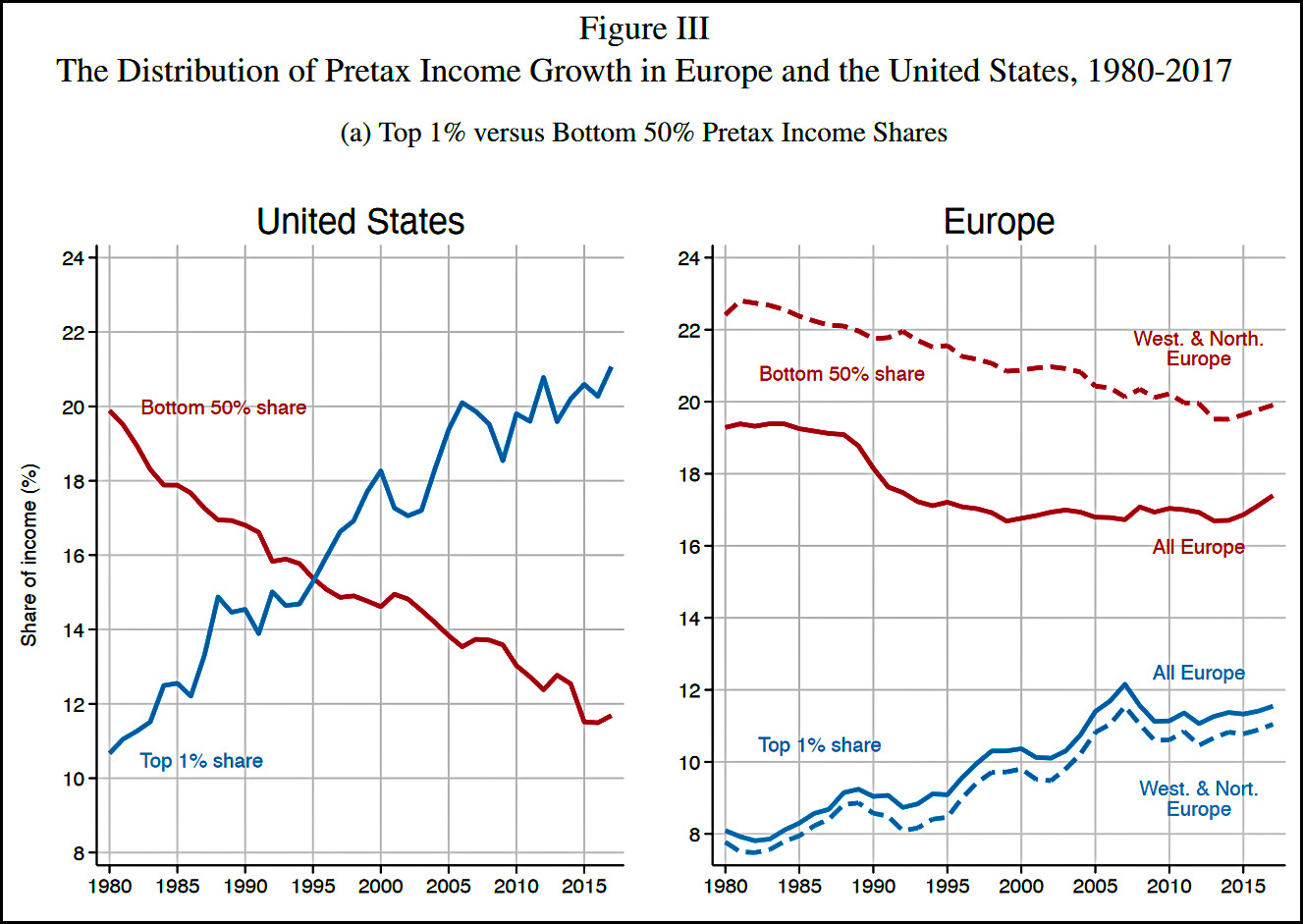

As you can see, the pretax share of income of the bottom 50% is a meager 12% of national income in the US and around 18-20% in Europe. An extra two points in transfers barely makes a dent in overall income inequality. Europe remains a much fairer society than the US.

As you can see, the pretax share of income of the bottom 50% is a meager 12% of national income in the US and around 18-20% in Europe. An extra two points in transfers barely makes a dent in overall income inequality. Europe remains a much fairer society than the US.

I'm a little skeptical of the tax stuff on two counts. First, although European countries rely heavily on VATs, which tend to be regressive, their income taxes are both high and progressive. So I'm surprised that virtually every country has a net regressive tax system. Second, when you account for state and local taxes, the US tax system is not all that super progressive. I'm surprised that we come out not just more progressive than every European country, but far more progressive.

In any case, if the conclusions of this paper are correct, we've learned two things:

- Via taxes and transfers, we give a little bit more to the bottom 50% than any country in Europe.

- Nonetheless, income inequality has grown so dramatically in the US that our higher level of transfers barely even registers. The bottom 50% has lost more than eight percentage points of national income since 1980, and an extra one or two points in lower taxes doesn't do much to fix that.

Vive la différence.