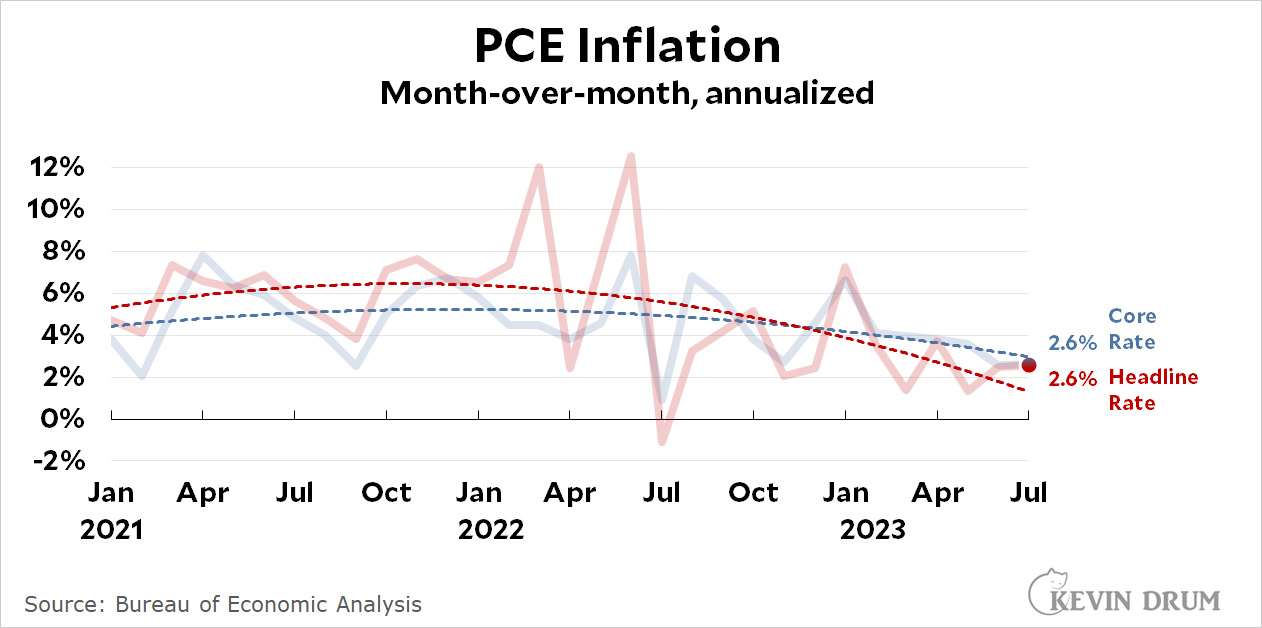

For the second month in a row, PCE inflation stayed below 3%:

Both core and headline PCE came in at 2.6% on a month-over-month basis. On a year-over-year basis, headline PCE was 3.3% and core inflation was 4.2%.

Both core and headline PCE came in at 2.6% on a month-over-month basis. On a year-over-year basis, headline PCE was 3.3% and core inflation was 4.2%.

Core PCE, which is the Fed's favored measure, shows every sign of being well under 3% on a steady basis. It's at 2.9% over the past three months. If this holds up, the Fed's inflation fighting job is done.

POSTSCRIPT: I notice that our nation's news media barely even reported this. When inflation is up, it's big news. When it's down they can hardly be bothered to take notice.

If this holds up, the Fed's inflation fighting job is done.

I hope the Fed reads this post, Kevin. Mortgage rates are now the highest they've been in more than two decades. I know a lot of people have their rates locked in, but the dearer money isn't limited to only home loans (autos, credit cards, etc). I hear credit card delinquencies are rising. Problems seem to be multiplying in the commercial leasing sector. And we're likely to be seeing weakening demand from Asia, because of spillover from China. Also, student loans will hit incomes in the US in the months ahead.

The free money wasn't going to last forever. Interests rates were arguably way to low for way to long.

If higher interest rates start pushing down the stratospheric real estate prices on the coasts, and maybe encouraging people to buy smaller, more affordable, fuel-efficient cars instead of the $75,000, school bus-sized SUVs and jacked-up, exhaust-belching pickups I still see so many of, that may not be a bad thing.

News flash: higher rates don't appear to have impacted real estate prices all that much. E.g., NYC is basically on trend: https://www.zillow.com/home-values/6181/new-york-ny/

While there really isnt a good argument that rates were way too low for too long, its certainly possible to argue anything.

The past year has convinced me that the Fed's days of being able to substantially impact inflation are over - at least in our current economic circumstances.

Given that inflation seems to have resulted more from companies raising prices than from excess demand, the Fed could modestly probably lower rates without any impact on inflation whatsoever. In fact, bond purchasers seem to be expecting the Fed to lower rates a little bit sometime in the next few years. They should probably just get it over with and do it now.

Not according to the Fed, it won't be. They can, and will, look you dead in the the and say "three percent is fifty percent higher than where it should be."

By golly, they'll destroy inflation whatever it takes--even if they have to kill the patient.

Here's the way I've been thinking about Powell's mission: He seems determined to give everybody the idea that he’s going to keep raising rates until he’s ripped out the beating heart of inflation, stomped that sucker flat, ground it to powder, set it on fire, and buried the ashes under a ton of salt. Or sees unemployment rise significantly. Or both. And mostly because some galaxy brains complained in the financial press that he was too accommodating during the covid period.

So no, it doesn't seem to me like a sure thing that they're done raising rates.

He seems determined to give everybody the idea that he’s going to keep raising rates...

I agree, but "giving everybody that idea" and actually doing it are two different things. I can't read Powell's mind, but I think we'd be in a very different situation if inflation hadn't already dropped significantly. But it has!

At this point it's well within the realm of possibility he's now in the "ok it's worked but I've got be careful about messaging" stage.

I predict 25 basis point, max, before a lengthy pause, with the next move after that more likely than not (say, next March/April) to be an easing.

Depends on who you see as the patient. Workers? Or Investors?

Hey, some people just need a Republican in the White House -- every bit as much as they did when Arthur Burns put Nixon there....

https://www.aeaweb.org/articles?id=10.1257/jep.20.4.177

Not according to the Fed, it won't be.

Paul Krugman suggests that the Fed may be contemplating a shift to a 3% target (a widely though not universally supported move among economists), but that they would likely not make this official for many months, because a hasty announcement to this effect could create market turbulence.

https://www.nytimes.com/2023/08/22/opinion/inflation-target-fed-economy.html

The news is whatever the GOP wants it to be as Atrios never tires of pointing out. If the GOP is out of power, it is important to get the view of the opposition. If they are in power, it is important to get the view of the people making the rules. In any event, it is never news that people at the bottom of the economic spectrum would like to keep their job, no matter how crappy a job it is. Those people just don't matter.

Is Canada 'sitting on the largest housing bubble of all time'?

https://www.bnnbloomberg.ca/canada-likely-sitting-on-the-largest-housing-bubble-of-all-time-strategist-1.1962134

The problem in Canada is complicated and not only about a "bubble." Escalating (and some places just plain ridiculous) housing cost is a result straight out of Henry George. Combine highly concentrated population (only 7 to 9 major cities, depending how you count) that continues to concentrate, high levels of immigration which goes primarily to those few metro areas, and very few mortgage lenders, with restrictive building regulations that differentiate sharply between urban and rural land, and you have sky-high and rising housing costs in those metro areas that everybody wants to live in. Is that a bubble, or the invisible hand at work?

It's a big problem for people who don't currently own a house or have parents who do, and a big political problem that may be central in the next election. And it'll also become a problem even for owners because mortgage rates almost all get re-pegged every 5 years so there's no escape even for current owners unless they're completely paid off.

But calling it a bubble implies that the pressures creating it will dissipate, and I don't see that happening. The other option is that housing costs outrun borrowers' and renters' ability to pay. But unless there's a complete economic collapse, that seems like a slow-motion cyclone that's already on the radar and big enough to break the supply logjam.

Yes there is a piece in the NY Times saying "inflation ticked up"

https://www.nytimes.com/2023/08/31/business/economy/fed-inflation-july.html

which is stupid because there is no new information in the PCE index - it's just a recalculation of the same data as in the CPI (released two weeks ago) and the two indexes are usually in strict parallel:

https://fred.stlouisfed.org/graph/fredgraph.png?g=18gRj

New price data will come out in two weeks in the CPI.

I am so so sick of hearing the poll-obsessed pundits telling us that regardless of the actual data, voters just don't "feel" good about the economy. Where do these "feelings" come from, we wonders, Precious? Not from the media, of course -- they just report on how the public "feels" -- for whatever reason.

Repeat after me: "self-fulfilling prophecy."

I expect Republicans and pundits will stop discussing inflation soon and turn to the crippling Bidenomics interest rates which are stifling investment and putting home ownership out of the reach of ordinary Americans.

Kevin, thanks for following the inflation story these past couple years. It has helped me understand the situation better, even though I don't always come to the same conclusions as you. Inflation has been looking like a diminishing problem for a long time now. Accordingly, the Fed tapered off on interest rate increases this year, and now they only keep talking about possible further increases to keep the inflation hawks peaceful.