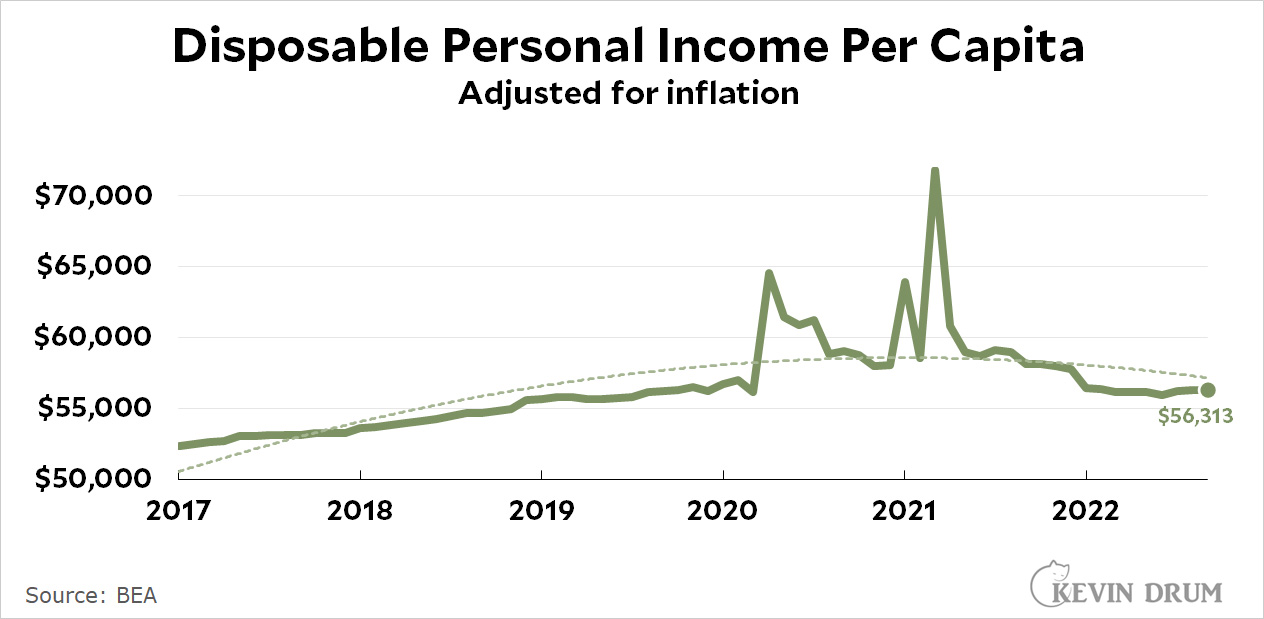

If it's PCE inflation day, it's also personal income day. Here is disposable personal income through September:

The bad news is that after adjusting for inflation personal income was flat from last month (actually, up 0.02% if you want it to the fourth decimal place). That's a drop of more than $2000 since its trendline peak at the start of 2021.

The bad news is that after adjusting for inflation personal income was flat from last month (actually, up 0.02% if you want it to the fourth decimal place). That's a drop of more than $2000 since its trendline peak at the start of 2021.

In trendline terms, real DPI is now down to its level from the start of 2019, nearly four years ago. In absolute terms, it's down to its level from late 2019.

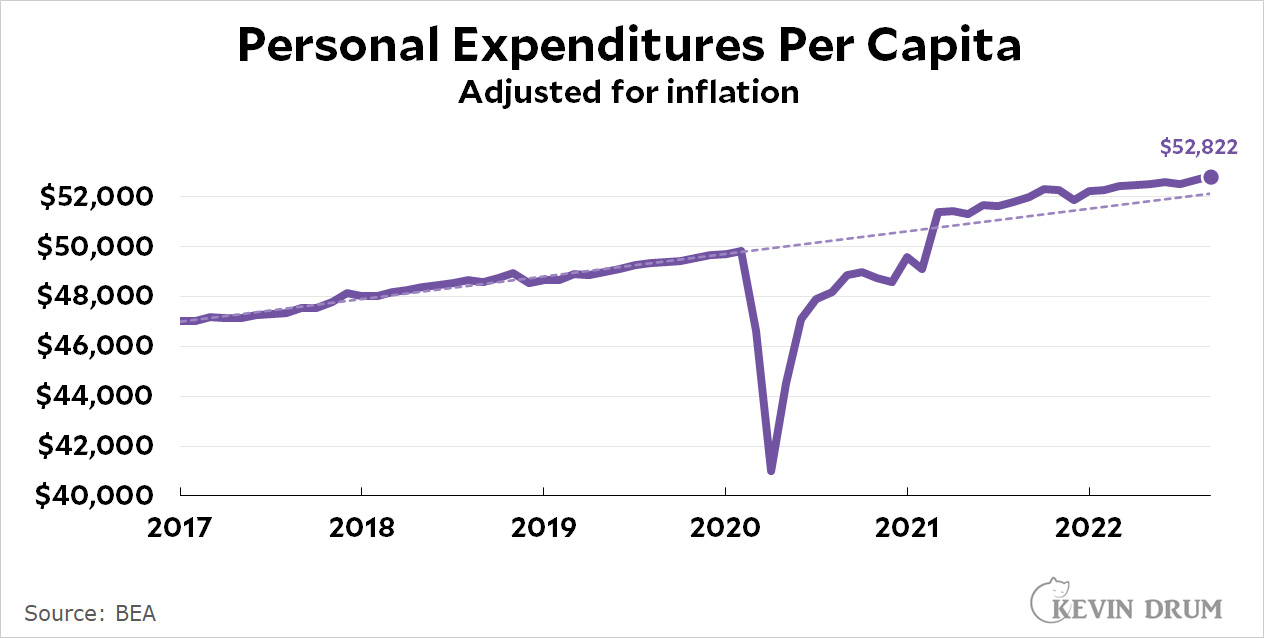

In other words, when you adjust for inflation, there's been zero progress for personal income over the past three years. On the brighter side, expenditures continue to increase:

As you can see, expenditures have continued their pre-pandemic trend and are now at a record level. How long can this keep up with incomes flat? Come back to me in a year and I'll tell you.

As you can see, expenditures have continued their pre-pandemic trend and are now at a record level. How long can this keep up with incomes flat? Come back to me in a year and I'll tell you.

As I pointed out before, demand deposits (mostly checking accounts) have gone way up starting in 2020 and are not coming down:

https://fred.stlouisfed.org/series/WDDNS

This shows up in both M1 and M2 aggregates, which means that there has been a huge increase in the money supply.

These accounts are not part of personal savings - they couldn't be, the amount is huge. If a large part of this money is really being held by the majority of consumers (other than the highest incomes) it is not surprising that expenditures remain high. But anyway it would seem that people are not really being squeezed as much by inflation as the media stories make out. If they were, expenditures should be going down.

Personal income is of limited usefulness because it doesn't include capital gains and actually counts capital gains as a reduction to personal income because capital gains taxes are subtracted from income even though the capital gains are not included. Usually not a big deal, but the gains realized over the last 18+ months are quite large.

Also, I do not believe the expenditure stat captures the large reduction in monthly mortgage payments that occurred in the refinancing frenzy of 2020 and 2021.

Both of these items seem significant pieces of the puzzle.