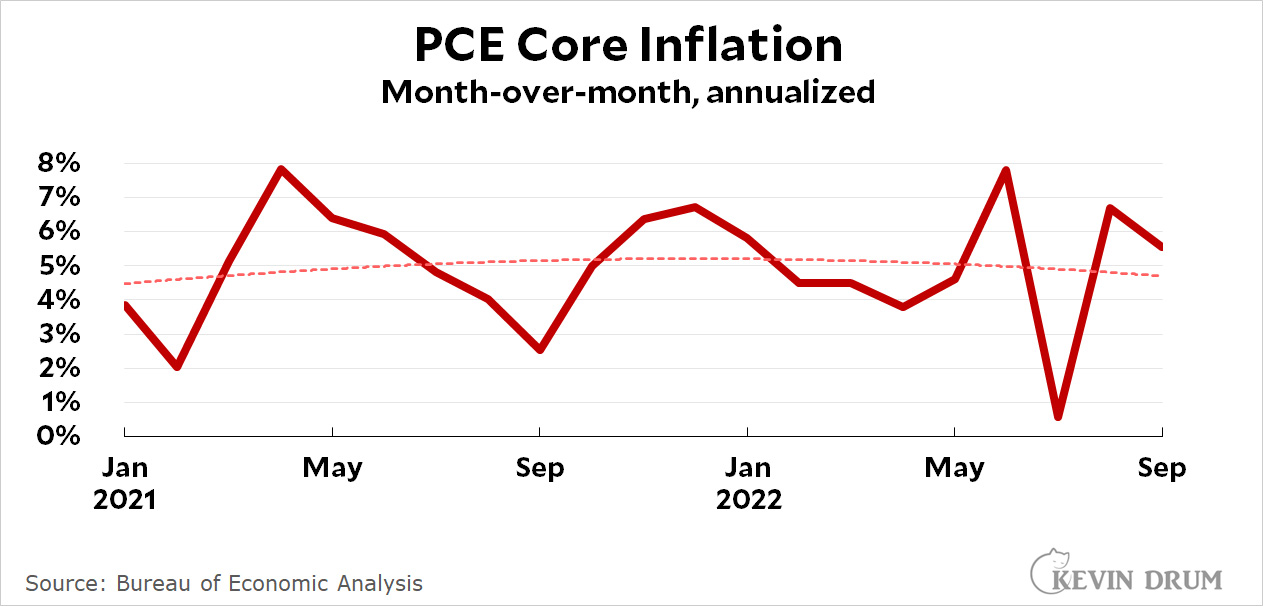

Without further ado, here is the core PCE inflation rate through September:

Core PCE checked in at 5.5% in September, with the trendline down to about 4.7%.

Core PCE checked in at 5.5% in September, with the trendline down to about 4.7%.

I am, as usual, highlighting the core rate (inflation excluding food and energy) because that's the figure that allegedly drives the Fed's decisionmaking. The good news this month is that it's down a bit from last month. The bad news is that it now looks like July was an outlier and core PCE is declining at a slower rate than we'd hoped.

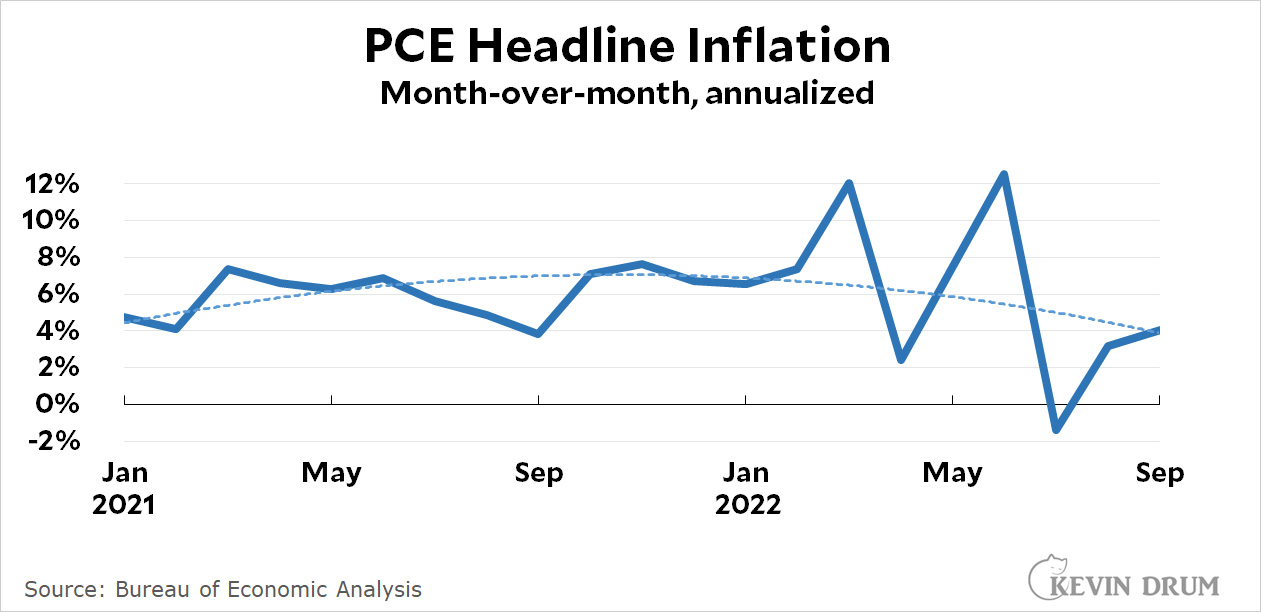

Here is ordinary old headline PCE inflation (includes everything):

Th news here is actually better. PCE inflation was up a bit in September to 4.1%, but that's still pretty low and keeps the trendline solidly down. For what it's worth, an inflation rate around 4% is really not all that bad, especially if it's declining smartly.

Th news here is actually better. PCE inflation was up a bit in September to 4.1%, but that's still pretty low and keeps the trendline solidly down. For what it's worth, an inflation rate around 4% is really not all that bad, especially if it's declining smartly.

(The more normally reported year-over year figures came in at 6.2% for core and 5.1% for headline inflation. But after all this time we know better than to rely on annual changes that already have 11 months of data baked in. Right? It's better to look at monthly changes that show how inflation is doing right now, and then draw a trendline to see the longer-term change.)

And will the Fed stand pat?

The chair recognizes that the Fed rate won't help with the drought in the West or the war in Ukraine--but went ahead with the last round of increases.

Some rate increases were needed, and the puncturing of the apparent crypto bubble, amongst others, was needed. A three percent rate won't kill the US economy, at least not immediately. However, it may make things harder for our allies.

As for the housing market--investors have been taking over single family homes so they can rent them out. Cash offers are not as affected by interest rates. Buying up current housing stock is different than funding new building projects and then selling the houses to families.

"For what it's worth, an inflation rate around 4% is really not all that bad, especially if it's declining smartly."

Respectfully I disagree

1) Does this likely data point mean the Fed will stop raising rates?...no

2) Does this likely provide Democratic politicians with a strong counter point to inflation concerns?....no

3) Will this change consumer or business behavior?....no

Inflation, even with this new data, remains an economic and political challenge.....

I partly agree with you.

If everyone could be happy with 2 percent inflation for the past thirty years, I'd think most everyone could be happy to have the Fed keep it around 3 percent for the next thirty years. But 4 percent right now is not going to be acceptable to many, and we aren't even at 4 now. Nor is inflation "declining smartly".

So it's too much to hope that the Federal Reserve is done raising rates. But people are saying they might go with less than a three-quarter-percent increase next time, or maybe they're hinting that the next increase could be the last one.