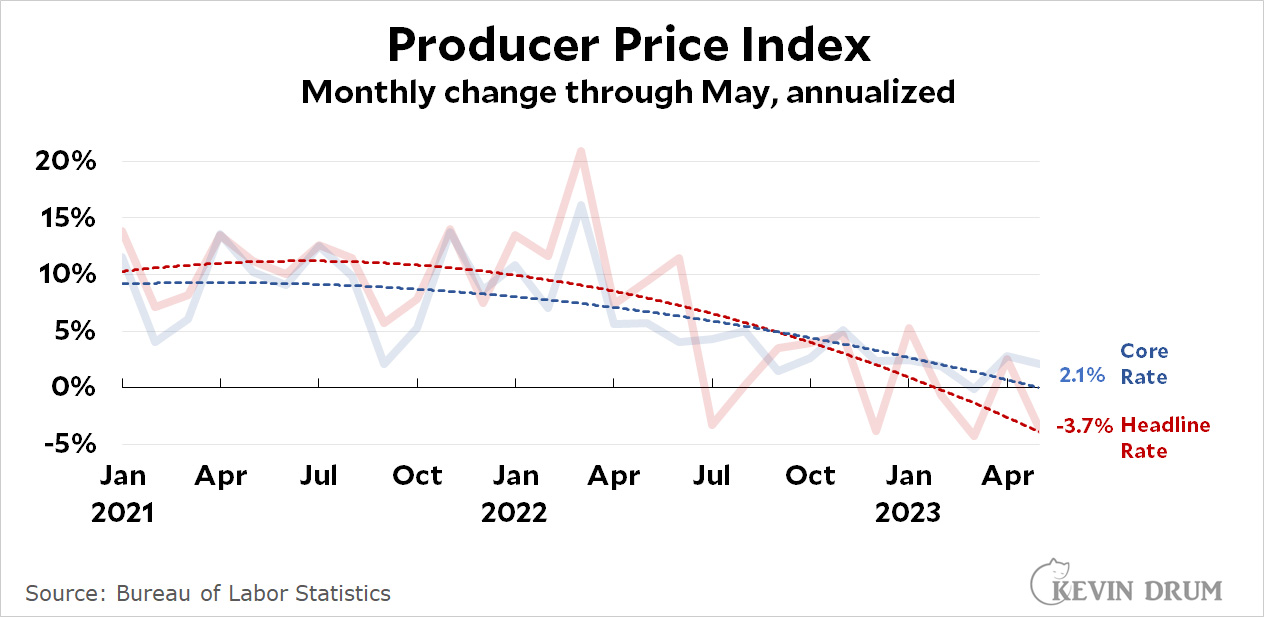

If yesterday was CPI day then today must be PPI day. Here's what the Producer Price Index looks like through May:

If you look at goods and services separately, even the PPI for services was up only 2.9%—largely because of autos and auto parts. That's an excellent number since services are the prime contributor to recent inflation.

If you look at goods and services separately, even the PPI for services was up only 2.9%—largely because of autos and auto parts. That's an excellent number since services are the prime contributor to recent inflation.

All of these numbers should feed through into consumer inflation over the next few months. It's yet another reason¹ to think that inflation is already set to decline throughout the rest of the year and the Fed has no reason to hike interest rates yet again.

¹There are many reasons to think this:

- PPI inflation is very low.

- CPI inflation is dropping.

- Fed interest rate hikes should take effect over the next six months.

- Global supply chains have completely recovered from the pandemic.

.

- Housing inflation, when properly measured, is about zero.

- Fears to the contrary, wage growth has been restrained and there's no evidence of a '70s-style wage-price spiral. And wages probably don't matter that much anyway.

.

I can make $200 an hour working on my home computer. {h42 I never thought it was possible, but my closest friend made $25,000 in just five weeks working on this historic project. convinced me to take part. For more information,

Click on the link below... https://GetDreamJobs1.blogspot.com

The Fed and the people who influence it (the circles the Fed bankers float in) think employment is too high, so of course they have reason to raise rates some more.

Yes, but when they -- people like Larry Summers -- say that, what they're saying is that the noncyclical rate (roughly NAIRU) of unemployment is higher than the actual rate of unemployment, and so the belief is that the economy is too hot.

In a normal economic period, this would tend to lead to rising inflation, but it's doing the opposite.

Curiously, the unemployment rate increased even though the number of new jobs surged. If this can keep going for two more months, the gap will have closed and then policymakers will be satisfied to some extent, but also completely flummoxed on the actual state of economy.

The most informative view of PPI is probably the usual year/year change values:

https://fred.stlouisfed.org/graph/fredgraph.png?g=1690F

particularly when comparing to the usual year/year headline CPI inflation. During the height of CPI inflation, PPI inflation was higher than 20% for over a year. Those high PPI values were not caused by uppity worker wage increases, nor did the Fed have anything to do with their decline.

Obviously we need to keep raising interest rates to get used car prices under control.

When the value (% change) goes negative, I think it makes more sense to review the index, and as always, use a longer series.

When you look at the index over a very long period, doesn't it make you think that the PPI will likely drop a lot more?