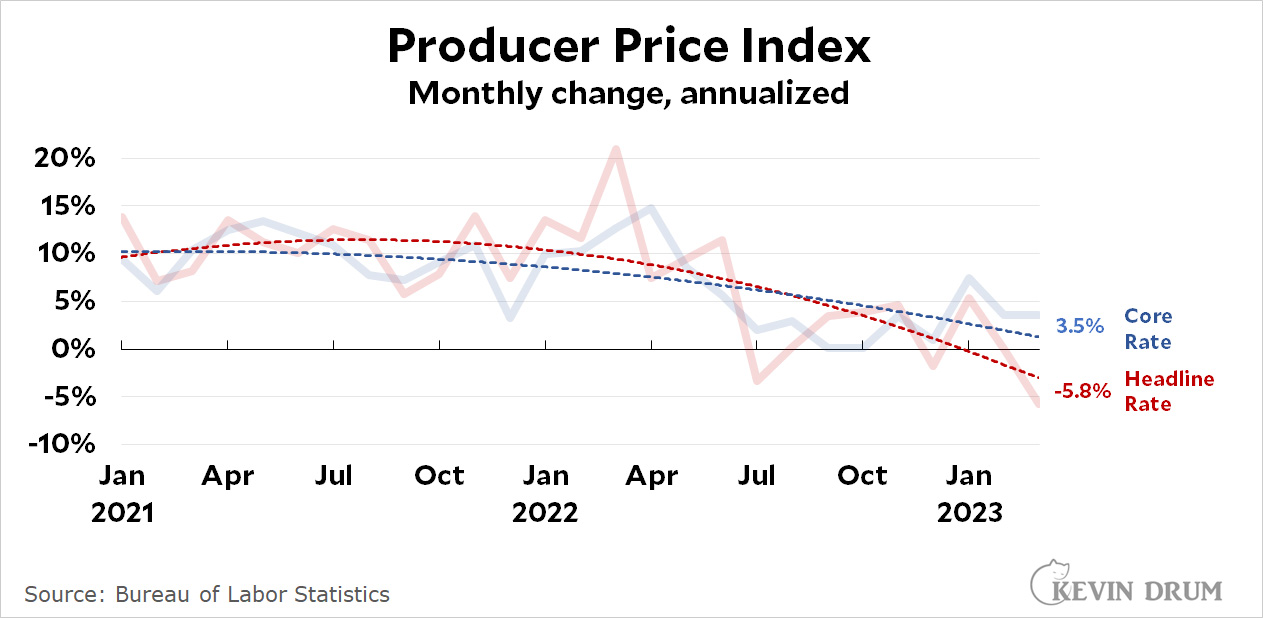

Yesterday was CPI day, which means today is PPI day. Here is the producer price index through March:

Since last June, headline PPI has risen at an annualized rate of 0.7%. Core PPI has risen at an annualized rate of 2.6%.

Since last June, headline PPI has risen at an annualized rate of 0.7%. Core PPI has risen at an annualized rate of 2.6%.

Both the headline and core PPI rates are considerably lower than the CPI rates. Since lower producer prices eventually feed through to consumer prices, it means there's still downward pressure on CPI. In addition, the shelter index will begin to drop later this year. Unless there's another energy spike, CPI is likely to drop to 2-3% by the end of summer.

UPDATE: I am forgetful these days. Here's the PPI for the dreaded services sector, down almost to zero.

Won't stop them from continuing to raise prices.

Yup.

>Since lower producer prices eventually feed through to consumer prices

I don't think that is necessarily the case any longer.

Due to concentration/consolidation within industries, it isn't very true.

You’ve given headline, and core. Is there also a “supercore” ? …

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article... https://createmaxwealth.blogspot.com