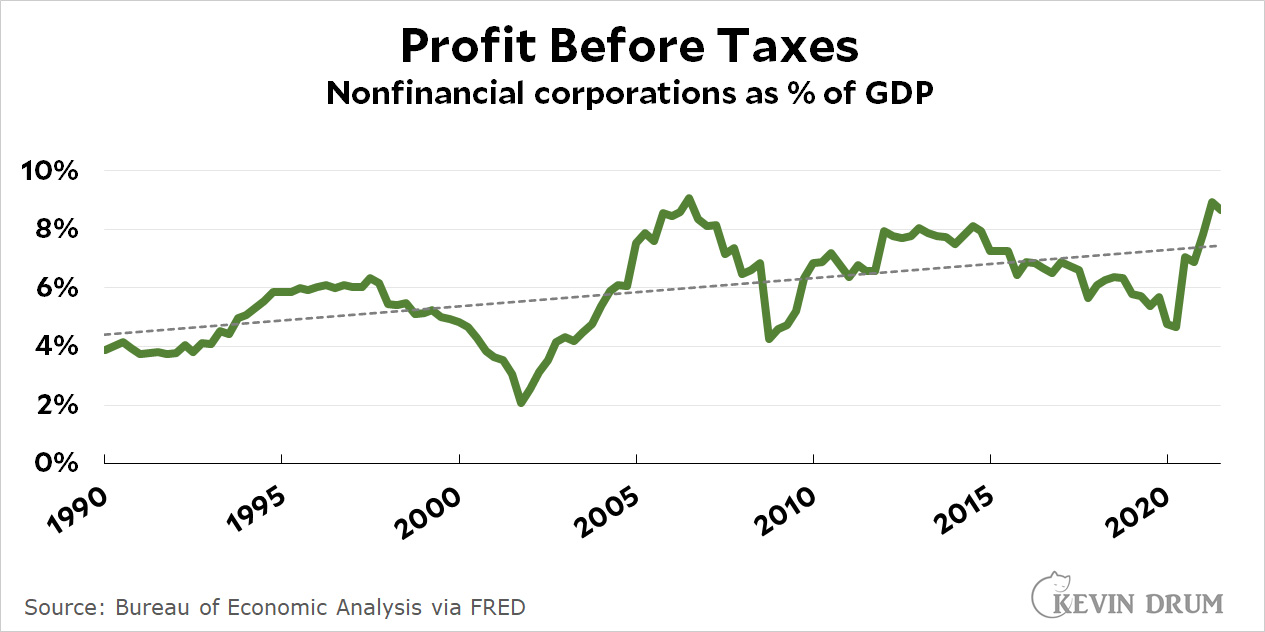

I would like to show you a few charts. First up is corporate profits:

Not bad! Not only is the long-term trendline nicely up, but the pandemic has been good to American businesses. Profit before taxes has spiked up 82% since the start of 2020.

Not bad! Not only is the long-term trendline nicely up, but the pandemic has been good to American businesses. Profit before taxes has spiked up 82% since the start of 2020.

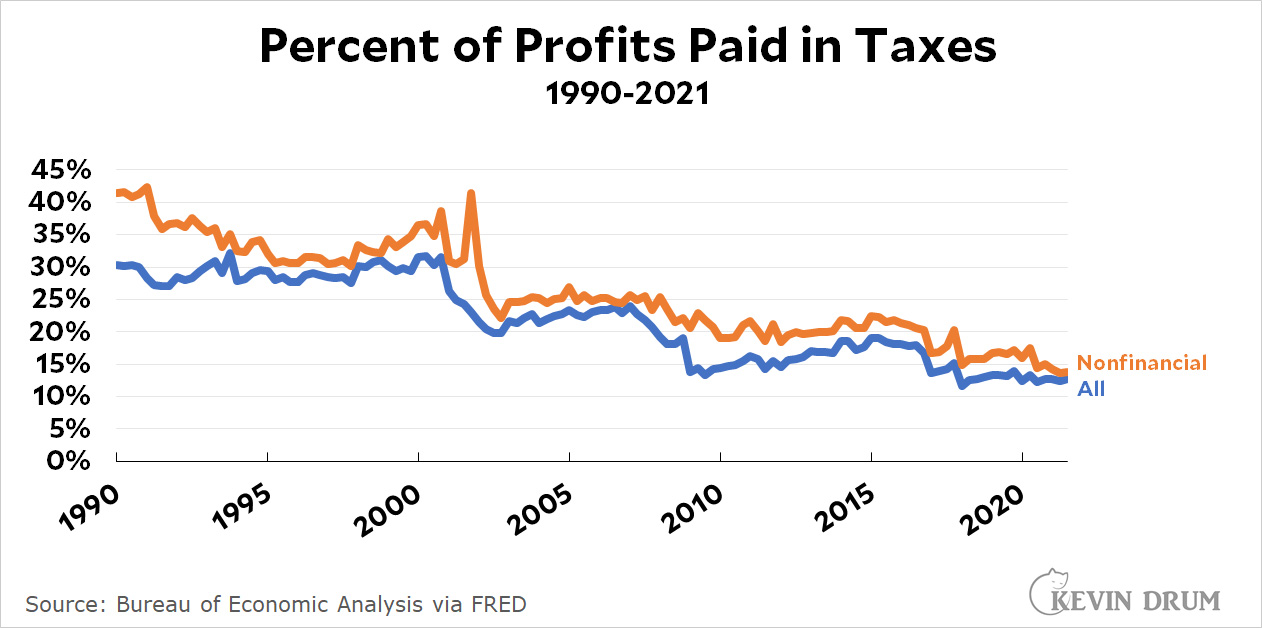

And speaking of taxes, those are down, down, down:

Back in the bad old days, nonfinancial corporations paid 30-40% of their profits to Uncle Sam. Today, after big drops thanks to the first Bush tax cut and the Trump tax cut, the average tax rate is down to 14%. Ka-ching!

Back in the bad old days, nonfinancial corporations paid 30-40% of their profits to Uncle Sam. Today, after big drops thanks to the first Bush tax cut and the Trump tax cut, the average tax rate is down to 14%. Ka-ching!

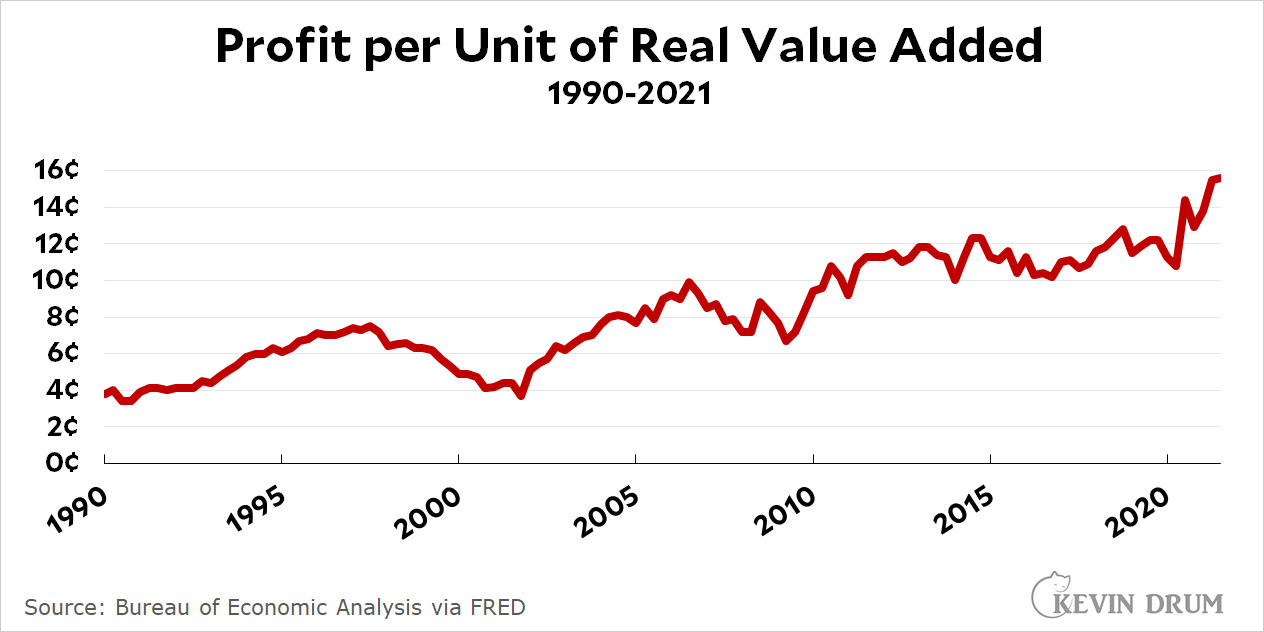

Put this all together and you get this:

This is not a common metric, but it's an interesting one. Generally speaking, we all believe that corporations deserve to be profitable if they produce a lot of value-added. That's only fair. But that isn't quite what's happened. Back in the 1990s, corporations earned 4-8 cents per unit of value-added. Today, after the big pandemic profit spike, they earn 16 cents per unit. This means that even if they plod along and produce exactly as much value-added every year, their profit has more than doubled.

This is not a common metric, but it's an interesting one. Generally speaking, we all believe that corporations deserve to be profitable if they produce a lot of value-added. That's only fair. But that isn't quite what's happened. Back in the 1990s, corporations earned 4-8 cents per unit of value-added. Today, after the big pandemic profit spike, they earn 16 cents per unit. This means that even if they plod along and produce exactly as much value-added every year, their profit has more than doubled.

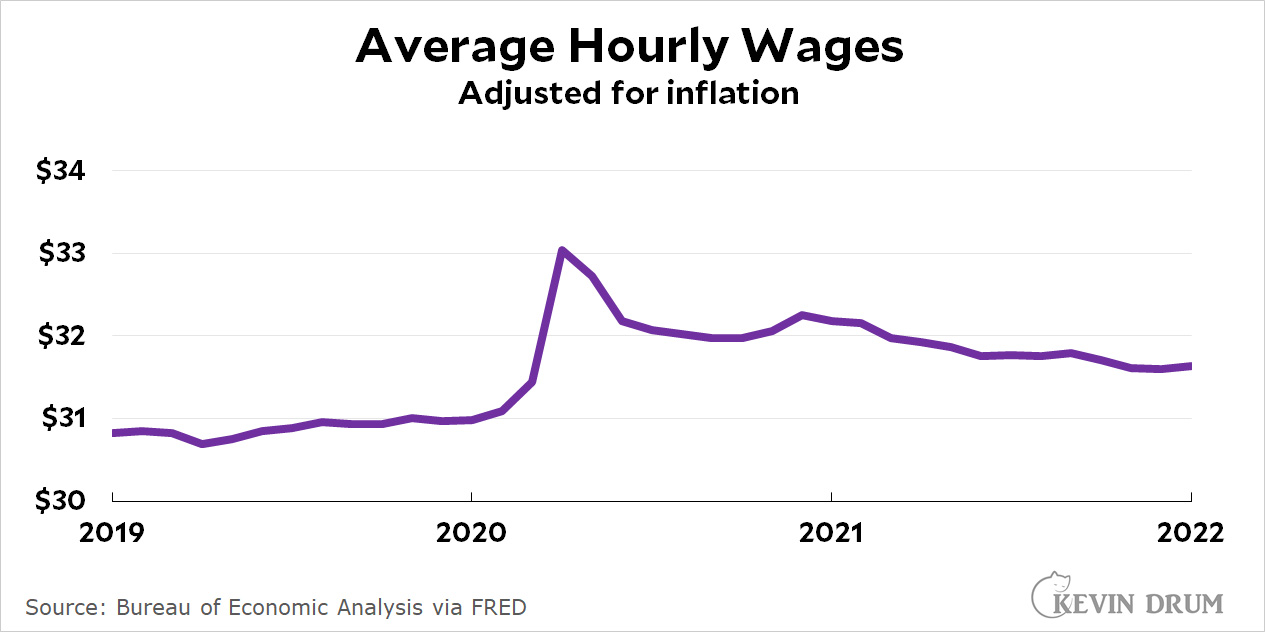

That's a helluva nice pay plan! So you'd think that since the pandemic has been good to corporations and they're desperate for workers, they'd happily raise wages. Let's take a look:

Nope. Wages went up a bit during the spike right at the beginning of the pandemic, when companies were paying "essential worker" bonuses and so forth, but they've been dropping ever since the start of 2021. Real wages today are 2% lower than they were a year ago.

Nope. Wages went up a bit during the spike right at the beginning of the pandemic, when companies were paying "essential worker" bonuses and so forth, but they've been dropping ever since the start of 2021. Real wages today are 2% lower than they were a year ago.

I leave further analysis as an exercise for my readers.

Average real wages jumped up at the beginning of the pandemic primarily because it was the lowest-wage people who were laid off, which raised the average. Inflation also dropped at that time. There were some temporary bonuses, but most individuals did not see an increase in pay. As most of those laid-off people came back, the average dropped down some. While the level since 2020 has been higher than before then, there is probably still a component of missing lower-wage workers (Total employment is still several million below where it was at the beginning of 2020). So again, the higher average wage level - which as Kevin says is dropping because of inflation - is still probably somewhat artificial.

Yes, there is little doubt that most or all of the spike and return to trend are composition effects. If economists were any good at measurement, we would have a ’basket of labor’ measure that would average over a broad collection of occupations, unweighted or with weights smoothed over a decade or so. That would be much more indicative of the typical worker’s experience.

But the chart of profit per unit of value added is quite illuminating. I speculated in an earlier comment that companies were taking advantage of the ‘cover’ provided by high-profile price increases like gasoline and milk to raise their own prices, whether or not they experienced higher costs. This is evidence that skimming isn’t uncommon.

I am no expert, just pointing out that Krugman discussed this in his Jan 22 column...

"The most commonly used wage numbers have been screwy during the pandemic, because of compositional effects. For example, average wages shot up in 2020, not because workers were getting big raises, but because low-wage workers were laid off in disproportionate numbers. So weneed to look at estimates that are supposed to correct fort

Inflation and the Power of Narrative

https://www.nytimes.com/2022/01/25/opinion/inflation-economy.html?referringSource=articleSharethese compositional effects, like the Atlanta Fed’s wage trac

sorry for the weird text there. some bug somewhere

Thanks for that link. The Atlanta Fed’s wage tracker is a much better representation of the typical worker experience (it is the median percent change in wages for individuals in a sample, yoy. Analogous to the ‘same-store sales’ measure used for retailers, to eliminate artifacts from openings and closings.)

Why doesn’t the wages chart start in 1990 like the rest of the charts?

Bbbut…. That is comparing with the trough of the imposed recession. Back when you were still trying to nothingburger inflation you were saying the trough had to be factored out. Why haven’t you done so here? …

fun with stats!!!

I guess those cherries won’t pick themselves.

It looks to me that writing "Real wages today are 2% lower than they were a year ago" is cherry picking your start date for comparison, somewhere in the middle of an ongoing pandemic. More realistic, I think, would be "Real wages today are about 2-3% higher than they were two years ago, before the pandemic."

That, of course, omits the cogent point made by Skeptonomist, which is still very much relevant.

High profits minus flat wages = high inflation.

High inflation = clueless voters throw out Democrats and elect Republicans.

More Republicans = even lower taxes = even higher profits.

Math!

They have pricing power now. Good for them!

Are you trying to say it's really not a wage-price spiral??? Sacre bleu

It is. Businesses are raising wages and prices to attract workers. It's partial reason of the inflation puzzle.

Weak labour laws, suppressed unions and no monopoly law inforcement means companies have no incentive not to maximise profits by raising prices and keeping wages low (while also raising management compensation.

Updating and enforcing monopoly laws and improving labour laws is not socialism just smart policy.

Nope, wages are surging. Government reporting lags and Midwestern diffusion on wage hikes can be misleading.

Wages are booming in Ohio. What Biden is doing is what they wish Obama did in 2009. Contrict capital flows for onshoring, pass infrastructure. Work with Carbon capture.

Yeah, it sucks for coastal elitists. But good for rustbelt democrats.

Independent of whether or not the Trump tax cut was a good thing, If one were to draw a trend line from the beginning of the chart, that cut wouldn't seem to have budged things much from the trend line and it looks not all that much bigger of a change than the noise.