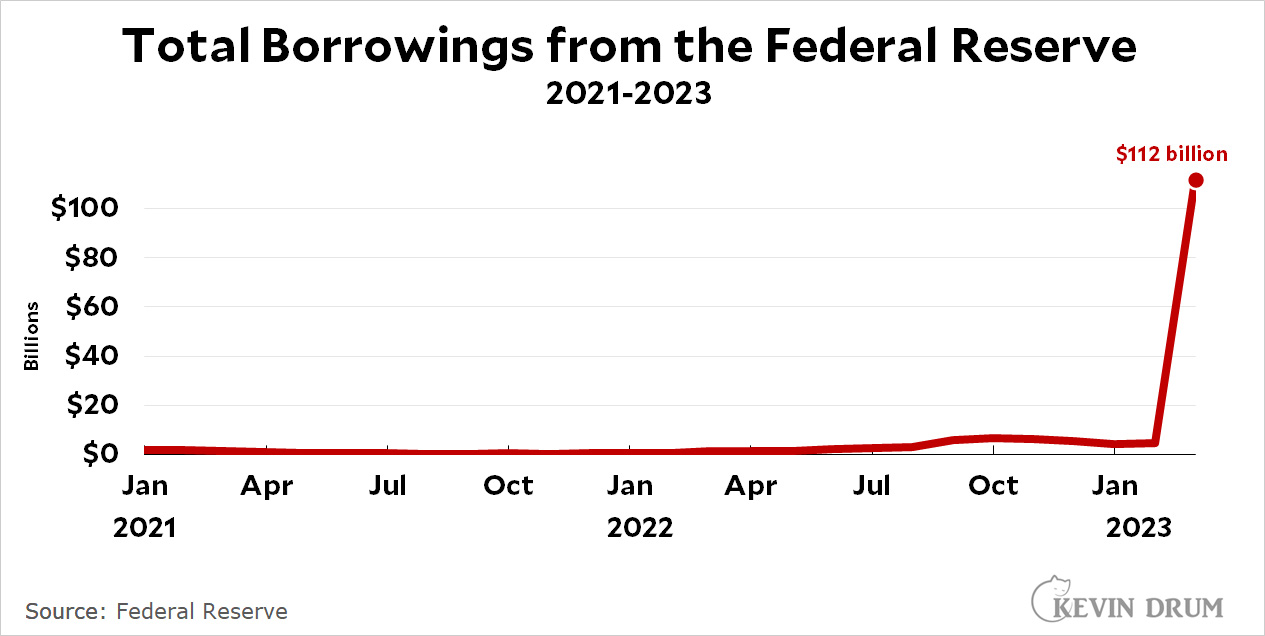

Here's how much banks have borrowed from the Fed this month:

During the Great Recession, this number peaked at around $400 billion in October 2008. That's the highest it's been over the past 40 years. We're nowhere near that, but March 2023 is still in a strong second place.

During the Great Recession, this number peaked at around $400 billion in October 2008. That's the highest it's been over the past 40 years. We're nowhere near that, but March 2023 is still in a strong second place.

Gives a feeling something is, or was, going on no one is talking about in public.

One could draw a line directly from the 2008 banking crisis to Trump. A second banking crisis in just over a single decade and who knows where that line could go. I can see why nobody wants to talk about it.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

Everybody and their brother is desperate to make sure they have adequate liquidity. Including me.

That is one reason why CD rates and other deposit rates have gone up a lot over the last 3 weeks even as Treasury rates declined.

You also need to remember that borrowing from the Fed is almost free.

If you leave your money at the Fed then you are earning almost as much on you deposit as you are being charged.

Also, if you had loans pledged to FHLB then you could borrow between 80% and 90% of market value. Now the Fed will let you borrow 100% of face value.

So if your bond went down in value then the Fed will allow you to borrow more than the bond is worth. Effectively allowing you to borrow unsecured.

So it doesn't surprise me at all that people are borrow a ton of money from the Fed.

Are those amounts normalized to inflation? What's the percent of gdp?

Any chance you have data earlier than Jan of 2021?

The FED is trying to suck up dollars to quell inflation, but is lending out dollars to banks at, what, no interest?

Funneling money up.

2008 scared the bejesus out of the banks, the Fed, and both political parties. Banks aren't private businesses anymore.

It would seem that giving everyone an account at the run-proof central bank would be worth considering as any regular bank is vulnerable to a run; just a basic one allowing safekeeping of funds and transfers to other accounts for payments (instant and without fees to make the scheme really useful: electronic money with minimal friction), the private banks would still deal with anything more complicated (without the need to deposit insurance or bailouts though). The cost /account would be minuscule and could be easily covered from the central bank's interest spread.

Earlier this would have been impractical, but with internet/app banking the need to have physical branches everywhere has gone away and data is routinely processed at this scale. Why should just banks have access to the public utility that is the central bank? Besides the government / central bank has been providing cash money for ages, a similar public utility service nobody seems to mind.

The drawback would be that this would affect how banks get the money to lend out and how most of new money is created in the economy. Can't say I know how much a problem this would be and how to best solve it (although, obviously, the central bank could lend the deposits right back to regular banks). Privacy is another concern, but with carefully set up legislation and technical implementation this should be no worse and could be better than the current situation.

The Fed wanted to shrink its balance sheet to help lower inflation. But, now, because of SVB and others, it has now rapidly increased its balance sheet.

That's your irony right there, KD. The unintended consequences of rapidly rising rates has forced the Fed to increase its balance sheet even while driving up rates another 25 basis points.