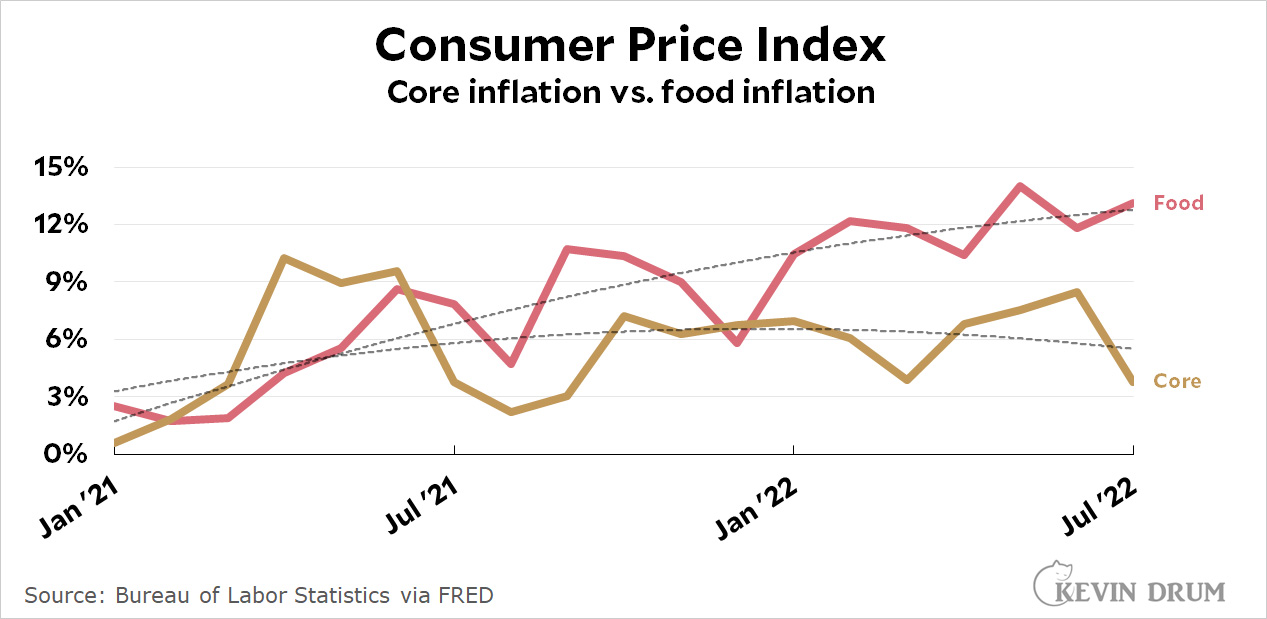

The good news on inflation is that the core level is moderate and dropping. Energy inflation is also coming down thanks to dropping oil prices.

The bad news is that food inflation remains high and rising:

This chart shows the monthly change in inflation, annualized to a yearly level. Because this is a volatile measure, it's best to look at a trendline, and the trendline for core CPI seems to have peaked in early 2022 and has been trending lower ever since.

This chart shows the monthly change in inflation, annualized to a yearly level. Because this is a volatile measure, it's best to look at a trendline, and the trendline for core CPI seems to have peaked in early 2022 and has been trending lower ever since.

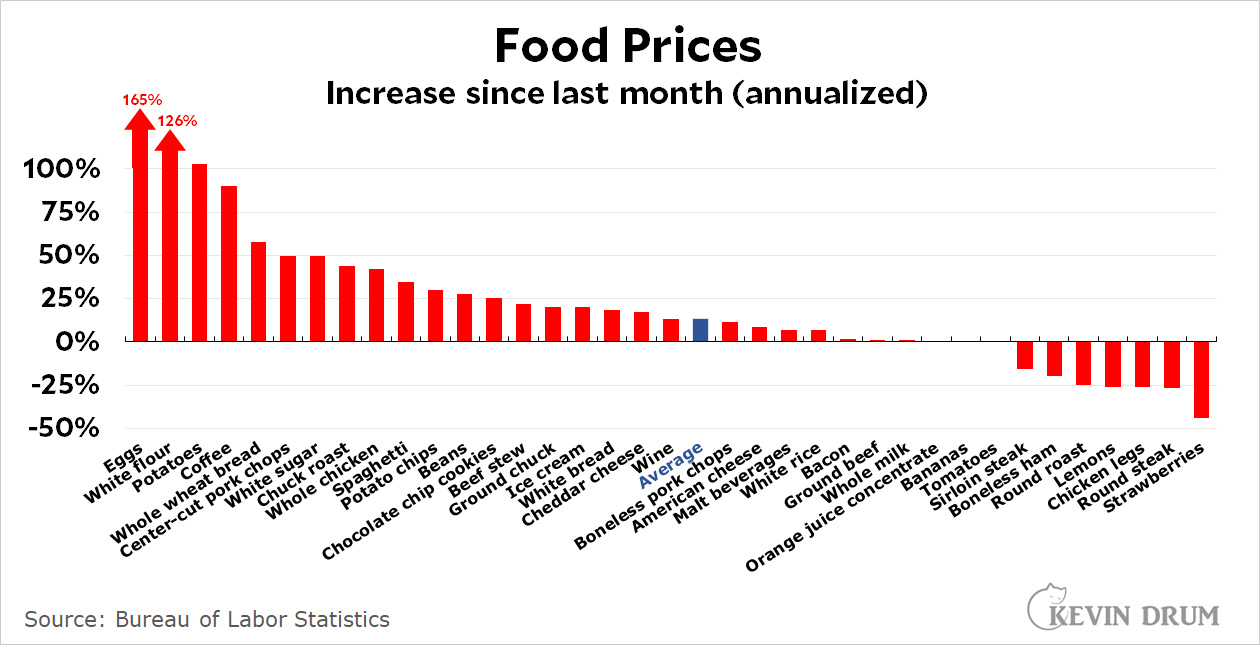

But no such luck with food. You barely even need a trendline to see what's going on here, but it's still best to look at one anyway. What it tells us is not just that the food inflation rate is high (13.1% in July) but it's continuing an upward trend. Even more than gasoline, food prices are what people see most often and react to most strongly. So all the news in the world about the core rate or the headline rate or even the declining price of gasoline can't wipe out the continuing shock of a visit to the supermarket for plain essentials: The cost of food in July was 11% higher than last year and 1.1% higher than last month (+13% at an annualized rate). Here's a sampling of food price increases from June to July:

Some stuff was flat or even lower in July: Bacon, milk, tomatoes, ham, and a few other items were down significantly. But eggs, flour, coffee, chicken, and other staples were up 30% or more. Those are annualized rates, but even if you divide them by 12 to get an idea of what people actually see on price stickers, these are still eye-watering price increases. And you see them month after month.

Some stuff was flat or even lower in July: Bacon, milk, tomatoes, ham, and a few other items were down significantly. But eggs, flour, coffee, chicken, and other staples were up 30% or more. Those are annualized rates, but even if you divide them by 12 to get an idea of what people actually see on price stickers, these are still eye-watering price increases. And you see them month after month.

As long as food inflation stays high, the public perception of inflation will stay high and news outlets will continue to produce plenty of segments on inflation using masses of B-roll footage of supermarket aisles and clanging cash registers. That's just the way it is.

There's a major culling of poultry going on in multiple countries, I believe (due to disease), and perhaps this is affecting egg prices?

Kevin, entirely O/T, but will you ever get around to doing a follow up post on that meta-analysis on the lead-crime hypothesis out of Scotland? Are you aware if any similar meta analyses (or any new research at all) have been done? I haven't been able to find anything new...

Bingo!

This is why is should be a red-waye year even though these prices are not due to the policies of this White House or the Fed.

Bird flu, drought and war in Ukraine are the main issues for the commodities. Plus limited competition in the meat packing industry, etc. I'm surprised beef prices aren't still going up in general--but I'm guessing they're pretty high already.

But, Americans spend (or at least spent…?) too little on food: https://www.motherjones.com/food/2012/02/america-food-spending-less/

So this is a good thing, right??

(It seems unlikely the relative positions changed much since that article)

Okay, it would be rude and unthinkable to comment that we eat too much, anyway. ("speak for yourself", right?)

However, as I noted elsewhere, overnight the two gas stations that had been advertising regular for $3.18.9 for nearly a week are suddenly showing $3.78.9. A sixty cent increase! I have no idea why.

I’m not sure people notice a 1.1% increase month to month. I’m not even sure people notice an 11% increase year over year. 10 bucks on 100 bill? Since what you buy at the grocery store changes each time, seems to me you would just chalk it up to variation/randomness of items, etc. Unless you buy the same thing each time, which some do…

Gas prices, OTOH, since it takes about the same amount to fill your tank each time, seems like you’d notice - I live in SF and when my 15 gallon tank started hitting $100.00 to fill up I noticed.

My two cents.

Buy the same thing each trip to the store? No. Buy the same items over and over? Absolutely.

Raising interest rates will fix the high food prices. It will put those uppity cows, pigs and chickens who keep holding out for wage increases in their places. Higher interest rates will also cause greater rainfall (in places that are having droughts, not where they're having floods).

+1!

Let's see. China has just announced they;ve lost half their crops to extreme temperatures and drought.

Ukraine, europe's bread basked is going to lose much of their crop to war.

The rest of europe is facing the same situation as china.

Western US will also have reduced crops because of drought.

As a result food prices are rising. This is not inflation. This is the antithesis of inflation.

On the contrary, it's classic inflation. ' Demand-pull inflation is the upward pressure on prices that follows a shortage in supply, a condition that economists describe as "too many dollars chasing too few goods."'

I’m with memyselfandi on this one, and with skeptonomist, who said essentially the same thing satirically. That economists foolishly apply one term to a whole gamut of situations which vary in cause, time course, geographical range, and most importantly, in remedies, does not make them one thing.

A dozen eggs last a month. Bread lasts a week. Big effing deal.

And water straight out of the tap is FREE! (sigh)

FREE?

Mine has PFAS in it (forever chemicals) from a plant upstream.

At least they don't charge for that addition to our water supply !!!

Maybe it's pointless to keep repeating this, but every price increase is not inflation.

I read an article this week that said that beef herds were down due to drought which would drive up beef prices which would be inflation. I screamed.

Inflation isn't some prices go up, it's all prices go up.

It’s hard to extrapolate looking at the individual data, center pork chops are significantly higher but not pork chops? I would assume the supply is the same, so something is amiss. I do note three things: wheat and wheat related products, same with potatoes, and chicken and eggs. The Ukrainian war is affecting the first two (Ukraine is a top producer of wheat and because potatoes can substitute many wheat starchy products its demand is increasing with the lack of wheat) and I have read there’s is a major chicken illness decimating a lot of roosts though I would like to see some real data. The point being that this table does not really show foods in general to be highly inflationary specially because the data is too thin (one month).

High fuel prices need to work their way through our 'food chain'. Fertilizer, herbicides, transportation costs are highly sensitive to fossil fuels but price effects are lagged relative to many other items (see....fertilize in spring, harvest in fall). These price increases might be stickier than others.

Completely agree - the commodities listed are very, very grain based, which is to say petroleum based. Beef has a longer "cow-calf" cycle:

Cattle Cycle

The cattle cycle is a process in which the size of the national cattle herd—including all cattle and calves—increases and decreases over time. The herd-size variation is often caused by the lengthy gestation period relative to hogs and poultry delaying cow-calf producers’ response to profit fluctuations. The total number of beef cattle in the United States is highly dependent on the stage in that cycle.

https://www.ers.usda.gov/topics/animal-products/cattle-beef/sector-at-a-glance/

Great example....And diesel the main fuel on many farms, has not dropped as quickly as unleaded. High food prices for many items will probably last through the winter.