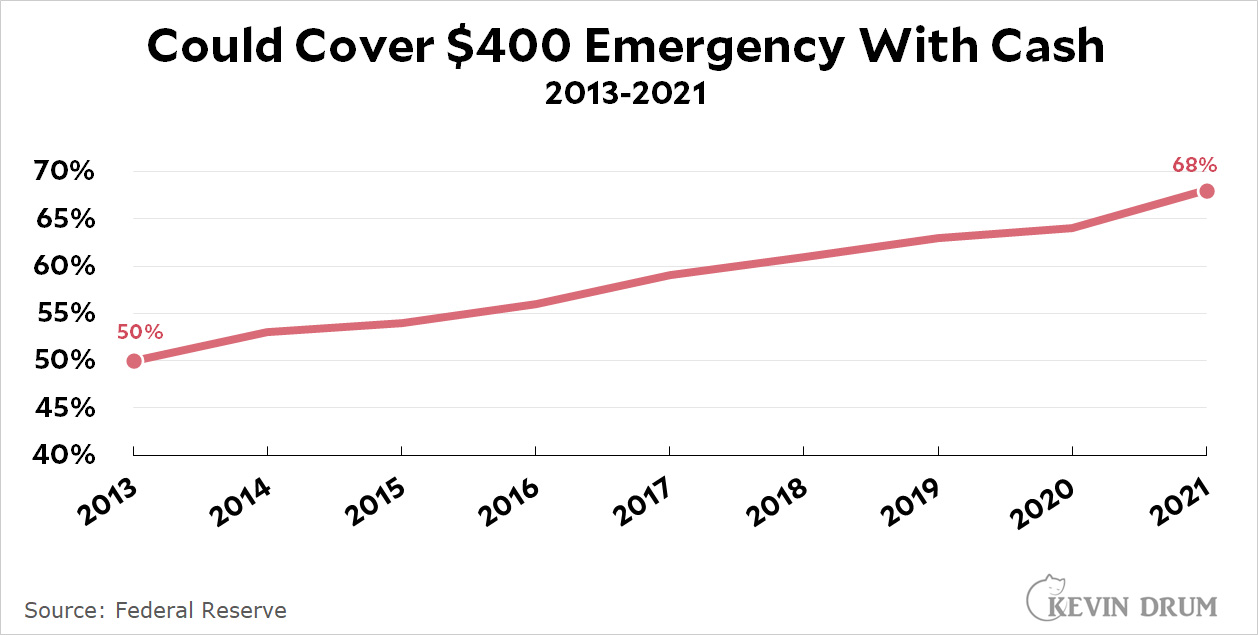

Every year since 2013 the Fed has released a report called "Economic Well-Being of U.S. Households."

Every year one of the questions is, "Could you cover a $400 emergency expense using cash?"

Every year the media breathlessly reports the answer with no context and no comparison to previous years. It is simply a totem showing how badly off American households are.

But this year is different. The Fed didn't just report the number for 2021, they included a chart showing the trend over the past decade:

It's hard to see this and just report the same old stuff. Obviously American households have been getting better and better off for eight consecutive years. And last year was especially good: the number of people able to easily handle an unexpected $400 expense went up four percentage points.

It's hard to see this and just report the same old stuff. Obviously American households have been getting better and better off for eight consecutive years. And last year was especially good: the number of people able to easily handle an unexpected $400 expense went up four percentage points.

In fairness, especially from an inflation obsessive like me, it's worth pointing out that $400 today is not as big a deal as $400 in 2013. In fact, if you adjust for inflation the Fed should be asking about $500 expenses these days. Eventually the Fed is going to have to figure out what to do about this: change the question every year or so, which produces odd-looking amounts; or change it every decade or so, which produces unfortunate breaks in the series. But that's a problem for another day. For now, the best conclusion to draw from this chart (and from other data in the Fed report) is not only that American households are doing pretty well, but they've been improving their economic well-being for nearly an entire consecutive decade.

Or, maybe people are just becoming more conservative with their personal finances due to the incessant drumroll of press about people suffering catastrophic economic problems after a health issue, or when a car breaks down, or after a job loss? The sad thing is $400 isn't even a month of groceries for most people, so a more important question might be how many people could survive a month with no income? That's realistic for many hourly wage earners who have no paid leave.

$400 is 100 loaves of enriched bread and 40 gallons of milk. It is the number of calories four people need to live just fine; that's not even counting calorie dense or nutrient dense foods.

If your grocery budget is higher than $400/mo, you either live in a food desert or you're not hurting.

In 2020 the USDA said the average household spent $411 a month on groceries.

The "average" of most things is skewed by outliers at the high end.

But that's the wrong target anyway. The median would be more meaningful, but you would still want to know what the distribution looks like to decide what was a meaningful target amount for most people.

WHOP de do.

A whopping 68% of Americans can cover a $400 emergency.

More appalling, a whopping 100% of the top 1% of Americans wouldn't even bother looking for a missing $400.

Now now Kevin. Everybody knows inflation never happened before Joe Biden took office. Before that, no price of anything had ever gone up (except perhaps during other Democratic administrations). Ergo, the solution is simple: the Feds shouldn’t allow Democrats to be in charge. Inflation solved!

But it doesn't feel that way....

The loss of the added (refundable) child tax credit was and is a real blow to many families. Now, do the parent(s) vote for the person in office when this happened, i.e. the one who pushing it through initially, or for the ones that "took it away"?

Too bad most emergencies cost way more than $400.

AAA says that routine car repairs average around $500-$600, and the average person needs that car to get to work.

And medical emergencies WAY more, depending to some extent on your medical plan ... and whether you can even afford the copays for treatment.

Depends on what you mean by the word. If you define it as an "unexpected expense" lots of things happen that cost that or less. If you reserve it for life-threatening calamities then those are usually far more expensive-- but also much rarer.

As an "always adjust from inflation" guy, I'm honestly surprised Kevin is letting this off so easy.

So basically this chart says that in 2013 only 50% of folks could afford $400 (in 2013 dollars). Now 68% of folks can afford a $322 expense (in 2013 dollars).

How is this telling us anything interesting?

He literally spends the last full paragraph complaining about it?

So what if he complained about it? It is still absolutely meaningless graph.

Also, how can being able to afford $400 possibly be used as criteria to assert that "American households are doing pretty well"?

I always wonder about the framing of this question: ""Could you cover a $400 emergency expense using cash?"

I am financial comfortable but never use cash anymore. I use credit cards, debit card, Venmo etc for almost all purchases. I don't have $400 cash in my house.

So would I answer no to this question?

Yeah, my kids couldn't cover a $20 expense using cash! It's funny when I get questions from college educated 20-somethings about how to properly write a check or mail something. Just not something they do very often. But, I imagine by "cash" they are assuming that means cash you could access quickly by writing a check or using a debit card, for example.

I think you're (a) picking a nit regarding terminology, but (b) your comment contains a serious point as well.

(a) Most merchants and service companies will treat a verifiable debit card or bank check as a "cash equivalent." That's very different from a credit card, which involves an accrual of debt to the payer and risk to the payee.

However, (b) a fair number of Americans live from paycheck to paycheck, with some using credit cards just to get from Monday to Friday. For those folks, it could be a problem to come up with the "cash or cash equivalent" to cover an emergency that wouldn't accept a credit card, or that would exceed the remaining available credit on a card that was already near maxed out. My guess is that most of us who read Kevin's blog are fortunate in that our finances are much stronger than that, but there's a significant fraction of our neighbors who are hard-pressed to deal with any unplanned sudden expense.

A separate, but very important, point is what is the typical cost of a "low-priced emergency?" If it's really an emergency, and not just a minor inconvenience, my guess is that it's higher than $400.

Ken Rhodes - are you certain I am "picking a nit regarding terminology." I know a bit about survey design: research shows issues such as wording, sequence and environment (where you take a survey) can all have a meaningful impact on survey results.

IF the intention of the question is to include cash equivalents (for example, a trip to the ATM, pay with a credit card that you pay off straight away etc) then why not refine the question?

Stated differently, do you find my confusion to the term "cash" to be unique to me, or might some respondents also struggle with the true intention of the question?

I have actually looked up the wording of this question in the past, because the news reports don't give the options, and credit cards are viewed differently by different people.

They have two options that are cash or cash equivalent:

- credit card, pay off end of month

- money in checking/savings account

Other options involve repayment over time/lack of immediate funds:

- credit card, pay over time

- bank loan/line of credit

- borrowing from friend/family

- payday loan/overdraft

There is also the can't pay at all option.

Finally, there is the one that I find a bit confusing:

- selling something

I know plenty of people who have responded to needing cash by selling something, and it isn't always a move of desperation. Especially given how many people see themselves as part of the "gig economy," I wonder how many choose to unload old stuff instead of parting with cash. My Facebook has plenty of well-off people unloading old stuff for a bit of extra cash. My FIL, for example, sells used books online as a side gig. The amount of time he devotes to it is highly variable and somewhat dependent on his immediate material desires. He could use savings, or just spend more time posting books online.

Also, I find it odd that "pick up more hours at work" and "pawn something" aren't listed. Those are common options for a lot of lower income people.

same, I use credit cards for everything I can to get rewards and and pay them off every month.

So the way I'd interpret the question is how much extra above my budget could I spend and still be able to pay off my cards like I plan to?

It is actually strange that they used that wording, is having $400 lying around at home really something to strive for? I guess in case of a major electronic breakdown it would be good to have some cash, but since practically nobody uses cash at all where I live, that would be a community problem rather than an individual one anyway.

I have in fact not used cash at all for several years. And I mean that literally. I don't own a wallet, just a card holder. The design of Swedish notes and coins were changed some years ago, which unfortunately coincided with everything changing to cashless. This means that I, and probably a majority of Swedes, don't really know what our currency looks like. I'm not even sure what denominations exist today, and I would definitely not be able to verify that a note is authentic.

There are obvious weaknesses to a completely cashless existence, like the example mentioned above, but it doesn't worry me enough to keep cash at home. I guess the day Putin actually comes to get us, I may change my mind.

I would think you guys would want a stash of emergency cash in your house to have on hand in case of national disasters. In the US bad weather like derechos, hurricanes, earthquakes, fires and blizzards can cause widespread power failures so having cash is useful to be able to say get gas for the car buy food etc until the power is restored.

Here in parts of the USA you can't buy certain things without cash, meaning actual bills and coins. I frequent several food places that are this way. Buying something like an old car via Craigslist often requires cash. Heck, I've bought a pretty big boat for cash. I know people who regularly carry around several hundred dollars or more in their wallets.

It’s the other way around in Sweden, many (and I mean many) shops and restaurants don’t accept cash . We are paying with cards or smartphones. We aren’t even using cash in between private citizens we are are using an app named Swish

I haven't stumbled on any place of business that doesn't take plastic above the level of a craft fair booth selling cheap tschotkes in a long time now. Even the guy in my area who makes money hauling bulk trash away accepts payment via Zelle and Venmo. During the Pandemic a lot of places preferred plastic payments both because of a coin shortage and because cash was seen as a possible source of infection.

This would certainly be one of the reasons you may want to keep some cash at hand. And it may depend somewhat on where in Sweden you live, but in general we are very fortunate when it comes to natural disasters; we don't really get severe weather phenomena or earthquakes and the like. Well, so far, I should say, who knows what the climate change will bring.

Since so much of our society is cashless, I think most people here prepare for disasters by keeping an emergency kit with sustainable food, water and the like, rather than actual cash which might not be that useful anyway. But again, things may change. There is Putin, for example.

(It is strange how quickly one can get used to not handling cash at all. I have not seen, much less touched, any piece of Swedish currency for so long; by now I don't think of money in terms of coins and notes at all.)

Cash in your house is not insured in the event of theft or fire. Any money you stuff in a mattress in vulnerable to being lost for good.

I am frequently using the expression “you are being robbed blind..” when commenting in US media. This is one good example. Mr Drum is defining this as a very positive sign (even if he “forgot” to compensate for inflation) .

$400 isn’t an emergency, it’s nothing more than a broken washing machine.

An acute medical condition is an emergency and many (most) Americans can’t handle that economically

Medical bills caused 1 million U.S. adults to declare bankruptcy every year and 26 % of Americans age 18 to 64 struggled to pay medical bills. The most common cause of medical debt is an unexpected refusal by insurance companies to pay for a medical procedure. Approximately 16 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and 3 million people (1% of adults) owe medical debt of more than $10,000. Medical debt occurs across demographic

Greetings from your favorite Swedish troll

How much of that is the median income rising? $400 today isn't as big as $400 twenty years ago.

I had a boss one time review a powerpoint presentation I had made for him. His only comment wasa terse "the lines have to go up." For as long as he was my boss, the lines, they always went up !

I had a boss once who the joke about was give him 1 data point and he could create a positive trend line

Economies are cyclic, and the US has essentially been in an expansion period since 2010. So it's not surprising that people would be better off as employment decreased, etc. The pandemic disrupted things with a very brief recession, but actually it looks like the stimulus payments gave most people some excess income. This chart would be much more meaningful if it included some downturns, and of course were corrected for inflation. Also comparison with actual emergencies, as others note.

"For now, the best conclusion to draw from this chart (and from other data in the Fed report) is not only that American households are doing pretty well, but they've been improving their economic well-being for nearly an entire consecutive decade."

Looks to me like American households have been doing no better than they have been doing. They can afford to cover the expense purely because the expense is so much lower due to inflation.

I am not a rich person, so I rely on information from others for this comment. Apparently, among rich people it's fairly common to be fully invested most of the time, and to keep only enough cash on hand, or in a bank account, to meet regular expenses. (Naturally, at least some of the investments produce revenue streams, such as dividends or rent.) When an emergency, or impulse purchase, arises, rich people have lines of credit that enable them to borrow large sums at low interest rates and to pay off those large sums at leisure.

Poor people generally don't qualify for low interest lines of credit, and relying on a high interest credit card to cover emergencies can be financially disastrous. However, people of quite modest means who have good credit ratings can qualify for lines of credit with moderate interest rates. The upshot is that it's only very poor people and those with bad credit ratings that need to have cash available, and of course those are the very people who find it most difficult to keep cash on hand for emergencies.

Or express it as a percentage of income.

Re: Every year one of the questions is, "Could you cover a $400 emergency expense using cash?"

A quibble but "cash" should be replaced with "savings". Most of us do not have $400 in cash sitting around our house.