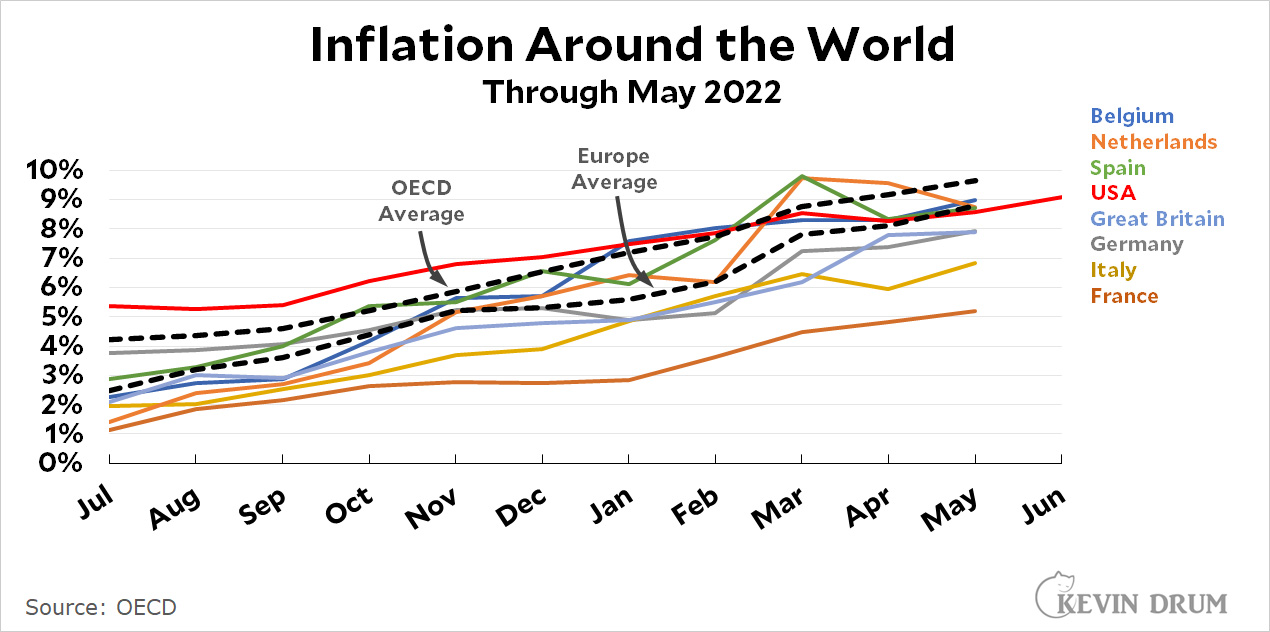

With inflation in the news today, aren't you curious about how the rest of the world is doing? Sure you are:

This only goes through May, since it takes a little while for the OECD to collect everything and put it up. In another week or two we'll see if everyone else joined us in our little June surge. I'll bet they did.

This only goes through May, since it takes a little while for the OECD to collect everything and put it up. In another week or two we'll see if everyone else joined us in our little June surge. I'll bet they did.

You should consider adding Mexico and Canada, by virtue of being next door and closest trading partners.

For comparison Canada's inflation rate for May was 7.7%.

https://www.cbc.ca/news/business/bank-of-canada-rate-hike-1.6518161

I'll do you one better.

OECD US-MX-CA CPI: https://fred.stlouisfed.org/series/CPALCY01CAM661N#0

Since the dollar is arguably currency of the world, did our stimulus affect prices worldwide as Americans gobbled up the available goods with our transient wealth?

By the same JAQing off token, one could argue the Euro austerity response to the the Chinesse Plandemic should have acted as a counterweight to Democrat Neoliberal Race Warrior overgenerosity to the otherwise expendables in the population whom we should have just let die.

In reality, the largesse or lack thereof of the national Plandemic responses, had little to do with inflation spikes. Rather, it was poor private sector business planning for what to take offline during the Rona, & poor estimation of how quickly those things could be gotten back online. Of course, a bad faith GQPer like you would never dare assert the private sector corporate community did anything wrong.

First paragraph is one of your best!

Um, that chart of Inflation Around the World only shows countries in Europe and the U.S. That's not the World. (Japan had inflation at 2.5% last month.) The countries in the chart are affected by Fed and European Central Bank policy. Both recently admitted they screwed up:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

https://ecaef.org/inflation-we-were-wrong/

The first to admit the error was the European Central Bank. In the Economic Bulletin, Issue 3/2022, Frankfurt’s economists issued a mea culpa for persistently underestimating inflation, blaming increasingly large forecast errors on surging energy prices, supply chain bottlenecks and a stronger-than-expected demand rebound from the pandemic. Financial Times wrote that “the ECB made its worst ever inflation forecast in December 2021 when it predicted eurozone consumer price growth would fall to 4.1 per cent in the first quarter of this year.

The second to apologize was Janet Yellen, a former chair of the Federal Reserve and current United States secretary of the Treasury. “I think I was wrong then about the path that inflation would take,” “There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that I didn’t — at the time — didn’t fully understand, but we recognize that now.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Kevin's strong denial of inflation trends, going back to early 2021, is so striking *and out of character* that I have to conclude that sometime earlier in his life he was stung when inflation was proclaimed a concern, which turned out to be unwarranted, and that he suffered somehow as a result.

For years, certain people were running around claiming the Fed's ultra low rates and massive asset purchases were going to cause runaway inflation. That never happened. Plus, the same people were usually on board with crazy shit like Trump's 2018 upper class tax cut, which pumped billions in gains into the pockets of wealthy taxpayers like, um, Trump himself, during a period of strong growth and virtually full employment. Now those same people are crowing that they were right and neener neener, etc. A master class in gaslighting and goalpost-moving, but whatever. The fact remains that what forecasters got wrong was how fast demand would rebound and how long it would take producers to sort out their supply chain issues. I think there's still a good story to be written about why governments had such an opaque picture of the supply chain situation in particular.

Trump's tax cuts triggered much of the problems.

Tax cuts for the wealthy aggravates income inequality and it fuels a lot of "investment" money. Unfortunately, those "investments" tend to favor rent seeking and consolidations, not new opportunities. Granted there were some new companies and a lot of them burned through a lot of cash to grow market share, but now that's ended and the chickens are coming home to roost.

Every grocer or restaurant needs delivery app(s) now. People are used to them being "free"--so the apps charge the businesses, who then have to raise prices a few percent on everyone to cover those fees.

Credit card fees have gone up, and that goes to higher prices.

The frackers have been bought out--so instead of immediately pumping up when prices rise, it makes more sense for the parent company to have prices go higher to make more money on their current supply.

A free market is not free if dominated by a few players.

Enron thought the companies well.

"Japan had inflation at 2.5% last month."

Japan (and other Asian countries) spending patterns are VERY different from ours or Europeans. Consumption of wheat products, for example, in Asian countries is usually 1/2 to 1/3 that of European or North American countries.

So if there was a war somewhere in the world that reduced the production of wheat - like, say, the one in Ukraine - wheat obviously becomes more expensive to buy. But in countries that weren't buying as much of it to begin with, it would affect their overall food inflation much less.

Same with fuel. Asians are far more likely to take electric-powered transit anywhere they go, versus driving in a car like Americans do. So if something happens that causes gas prices to go up - like, say, the embargo on Russian oil - countries where rail is plentiful and car ownership isn't as high isn't going to see as much of an impact on their overall inflation as countries in which almost everything has to be moved using gas-powered vehicles.

I understand that neither food nor fuel are directly incorporated in most estimates of inflation, because they fluctuate wildly from year to year even in "normal" times. But the expectation of food and fuel prices does factor into what everybody else in an economy will want to charge for whatever it is that they're producing. If fuel is expected to cost a lot "forever," businesses eventually incorporate that into the price for, say, an airline ticket or shipping a new TV or whatever... and those types of goods and services are most definitely included in estimates of inflation.

As mentioned above, Japan and South Korea have much lower inflation than the US. While it is true the food consumption does vary by country/Asian countries eat more rice than European countries, items such as wheat are a small part of the basic of goods that are used to calculate inflation.

As for the oil use question the theory is hard to support with data. For example, South Korea and Switzerland use about the same amount of oil per capita. In contrast Denmark uses much more oil than South Korea but has low ish inflation (4%)

https://www.nationmaster.com/country-info/stats/Energy/Oil/Production/Per-capita

https://www.worlddata.info/europe/denmark/inflation-rates.php#:~:text=The%20inflation%20rate%20for%20consumer,rate%20was%204.5%25%20per%20year.

Of course Japan and South Korea have the same supply chain challenges that hinder Europe and the US.

https://www.nationmaster.com/country-info/stats/Energy/Oil/Production/Per-capita

Interesting how the line for the US shows none of the same considerable fluctuations of Kevin’s previous charts.

looks similar to CPI data, just over different time frame so you don't see the jump from 2% to 5%. Much different than core data plotted month to month.

If you doubt his chart, you're welcome to plot your own.

In the past I have. This time I got confused by the shift in metric.