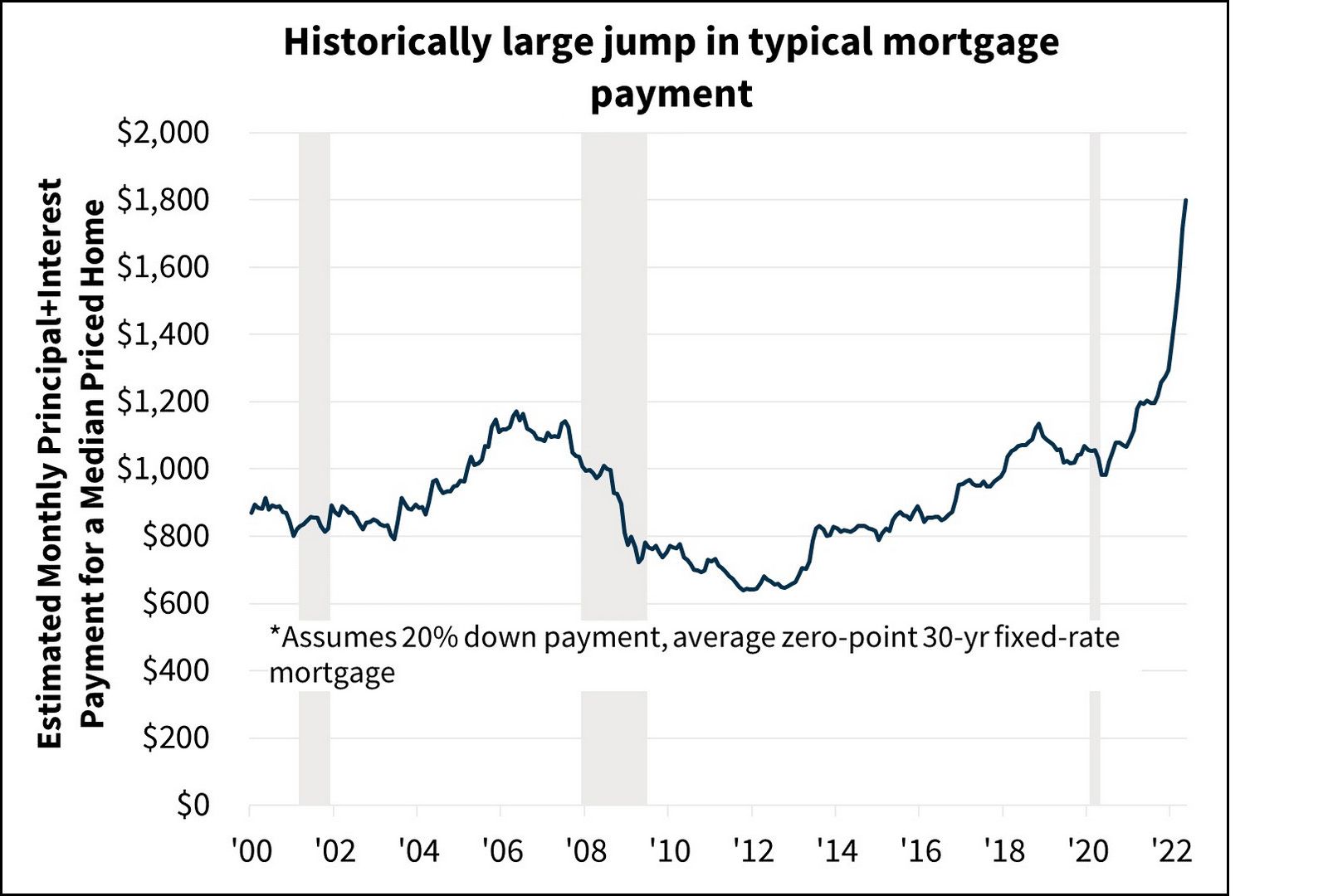

The latest housing forecast from Fannie Mae takes note of the tremendous jump in average monthly payments for homebuyers in 2022:

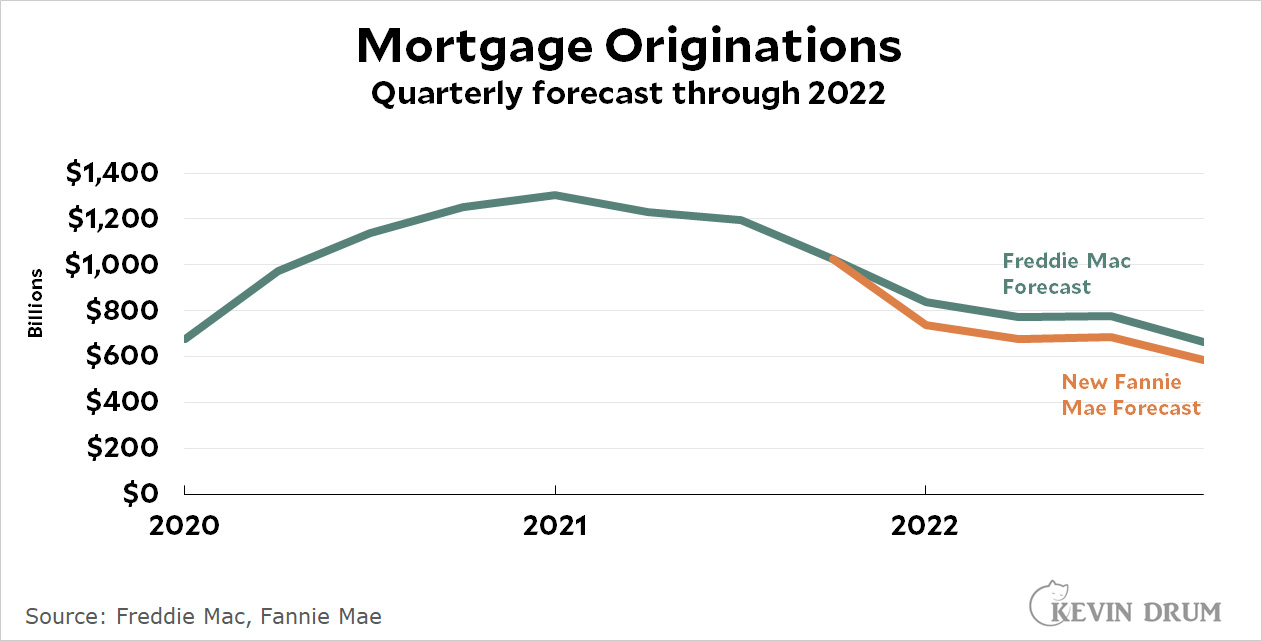

As a result, their forecast for mortgage originations has declined:

As a result, their forecast for mortgage originations has declined:

That totals $2.7 trillion for 2022, and Fannie now projects that 2023 will see only $2.25 trillion in mortgage originations.

That totals $2.7 trillion for 2022, and Fannie now projects that 2023 will see only $2.25 trillion in mortgage originations.

Maybe home prices will mellow out.

You mean the fake cash bubble is gone??? Big deal. Housing is so 20th century.

FOAD, please.

Maybe but the scale of the runup here has been literally insane. Median house prices peaked in 2005 at about 4.75x the median wage, after sitting for all of the 90s around 3.5x the median wage. Pre pandemic they were at about 4x median wages, and since then they've shot up to 5.25x.

I totally get the idea that we're supply constrained, but i don't understand how this situation is supposed to be sustainable. The last time we had mortgage rates like this the market couldn't take price pressure anywhere near this level before we had significant demand destruction.

So much of the cash flow of the US economy depends on housing, turning that off this fast has got to do some serious damage to GDP and bring house prices with it... doesn't it?

Nope. 2000's was debt problems with the banks. Not this time. Nor does Residential investment mean much. It's 50% of what it was in 2000 in terms of total impact on gdp.

Debt is nonbank lending, subprime consumer banking. The financial crisis pretty much was the end of a era. RE has shrunk in terms of credit lines and means less than a generation go. It many respects a blow off of the last population boom.

I'm not trying to say that there is a banking crisis looming, but I also do not understand how there can be rising interest rates (and therefore monthly payments), stagnant wages, constant lending standards, and no downward pressure on house prices all at the same time. Seems to me one or more of these things will have to give.

When you say that real estate has shrunk in terms of credit lines, can you expand a little on this? By means less, do you mean it means less to household balance sheets or means less to banks? Will the fed's announced plan to stop buying mortgage bonds change that going forward?

Regarding the last population boom, when was this? The millennials are as big a generation as the baby boom was, and we spent a decade not building houses. Is the pent up demand from this so large that even with nominal wage cuts, the available inventory is so small that purchasing housing is = only within reach of those who don't have to worry about such things anyway?

The millies are nowhere the baby boomers. Follow population growth patterns since 1900.

Matter of fact, real estate was a negative for cash until 2018. Yet, the economy still grew. We are at the turning point in history when it comes to money and how it operates. Either you get it or you don't

According to Freddie Mac (Fannie's "friend", I guess) mortgage rates for fixed 30yr have dropped two weeks in a row. At 5.1% they're still (a lot!) more than the 2.95% at this time last year, but better than last week's 5.25%.

Four out of 9 are just troll scat. Not a good look.

We will find out, but the housing market is a strange "market."

I sort of understand the methodology being Case-Schiller, but looking at Southern Cal it looks to me as if there has been a steady decrease in what level of "house" a given person can afford. And by "given person" I mean, say, given teacher, given police officer, given accountant, given lawyer.

I am familiar with the lawyer part of that, and I can tell you that lawyers are not getting anywhere near the level of house that they once could buy, say in the 1980s, so its not only that houses are more expensive, but the size is shrinking, and the location is getting worse, or both.

Yet, population growth can sustain some serious first world prices.

Oddly, the main feature of this run up seems to be the fact that many owners are "locked in" - unless they plan on selling in CA and moving somewhere cheaper, they are disincentivised to sell.

Its not that monthly payments are up, by the way, they are only up for new buyers, for everyone who has a house its a disincentive to even be a "new buyer"

So what's behind the huge uptick? If it's not mortgage interest rates, it must be principal driving it. Did home prices really go up that much just this year?

I'm just glad we refinanced in that downtick in 2020, when it looked like things might get really bad.

The housing market seems destined to crumble, with prices out of reach and now interest rates pushing them even further away. Maybe the end goal here is significant increase in institutional ownership, with the proles forced to rent.