President Biden says he hasn't yet made up his mind what to do about OPEC's decision to cut oil production. And by "OPEC" he means "Saudi Arabia." As he's pondering, here's something that should be front of everyone's mind:

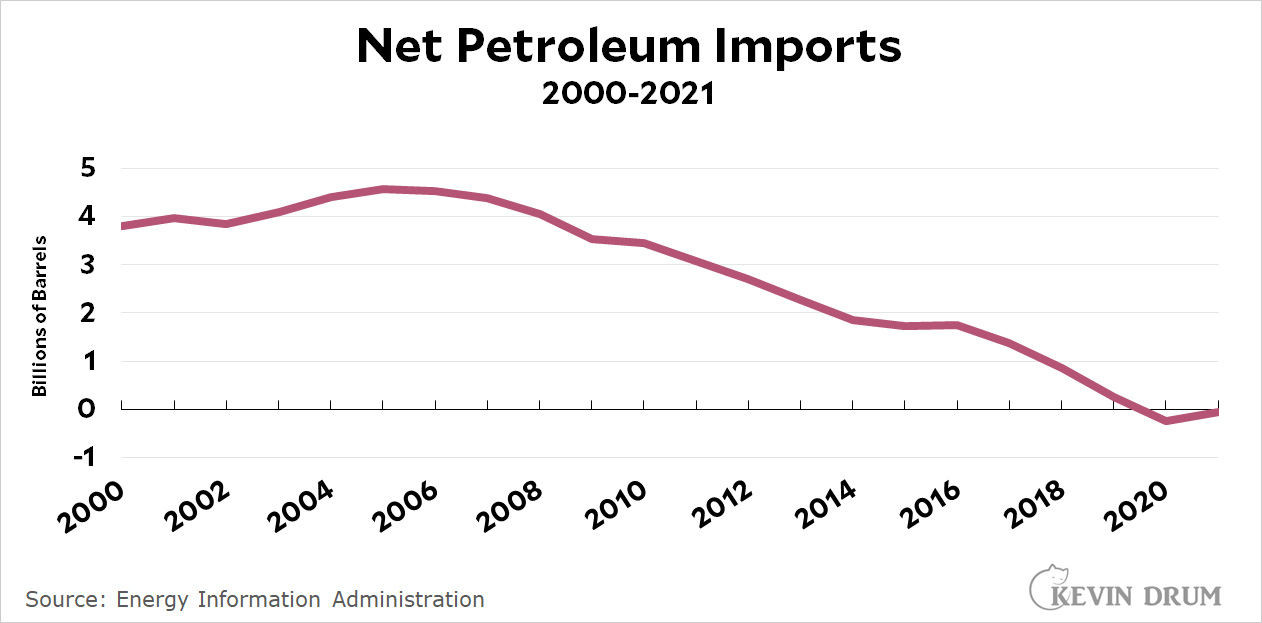

The United States is an energy independent nation. For convenience, we still import some oil, and for political reasons we still import a little bit of it from Saudi Arabia. But not because we need to. We could easily get along without any OPEC oil at all, which certainly broadens our retaliatory options.

The United States is an energy independent nation. For convenience, we still import some oil, and for political reasons we still import a little bit of it from Saudi Arabia. But not because we need to. We could easily get along without any OPEC oil at all, which certainly broadens our retaliatory options.

But there are a couple of other things to consider. First, Europe and Japan do still import a lot of OPEC oil. With natural gas supplies from Russia cut off, the last thing they need is to be bit players in a US decision to risk OPEC oil supplies as well.

Second, cutting oil production affects the world price. Even if we don't actually import any foreign oil, we still pay that world price, the same as everyone else. Generally speaking, higher prices are great news for Russia, OPEC, and oil companies. They're bad news for gasoline consumers and the politicians who get blamed for higher prices at the pump. It's also bad for the economy at a time when the Fed is already determined to throw us off a cliff.¹

So a cut in production (a) affects our allies, (b) helps Russia, and (c) slows a global economy that's already slumping. It is frankly unclear why OPEC would do this. It's also unclear (to me) why we're mostly hearing from the US about this rather than all the European countries who have a good deal more to be mad about.

In any case, the silver lining here is that if the economy is already slumping, that will probably cut demand for oil. This means that a small cut in OPEC production might have no real effect at all. We'll see.

¹Not that we can blame that on Saudi Arabia, mind you.

I think you need to take OPEC+ announcement with a grain of salt.

OPEC+ target shortfall:

July = 2.9 mb/d

Aug = 3.6 mb/d

Sep = 1.4 mb/d

If they cut their target by 2 mb/d, it's only a cut of 0.8 mb/d in real terms. They were falling far short of their targets even as prices were dropping.

It's also notable that the western (Euro/US/allies) price cap on Urals has had a real effect, in Sept. avg $85 compared to $100 WTI. It doesn't seem likely that this proposed cut will have much of an effect on the price of Urals.

pardon the bad math. 0.6 mb/d.

Because MBS is a tyrant and wants to kick Biden in the balls after Biden bent the knee.

Best reason to buy an electric vehicle--Telling OPEC to f**k off.

For real. I'm wondering how much of this is throwing around weight while they can. Global vehicle sales dropped in 2020, and now they're at the same level they were in 2012.

At the same time, electrics are growing quickly. In 2018, electric cars made up 2.6% of global car sales, by 2020 it was 4.9% of global car sales, a year later it was 10.3% of global car sales. We're in the going up really fast phase of the sigmoidal curve. (It might be a bit lower depending on cars vs. vehicles, but the numbers sold doubled between the years.) OPEC can read between the lines. They have eight years maximum until a solid majority of new car sales are electric, and a minimum of three years. 13 years after that, most of the cars in the market will have cycled out.

They'll squeeze while they can, but it won't be that long.

https://www.reuters.com/business/energy/around-10-paris-petrol-stations-having-problems-getting-enough-supplies-french-2022-10-07/

PARIS, Oct 7 (Reuters) - Around 10% of petrol stations in the Paris region are having problems getting enough fuel supplies, French government spokesman Olivier Veran said on Friday, as strikes at four TotalEnergies refineries continue for a tenth day.

Strike action and unplanned maintenance has taken offline more than 60% of France's refining capacity- or 740,000 barrels per day (bpd) - forcing the country to import more when global supply uncertainty has increased the cost.

This is probably a "self-defense" measure to the new price-ceiling strategy. They probably really hate the idea of a cartel of buyers opposing a cartel of sellers. Other than the US, how many of the oil-producing countries would have anything resembling a modern economy if they quit selling oil tomorrow? It's even worse, because they couldn't do something like the gas crisis without regime change in several member states.

I can't wait till EVs and other anti-climate change measures clean their clocks.

It is frankly unclear why OPEC would do this.

To help Republicans in next month's election and hurt Democrats. That's why.

Gas prices have been moving back upwards the last couple of weeks. That could be pretty bad for Democrats. Who knows what the election will turn on? And sure, who knows what the long term effect of a modest cut in production will mean? But short term? Is it too much of a leap to suppose the reaction of oil markets will exert upwards pressure on prices, and this will in turn mean US consumers will continue to see increases in the cost of filling the tank in the coming weeks?

Several of these Senate races have been tightening.

I drive an EV and don't pay attention to gas prices normally, but I hear about them every day on the news now. It's CA, where it's worse. But making gas prices top of news is clearly the agenda of the Saudis, the Russians, and Republicans.

What happens when oil companies take refineries offline an OPEC cuts production?

Avg. price of (regular) gas in Calif.

1 month ago: $6.392

Now: $5.279

+$1.113 per gallon

Avg. price of (regular) gas in US

1 month ago: $3.764

Now: $3.891

+$0.127 per gallon

Latest cutback not yet priced in. We'll see how much impact that has. In any case, no coincidence this is happening < 5 weeks before the midterms.

https://gasprices.aaa.com/?state=CA

I mixed up the CA prices. The difference is correct.

Corrected:

Avg. price of (regular) gas in Calif.

1 month ago: $5.279

Now: $6.392

+$1.113 per gallon

I never understood the "net imports = 0" thing. The us has been using petroleum at 20M barrels/day for about 30 years, with only small fluctuations. Production has fluctuated from about 6M bpd to about 13M bpd in the same period, with fluctuations based on price.

consumption: https://www.eia.gov/tools/faqs/faq.php?id=33&t=6

production: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS2&f=M

How am I doing the math wrong here? How do we get to net zero imports. Maybe Canada and Mexico don't count?

Capital, specifically Petro-Capital is angry and must be appeased. How else can a rabid, cornered animal be appeased except by giving it what it wants. Or you know...kill it.

"It is frankly unclear why OPEC would do this."

I can't tell if this is an awkward gloss to avoid bringing in different topics, or a simple statement.

Either way, no, it isn't. Pretty obvious, really.

This is from our world in data.

https://www.worldometers.info/oil/us-oil/

Net imports are 7M barrels/day. How does this reconcile with the data you show? Is there a difference between Oil and Petroleum that I don't understand?

You missed this bit on the worldometers figures:

"(Data shown is for 2016, the latest year with complete data in all categoreies)"

That's the risk of using non-official sites.

Here are the most up to date available numbers:

https://www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php

There is an inherent conflict on this issue for the Biden Administration.

- On the one hand, high oil prices seem to hurt politically.

- On the other hand, high oil prices likely helps his green agenda.

The more they raise price the more they cut own throats in the long term. Fine. In the end, it will be said "They did it to themselves."

OK,

I am sure someone knows why this is, but if a country, say, the US, produces enough of something so basic as oil, why do we pay the "world price?"

Its probably some capitalist advantage to multinational oil companies, but rising oil prices are such a pain in the ass for politicians you would think they would just regulate it.

A US corporation, such as an oil company, sells their product globally. If the US. say via regulation, forces the oil company to sell to American's as a deep discount then, one can assume, the oil company would just sell more in other markets for a higher price. Further, at some point the US oil company would transfer their headquarters to another country.

Final point, conceptually you could nationalize the oil company (the US government takes over the company). Of course the track record for that (lots of international examples) is very poor AND the US Supreme Court (it would be termed an unfair taking) would never support it.

So yes, US consumers buy gas at about the global price plus local taxes etc.

The way some countries that have nationalized their oil production handle this issue (world prices for oil), is to subsidize the price of fuel at the pump to make it cheaper for personal consumers, but costing the nation as a whole, and long term it leaves the country in deep economic holes (Venezuela and Mexico are two examples of this).

Another issue with oil production is that not all oils are the same. Depending on the refining capabilities of the country a country can produce a lot of oil of one kind but not have enough refining capacity for that kind of oil, and thus they export crude oil of one kind, and purchase crude oil of the one they can refine (like the US does to some extent). Highlighting once more why countries can't simply bypass the world market.

I've been in the woods for a couple of days and I'm sure this is too late for anyone to read, however, China has export taxes on various raw materials to ensure that Chinese manufacturers have an advantage due to reduced raw material prices. (What a damn long sentence; hope I'm not channeling Faulkner.) If the world price of brass is $3/lb and there's an export tax of $1/lb, you'll happily sell it domestically for anything over $2/lb. I've seen brass parts made in China being sold for less than the scrap value of the brass in the US.

There's no reason the US couldn't have export taxes on natural gas and petroleum to reduce internal prices. We won't because of a whole bunch of reasons that boil down to it isn't in the interest of some rich people.

As an American who's currently living in Kenya working for a humanitarian organization, I'd like to note that a rise in oil prices hits economically developing countries even harder than the US and Europe. Countries like Kenya, which is one of the more well-off countries in Africa, have already been hard hit by the rise in global food prices due to the Ukraine war, and a rise in oil prices will raise food and transport costs even higher. So many people already have to spend so much of their income on basic necessities -- it's infuriating to think of MBS squeezing the world's poor for selfish, political purposes and the likes of Trump and Putin. So the US finding a way to pressure Saudi Arabia into raising production will not only benefit U.S. consumers but the most vulnerable people all around the globe.

Europe could make it up by taxing the play palaces of Saudi princelings and limiting how many of them are really entitled to entry on a diplomatic passport.

I hope that this is true, but I'm wondering why Biden today said he'll release 10 million more barrels from the dwindling 'oil piggy bank' after OPEC's production cuts.

https://www.yahoo.com/finance/news/biden-says-hell-release-10-191500094.html