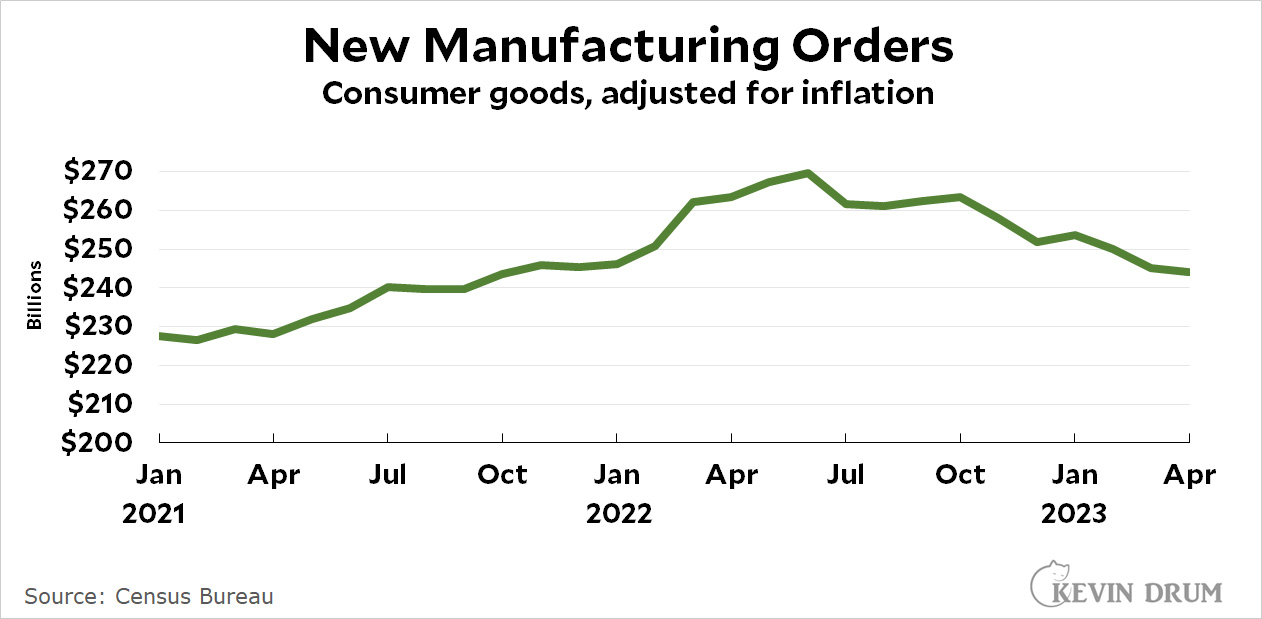

Adjusted for inflation, new manufacturing orders for consumer goods fell another 0.5% in April, continuing a decline that began a year ago:

Since June of 2022, new orders for consumer goods have declined nearly 10%. New orders for all manufactured goods have declined 5%.

Since June of 2022, new orders for consumer goods have declined nearly 10%. New orders for all manufactured goods have declined 5%.

I'm less concerned about this because inflation has been almost entirely on the price side - possibly at the final point of sale (although I have no reason to think that manufacturers wouldn't have gotten in on the price gouging as well). I don't think this is necessarily a bad thing for the economy as a whole.

Alternate headline: orders for consumer goods approach pre-pandemic trend after surging to unsustainable post-vaccine recovery levels.

But again, Kevin only looks at the pre-February 2020 trend when it suits his pre-determined narrative.

Looking at the full chart, it looks like you made that up. Irony? Bad faith? Both? Lol.

https://fred.stlouisfed.org/graph/fredgraph.png?g=15RCA

Now, look at credit card debt. Look at productivity. Powell is going to get his wish. I think post-pandemic exuberance will soon result in a recessionary hangover.

It's not that people don't want to buy stuff. It's that they aren't paid enough to buy stuff.

Nominally, new orders have increased two months straight. Lingering/ongoing effects of exogenous inflation can fool you as to the direction of the economy. As noted today by CNN:

Are you searching for data to fit your belief?