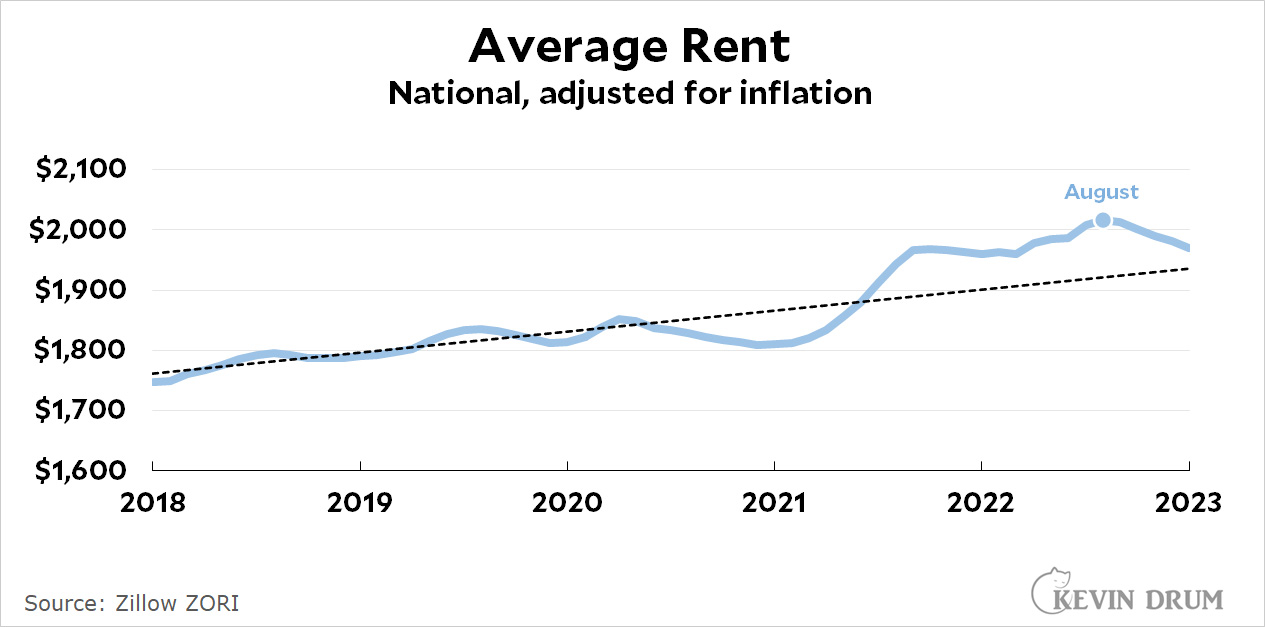

The Wall Street Journal reports that rents are falling. And indeed they are. Here's the Zillow ZORI index through January:

Rents peaked in August and have been falling ever since. The February numbers will be out shortly and will probably show that rents have almost completely reverted to their pre-pandemic trend.

Rents peaked in August and have been falling ever since. The February numbers will be out shortly and will probably show that rents have almost completely reverted to their pre-pandemic trend.

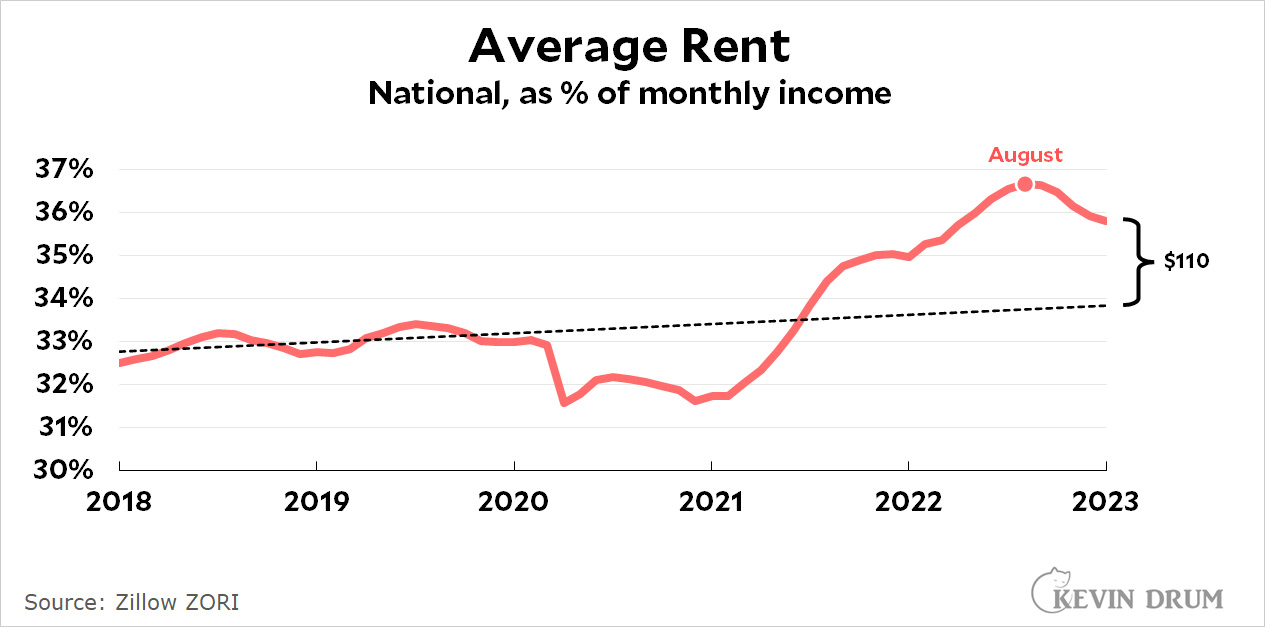

That's good news, but a little less good than it looks. Wages haven't been keeping up with inflation since the start of the pandemic, which means rentals are taking a bigger share of income than they did a few years ago:

In dollar terms, average rent is $110/month higher than it would be if it had followed the pre-pandemic trend. That's about $1,300 per year.

In dollar terms, average rent is $110/month higher than it would be if it had followed the pre-pandemic trend. That's about $1,300 per year.

I suspect your graphic, average rents, is missing an important variable: thus, the graphic, while accurate, is not telling the full story.

Typically, credit loss, the difference between the expected rent and the actual rent collected, is reasonably constraint: for example, in the market rate apartments I am familiar with, the average is a 5% credit loss.

During Covid, with the eviction moratoriums etc, the credit losses were 4 or more times larger than normal. Also, in many locations rent increases were prohibited. Further, not all the evictions, some dating back over a year, have made it through the court system.

Given the aforementioned dynamic, assuming demand is sufficient, many landlords are trying to recover losses incurred during Covid.

They're mostly using COVID (first) and inflation (second) as an excuse to extract higher profits.

Same as the other big corps.

And I don't want to hear from people talking about how mom-and-pop landlords outnumber the big development/landlord companies, and therefore profit-seeking isn't the motive behind the spike in rent because mom-and-pop places are more vulnerable to supply and demand (allegedly) and don't have big overheard costs to cover for (or shareholders to enrich). The big companies set the market that the little guys play in.

cmayo

"They're mostly using COVID (first) and inflation (second) as an excuse to extract higher profits." Is that not how capitalism works?

My point above, the charts Kevin present overstate how 'well' landlords are doing: many suffered large losses during Covid's eviction moratorium

Yes, it's how capitalism works - it extracts ever more wealth. The jumps in the chart are for seeking ever-higher profits, not simply making up for losses. Landlords used exogenous factors as cover to inflate rents as much as they thought the market (which is drastically under-supplied) would bear. The housing/rental market is not really a capitalist market anyway - it's highly protected.

"Many suffered large lossees" - please cite sources instead of regurgitating talking points.

This isn't really "rents are shrinking", it's more "inflation is going up and rents aren't going up as fast as overall inflation."

Rent is still going up. Also, rent is seasonal. It peaks in the summer every year, and does come down a bit. It's gonna have another bumpy peak that starts in 3-4 months and then drops slightly in 8-10 months. Also also, you can see in 2021 how landlords decided to really jack up prices simply because they could.

Note that the peaks and troughs of the chart as shown still show an upward trend.

Until we build millions of units of more housing (and in large enough batches to matter, not just 100 high-end units here and there with 10 "affordable" units thrown in, possibly only for the first few years), we're going to see rent (and home) prices continue to outpace everything else.

And given that we've turned the entire housing market into a financial market and investment commodity, it's probably the situation we're going to be in until it finally falls apart. But we'll keep using our national affluence to maintain that stupid construct for as long as we can before it blows up.