China's housing bubble is catching up to them:

A raft of data released Monday showed economic activity slowed across the board in July, including factory output, investment, consumer spending, youth hiring and real estate, highlighting the breadth of the economic challenge facing policy makers in a politically sensitive year for leader Xi Jinping, who is expected to break with recent precedent and seek a third term in power this fall.

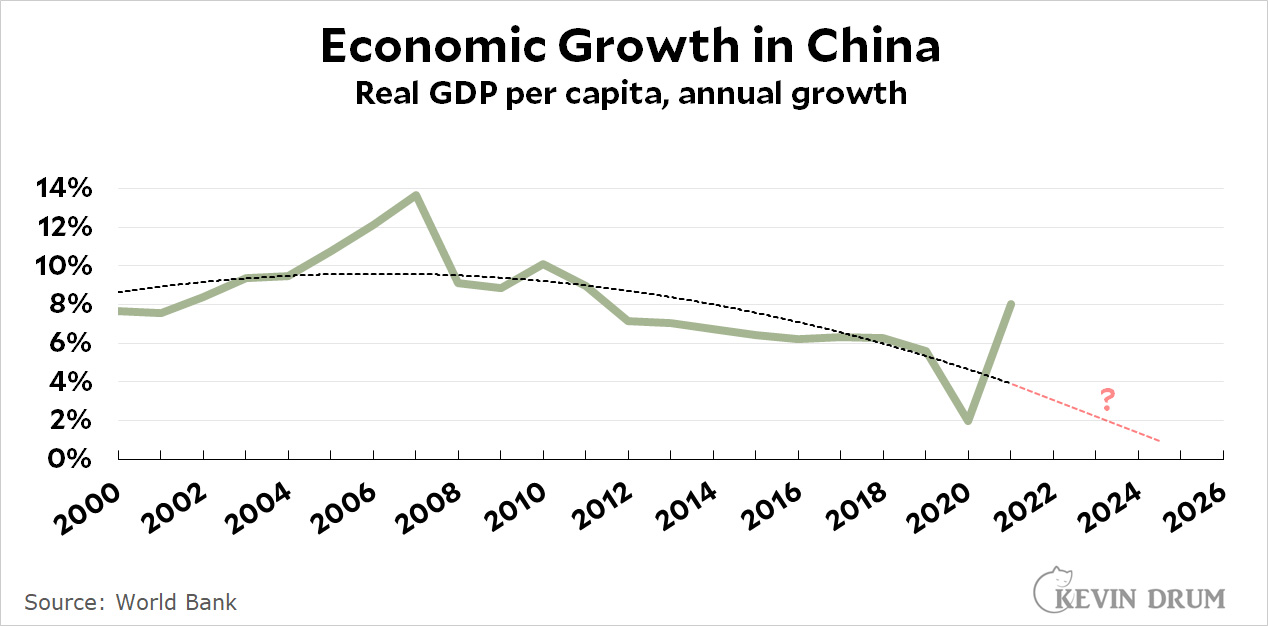

This is on top of a longer term slowdown in economic growth:

China has a very uncertain future. Their demographics are bad; their dependence on low-value manufacturing is bad; their obsession with Taiwan is bad; and Xi Jinping's brand of nationalistic autocracy is bad.

China has a very uncertain future. Their demographics are bad; their dependence on low-value manufacturing is bad; their obsession with Taiwan is bad; and Xi Jinping's brand of nationalistic autocracy is bad.

On the other hand, their educational system is good and their dedication to economic growth is good. Those might be enough to make up for everything else. Maybe.

Their educational system is fine, but not spectacular (and their rural education system is pretty bad). For a long time, they were basically rigging their education score by only including a select set of schools, especially "Beijing Public High School No.4" (the Eton of Chinese high schools, basically used by the elite).

Chinese croney capitalism may work better than the Russian version, but in the long term it is hard to believe it will be competitive on the world market.

In many ways they're already not "very competitive"—at least in tech and the more advanced sectors. When you look at areas where China and a Western (typically US) firms bump up against each other in a third party market, the Chinese firm is usually an also ran. Whos in the UK uses the Chinese equivalent of Netflix (there is one, but its name escapes, just like it escapes most global consumers). How about search? Who opts for Baidu over Google? How many outside of US/China opt for Weibo instead of Twitter? When's the last time you saw a Japanese tourist talking on a Huawei instead of an iPhone? How many Italians use Taobao instead of Amazon? How many Germans opt for Wechat* over Facebook? And so on.

Tiktok is the principal counter-example. But for my money, China's flabby, uncompetitive global firms are exhibit "A" as to why protectionism doesn't make sense. They coddle their firms from outside competition. And it shows!

*Too bad about that one: it's really much better than the execrable Facebook.

It can't help that so many people, me for instance, think of any Chinese tech product as an all-sucking Roomba of Chinese intelligence.

Weibo is Mandarin for Truth.

China is doing just fine: https://www.mondaq.com/china/patent/1203776/china-takes-global-lead-in-number-of-declared-5g-patents

The housing crisis there is taking a toll....and demographics means we can expect a deflationary stent in 10 years or so, like what happened in Japan.

Was talking with Chinese friends over the weekend and expressed much the same opinion that the economy looked bad, and they replied noting that the government had just shut down the economy of Shanghai for 2 months with no fear or repercussions. Their point being, the current leadership doesn't care much about economic growth. I'm not sure what to make of that, just noting it.

They're very concerned with economic growth. Very. They're just not as concerned with it as they are with holding onto power. The CCP prioritizes maintaining its authority over all other priorities, including the economy, including national security. Often those things are in alignment (a bad economy is a negative for the Party's authority, after all). But not always. And right now, they're (mainly Xi) afraid of a big flare-up in Covid. Rumor has it things may ease in November in terms of restrictions.

I'm vacationing in Qingdao right now, as it happens (utterly lovely city, for my money the prettiest and most relaxing in China), and had to wait in a queue for 35 minutes—87 degrees and 80% humidity—for my Covid test. Always nice when you're a tourist to have to do this sorta thing (no test and I won't be able to board the train back to Beijing).

Demographics are a very complicated subject work out all the possible social and economic dynamics in modern society to say simplistically say good, or bad.

One could argue that if China has "bad" demographics, then India is facing a nightmare for the opposite reasons.

One example:

A labor historian that I knew (retired now) used to point out to his students that fewer workers may weaken an economy - how much depends on improvements in productivity - but it also benefits the remaining workforce: higher wages and benefits, more clout with companies and in the marketplace.

It can also reduce the power of the rentier class.

Their dedication to economic growth starts and stops on official reports of economic growth. They have no foundations for sustained growth absent massive government supports, especially in housing. Housing growth is how many Chinese family invest and what they use for banking at the same time, since the government-owned banks would be unlikely to repay non-commercial customers in the event of a banking crisis.

This doesn't sound right. I think it's just the opposite: fly by night, small, private bank-ish institutions might stiff depositors. I very much doubt the big state-owned banking firms would do so (at least up to the deposit insurance limit).

Fly-by-night operations don't get licensed to operate, no matter how many brothers-in-law you have in Politburo or regional government. Remember, it's unregulated crony capitalism and kleptocracy at the top levels there and banks operate there. Banking and loans are either under-the-table, back-alley operations or major business...so mobster type stuff but at both ends of the spectrum.

And what's this "deposit insurance limit"? That sounds like capitalism, not "communism". Deposit insurance isn't a thing, nor are reserve requirements.

The PRC deposit insurance systems covers business and individual accounts up to 500,000 RMB. This has been in effect for about 6 years. There are also reserve requirements.

Reserve requirements it would seem they have been reducing: https://www.ceicdata.com/en/indicator/china/reserve-requirement-ratio

Right. The government is clearly concerned with recession.

Is it? https://www.statista.com/statistics/239093/co2-emissions-in-china/

The problem with data on the Chinese economy is simple: the data is created by the Chinese government....lets say not everyone believes the Chinese government

I see our middle of the road "Democrat" might actually be Haw-Haw Hawley's burner.

This shit is bussin, forreal forreal.

He has changed the law. Had he not done so, he'd be ineligible for another term.

How will they maintain economic growth when they out Ikea into lockdown… https://amp.cnn.com/cnn/2022/08/15/china/china-covid-shanghai-ikea-lockdown-intl-hnk/index.html

Is anyone familiar with Peter Zeihan's take, that China is in economic and demographic collapse, and that there won't be a unified China by the end of * this decade *? Don't know what to make of him or his pronouncements.

Zeihan is a bit surreal.

China’s Population Will be Halved by 2050

Literally can't happen. Real simple statistical analysis - it would require zero birth rate going forward, and everyone over 38 dead by 2050

China, in ten years, will not exist as a functional nation!

He goes with the combination of famine, economic collapse, and the world attacking China on various fronts.

Right....

He also doesn't bother to mention nuclear winter as a possibility, but that would have consequences that can't be spoken of.

Haven't tried to do the math, but it seemed a little questionable. And he's got that show-biz delivery style.

It's not nearly as bad as the "Great Leap Forward", nor as bad as Russia--though Xi is/has cracked down on wealthy businesses and their owners/CEO's, think Alibaba (which is owned by Softbank???)

With manufacturing moved to China, the incremental improvements that help make products better and cheaper are centered there. Rebuilding manufacturing here will take time because it takes time to learn the tricks of the trade.

But don't we already know the tricks of the trade? Manufacturing has been happening here for 100+ years.

Not sure why the China pessimism here. They’ve managed to navigate a catch-up economic growth transformation that exceeds anything in history. They have very high personal and economy-wide savings rate, investment rate, capital deepening… I think they’ll doubling and tripling US GDP growth rates within a couple years. (Not 4-8X like before though).

Sure they overbuilt some massive property developments, but it’ll be unwound much more easily than it would in capitalistic economies with democratic governments - instead of competing interests - banks, developers, consumers, regulatory agencies, politicians, lobbyists - fighting over who’s holding the bag, it’ll just get bailed out, propped up, floated… until it doesn’t matter anymore. They could bulldoze them and make everyone whole without breaking a sweat (but they don’t have to because there aren’t big incentives to complain, the opposite is true).

As far as low value manufacturing China is the biggest chip maker in the world, although the more complex ones for Apple, Nvidia, etc., are made elsewhere (TSMC in Taiwan apparently). But we’re all reading this on computers and phones made in China, it’s still the factory to the world. Everything is made there. Glueing Nikes together moved to Vietnam, Malaysia, Bangladesh years ago…

They could replace the entire student body of all of America’s flagship universities with Chinese nationals, and the average admittance test scores (SAT, etc.) would go up, significantly I bet. Not saying “better students” cuz what does that mean, but they outscore us on average, even in the English language.

I wouldn’t wanna live there - but expecting China’s economic decline from heavy-handed central planning/industrial policy, means you’ve been reading The Economist for too long. And expecting the ruling party’s collapse from a lack of democratic voice, people rising up against an oppressive regime, I think misreads the place.

Hard to know, but online buzz seems pretty excited to be lobbing missiles over Taiwan, sticking a finger in US’s eye. Their politicians know as well as ours that the plebes love an enemy.

No, GDP growth really has slumped dramatically. That's not a made up thing. And China's demographics really are awful. Mind you, if your population is shrinking, you can grow your economy very slowly and still increasing living standards in absolute terms. But the bottom line is the go-go days are over.

I'm not suggesting China's economy is going to collapse. Italy and Japan haven't "collapsed" either. But I do think it's clear the dreaded "middle income trap" has arrived (it's no longer something in the future), and doing the things to reverse it (big increases in immigration, much more economic openness, selling off moribund SOEs, increasing the retirement age, etc) are generally in conflict with the regime's desire for control.

The demographics fears are ridiculous, it’s GDP per capita that counts - if everyone has a bigger slice than last year, no one complains about the size of the pie. China’s growth is bound to slow, though: the high growth of past years was possible because they were starting from so far back. I found some data and estimates a few years back from which I calculated that coal miners in the US were 50 times as productive as miners in China. When you are using picks and shovels, you can take a Great Leap Forward at minimal expense by buying some dynamite. But each advance in technology comes dearer than the last - longwall miners are the cutting-edge technology (heh) of today, and they are big, complex and expensive. Once you have adopted the latest off-the-shelf technology, continued improvement requires investment in R&D, and invention. It’s just going to be slower and costlier.

The demographics fears are ridiculous, it’s GDP per capita that counts...

I think that's a fair statement if demographics had zero impact on economic growth per head. But most of the evidence suggests otherwise. This is likely because, invariably, a population that is stagnant or decreasing is a population characterized by an aging workforce and an unenviable dependency ratio. And this is bad for growth (yes, even growth per head). We see this illustrated clearly in the case of Japan*, say, or Italy, or sundry European states. We may well see it in the US, too (GDP per capita appears to be growing more slowly over the long term in in America than it did decades ago when the population was increasing more rapidly).

My own theory is that population growth—especially when it's relatively robust—exerts synergistic effects on productivity, because the constantly expanding capacity needed to accommodate greater numbers is accompanied by the happy byproduct of ensuring that an economy is constantly adding newer (and therefore more modern and improved) production facilities. In essence, an expanding population helps insure a base level of new capital investment that a sluggish or declining population is hard-pressed to emulate. Over time, this affects productivity and eventually per capita growth and living standards.

Mind you, even a perniciously slow rate of economic growth per capita isn't a crisis if you're already rich. But China's not yet rich!

*Japan's real GDP per capita is lower in dollar terms than in the year 2000! That's really an astonishing factoid. Sure, it's a nice place—and a perfectly rich country by world standards. But by high income country standards Japan isn't very, well, rich these days (S. Korea is now richer, for example), and has gone from being closer to Spain or Poland than to Singapore or the US. Relative poverty is higher in Japan than in much of Europe; real wages have been in decline, and so on.

https://www.macrotrends.net/countries/JPN/japan/gdp-per-capita#:~:text=Japan%20gdp%20per%20capita%20for,a%201.84%25%20increase%20from%202018.