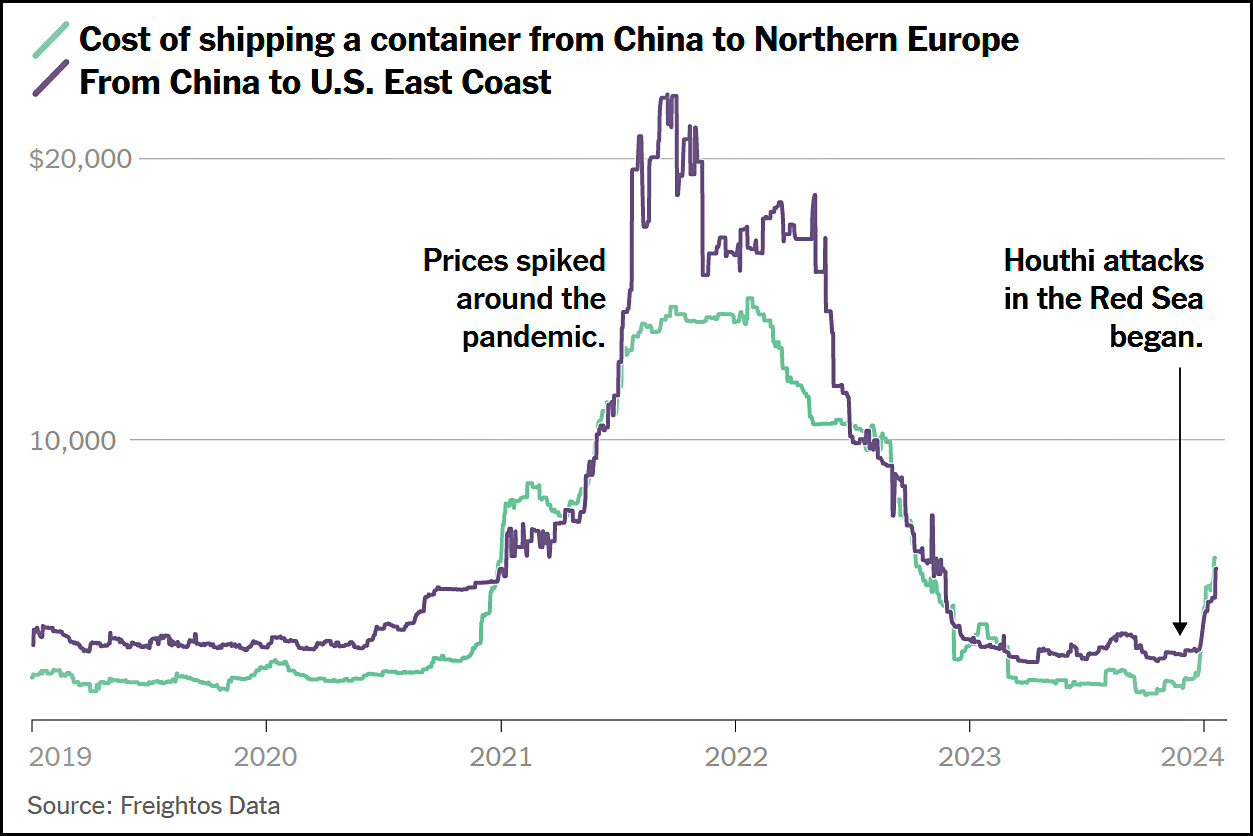

The New York Times has some pretty maps today showing how shipping through the Suez Canal is diverting around the Cape of Good Hope. They also have a chart showing how much this costs:

That doesn't look like an especially huge increase to me, but the chart was sourced to Freightos Data so I clicked around to see what they could tell me. Here are recent shipping costs:

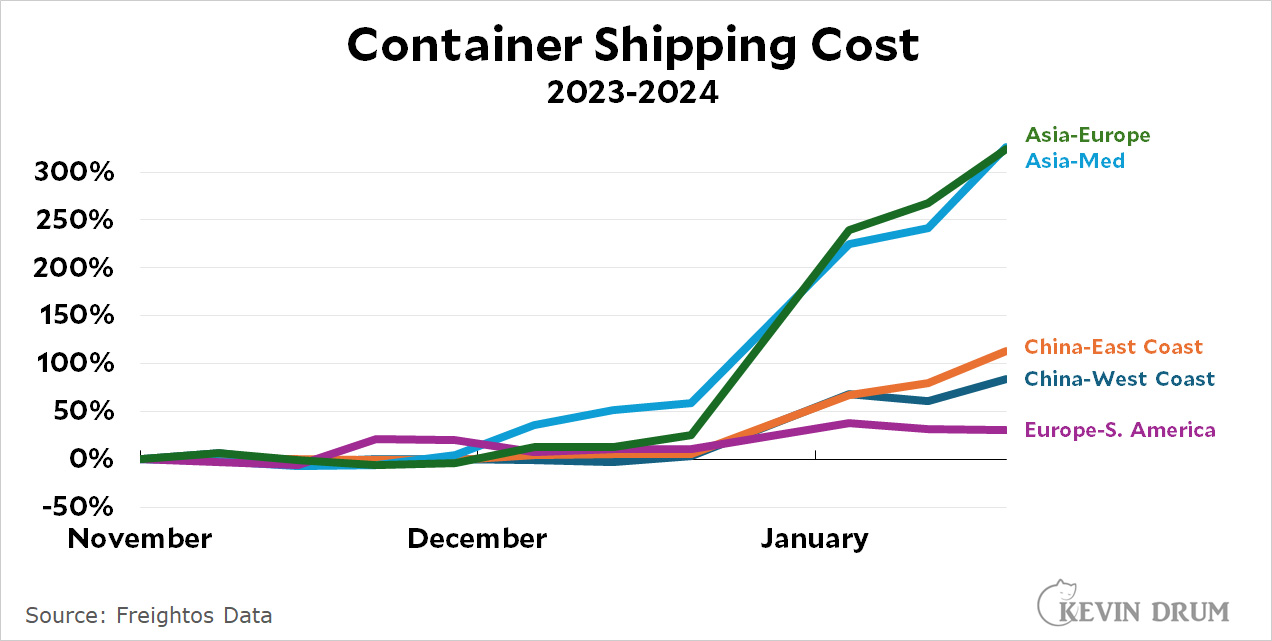

That doesn't look like an especially huge increase to me, but the chart was sourced to Freightos Data so I clicked around to see what they could tell me. Here are recent shipping costs:

The interesting thing is that although the biggest increases came in shipping diverted from the Suez, everything else surged too. The cost of shipping from China to the US west coast, which involves no canals at all, has nearly doubled. Shipment costs to the east coast have more than doubled. Even the short voyage from Europe to South America has gone up.

The interesting thing is that although the biggest increases came in shipping diverted from the Suez, everything else surged too. The cost of shipping from China to the US west coast, which involves no canals at all, has nearly doubled. Shipment costs to the east coast have more than doubled. Even the short voyage from Europe to South America has gone up.

I don't quite get this. I suppose that delays due to avoiding the Suez might be soaking up additional ships, which would have a knock-on effect everywhere, but that doesn't seem like enough to double rates.

But who knows? Spot shipping rates are notoriously volatile, so maybe this is just par for the course.

POSTSCRIPT: Freightos data is specifically for ocean freight only, which makes me wonder why they say a "key port" on the US west coast is Chicago. The last time I looked it was neither an ocean port nor on the west coast.

Chicago is the listed destination point for many containers landed at west coast ports but intended for eastern destinations. Train loads of containers are routed to Chicago where they are sorted for onward movement. One of the key metrics for west coast ports is how good their rail connections to Chicago are.

I am making 285 Dollars each hour for working online. I never thought that it was legit but my best friend earns 29,000 dollars every month doing this and nc03 she showed me how.

Check It............................. https://careersrevenue07.blogspot.com/

Not to mention that traditionally some ships made it up the Lawrence seaway, though I don't think Chicago has had much ship-shipping in a long time.

The Seaway has limited size capacity. The famous Edmund Fitzgerald was a max size Lakes boat, with 26,000 tons of cargo capacity. Ocean going container ships generally range from huge to enormous and have no chance of fitting in the Seaway's locks.

They use ORD for Chicago and LAX for LA, both airport symbols. And although the linked page is specifically for ocean containers, they say they're a "platform that spans thousands of global logistics providers, importers, airlines, ocean liners, and leading tech players." So it looks like the overall description includes air freight. And if lawnorder is right, they may be using ORD for all inland US destinations (from what I understand, there's an effort among some of the rail lines to avoid Chicago and develop alternate cross-country routes).

Just a further thought, but using ORD may be related to how Customs classifies these kinds of shipments, as well as how railroads and freight forwarders handle them. A lot of businesses have weird internal conventions that might not make a lot of sense from outside.

desantis drops out

https://www.nytimes.com/2024/01/21/us/politics/desantis-drops-out.html

The man with all the big money behind him couldn't make it as far as the first primary. Just one week after he was railing about Republicans kissing the ring, he kisses the ring.

Who could have seen that coming? Everybody!

Up next, the woman who says "we cannot have a president who is obsessed with dictators" will bow out and throw her support for a (former) president who is obsessed with dictators.

The 2024 campaign is the most deranged in memory and also the most boring, predictable, unsurprising campaign in American history. This is the way the Trump era ends, not with a bang but a ... but with a ... pardon me ... but with a yawn.

" ... but with a yawn."

Unless Biden has a serious health issue or the economy goes down for some reason.

I doubt there are many ships just sitting there waiting for cargoes to take-up the slack. So, you have presumably just as many things to be shipped, but fewer available slots by which to ship it. And for at least a fraction of that, it was stuff needed/wanted by a certain date. Constrained supply, not-constrained demand, prices rise. Or your goods sit waiting it out in a deepening queue.

Bingo--longer travel times ties up container ships. Fewer ships available, higher prices.

Agreed. I was in logistics. Longer trips in a major route means less capacity everywhere. Another supply shock. Not good for us that central banks cannot separate the supply shocks from the demand shocks!

"Freightos data is specifically for ocean freight only, which makes me wonder why they say a "key port" on the US west coast is Chicago. The last time I looked it was neither an ocean port nor on the west coast."

Shipping in the Great Lakes can move by locks and dams to the Atlantic, so technically Chicago is an ocean port, though that would the east coast, not the west. So most likely this is referring to lawnorder's point.

I have about 30 years of experience in ocean logistics and have worked with and for shipping companies like Maersk, so I can address this issue with some expertise. Your other commenter is correct that Chicago is a main inland hub for ocean freight. Ocean carriers are also responsible for the rail transportation and the customer is offered a bundled price for the entire move, so this is why Chicago shows up in ocean destination data, even though it isn’t a port. Some of the other commenters have correctly surmised that higher prices for trade lanes that don’t actually transit the Suez Canal are due to the supply and demand imbalance for both space on the ships and the ocean containers themselves. The longer transit times are having a trickle-down effect on both. If it takes you longer to get from point A to point B, then you have fewer sailings per month and therefore less space for cargo, so what you do have becomes more expensive. The same is true with the containers. If it take you longer to bring the empty containers back to Asia, then there are fewer of them and the cost goes up. The global fleet of both ships and containers is very interconnected.