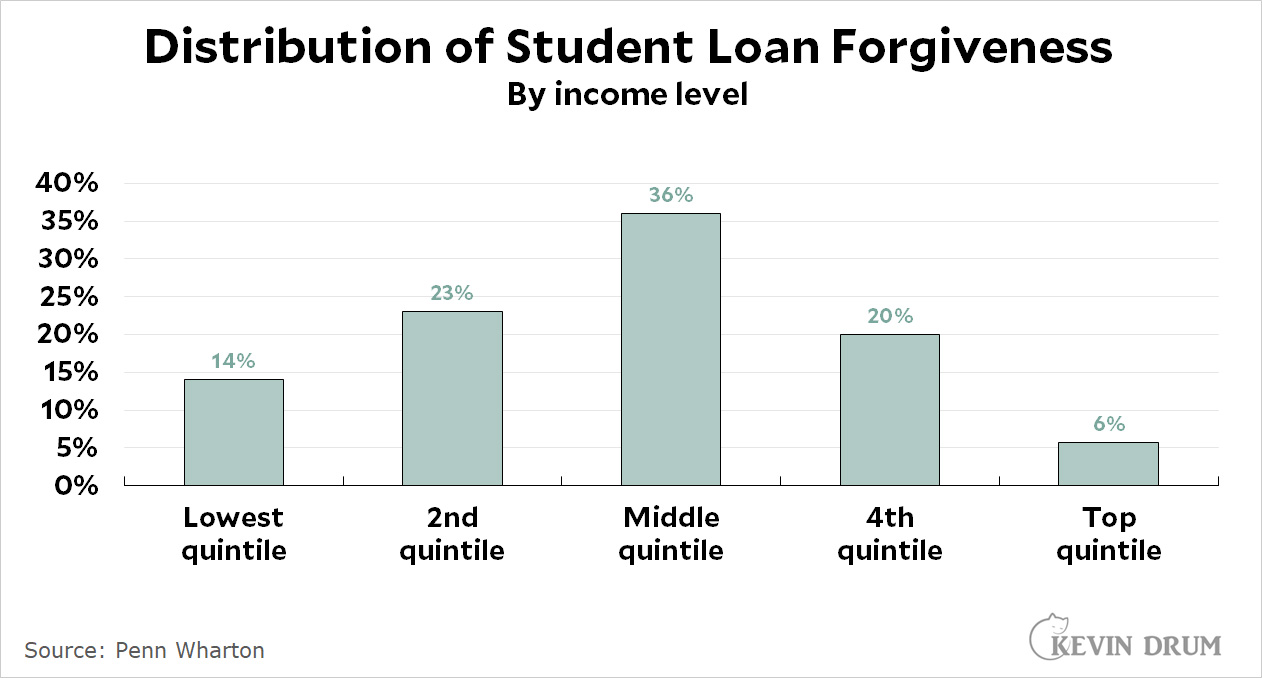

According to Penn Wharton, the distribution of benefits from President Biden's student loan forgiveness program looks like this:

About three-quarters of the benefit goes to working and middle-class families. One-quarter goes to the upper middle class.

About three-quarters of the benefit goes to working and middle-class families. One-quarter goes to the upper middle class.

Because it's paid for out of the general fund, which is mostly individual income tax receipts, the loan forgiveness program is funded almost entirely by the top quintile. The cost amounts to roughly $50 billion per year, or about 0.8% of the entire federal budget.

The White House has been kicking ass on congresscritters and their PPP loan forgiveness.

Not according to Drum's blog homey Meghan Mc Cardle!

So we're good, then.

While the chart is interesting, perhaps it is misleading: it only shows folks who have outstanding college debt.

Approximately, 50% of Americans never get any post high school education. Thus, half of all Americans, who typically earn less than the folks who go to college, don't directly benefit from this $300 billion (estimated ten year cost) executive decison.

How much you really care though.....When aca was expanded and infrastructure was passed. In the end, it's a pretty low amount and it goes off the party to party platform.

OK Liebermann.

You often write posts arguing that the Democratic party needs to do more for the middle class. Looks like they done right here.

I'm guessing this sort of mirrors the distribution of loans.

My guess is that the higher quintiles had a bigger share of the loans, but aren't getting as much relief.

Perhaps it is really the/some states which benefit: https://www.cnbc.com/amp/2022/08/26/13-states-may-hit-borrowers-with-state-tax-liability-on-forgiven-student-loans.html

I assume all the folks expressing such concern about distributional effects, the negative impact on those who paid off their loans (which is none) and leaving out those who don't go to college said exactly the same thing about the R tax cuts back 5 years ago which did exactly NOTHING for the lower quintiles and lavished virtually ALL of the benefits on the upper quintile.

https://www.washingtonpost.com/politics/2021/07/20/zombie-claim-2017-tax-cut-gave-83-percent-top-1-percent/

Ah yes Glenn Kessler the one who rated the claim that a ten year old in Ohio needed to go to Indiana to get an abortion as false.

https://www.levernews.com/emails-raise-questions-about-washpost-fact-checker/

I used to feel bad that I would confuse Glenns Kessler & Thrush, but that regret has passed after Kessler's stanning the Buckeye GQP to deny Democrat Party hysterics over Dobbs.

Likewise with my confusion of Ryans Grim & Knight. Similar reason, too, given that Ryan Grim confabulating the Tara Reade assault timeline, then turning around to white knight for Aaron Coleman, told you all you needed to know about the man's moral background. Really, at this point, Ryan Knight's hipster griftery is less embarrassing, in comparison.

Ol' Rape Denialist Glenn Kessler is where I go for the truth.

Bottomless Pinocchios forever!

This isn't quite the debunking you seem to think it is. From the wapo "fact check":

" “The 2027 tax tables produced by the nonpartisan Tax Policy Center (TPC) show 82.8 percent of the tax cuts will flow to the top 1 percent.”

The reason that statement is misleading, which it technically is, is explained

elsewhere in the same essay:

"budget gamesmanship means that the tax tables for 2027 are distorted. The corporate tax cuts stay intact, but virtually all of the tax cuts for individuals were canceled, as Republicans bet that political pressure to keep the individual tax cuts in place would force a future Congress to extend them.”

Seeing as how the GOP supporters of the tax cut bill and who almost certainly were assuming (certainly hoping) the tax cuts would be reinstated , are some of the same people crying about the "distributional effects" , I'd say the point censustaker1 makes holds up pretty well.

I wonder if the numbers also account for the fact that the wealthy get the most benefits of the corporate tax cuts albeit indirectly.

Not only is the income tax fairly progressive (meaning the tax burden of this tax cut—this initiative is essentially a tax cut—will shift toward the affluent) but the very people rightists are complaining about the most in terms of "unfair" gains—250k couples! future investment bankers! etc—are the very ones who are likely to be paying large sums to the Treasury the rest of their working lives, via the income tax.

I'm not a huge fan* of this loan forgiveness plan. I'd really like to see us pursue root and branch reform of higher ed finance at some point and this falls (very) far short on that score. But the "fairness" issue is typical right wing agitprop-pablum.

*Although I could yet become a big fan if it helps Democrats defeat Republicans; for now my single biggest concern is its electoral impact, although my reading of the early tea leaves suggests it may, on net, prove popular with most voters. We shall see!

Thank you, Chinese David Shor, for checking in!

What's the political model for how this translates to electoral votes?

- Is this going to be an on-going program? In which case we all want details...

OR

- Is it a one-time thing, doing nothing to change the systemic problems (credentialism, predator colleges, the crazy cost of college)? In which case why should my vote in the future depend on what has already happened?

The past is the past, votes aren't Thank You notes.

What's the political model for how this translates to electoral votes?

We don't know this plan will help Democrats politically. It's certainly possible it won't. But it's may help them, we'll have to wait and see: As Kevin has demonstrated, the bulk of the benefit goes to non-rich voters, and such people obviously hugely outnumber the affluent. Also, nearly every benefiting person will have family members who vote, so there's that, too. Plus, some fairly major revisions to repayment rules—there are policy details beyond the debt forgiveness component—will be an ongoing help to millions of voting Americans.