The LA Times reports that rental life is grim everywhere, but especially in California:

Minimum-wage workers shouldn't bother trying to find a two-bedroom apartment anywhere in the country.

According to a new federal report, "in no state, metropolitan area, or county in the U.S. can a worker earning the federal or prevailing state or local minimum wage afford a modest two-bedroom rental home at fair market rent by working a standard 40-hour work week."

....A California renter need to earn $42.25 an hour to afford a two-bedroom unit, the most in the nation, according to the study. The mean hourly wage for California renters is $33.67.

There's something to this. Not about the federal minimum wage, though, which currently affects only 1.2% of working adults. It's irrelevant to any serious discussion.

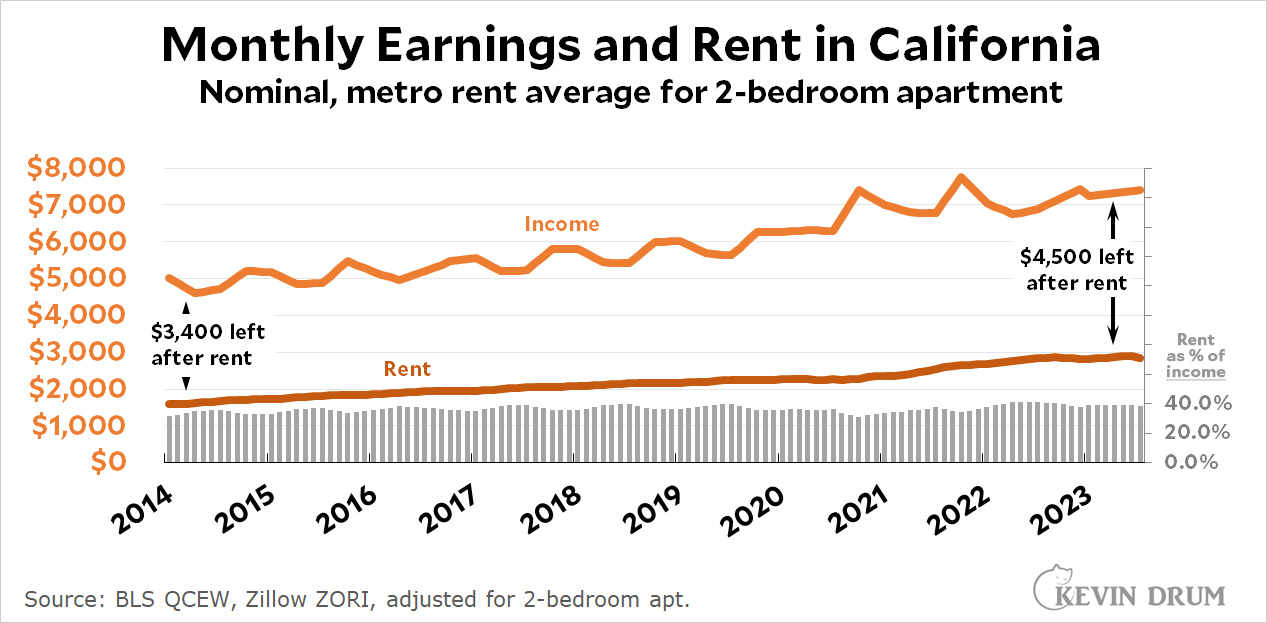

But rent in California is indeed very high, especially in metro areas. An average worker renting an average two-bedroom apartment in a metro area paid 32% of their monthly paycheck toward rent in 2014. Today it's more like 39%. On the other hand, there's also this:

The average worker today has $4,500 left after paying rent. Adjusted for inflation, this is about 4% higher than the $3,400 left over after paying rent a decade ago. The increase would be more if not for the overall decline in real wages over the past few years:

The average worker today has $4,500 left after paying rent. Adjusted for inflation, this is about 4% higher than the $3,400 left over after paying rent a decade ago. The increase would be more if not for the overall decline in real wages over the past few years:

California is the worst rental market in the country, but even here things haven't changed all that dramatically over the past ten years.

California is the worst rental market in the country, but even here things haven't changed all that dramatically over the past ten years.

How can you possibly talk about the decline in real wages since January 2021 without mentioning the huge spike in real wages during 2020?

So dishonest.

Wages since 2014 is in his first chart.

There are a few problems in your graphs that are contributing to your confirmation bias in this post (in addition to the one already pointed out).

First, there are some biases in the sample. (1) It's averages, and we know how averages get skewed by outliers on the top end. (2) On top of that, there is survivorship bias present here: as rents rise, only those with higher incomes can afford them.

Second, you're just going to literally ignore that average rents are ~50% higher 9 years later (from ~5K to ~7.5K), in nominal terms? That's insane.

And finally, there's this sentence which displays a fundamental lack of understanding about how price-setting for wages works: "Not about the federal minimum wage, though, which currently affects only 1.2% of working adults. It's irrelevant to any serious discussion."

That's even more insane. Just because only 1.2% of working adults are making exactly the minimum wage doesn't mean that there aren't substantial numbers of adults who are making 101-105% of the minimum wage, or 110% of the minimum wage, and so on. The minimum wage functions as a wage floor (duh!!!!). It helps to set the level of the wages that are earned by those just above the minimum, and those a step above that, and so on going up the ladder. This is why we use medians to look at these things.... which you haven't done here.

This is a completely unserious post written from a perspective of extreme financial (and housing) privilege that has gone unchecked. Check yourself.

I do wonder how different this chart would look with median income. of course, median rent would then need to be considered as well.

I know you're doing this in good faith, but based on my experience (even as I have lots of insulation from the hard knocks of CA housing), I continue to feel like your CA housing analysis is missing something crucial, but I so far cannot figure out what it is.

Speaking only for myself, the change was dramatic enough that I had to leave the state last year, and I have no hope of ever being financially able to return to my hometown in California. This, of course, is anecdotal, but I wonder how many others have the same anecdote to tell.

We live near a national park, so AirBnB has jacked up rents. A heartening trend is that a number of marginal motels and commercial buildings have been converted to apartments. The old Sportsman Motel is now Sportsman Apartments. I looked them up online. They're charging $900 for a studio with a studio apartment scale kitchen. You'd have to work full time and earn $16.20 an hour or more to have a place that costs 1/3 of one's income. Minimum wage is $15 and rising here, so this isn't an insane stretch. It's a block from two supermarkets and a bus stop. I can afford better, but it's nice to see. (I see a lot more cars parked there too. It wasn't doing all that well as a motel.)