The news is alive with reports that rent is skyrocketing and will continue to skyrocket next year. Apartment Guide reports that rents are up nearly 20% from last year, and double-digit increases are here to stay for at least the next couple of years. Zillow reports similar numbers.

But Apartment Guide also report that rents in my hometown of Irvine are up 36%, and this made me go hmmm. Irvine is certainly a high-rent kind of city, but that still seemed awfully steep. And the BLS reports that rents nationally were up only 2.7% in October.

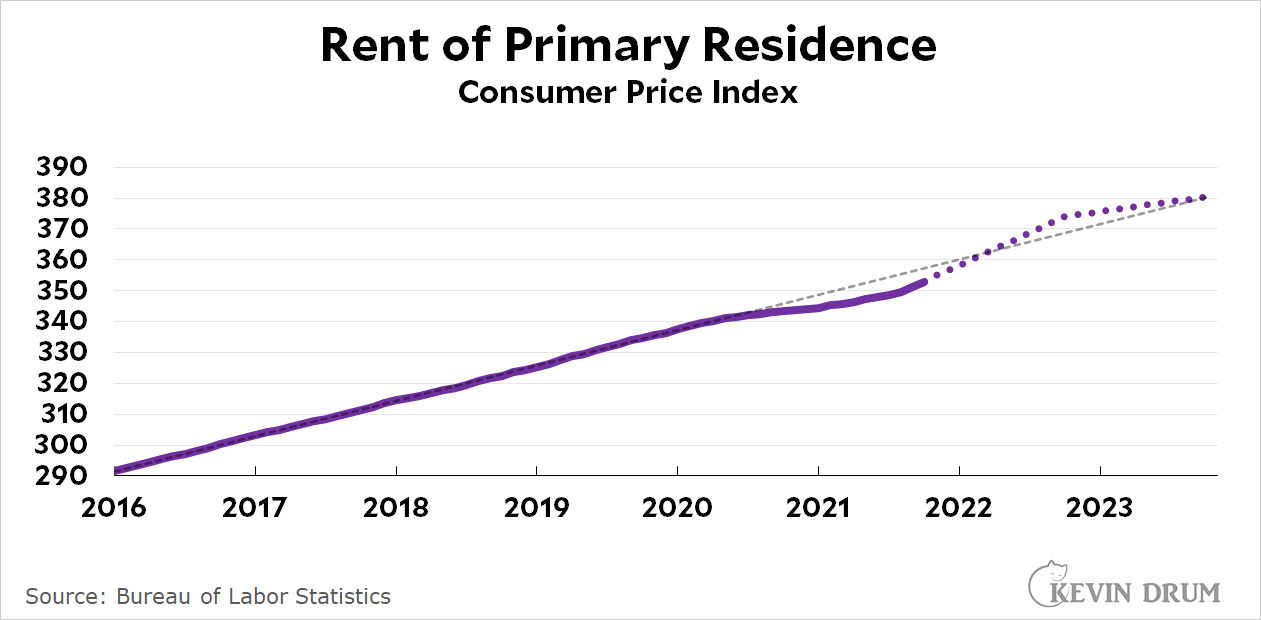

What's going on? As usual, it all depends on how you care to interpret the long-term trend. First of all, here's the BLS data for the past few years:

As you can see, rents nationally were increasing at an extremely steady rate of about 4% per year until the pandemic hit. At that point, rent increases slowed way down. So what's happening is that landlords are now trying to make up for their losses during the pandemic, which means a period of high rent growth for a while if the market can sustain it. Which apparently it can.

As you can see, rents nationally were increasing at an extremely steady rate of about 4% per year until the pandemic hit. At that point, rent increases slowed way down. So what's happening is that landlords are now trying to make up for their losses during the pandemic, which means a period of high rent growth for a while if the market can sustain it. Which apparently it can.

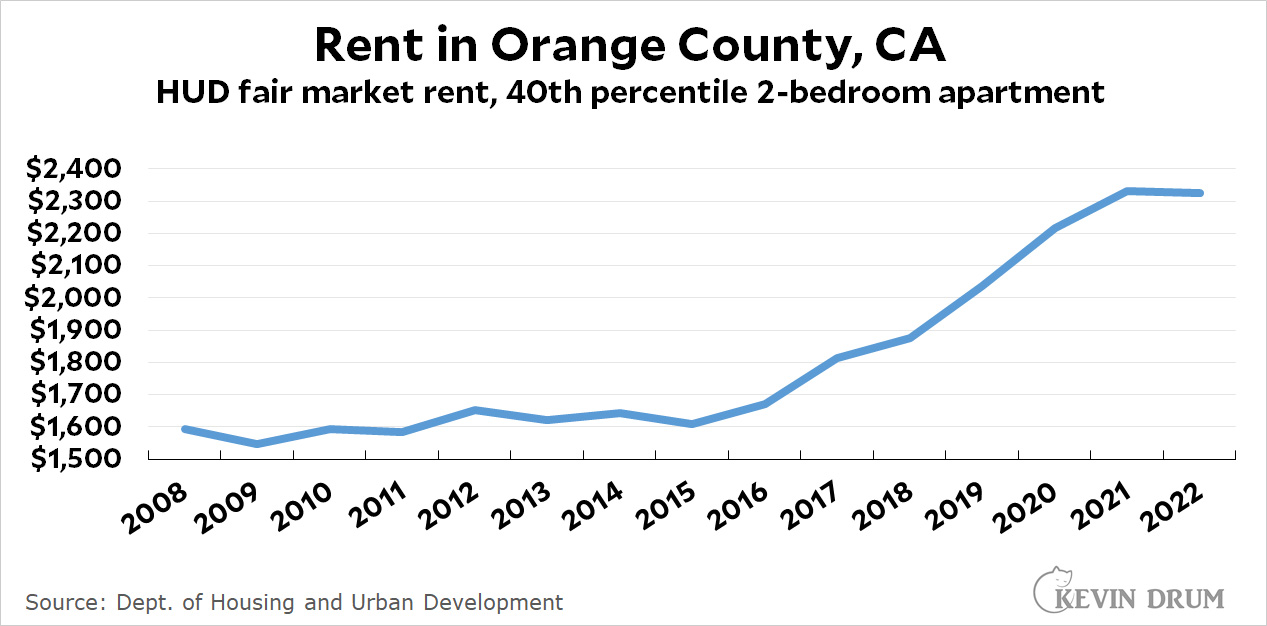

Nonetheless, this suggests something like 6-7% growth, not double-digit growth. So here's a different look at rents from the Department of Housing and Urban Development. They estimate "fair market rents" for every region in the country, so I went ahead and picked Orange County to look at:

HUD is interested in low-income rentals, so their estimate is for rent at the 40th percentile, a bit below the median. They show that after several years of stagnant rent growth, Orange County rents climbed substantially through 2021. No pandemic slowdown for us! But they also estimate that rents will be flat in 2022. Apparently Orange County landlords have reached the limit of the market's ability to absorb higher rents.

HUD is interested in low-income rentals, so their estimate is for rent at the 40th percentile, a bit below the median. They show that after several years of stagnant rent growth, Orange County rents climbed substantially through 2021. No pandemic slowdown for us! But they also estimate that rents will be flat in 2022. Apparently Orange County landlords have reached the limit of the market's ability to absorb higher rents.

There are a few lessons here:

- Nationally, rent increases were low during the pandemic and we're now making up for that. This means higher than normal rent increases for a year or two.

- "Higher than normal" seems like it means 6-7%, not double digits.

- Every region is different. Your region might well see double digit growth in rents. Or it might show no growth.

- And this is important: Landlords raise rents more on vacant apartments than they do for occupied apartments, and overall rent figures are an average of the two. HUD estimates that rent increases for new tenants are about a quarter higher than overall rent increases. So for people shopping around for new apartments, rent increases might be on the order of 7-9% nationally. Assuming HUD knows what it's talking about, that is.

Needless to say, none of this is set in stone. They're just estimates from different sources. But my guess is that most regions will see rent increases that are high but not skyrocketing. Maybe it will end up in double digits, but only barely.

Cometh the hour, cometh the man.

https://en.wikipedia.org/wiki/Rent_Is_Too_Damn_High_Party

I couldn't agree more Martin.

Which will not stop the NYT and other members of the MSM running breathless stories about soaring rents, featuring upper middle class people in NIMBY neighborhoods complaining about how hard it is to afford to rent a high-end dwelling in an expensive location.