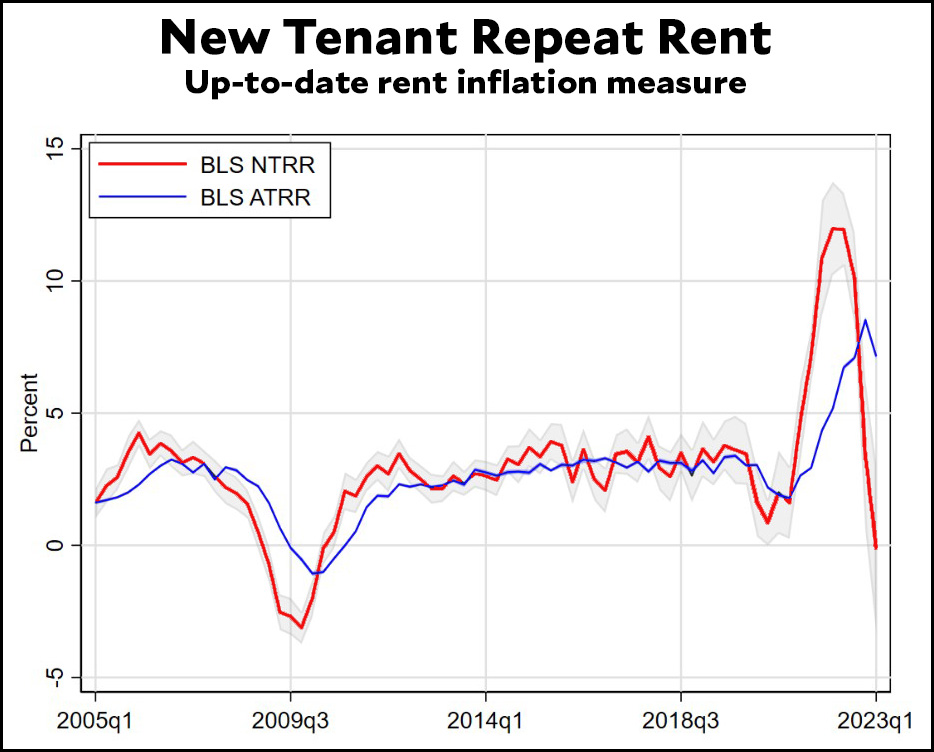

For technical reasons, the normal rent inflation measure from the BLS lags actual rent by 6-12 months. BLS has been investigating how to fix this, but in the meantime they've come up with an alternative measure that looks only at the rent paid by new renters. This index is released quarterly and leads the normal shelter inflation measure by 2-4 quarters. In other words, it measures rent right now, not a year ago. Here it is for the first quarter of 2023 (red line):

When rents are going up, new rent is generally higher than average rent (blue line), which includes people who are continuing to rent the same place and generally don't see big rent increases. You can see this in the big spike in 2022.

When rents are going up, new rent is generally higher than average rent (blue line), which includes people who are continuing to rent the same place and generally don't see big rent increases. You can see this in the big spike in 2022.

Conversely, when rents are moderating, new rent is generally lower than average rent as landlords compete for new tenants. You can see this in the recent plunge in rent inflation, which is 0% as of Q1.

Roughly speaking, when BLS calculates normal CPI inflation it uses the average rent shown in the blue line, which is hovering around 7% and has only barely started to turn down. In reality, rent inflation is zero. If the overall CPI (and PCE) inflation measures incorporated this, they would be significantly lower—and more accurate. This is probably one reason why the measures of underlying inflation that I posted yesterday are already more than a point below standard measures. The Fed should take notice.

It's clear as day, the pandemic bump, when the series is extended out several years, don't you think? Exogenous, yeah? So, maybe you could do that with other data series.

Still, the Fed is likely to raise rates at least one more time, given how hot the market is.

At least until the next sharp uptick, at which point pundits various would probably start pointing at the lagging indicator.

why would they do that?

The new renters rate does show where things are going, but doesn't reflect what everyone is currently paying.

This is true of most items in the inflation index.

The 'regular' CPI method of estimating housing costs certainly doesnt do a better job of identifying what everyone is paying each month for housing.

I’ve given Kevin a lot of flack about inflation and the Fed, but I want to completely associate myself with this post. Completely ok point.

It's almost like landlords used the pandemic as an excuse to hike prices simply because they could. For various reasons: housing is a replacement good and skyrocketing SFH prices meant there was more room for rent to increase, demand has been higher than supply for over a decade now, demand was already higher than supply in the most expensive places, etc.

It's also where a giant portion of the inflation came from - BLS literally said 70%+ of inflation was coming just from housing price increases.

Team transitory.

Looks like team transitory was right all along.

The inaccurate or misleading housing costs in the CPI calculation is something to keep in mind when you see income stats adjusted for CPI inflation. A more accurate inflation adjustment would likely show slightly lower real income in 2021/2022 and higher real income in 2023. Not a huge difference, but when splitting hairs to identify trends it would probably make a difference.