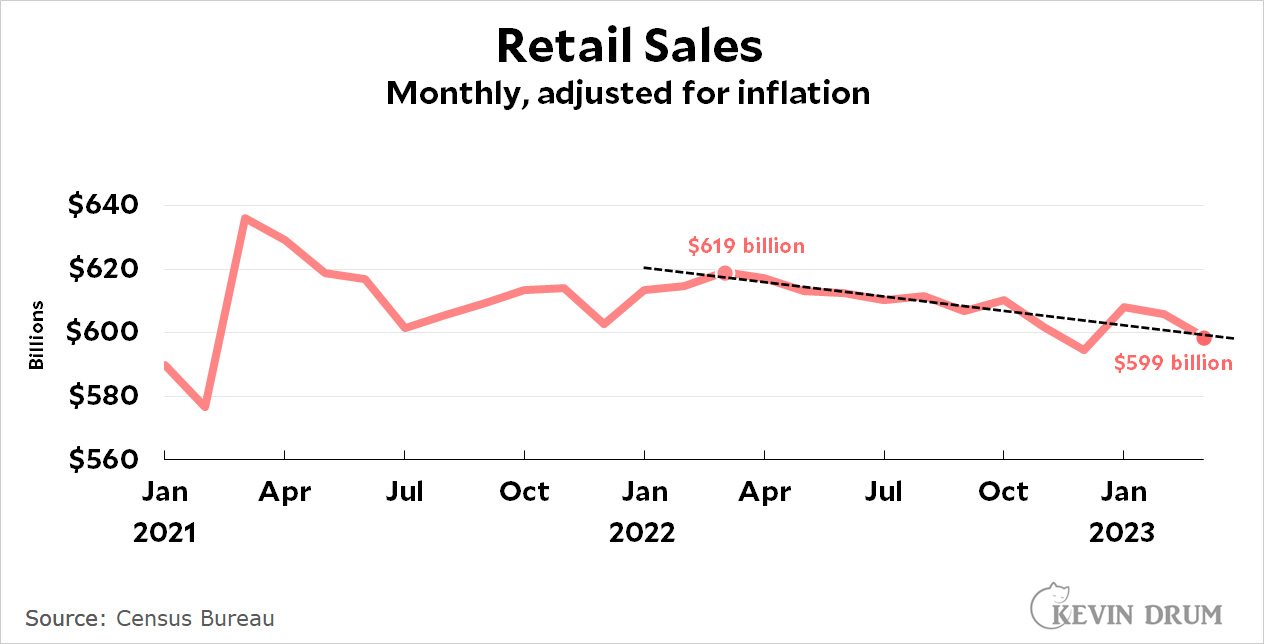

Retail sales fell once again, as they've done steadily for the past year:

Sales were down 1.2% from February to March. That's an annualized rate of 14%.

Sales were down 1.2% from February to March. That's an annualized rate of 14%.

But the Fed still thinks the economy is running too hot.

Cats, charts, and politics

Comments are closed.

So why the linear trend line here rather than the type Kevin uses these days for inflation?

Month to month change, as stated in the text. IIRC, that’s exactly how he’s analyzing inflation

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

Once you realize the Fed only cares about maintaining unemployment levels high enough to make the wealthier classes comfortable, it makes sense.

How reliable are these numbers? For example do they do a good job of capturing retail via the internet?

I could believe that, while there's some band-aid attempt to capture internet sales, it's still somewhat rough and ready and steadily drifting out of alignment with reality, especially if ever more sales happen through channels direct to small/home businesses, or to new types of internet businesses (like selling cars or similar high ticket items by internet).

Well, are the numbers below pre-pandemic levels yet??? In absolute terms of course--none of this fancy correction for inflation.

I honestly believe the Fed is lost or have their eyes covered and ears plugged. We need some new folks on that board!

I’m late to this but the dishonesty is once again shocking.

Kevin Drum, repeatedly:

“You have to show pre-pandemic trend lines through February 2020 in order to get a sense of whether things are back to normal.” (I am paraphrasing)

Kevin Drum, anytime he’s trying to make a point about inflation and this method doesn’t make his argument doesn’t work: “look at this chart that starts in January 2021.”

Disgraceful.