The Washington Post reports today on inflation:

“In the last few months, we’ve seen the shift away from trying to fight cost increases to pushing for [vendor] cost decreases,” said Bobby Gibbs, a partner in the retail and consumer goods division of the marketing consulting firm Oliver Wyman.

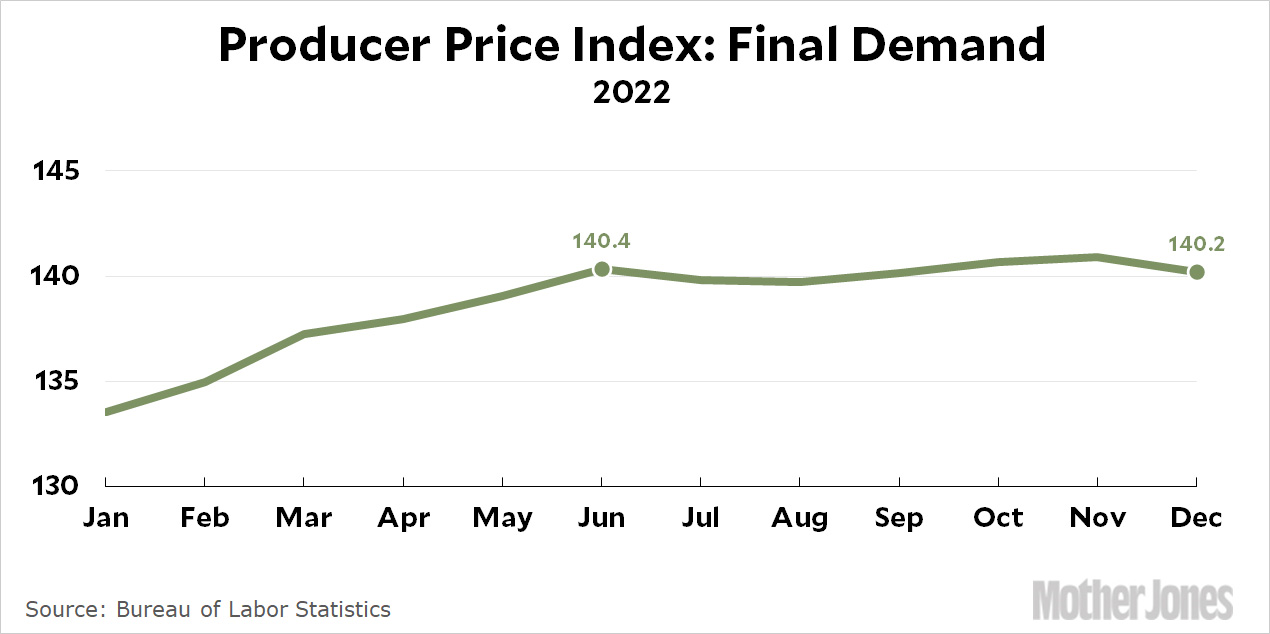

That's how it goes. When inflation is high, stores push their vendors for the smallest possible increases. When inflation has cooled off to nearly zero, they push for decreases. And wholesale inflation has actually been less than zero over the past six months:

That's a -0.3% annualized rate. Needless to say, this is an overall rate and it's different for different products. Food stores are still facing positive inflation rates, for example, while paint and hardware are down 4%.

That's a -0.3% annualized rate. Needless to say, this is an overall rate and it's different for different products. Food stores are still facing positive inflation rates, for example, while paint and hardware are down 4%.

Still, overall consumer inflation is at 1.9% over the past six months while wholesale inflation is at -0.3%. That negative wholesale inflation rate should feed into consumer inflation within a few months, pushing it even lower. What's more, rent is flat and those Fed interest rate hikes are going to start kicking in soon—both of which will also put downward pressure on inflation. At the moment, inflation is probably the least of our problems.

I'm starting to get pretty skeptical of the "will kick in soon" - I don't see why it hasn't already kicked in to a large degree. Every single refinance, construction loan, and new mortgage was hit by the higher rates. Every single person looking to buy (whether they currently own or not) has less room in their budget for things other than that future mortgage payment. I don't buy the argument that rate increases don't impact the economy for 6 to 12 months. GDP related to housing is 15%+ of GDP

In addition to expectation-setting, they have an immediate chilling impact for regular people. When you're talking about lots of regular people, that adds up.

Sure, the business/capital investment stuff might take half a year to show up (and maybe it's showing up now), but on the consumer side it shows up basically immediately or in a very short time.

it takes time because only a very small portion of the country got mortgages and loans so far. Most people haven't been affected by this yet. For instance, I'm in a position where even though interest rates are through the roof, I haven't purchased a home or gotten a loan of any size large enough to affect me. It's going to take time for this to really show up for everyone.

Yes, well aware of that - it doesn't impact current mortgages. Duh. I've had several.

But mortgages aren't the only thing it hits. Basically everything that uses an interest rate is impacted - and more so on the cost side for most people than on the savings side (know any savings accounts where the interest rate went up by as much as the fed raised the prime rate? didn't think so). When the prime rate goes up, so does the rate on pretty much every form of debt and leverage. Not all forms of debt and leverage are mortgages.

There's credit card rates - the total amount of credit card debt went up 18.5% from 2022 to 2023, according to CNBC... and payments on that amounts to almost 6% of national household income. It's other lines of credit (home, small business, etc.). It's car loans (a more frequent purchase than homes). It's student loans.

So there's the immediate impact (within a month or two) from all of those, and then there's the chilling effect. On the margins, fewer businesses are going to desire and/or be able to take out a short term line of credit. People will hold onto cars for longer. People will delay large purchases that they might have otherwise financed. It simply may no longer make sense, whereas it would have before when rates were lower. Note that these aren't necessarily bad things for the broader economy, but the point is that higher rates = more expensive financing = harder money = things move more slowly. Those things can and do have an impact much sooner than Kevin's 6 to 12 months proclamation.

I think we stuck around the zero lower bound for far too long, with easy/loose money for far too long, but I also think the Fed was far too aggressive in raising rates this much this quickly. And it's going to bite us in the ass in 2023 as they continue to do harm to the economy.

"I think we stuck around the zero lower bound for far too long, with easy/loose money for far too long, but I also think the Fed was far too aggressive in raising rates this much this quickly"

In LESS than 40 words you nailed the crux of the problem

ADD into that corporate greed and the fanatical desire to please stock holders and the problems become apparent.

Now, I'm NOT saying that companies should suffer to insure that consumers are not impacted - that is NOT capitalism - but how much profit is considered good?

Exxon Mobil made $20B in PROFITS

Chevron $11B

Shell $9.5B

BP made >$8B

In profits - not sales - profits.

When all is said and done the large corporations are making money and a variety of ways not always available to ordinary consumers - all the while using tax breaks not available to us.

It's no wonder many are calling for a roll back of the corporate tax cuts made by Bush and Trump. The problem is that those very same corporations will just pass THAT cost on to consumers.

It's a head scratcher for sure

I think it would be better to say we are filling some effects of the interest rate hikes now, but the full effect has yet to kick in.

Will economists have to invent a new word for steady prices and robust economic growth - the anti-stagflation? Whatever it is, I'm confident it will signal that this is still Jimmy Carter's second term.

Hasn't this been called a 'Goldilocks' economy? It's been so long since we had stable growth I'm not sure I'm remembering this right.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://createmaxwealth.blogspot.com

If inflation is pretty much non-existent and interest rates haven't yet kicked in, do you expect deflation?

My expectation is deflation won't happen because interest rates don't do anything for inflation.

I’ve gained only within four weeks by comfortably working part-time from home. Immediately when I had lost my last business, mtg I was very troubled and thankfully

following website___________ http://worksite76.blogspot.com/

Any chance that the "LisaHudgens" bot and its toxic links can be banned? Please?