Sen. Rick Scott got himself into the soup a few days ago by releasing a plan for the Republican Party that included, among other things, a tax proposal:

All Americans should pay some income tax to have skin in the game, even if a small amount. Currently over half of Americans pay no income tax.

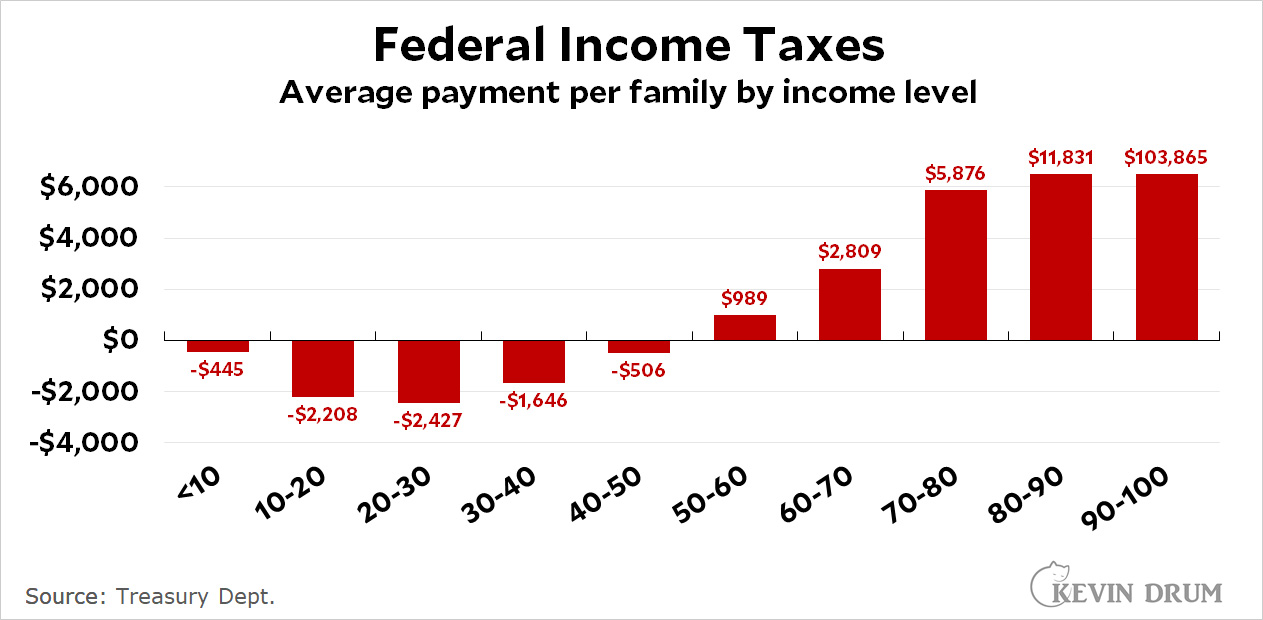

Mitch McConnell dressed down Scott today and his plan was DOA from the start. Still, it's worth understanding exactly what Scott was proposing. He says he wants everyone to pay at least a "small amount," but it's nowhere near as small as he thinks. Take a look at this chart showing the amount of federal income tax paid by families at different income levels:

The working poor, thanks to things like the EITC and the Child Tax Credit, often have a negative income tax bill. So a "small" amount—say a hundred dollars or so—is actually a tax increase of $2,000 or more. For some families it would be an increase of $5,000.

The working poor, thanks to things like the EITC and the Child Tax Credit, often have a negative income tax bill. So a "small" amount—say a hundred dollars or so—is actually a tax increase of $2,000 or more. For some families it would be an increase of $5,000.

That's a very, very big increase for a family with an income of $20-30,000. Rick Scott probably doesn't understand what his own proposal would do, but Mitch McConnell does and he wants no part of it. This is the risk in filling a plan with red meat talking points without bothering to figure out what they mean in real life.

Going after the "lucky duckies". I'm hoping some folks in here are old enough to know what I'm referring to. 🤣

We skew older, like Kevin himself. Conservatives like to bitch about the lucky duckies, but the majority are too dumb to realize they are lucky duckies, while the rich minority aren't about sign up to be lucky duckies.

Exactly! I believe the origin of the term was on the WSJ edit page, along with the idea that the poors need more “skin in the game”. Yeah, the main problem with being poor in America is that your life needs to be harder… truly the voice of the country club is back…

The poor have LOTS of "skin in the game", mostly their own, and not "financial" skin.

There is something wrong on the right hand side of your chart.

Badly wrong. Misplaced decimal point?

Yes off, but not a decimal point problem....

The last point is using the "Total Federal Taxes" column, not the individual income tax column, so it's 1848/17.8 not 1211/17.8 (then x 1000).

Nice to see you again. How are things?

I’m really glad to see that everyone in the Democratic Party leadership has been relentlessly pound Scott and demanding the every Republican candidate take a stand on this proposal. That’s how politics should be done.

Have Skeletor and Rick Scott ever been seen in the same spot at the same time? Just asking for a friend.

I hope that Mr. Scott's plan will become part of a "D" midterm campaign. The slogans write themselves.

I seriously doubt the Democratic consultant class would consider doing such a thing. Tarring Republicans like that would be uncouth and partisan.

If the data labels are accurate, my guess would be Kevin employed a truncated Y-axis to avoid the numbers from the higher percentiles swamping the rest.

As social security and medicare taxes, which are 15% employer and employee from wage dollar one, are very much “federal income taxes” even though not labeled as such, I’ve always felt this “bottom 50% pays no taxes” argument is a classic example of bad faith.

Scott and many Republicans want to end Medicare and Social Security, so there’s that.

I would like to end Rick Scott.

Don’t feed the troll.

Give him a mirror.

Well, “bottom 50% pays no taxes” is absurdly wrong. They pay sales taxes, gasoline taxes and, even if they rent, property taxes. But yes, even if you qualify it as "income taxes," anyone who draws a check pays FICA.

Ah, typical globalist Republicans stating their globalist agenda. Next is selling out federal, state and local properties to the billionaires.

Don’t feed the troll.

If he wants more people to pay taxes, he should come up with policies that would lead to more people making $50,000+.

Bonus: Demands for a tax cut would increase!!

Unions!!!

+10. What percentage of the population would be paying Federal income tax if wages had kept up with productivity, as they did in the era of private-sector unions?

I wouldn't opt for the numbers Rick Scott is calling for, but I've long thought we should take away this idiotic GOP talking point by making everyone subject to income tax. Maybe this isn't feasible given the existence of the EIC, but a low rate of, say, 3% on the first N dollars—rendered progressive by commensurate adjustments to the FICA tax—is the way to go in my view.

Everyone is subject to income tax, and that liability gets reduced through various deductions, esp. the fully refundable EIC, etc. And given help to the poor this way was a Republican idea. The help, esp. to families with children, is greater than their payroll taxes. An added problem--cutting their payroll taxes will cut their Social Security benefits later.

Now...companies should have to pay their share of the payroll tax on their entire payroll (no caps on the company side)...and include taxes on stock options too...

Everyone is subject to income tax...

While technically true, in practice it isn't because of the reasons you cite. The bottom line is a nontrivial percentage of Americans pay zero income tax. Republicans aren't actually wrong about this. Which lends the talking point credibility it doesn't merit.

An added problem--cutting their payroll taxes will cut their Social Security benefits later.

Not if we change the formula. I think we mess with FDR's masterpiece at our peril, mind you, but a modest adjustment (say, changing the wages subject to the FICA tax from the current 0=>147K to 9=>285K—or what have you—while making the necessary adjustments to make whole all who are eligible for SS benefits under the status quo) to cancel out the income tax burden might work. And then just send monthly checks to people with kids...

In any event our tax code is absurdly, harmfully complex.

The biggest group not subject to income tax are retirees living on just social security and pensions. You know, the people who vote every election. No Democratic politician who wants to be re-elected is going to propose raising taxes on them, even if some credit or deduction later on wipes out their tax.

And structuring a new minimum income tax in such a way that it hits-but-doesn’t-really-hurt poor people will just make tax forms even more complex, which your second comment also rails against.

Careful - you may have to pay income tax on your social security income if your pension or other retirement income is high enough.

From the aarp site (I looked for "Do I have to pay federal income tax on social security income") - they came up pretty near the top. They provide a simple example and state:

Careful - you may have to pay income tax on your social security income if your pension or other retirement income is high enough.

Rightfully so. It's income.

Then Republicans would campaign on a promise to eliminate income tax for retirees and the working class. Trying to take away idiotic right-wing talking points is whack-a-mole on speed.

Exactly. Once seniors discover they were among the ones not paying income tax, they are going to vote for whoever promises to get rid of that tax. And the GOP will be shameless and hypocritical enough to be the party of both “everyone should have to pay something” and also “but these good people should be exempted from all that.”

This complicated, technocratic approach would be a disaster. You've just invented three more talking points for the rightwing and the explanation would take far too long to be an effective rebuttal.

This complicated, technocratic approach would be a disaster. You've just invented three more talking points for the rightwing

I'm well aware the kind of tax code reform I'd like to see is pie in the sky. And sure, nothing can prevent Republicans from demogoging issues.

Nonetheless, what I'm proposing isn't complicated, and can be explained quite succinctly:

B) Everyone pays (at least a little) income tax;

B) Make Social Security fairer.

Simples!

The way to make more people subject to income tax is to require that employers pay a living wage. Note that if the minimum wage had kept up with productivity, it would be $26 by now $50,000/year for a full-time worker.

https://www.cbsnews.com/news/minimum-wage-26-dollars-economy-productivity/

Note that if the minimum wage had kept up with productivity, it would be $26 by now $50,000/year for a full-time worker.

I'm generally sympathetic to the idea of raising the minimum wage. But there are limits. The reality is not all sectors have "kept up with productivity." There really are a nontrivial numbers of jobs that would be eliminated with a $26 minimum wage. Also, not all kinds of jobs are an appropriate fit for full-time workers (especially those with families). If you're going to have kids, it's probably best to wait until you've moved up the ladder from 711 clerk.

Would such an approach leave some people (including plenty of parents) in the cold? Absolutely, which is why we should be sending money to families, and providing quality, universal healthcare coverage for all. And universal, free or low-cost childcare, too.

Trying to force firms to do the job that should be done by society as a whole (aka the public sector) is an exercise in futility, and is a big part of the reason America's political economy is such a shitshow.

the problem with rick scott is that he thinks everybody can just file a fraudulent medicare claim or two anytime they need a few bucks, just like he did back in the day.

+10

47th percentile heaven.

A joint Stephen Collins-Jim Jordan production.

This is extremely off topic my I wanted to acknowledge that a guess I made about Putin’s strategy was apparently wrong. It appears that the next country on Putin’s shopping list was neither Georgia nor Poland as I’d predicted but rather was Moldova. We know this because the president for life of Belorussia is a brutal thug but also evidently a complete moron.

https://www.mediaite.com/news/belarusian-president-shares-detailed-battle-map-that-appears-to-suggest-russia-could-invade-moldova-next/

Someone left him unattended with a Sharpie?

He is obviously unfamiliar with the concept of secret invasion plans. Also, I think I mentioned that he is a moron.

From the maps I saw, it looked like there were Russian troops in Moldova--but turns out they were in a breakaway region, Transnistria...

https://www.theguardian.com/world/2022/mar/01/russias-war-in-ukraine-complete-guide-in-maps-video-and-pictures

I said it would be Moldova. Tiny nation, not part of NATO, shares big border with Ukraine. Following this, he'd go after the Baltics. Making Ukraine a quagmire for Putin is the key to stopping his plan to put back together the USSR.

"Following this, he'd go after the Baltics."

All three are NATO countries. That's different from Ukraine, Georgia, Chechnia and Moldova. Putin intends to invade a NATO country? Isn't that exactly what NATO was created to oppose?

Yes to both questions. But flash back to a week ago or so. KD implied that the US/NATO would hesitate to defend a small nation in NATO, such as Montenegro or the Baltic nations. A lot of people have the same assumption, which probably includes Putin.

That's my reasoning.

And if Putin hadn’t allowed Biden to steal the 2020 election by the sneaky and totally unpresidented strategy of getting way more popular and electoral votes, he could have had all that choice Baltic real estate.

Russia should trust this guy with all their plans, he understands communication.

And, what's with the insert of the US and Canada in the upper right corner?

upper left corner,

https://twitter.com/peedutuisk/status/1498771564703240192

These are not Rick Scott's proposals. They constitute the policy agenda of the Trump Republican Party senators, and should be described as such.

Among the gems is one that would wreck US society overnight and cause a massive global depression: "Prohibit debt ceiling increases absent a declaration of war." I really think Americans deserve to be told more forcefully that this is what Trump Republicans aspire to do if they gain power.

We’ve been at war with someone for the vast majority of my lifetime. I don’t think that’s going to be a big hurdle to overcome for future presidents or Congresses.

The language is ‘declaration of war’. We haven’t declared war on anyone since June 5,1942.

The question is, how would he accomplish this? Lower the AMT threshold to $1 in earnings? Eliminate the lower two brackets and incorporate the 22% rate to all earnings below $86K?

No matter what he does, except if he finds a convoluted method that requires additional paperwork and expansion of the 1040EZ, he's going to end up raising the taxes for middle-class earners, too.

I think the theory is that if your taxable income of your 1040 or equivalent is zero, the last line of your 1040 or equivalent will prompt you to write in $1 or whatever owed instead of letting you calculate any refunds or write in $0 owed in taxes. That’s not too complicated, but it will piss off the largest beneficiary of $0 or negative taxable income, aka senior citizens living solely on social security and retirement plans.

Social Security benefits are considered income, but below $25K is non-taxable.

The two targets are those who (a) offset their income w/ deductions/credits/etc., and (b) the truly impoverished. The AMT was meant to capture some tax from group (a). That leaves just the truly impoverished who are being targeted by Rick Scott.

I think this is Rick Scott's subversive attempt to exacerbate the homeless population in blue states, frankly.

Well, Rick Scott is pure, unadulterated evil, so it's expected he would steal candy from babies. No, really, he's evil. He even looks like Skeletor. Evil.

Retirees are not going to like this. Bring it on, Ricky.