Republicans have recently backburnered the notion of cutting Social Security benefits, so Politico reports that some Democrats are telling Joe Biden to broaden the fight:

Progressives have pitched Biden officials and Democratic leaders in recent months on endorsing a plan to expand Americans’ Social Security benefits, according to several people involved in the informal discussions.

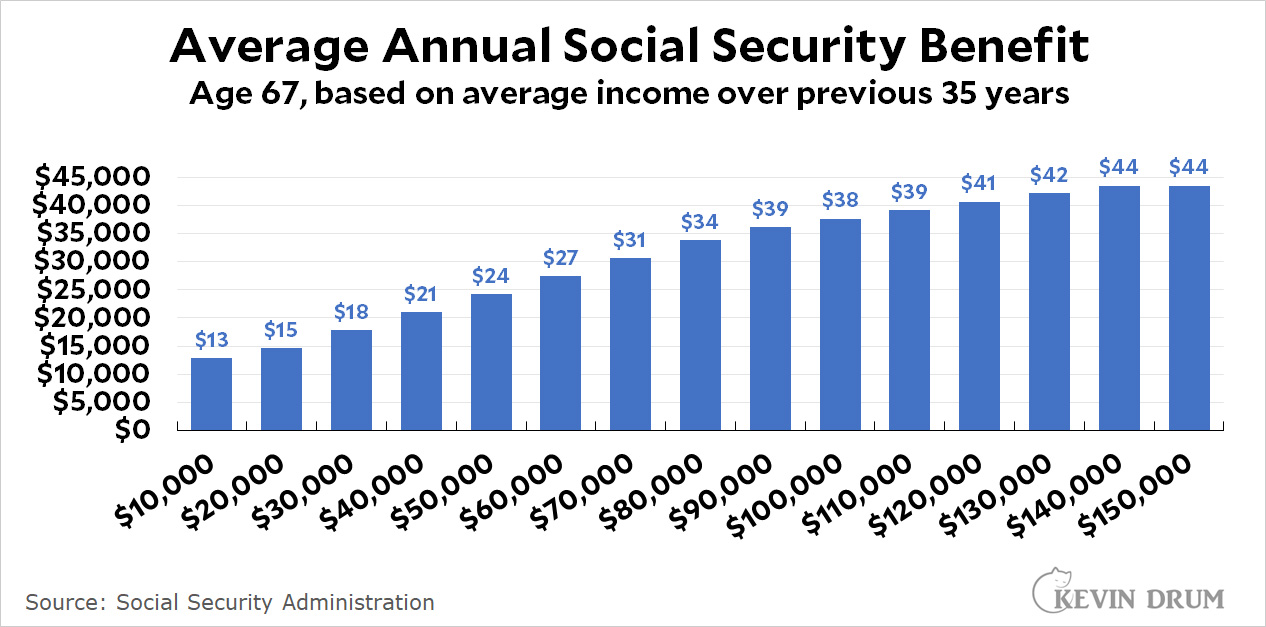

Here is the average annual Social Security benefit for someone who retires at age 67, the current full retirement age:

The median income in the US is currently about $40,000, which translates to a Social Security benefit of $21,000 per year. What do you think? Is that enough?

The median income in the US is currently about $40,000, which translates to a Social Security benefit of $21,000 per year. What do you think? Is that enough?

I hate to say it, but progressives are wrong on this one. The first thing we need to do is ensure that SS benefits survive beyond about 2035 at current levels. Until we fix that, all other discussions should be off the table.

It's possible to do more than one thing at a time.

It's possible to do more than one thing at a time.

Exactly. And, in answer to Kevin's question: yes, we should increase Social Security benefits.

I personally don't think they need to be bumped up for new retirees. But it would make sense, I believe, to increase benefits for those "unlucky" enough to make it into their late 70s. Outliving one's benefits is a real problem for less affluent retires because annual increases only keep up with inflation, not with the broad expansion of living standards. Also, doing paid work to supplement one's income become progressively more difficult as one ages.

We ought to substantially increase the payroll tax earnings cap and plow, say, 50% of the proceeds into such a benefits increase (in highly progressive fashion; obviously octagenarian billionaires don't need a boost) to retirees over 75. The other half can be used to shore up the program's overall fiscal strength.

So basically, welfare for really old people. Yeah, that'll go over well with about 50-75% of the population that hates paying taxes for things they themselves will never get. Just raise the monthly benefit, raise the cap on income taxed, and give it to everyone. That's the simplest solution which alienates almost nobody. (Virtually everybody except the rich loves bigger social security checks.)

I think increasing benefits for everyone who reaches a certain age would indeed be popular. I'm glad you agree! Also, the tax increase I suggest would go in part toward shoring up the program's finances. That benefits all Americans.

By "welfare", you're trying to delegitimize SS and Medicare as bennies for the so-called "idle poor." Call them "earned benefits" and the whole perspective changes.

(And "idle poor" is a loaded inaccurate slam, probably devised to detract from the very real phenenomon of the "idle rich.")

"It's possible to do more than one thing at a time."

With Donald Trump, our once and future President, it will be impossible to do even one thing.

Given political realities in this country, this post by Kevin crosses the line into fantasy.

How about we do three things at once?

1) Roll back full Social Security to 65. (The people who moved it to 67 are people who do not need Social Security)

2) Increase the minimum payment to $2000 a month.

3) Increase the taxable amount subject to FICA to One Million Dollars. (Both W-2 and Interest and Dividends.)

Yes, the GOP will oppose it. But they will oppose anything.

Your (3) is good! But it needs to be broadened to not just include "wages." The top tiers can take all of their income via a lot of different financing maneuvers. Or they might just be living off capital gains or dividends or interest. Major payroll tax avoidance schemes ought to be included in the income that SS and Medicare are deducted from.

Highly agree with you. And Tigershark, too.

Can we at least stop pretending raising the taxable income amount to "One Million Dollars" is easy. If you are self employed, which I am guessing accounts for a substantial percentage of the individuals over the current income limit, that amounts to a full 15.3% FICA tax rate on every dollar over the limit [12.4% for Social Security tax and 2.9% for Medicare]. That is a big hit on the near rich.

I don't actually have much sympathy for the near rich. Would I happily pay 15.3% if I could earn a million a year? In a heartbeat.

Actually, if you are self-employed there is a deduction your 1040 for the portion you pay as employer that reduces the bite.

We have the temporary problem of the boomer bulge to get through. By 2035 that cohort will be dying off, with the next ones much smaller.

We should not fall for the idea that benefits must be cut now, because the problem is temporary but the cuts are likely to be permanent.

As has been discussed here many times, it would not take much of a tax rise to get through the boomer era.

To all those saying "we can do two things at once", we can't even do this right now. The Republicans are locked into a "no new taxes" pledge and the Democrats are locked into a no tax increases on people making less than $400K. There is not much room for fixing SS PERIOD, unless both parties come off their high horses.

We have to do the necessary before we can do the aspirational.

When we're talking about the necessary, giving the Democrats clear majorities, filibuster proof in the Senate, is obviously necessary. Without that, even the one thing you want first is impossible. The Republican approach to putting SS on a sound financial footing is to cut benefits until the books balance.

.. and then cut taxes so the books are unbalanced again. Rinse, repeat.

The anti-abortion movement fought Roe v. Wade for fifty years, both in the courts and in legislatures across the country. They repeatedly pushed legislation that had no chance of passage, and repeatedly spent millions of dollars pursuing court challenges that failed.

In their 50 years of trying to ban abortion, they didn't say "we can't even do one thing." They fought in courts. They worked with the Federalist Society to find and support future judges who would rule in their favor. They got politicians elected who placed restrictions on abortion, threw up artificial barriers, authorized the creation of an entirely new kind of "clinic" where people could be advised against abortion, passed new regulations to restrict the practice of doctors who administered the procedures... all while trying to pass total bans.

In some states, they've lost utterly and continue to lose. Some passed laws that are extreme and very limiting. And it's likely that, across the course of history, this is a losing action for them. But they accomplished what they did by having a simple and clear objective and by trying to achieve their aspirations while also going for anything they could get. Every loss was a rallying cry to keep fighting, and every victory proved that they could win.

And banning abortion was never popular: Pew Research says that from 1995 to now, 44% was the highest support for banning abortion in "all or most cases" and the supporting side has been mainly above 50% across that period.

You have to try to do what you want, and THEN compromise as a step towards getting it. If you only ever aim for the achievable, you will never discover that your estimate of what you could achieve was wrong. And if these issues aren't important enough to try for, what is?

Easily done by removing the payroll tax cap.

That used to be true. We have waited so long that it no longer fixes the problem for any extended period of time. Removing the cap fixes it for at most a couple of decades. If that action had been taken a decade ago it would have worked.

That makes a great slogan, but do you have the numbers to back it up? Show your work.

Why not do both in a single fix? Increase the payroll tax income cap to donate while maintaining the benefit income cap and the SS system is secure for a long time if not forever. Raise the payroll tax income cap enough and you can also increase benefits.

Solved.

When Biden was running for President, he said that he wanted to raise the payouts to the lower tier folks, to increase the minimum payout, like raise the minimum payout from like 12k to 20k or something. I think it was a fine idea to help out the folks who need it most. Won't pass Congress, of course...

And we could easily finance (and re-finance the entire system) it by raising the cap on taxable SS income or raise the tax by like 1/8th of a percent for employers and citizens... it's not rocket science there.

I'd suggest removing the cap on the employer side. That can help deal with the growing income inequality.

The cap needs to be removed period. But since we have waited so long, doing so will only fix the problem for 20 years or so. Taxing income from ESOP's might help, too, especially since so much income in the higher echelons comes from stock options.

Social Security started out as a program to keep people out of poverty when they retire or could no longer work. As companies have dropped retirement plans, it has become the defacto retirement plan for many people, especially at the lower end of the scale. At the higher end, they'll have decent 401K's, etc.

Here's the thing, people treat it as a retirement program. But we shouldn't make it one. If we do, the pressure to privatize it will be great--which would disrupt the entire system.

"Here's the thing, people treat it as a retirement program. But we shouldn't make it one."

So... we should respect it and keep it going forever, but never actually acknowledge what it's doing? Yeah, that's weird. It's much better to just be straightforward about things, rather than concoct easily-falsifiable fictions about what it is that we're doing.

"If we do, the pressure to privatize it will be great--which would disrupt the entire system."

I'm pretty sure that even if everybody in power swore to not say "Social Security is the retirement plan for most Americans," the greedy SOBs that run everything will still notice that SS has a ton of money in it and be salivating at ways to privatize it. You simply can't take bad ideas off the table forever... there are always assholes out there willing to revive every bad idea that's ever been devised.

Here's the thing, people treat it as a retirement program. But we shouldn't make it one.

That horse has already left the barn. Also, SS still does enormous heavy lifting at keeping older Americans out of poverty, so it still very much does what it's intended to do. Finally, incentives matter: it's hardly illegal for people to save money and pay off their mortgage during their working years. I've often called Social Security "FDR's masterpiece"—it does tremendous good, and it's politically very popular. But it isn't meant to be all things to all people, and, while I agree elderly poverty is a problem, in fact our (far) bigger problem is child poverty.

Probably the best thing we could do for less affluent old people is to enact robust, truly universal health insurance so they stand a pretty good chance of reaching their 60s in good shape, able to enjoy their golden years.

"Can;t drive anywhere, can't get any new clothes, pretty cold during the winter and rather hot in the summer, not a lot to eat ... but at least I have my health!"

I don't think the evidence suggests elderly poverty is a huge problem that merits a large increase in resources. Your descriptions of deprivation are much more likely to characterize the non-elderly in America, especially kids. But I do favor tweaking, in targeted fashion, the program's benefits structure. This could be done in relatively affordable fashion, and need not undermine the program's delicate balance (progressive, but far from approaching a classic "welfare" program).

"... Is that enough?"

Not the right question. The government doesn't have unlimited resources. As I understand it old people in general are already better off than young people. Which makes it hard to see why we should transfer more money from young people to old people by increasing taxes on workers to increase benefits for old people.

old people in general are already better off than young people. Which makes it hard to see why we should transfer more money from young people to old people

As a general rule I agee. But there are some inadequacies that could be fairly cheaply fixed, hence my suggestion above. Poverty is indeed less common among the old than the young (one big reason is that the vast majority of them get a guaranteed government-provided income), but it's within our power to virtually eradicate elderly poverty without much extra cost. Also, today's young people will themselves be old, a fact that conservatives curiously never seem to mention.

" Also, today's young people will themselves be old, a fact that conservatives curiously never seem to mention."

No, today's young people won't get old. A 40 year old today will be only 50 when genetically engineered antiaging is availably by 2033 and maybe sooner. A Laboratory at Harvard will begin human trials in 2024 or 2025 under geneticist George Church.

Social Security benefits drop off if retirees make more than ca. $55K, down one dollar for every 2 over the cap--actual cap depends on circumstances. I guess that's partially why payouts level out at higher income levels--they have decent retirement plans, so Social Security payouts drop.

If I understand what you're referring to, these reductions apply only to earned income (essentially W-2 or self-employment income) and only to people who are drawing SS before their "full retirement age." Even then, the reductions stop at full retirement age even if the work continues. There's no effect on benefits at any age from unearned investment income, pensions, annuities, or (oddly, I think) rental income.

Income from non-SS sources *does* affect the percentage of SS benefits that are taxable by the feds-- that maxes out at 85% of benefits included in taxable income.

This is clearly explained. Thanks.

No. The reason that the curve flattens is that it is designed to flatten. The process is a bit complicated, but it is designed to advantage the first dollars of employment earned maximally, so that someone who works their entire life in a low-paying career is not left destitute.

It's "progressive" in both meanings of the word. Here's how it works.

Each year of earnings is first "indexed" according to what is essentially an "inflator" to equalize pay in the year earned with pay in the year that benefits are begun. Right now, the earliest year in the index is 1963 which has an index factor of 14.5099735. So a person who earned $7000 in 1963 (a lot then!) would be credited with $101K in "indexed earnings" for one of their "averaging years" SS then uses the highest 35 indexed values.

Once a worker's averaged indexed income is calculated it is divided by twelve to get average monthly indexed earnings (AIME). Then the worker gets credited with 90% of the first 1,174 dollars of AIME, 32% of the next $5,904 of AIME, and if the AIME is greater than $7,078, fifteen percent of the remainder.

Oh, one thing. When the "cap" was much lower, many people essentially lost a lot of their 15% earnings credit since the cap drew ever closer to the second "bend point" every year, until Congress indexed the cap.

That's the monthly benefit at whatever "Full Retirement Age" for the person is.

Thank you for the explanation.

Society at any point in time has limited resources. The limit increases over time thanks to productivity growth. For the last four decades the already-wealthy have captured almost all of the gains attributable to productivity growth, greatly increasing the inequalities of wealth and income we see today. So much of the increased income went to people already above the cap, and wasn’t subjected to the FICA tax. Had wages of nonsupervisory workers tracked productivity growth, as had been the case in the postwar decades, that income would have mostly been subject to the tax, and the Trust Fund would be able to pay full benefits farther into the future.

Anandakos gave us a good explanation of the progressivity built into Social Security OA benefits. And raoul makes the important point that we need to consider the large number of retired persons who have little or no other income. In every discussion of income or wealth, one needs to look at the stratified data; averages are useless.

The right question, to me as a progressive, is “Can’t a society as wealthy as ours afford to ensure that every individual, young or old, has the necessities of life?”, and the answer is, “Of course we can.”

"The right question, to me as a progressive, is “Can’t a society as wealthy as ours afford to ensure that every individual, young or old, has the necessities of life?”, and the answer is, “Of course we can.”"

Not a lot of people actually starving to death in the US. And do you also support open borders? Kind of hard to eliminate poverty while simultaneously importing millions of poor people every year.

Yes, I think SSRI should be higher (although first I'd increase SSDI and SSI).

But I'd like to point out that just because the median income is $44K, that doesn't mean that the average annual income over the last 35 years for someone who retired at age 67 is $44K. I don't know whether it's higher or lower, but this chart is worse than worthless because it's misinformation.

I'm sure there is a chart out there somewhere on average SSRI benefit paid out, is there not?

Oh hey look, there is! It took literally one google for "what's the average social security retirement income amount":

Social Security offers a monthly benefit check to many kinds of recipients. As of August 2023, the average check is $1,705.79, according to the Social Security Administration – but that amount can differ drastically depending on the type of recipient. In fact, retirees typically make more than the overall average.

Via Bankrate. FWIW, that's less than 21K per year.

The un-indexed average annual income for someone retiring in 2023 would be WAY less than $44 K. That's why income is "indexed" upward by up to 14 times when computing the "average indexed annual (and monthly) income". See above.

I was assuming/implying the indexing when making my point, i.e. just assume all the numbers (e.g., 44K vs. 21K vs. 1705 are all denominated in the same year's dollars).

There are lot of moving parts on how to adjust benefits. Recently, over at LGM, it was mentioned how national wealth has grown eight-fold greatly exceeding the impact of life expectancy change. Also, the impact of Medicare needs to be considered. Really, one cannot be considered without the other. Here is the bottom line, almost half the retired population relies on SSA. That’s just to little. Benefits ought to be increased while also increasing receivables (maybe raise the cap subject to taxation?).

Remove the cap on the EMPLOYER portion, not the employee contributions. That would essentially be a 6.3% tax on an expensive and luxurious part of corporate cost of doing business. And apply the employer portion to more of the "conditional" compensation that drives the C Suite such as option gains.

Yes, benefits should be higher.

We can obviously afford it, we just have to decide if this is the type of massive quality of life improvement we want to invest in. We made expensive, long term investments in blowing people up in Iraq and Afghanistan along with investments in new yachts and porsches for the ultra wealthy and extreme profits for Medicare Advantage executives and obviously nobody discussed these in terms of whether or not we could afford them....because we know that we obviously can, its just a matter of whether or not we prioritize it.

So yes, we should invest in ourselves.

Is this the right thing to do? Yes. Will this gain votes for Democrats? No. It’s probably a loser, because the notion is so ingrained in people that SS won’t be there for them, that they are paying into a system that has no personal benefit, that this will only alienate them further. Since it will necessarily increase the deficit or raise taxes, politically it’s toxic.

‘Ingrained’ of course through decades of conservative propaganda, lowering the expectations of younger cohorts so they won’t resist having SS gutted.

This is a completely backwards take.

We need to improve the safety net for 50 somethings and 60 somethings that had precarious employment especially those that gaps in employment due to major health issues like cancer, accidents, victims of crime etc that caused periods of disability. We load folks up with medical debt, they can't work and then they can't get jobs due to blatant age discrimination/discrimination of folks with major health issues.

This question falls into a large group of Democratic ‘priorities.’ Should the US have:

1. national healthcare

2. a child tax credit

3. a national basic income

4. better unemployment benefits

5. more affordable housing

6. much better public transit

7. new green deal

8. etc

There is a broad bucket of items, many Democrats believe the government should provide/provide at a much higher level. However, the solution to pay for any of these items is strictly redistribution, from the wealthy and large corporations.

Contrast that with countries that actually have broader social benefits, such as western Europe. The primary funding vehicle in most OECD countries is a broad based, VAT, tax. Basically, everyone gets X and everyone pays for X.

Few other OECD countries come near the inequality of income of the U.S. Get back to us when every state’s minimum wage equals or exceeds the local living wage.

The US is slightly higher (15% - 20%), in terms of inequality than say Italy, Spain or Australia. Further, at a political level, the Democratic position is that no American who makes under $400K will see a tax raise: to me, this implies, only the highest earning Americans have a moral obligation to contribute to these vast social needs.

My point, I don't think inequality has significant explanatory value to explain why the US does not have national health care, a new green deal, better unemployment benefits or a basic income. Rather, I think, in our political system its hard to accomplish big things, and the aforementioned concepts have not achieved critical political mass to overcome opposition.

https://worldpopulationreview.com/country-rankings/wealth-inequality-by-country

I think the already-wealthy had a moral obligation to share the last forty years of gains from productivity, instead of grabbing it all for themselves. But since they did, yes, I’m happy to tax a chunk of what they got, to help especially those left farthest behind.

I do agree that there are political obstacles to implementing Democratic priorities.Affordability isn’t an issue.

I've been mulling and seething all day about how to convey my opinion about this nonsense in less than a thousand words.

KenSchulz captures the heart of it. Thanks Ken.

Republicans seemed happy enough to fight the abortion issue to the point that it became an electoral liability nationally. I think they might do the same thing on Social Security, given a chance. 🙂

We’re just doomed. We’re in a war with an enemy and the political class is fiddling with SS benefits. Hilarious.

I don't know a single person who could live on $21,000/year.

Well my parents have a state pension and that coupled with SS means their income went up a bit since retirement. Since most folks lack a pension it probably makes sense to raise it but does it ever annoy me to dedicate even more of the budget to the olds.