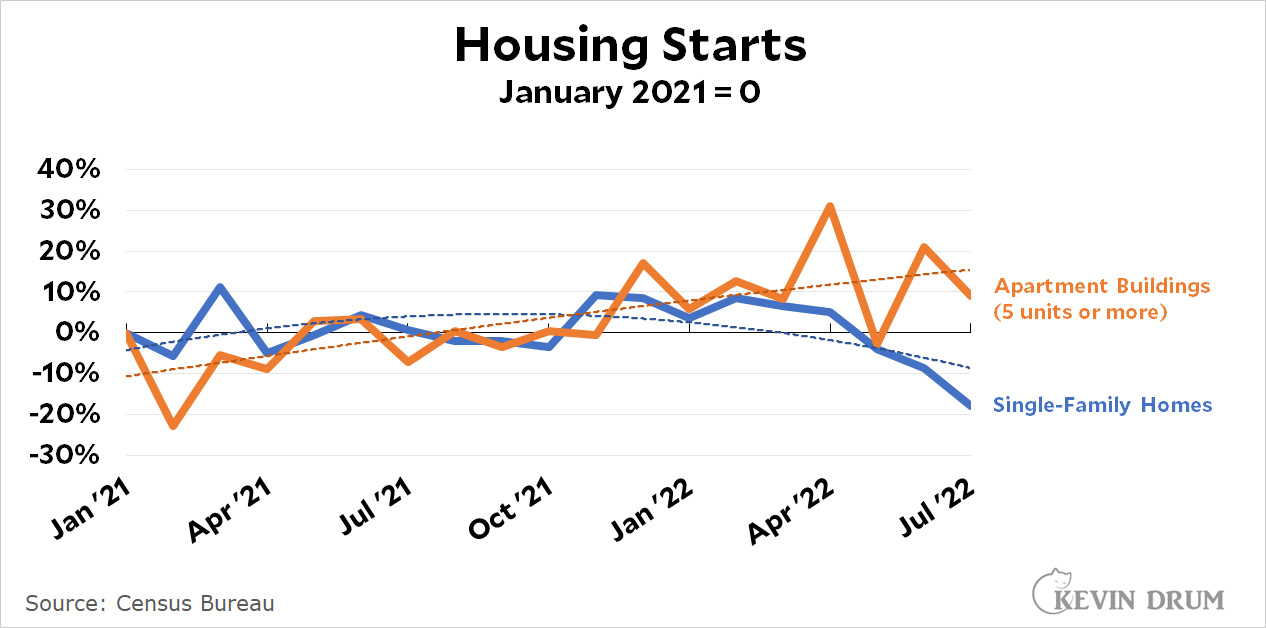

The Census Bureau reported today that housing starts dropped 10% in July. But that's a misleading number all by itself. Here it is broken into single-family homes vs. apartment buildings with five or more units:

Apartment buildings have been on an upward trend for more than a year and are up 3% since the beginning of 2022.

Apartment buildings have been on an upward trend for more than a year and are up 3% since the beginning of 2022.

But single-family homes are a disaster. They've been declining since the end of last year and are down 21% since the beginning of 2022. It's obvious that home builders don't believe the market will continue to maintain its current level of high prices.

In other news, lots of big retailers are now groaning under the weight of inventory they can't sell:

Many retailers that had too little to offer during the early stages of the pandemic now have too much of everything....The resulting pileup of unsold goods forced many big national chains such as Walmart Inc. and Target Corp. to mark down merchandise this year, warning that profits would suffer. Luxury furniture retailer RH and grill maker Weber Inc. pulled their sales forecasts earlier this summer, saying demand had plunged for luxury furniture and outdoor grills. Mattress maker Sleep Number Corp. also began offering additional promotions this year after sales slowed.

After a year of demand outstripping supply, we now have widespread reports of supply outstripping demand. It's hard to see how core inflation can remain high under these conditions.

I have never seen an article about housing costs include this important factor. Land costs. In many metropolitan areas most or all of the easy to build on flatish land has already been built on. Think Levitttown, the San Fernando Valley or Irvine Ranch. Some cities are all built out, like Seattle.

You could repurpose land, like strip malls or dead malls, but that is more expense than vacant land. Hence housing costs go up

And also the old, old joke: "Buy land, they are not making anymore of it."

tigersharktoo - your point is well taken and let me make an addition.

The fees, particularly in California, that municipalities charge to develop raw land have become significant. Beyond the application fee (several hundred thousand dollars for a 200 unit new apartment) we will pay more than $50,000 PER APARTMENT for the right to attach to municipal services such as sewer, electric etc. Further, these fee levels don't vary: the reason folks mostly build high end apartments is driven by the cost structure of land, municipal fees etc.

Prop 13 strikes again!!!

Mixed bag in the WalMart quarterly report issued this morning. Good: Revenue was surprisingly high as were profits (though, again, corporations reap the rewards of inflation at the expense of the working class). Not good: WalMart credited a lot of the revenue gain to a significant increase in the number middle and high income people moving to WalMart (especially for groceries) to combat inflation. And, inventories have grown. Good: WalMart reports increased activity at stores in July and so far in August because of falling gas prices and they are optimistic for the rest of 2022 and 2023.

I notice wheat futures have dropped to the same level as a year ago, wiping out all of the increase because of tight supply acerbated by Russia’s invasion of Ukraine.

Certainly seems like inflation will wane greatly the next 6-12 months without a resulting economic meltdown.

Back to school is more real this year, as is back to the office.

Beef prices will stay high--drought out west. I'm guessing vegetable prices will go up too--at least for those coming from CA.

https://droughtmonitor.unl.edu/

Grains are mainly out of the bad drought areas--which sort of surprised me:

https://ipad.fas.usda.gov/rssiws/al/us_cropprod.aspx

“ I'm guessing vegetable prices will go up too”

Sounds like bad news for Dr. Oz’s crudités tray.

Investors are buying up homes:

https://www.governing.com/now/investors-bought-a-quarter-of-homes-sold-last-year-driving-up-rents

Thanks Trump Tax Cut for the Wealthy!

"It's hard to see how core inflation can remain high under these conditions." It's not hard for the FED. They have a big crystal ball with "INFLATION" painted across the bottom.

Not anymore. Inflation is toast

Let's wait until a few million more people are unemployed before we rush to judgement. Better to be safe than sorry.

Can't see inflation continuing to spike as supply outstrips demand?

Don't worry: the recipients of the largesse of 2017's Tax Cutz n' Jobz Act will find a way.

January 2021 as a starting point is comparing with a time in the midst of the pandemic... I would think that January 2019 would be more appropriate if not an even longer term look.

Builders simply can't find materials and labor right now. We're doing a small renovation project right now and the contractor is running into all manner of delays and hiccups because this or that screw or type of siding or saw blade or something just can't be found or costs 10x what it did last year. You can't invest in building a subdivision and then suddenly have to halt work for two weeks because a roofing manufacturer can't deliver shingles, or the excavating company you hired can't do the job because three of their backhoe drivers quit. Similarly, a lot of the inflation in food prices goes back not just to drought and the Ukraine crisis, but to the fact that growers simply can find the labor needed to harvest and process crops. Biden and Congress could fix a lot of this by passing a major immigration reform act to grant visas and work permits to skilled and unskilled immigrant workers, but of course anything that promotes immigration is DOA with the current Republican party. Plus, once inflation eases, they have nothing to bash Biden with heading into midterms and we couldn't have that now, could we?

Nope. The materials are there, but not demand for the level. Notice that nonbanks are replacing federal reserve banks in terms of new mortgage originations.

More signs of the graying of America. Older folks need apartments more than single family homes. Their days of luxury furniture and outdoor grills are coming to an end.

I'm 66. I don't live in an apartment and don't plan to. My mother recently died at 93 in her own house. Anthills are for ants.

Would like to see rental price stratification in apartment and housing starts. And condo vs. apartment break-down. What percentage are 7-figures plus (not rentals but condos for sure)? What percentage of rentals are within tiers of median income for that ZIP (i.e. X% are 50-75% median monthly income, Y% are 75-100%, Z% are 100-150%, etc.). 20 million new apartments in New York City aren't helpful if their rent is $15,000/month and intended use is residential mailing address only).

To back to 2019.......eh, single family construction is pretty much the same as always.

Wait, this?: https://fred.stlouisfed.org/graph/?g=STBY

IDK, KD. Maybe you need to expand the time series first.