Here's the usual way for a private company to go public:

- Hire an investment bank to manage the process.

- Create a "book" of investors who want to buy shares of stock issued by the company.

- On Der Tag, open for business on the stock exchange of your choice.

The investment bank makes money by charging for its services. The private company makes money by selling shares of stock. Investors hope to make money when the stock opens at a higher price than they paid for the company stock. All nice and tidy—but also sort of a pain in the ass. The company has to write a prospectus and reveal all sorts of private information. Investors have to be rounded up. Quiet periods often prevent the company from normal marketing activities.

Enter the SPAC, aka a "blank check" company. A SPAC is basically just a pile of money, maybe a few billion dollars or so, that's already a public company. Now the process of going public is different:

- The SPAC noses around and finds a private company that looks interesting.

- The SPAC merges with the private company.

- The merged company is now basically the private company + cash + a listing on a stock exchange.

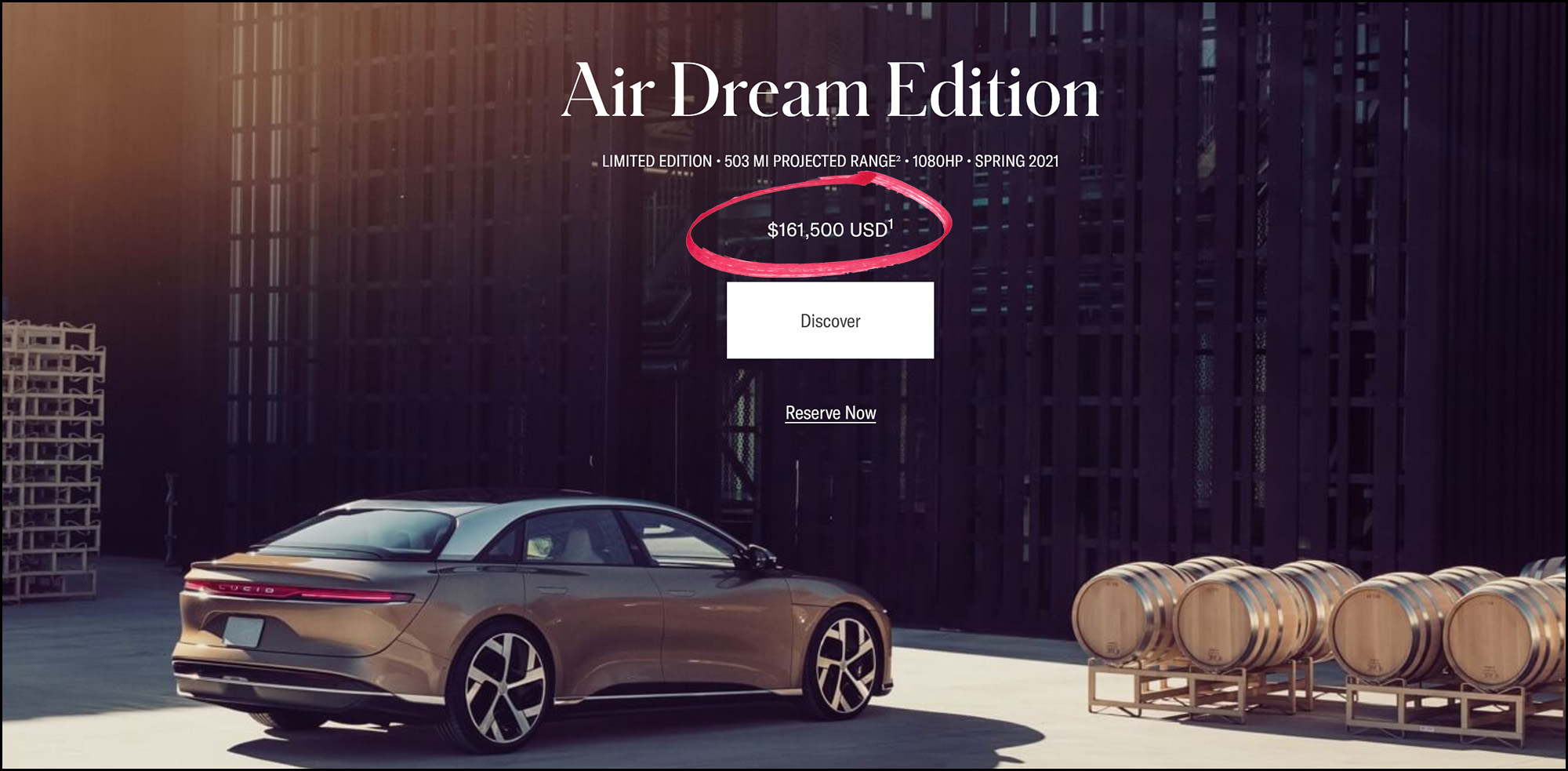

The private company now has access to a big pile of money. SPAC investors make money when the value of the company goes up. And it's all done quietly with none of the nonsense of prospectuses and road trips and worrying about the SEC. It's become a very popular way of taking a company public. Perhaps too popular? Check out the recent story of Lucid Motors:

When news emerged in December that Churchill Capital Corp, a blank-check company with no assets beyond its $2 billion in cash, had made an offer to acquire DirecTV, its stock barely moved. After a report in January that Churchill was in talks to merge with the buzzy electric-vehicle startup Lucid Motors Inc., it was a different story.

....The stock has surged more than 220% since the report last month, the biggest-ever stock increase of a special-purpose acquisition company before announcing a merger, according to SPACinsider.com. Talks between the two companies are continuing, though a deal isn’t imminent, according to people familiar with the matter.

Now, you might be wondering how a "company" that consists of nothing but cash can surge 220%. Cash is cash, and the value of the company is the value of its cash, full stop. What's more, even if Churchill does end up merging with Lucid, it will do so at a (supposedly) fair market price, which means the value of its stock shouldn't change. At most, buzz over the deal might move its stock a few percentage points, but it certainly wouldn't double its value.

The Journal article acknowledges this and attributes it to "the extraordinary appetite among stock-market investors for electric-vehicle startups," but that doesn't really make any sense. Cash is still cash, and it would only be worth twice its value if investors think Churchill is somehow going to merge with Lucid on fantastically favorable terms. But no one thinks that.

So rather than demonstrating the thirst for electric vehicle startups, perhaps this is more a sign that SPAC mania is finally reaching its frothy top. Bewarned.

UPDATE: Want to learn more about the exciting world of SPACs? David Dayen has you covered here.

A good rule of thumb for investing is, if I've heard of it, then it's already hit irrational exuberance stage and it's too late

What haven't you heard of?

😉

I don't think I agree that the value of a corporation with $X in cash is $X. Not if it has a plan. More generally, the value of any corporation is not the same as the book value of its assets because the assets are committed, presumably, to producing something of value that will return profits when sold. The value of a corporation's stock is supposed to be (if the markets are functioning correctly, the present value of its future income stream. If I have $X plus a plan for how I"m going to use it, then the value of that could be greater or less than $X, depending on whether the plan is likely to be profitable or generate losses.

I'm not saying that the response to the electric car acquisition announcement makes any sense--sounds like it doesn't. But it's just a garden-variety irrational market response, nothing out of the ordinary.

these things used to be called blind pools and were the perfect vechicles for scams

Kevin’s bewilderment is due to the difference between ‘investing’ and ‘speculation.’ . The SPAC, all by itself, is just a pile of money that has zero upside aside from its potential to use the money to acquire a company that lacks money but has a big upside. People speculate on electric transportation companies because there is a huge potential upside, like there was for, say, Amazon when it went public. Most electric car companies won’t become Amazon, and many will not survive, but one or two may well be big winners in the future. So investors in a SPAC are simply betting that the SPAC will become an electric car company with a huge potential upside - one that may see exponentially higher stock prices that make no sense if viewed as traditional ‘investments.’ See Tesla for details.

I work for a small company and there is definitely an angle to this related to cutting out the investment bank middleman. Right now, there is a huge amount of investment capital looking for a home in a lot of the tech sectors, and there is a lot of upside to a company to remain mostly unified and also take on a lot of cash for a planned expenditure. It's a buyer's market for capital, so well-run small companies feel like they can take the whip hand in SPACs.

In an environment where it's hard to find investors, investment banks play an important role securing commitments for an IPO, and they also take a pretty big chunk of the change by privileging the pre-IPO prices to themselves and their friends. That proposition might be worth it if you think that securing capital is a big challenge, but for a lot of tech the current environment isn't really like that. The investment is itself the product, and the SPACs are basically paying a premium so that they can convince 10X Genomics to give them a great stock price and then immediately go public so they can turn it around fast.