I'm glad to see that I'm not the only one who sees things this way:

Stubbornly high inflation has Wall Street worried that the Federal Reserve will respond by raising interest rates until the United States tumbles into recession, taking the weakening global economy with it.

The Fed and other central banks are tightening credit to fight historically high inflation even as three of the world’s main economic engines — the United States, Europe and China — are sputtering.

....“I don’t really get the sense that many or any central banks are paying huge attention to how their policies are affecting the rest of the world,” said Maurice Obstfeld of the University of California at Berkeley, the former chief economist of the International Monetary Fund.

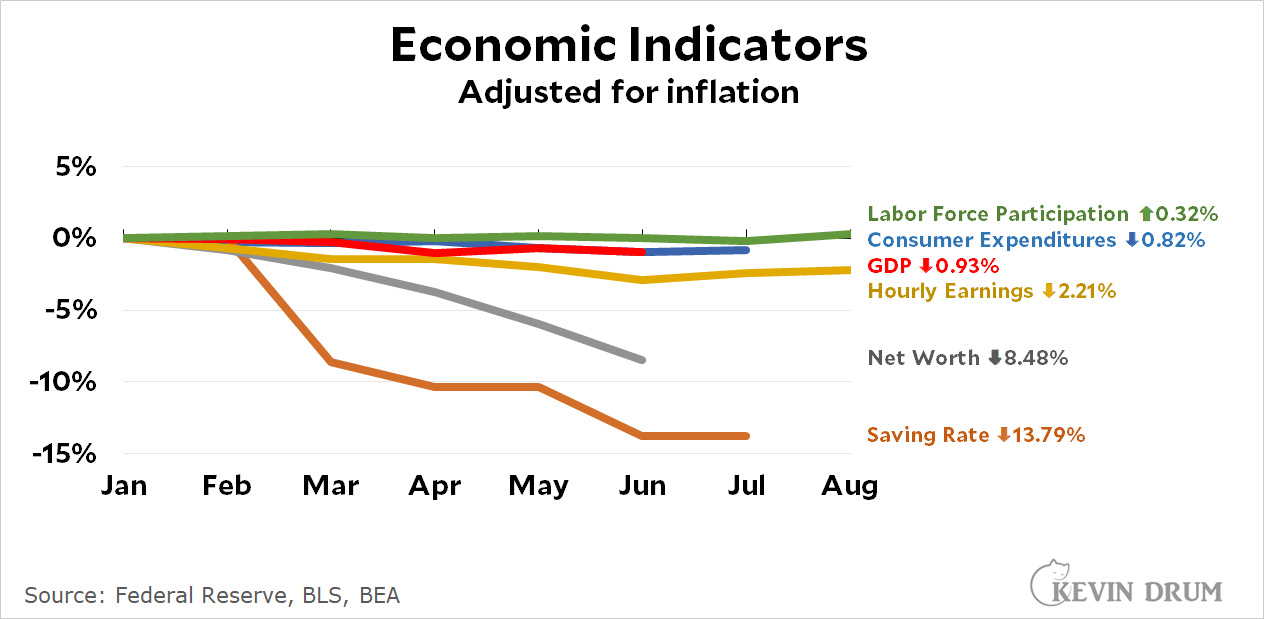

Here's a quick summary of the US economy since the start of 2022:

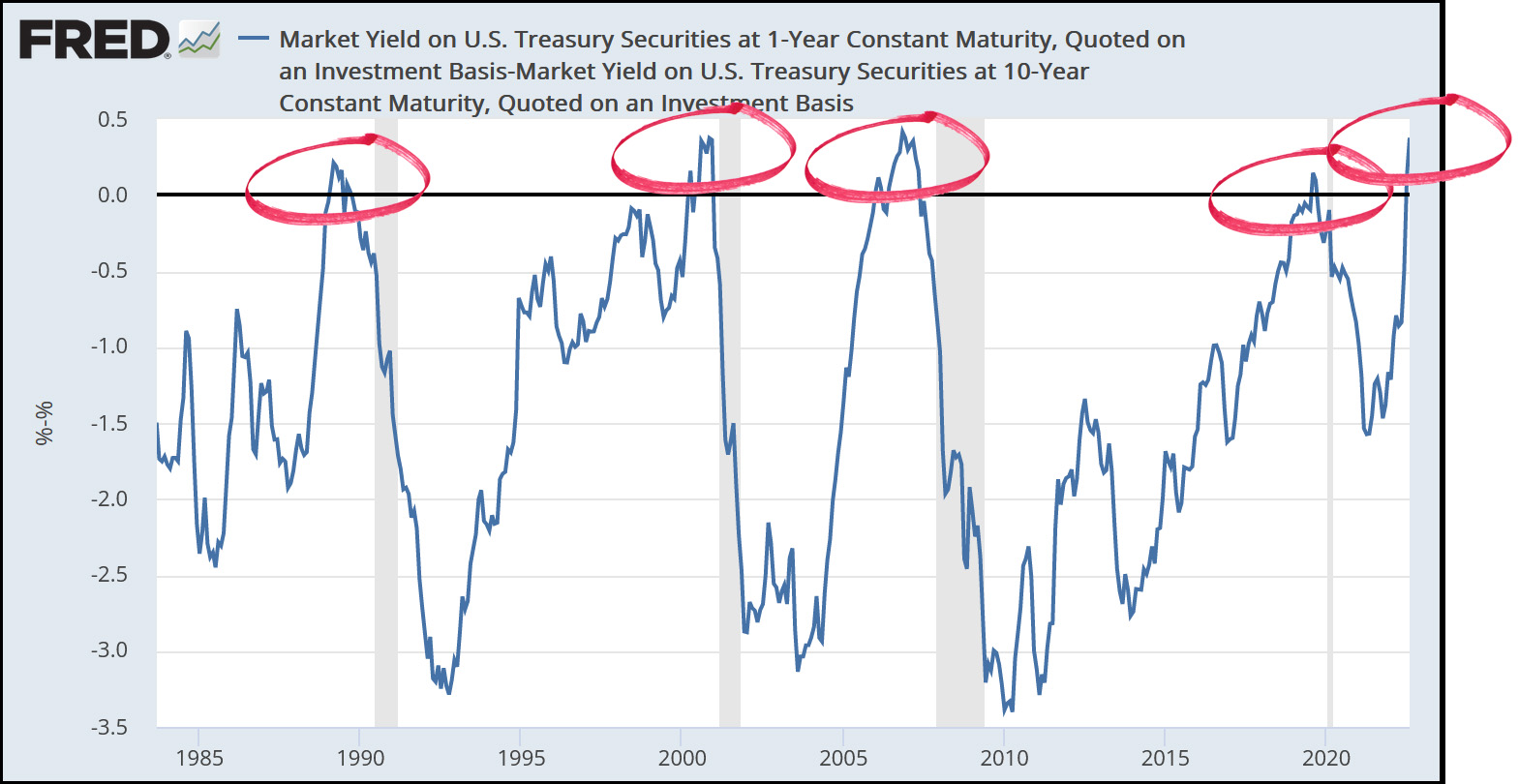

Labor force participation is up slightly, but everything else is down. And have I mentioned that the yield curve inverted a month ago?

Labor force participation is up slightly, but everything else is down. And have I mentioned that the yield curve inverted a month ago?

The global economy is not booming or overheated. It's in rickety shape, and right now it needs help. It's already started to roll down a hill on its own and the last thing it needs a big push to get it barreling over everything in its path.

The global economy is not booming or overheated. It's in rickety shape, and right now it needs help. It's already started to roll down a hill on its own and the last thing it needs a big push to get it barreling over everything in its path.

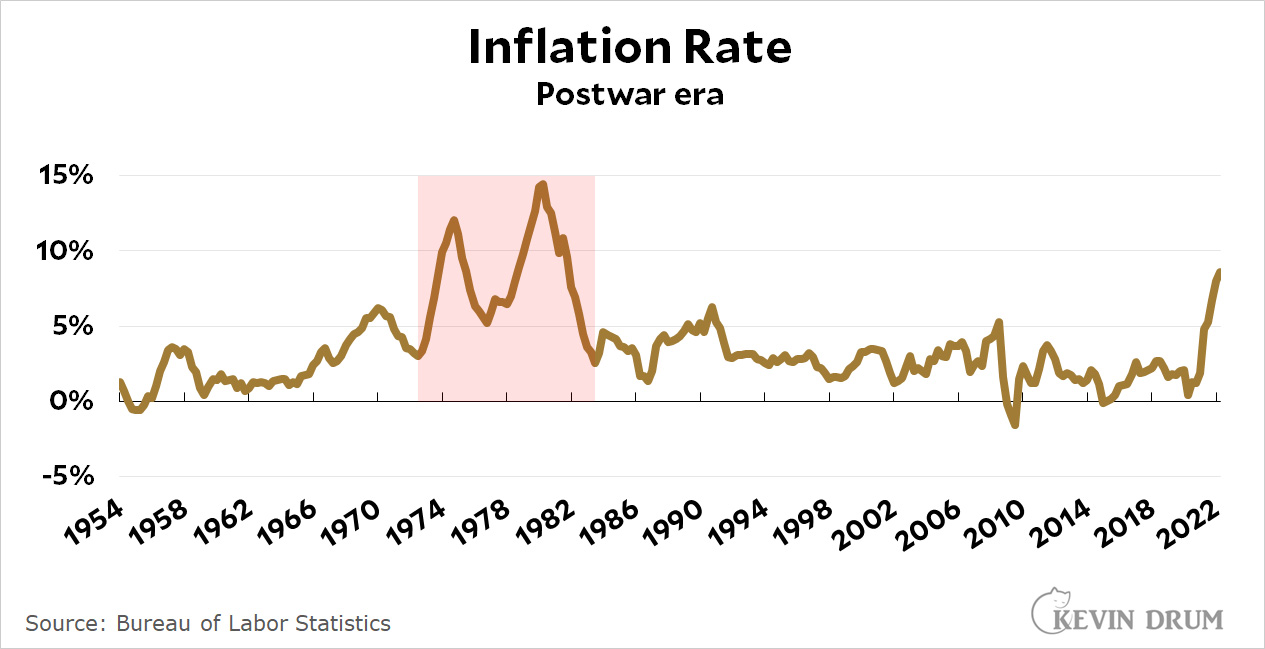

And one other thing. Larry Summers says that no one really understands inflation, and at least in the modern US context he's right. In fact, it's worse than that. Take a look at this long-term chart showing the inflation rate over the 70 years since the end of Korean War:

In this entire period there has been only one major inflationary episode aside from our current one: 1973-83. We know what caused that one, and we know—or think we know—that big interest rate increases and a sharp recession were the only cure.

In this entire period there has been only one major inflationary episode aside from our current one: 1973-83. We know what caused that one, and we know—or think we know—that big interest rate increases and a sharp recession were the only cure.

But that's it: In the US for the past 70 years, we have n=1. And even that single n is nothing like our current situation, which was fundamentally caused by a global pandemic and its effect on supply chains and business lockdowns. We don't have any experience at all to tell us the best response to this, so instead we're doing what we always do: looking back at the '70s and panicking that it's happening all over again. Don't do what Richard Nixon and Arthur Burns did! It took Paul Volcker to fix that!

But we're not doing that. This time around there's no Nixon, no Burns, and no circumstances even remotely like the one they created. But we're putting out the call for the Volcker playbook anyway. Why? A little humility would go a long way right now.

POSTSCRIPT: John Maynard Keynes allegedly warned that "The market can remain irrational longer than you can remain solvent." He was talking about asset bubbles, but the same idea is true of other things. Team Transitory originally thought that our current round of inflation would last a few months, and when it kept going beyond that they gave up and decided we must be replaying the '70s.

I doubt it. I just think that things like inflationary episodes (and pandemics) can last longer than you think. This is why I remain stubbornly on Team Transitory. At most the Fed should be slowly and calmly raising interest rates. At best they should probably be doing nothing while we wait to get a better idea of how everything is going to play out. After all, inflation is already subsiding before anything they've done has had any effect, and I'll bet it will continue to. But watch out for 2023 when all those interest rate hikes suddenly kick in just when we don't need them.

Maybe Biden remaining strictly hands off with the Fed is not really the best idea for a democracy.

Yellen is a big supporter of 325 bps. They may want a pause after this hike. They have been fast and outside oer lags, inflation has stopped.

I normally don't bother to comment if I agree (because I lean a-hole), but I think Kevin's exactly right. We have an uneven pandemic recovery, and high energy prices courtesy of Putin. No one knows how these things are going to play out, or how long to expect their effects to last.

But knocking the economy into a recession doesn't seem particularly useful to block the effects of either of these situations.

Core inflation is at 6% annualized rate the last six months. It is trending lower. Prior rate increases are still feeling their way through the market. As stated, the only high inflationary period the last 50 years was aided by huge increases in oil prices. The current situation no doubt was also aided by high oil costs but those have come down significantly. Continuing on the current rate path is simply not supported by data. Also, while 6% inflation is nothing to sneer at, it is still within a reasonable number so there is no reason to overreact. I read somewhere that the last 20 years have really being a deflationary period all things considered (inflation and rates have equaled 2%- meaning costs have basically remained stagnant) and the present is just catching up- if that’s the case, then we really need to allow the readjustments to work their way through and not let government interventionary policies muck things up. What the Fed is doing feels the opposite of the invisible hand of the market.

If Jerome Powell is in the shower, and finds it just a bit too warm, does he shut off the hot water and open the ‘Cold’ tap full?

Don't kinkshame.

The economy is already dead. Putin will drop a nuke or two as his military is humiliated and destroyed and then the gas / oil markets will seize up.

Or not… hope I’m wrong.

NATO fell for the Putin Trap. He can do anything. Commit any war crime. All because cowards are afraid of ICBM raining down upon them. Good grief.

There is no better use of the US military today than to kill Russians… or die trying.

Putin killed your economy. Doesn’t that piss you off?

No, I think the Rwandans, Serbs, & Burmese proved that, & with a shout out to then-premier of Gujurat State Narendra Modi & Aleksander Lukashenko.

Thanks for the view from your mother’s basement. Does she have a bomb shelter down there too when you start WWIII?

"There is no better use of the US military today than to kill Russians"

And here I thought Gen George S, Patton had died..... smh

More seriously, the same issue that arises in the shower holds with FOMC moves on interest rates — the response lag is uncertain. Maybe the Fed hasn’t tightened enough, or maybe it has tightened enough, or too much, already, but the effects have not yet shown up in the numbers that economists have to work with.

Right. The old answer is likely not a good one, and no one knows what would be better.

I wonder, though, if some of the old conventional thinking is still being neglected. What if Jerome Powell hints that a little more fiscal tightening by the United States government might take some of the pressure off the Federal Reserve to fix inflation? That is, how about another, more effective Inflation Reduction Act? How about dropping some tariffs, too?

Not before the midterms, of course.

Dropping tariffs is irrelevant. They are being bypassed. There is no inflation since June.

Inflation benefits debtors at the expense of creditors (because debts get repaid in less-valuable-dollars). Since the rich are the lenders, and the poor the borrowers, our oligarch-run society would rather destroy the economy than shift any power or wealth to the debtor class.

It isn't really about "lessons overlearned from the 70s"

Yes, and the unemployment pain is somebody else's problem...

Inflation is dead. Deflation coming Fed or no Fed. I think Fed funds rate at 325bps is no biggie.

Bringing the Fed rate up initially was a good thing--bursting some bubbles, e.g. crypto. Having the Fed rate ca. 2% should be fine. The current level is doing its job. Pushing it to 3% will lead to a recession. Above that, a very rocky landing....

What recent events have shown is that we do not have a very robust system. Everyone seems have convinced themselves that they don't have to have any inventory, nor excess capacity to be able to ramp production up if needed. Not tons of excess, just something. Alas, the lesson learned is that poor planning means price jumps and record profits....

Wrong.

So.

Net worth is down substantially

Savings rate is down substantially

Hourly earnings are down > than 2%

SPending is down <1%

So were is all this going?

On credit cards:

https://www.lendingtree.com/credit-cards/credit-card-debt-statistics/

{snip}

Americans’ total credit card balance is $887 billion in the second quarter of 2022, according to the latest consumer debt data from the Federal Reserve Bank of New York. That’s a $46 billion jump from $841 billion in the first quarter of 2022.

Since the second quarter of 2021, credit card balances have risen by $100 billion. That’s a 13% increase, the largest year-over-year jump in more than 20 years.{snip}

This is NON mortgage debt

Now we may be paying that back using inflation affected dollars

But that rate of credit rise cannot be sustained

Ordinary Americans are very loose with their spending

But inflation-adjusted spending is down, slightly. We’re not madly buying everything in sight, we’re just paying more to buy the same stuff we bought last year. And putting it on the credit card, apparently.

August exgas was .7 adjusted for inflation and core sales have shown growth this year.

Ken

So, we're already paying MORE than last year for the same items

And putting it on credit cards that have higher interest rates than last year.

If you pay cash for everything then you are paying using inflated dollars

But if you are using credit the whammy gets doubled. Higher prices paid with higher interest credit cards - completely negating the inflated dollar "advantage".

This is where the "cycle" has to stop.

At most the Fed should be slowly and calmly raising interest rates.

They are calmly slowly and calmly raising rates. You're the one who's panicking, Kevin. If the data continue to improve, the period of rising rates will come to an end.

Over a 4 month period (March to July) we saw the most rapid increase in the Fed funds rate since the 1970s. If the Fed continues with a large increase at the next meeting as is expected, it will surpass the rate of change seen in the 70s.

If you measure the change as a proportion of the existing rates before the increases began, this episode is by far the most rapid increase ever.

Describing the 1st or 2nd fastest increase ever as slow and calm is simply inaccurate.

You have to remember, Jaspy lives in China, where the day to day value of the Renminbi is determined by the position of Xi's morning constitutional on the Bristol Stool Chart.

So, by comparison, he thinks the US Fed Reserve is measured.

Are they like some Chinese spy or something?

+1

LOL.

“If the data continue to improve”

Wages are down, GDP is down, savings are down, net worth is down! These trends are not ‘improving’!

If you want JP to cut it out, then you need to get on Biden's case to quietly give Ukraine ATACMs, M1 Abrams, F16s, Warthogs, and have him force Israel to export Iron Dome to Ukraine, so that the war can end before winter.

I agree!

Just how quickly do you think someone can become proficient flying an F-16 in combat? Or Warthogs for that matter?

is probably why Ukrainians are training on virtual systems so that the crossover is easy and fast.

References for the Ukrainians training virtually fir any of those aircraft?

Time magazine: https://bityl.co/ETHB

Team Transitory as a political position (despite being entirely wrong about inflation not transmitting beyond the volitiles over one year now), arguing to replicate the errors of the 1970s central banks and government reaction.

Nope. Inflation is done. Will another ex-oer month finally get it through your skull???? Inflation rose 2.1% in the 4th quarter of 2021. That is a 2% yry decline and oer likely is in decline. The yry decline then may be 3%+.

Stop telling a story Loud. Your getting annoying with lies.

"Killing the economy" is the point. Business wants a labor surplus and will do anything to get it.

Looking at that picture of Aileen Cannon I suddenly realized who she looks like,

she looks like the governess in Turn of the Screw.

Kevin is hopeless. The trajectory of inflation is very similar the the 74 - 80 path, but he dismisses it because it doesn't have the same causative agent (Nixon/Burns). We have already seen multiple instances of Kevin cherry picking, where, in a spread of data, he looks for elements that help his case. Now it's the reverse (!) where troublesome data from the past is ignored because it - necessarily! - arose in different circumstances.

If you fall off a balcony or are hit by a car, the treatment for broken bones is the same, even though how you got there is wildly different. (I hade using analogies, but have to in order to make this point obvious to even the dim-witted.)

If you want to get into the details, you could argue that both 1974 - 1980 and 2021 - ? are the result of too much money pumped into the system. The first, was Nixon for political purposes. The second, a response to a global pandemic. So there.

But what really bothers me isn't his attempts at statistical legerdemain. It's his refusal to acknowledge that *right now* poor people are feeling the brunt of inflation. I know some of them and they are very distressed. Those with real assets will see their worth mostly intact. Some losses, but nothing like what a poor person - who only has cash - is experiencing.

Incredible lack of compassion.

Except, your wrong. Right now poor people are feeling the brunt of disinflation. Your lagging and it shows. How do we know??? Poor people are telling us.

The cause of any effect or symptoms seems pretty important when devising a solution. Paying attention to the cause when determining a solution isn't as ridiculous as you make it out to be.

Your analogy stinks because blunt force trauma caused both cases of broken bones....the cause is exactly the same. If the broken bone was due to osteoporosis or cancer, the doctor would lose his license if he refused to consider these causes.

Again I ask, show your work. Was ‘too much money pumped into the system’, net of the business revenues and workers’ wages lost to the pandemic and its countermeasures?

Lower- and middle-quantile wage-earners will also be hit harder by increases in unemployment as interest rates rise. Is it better that a smaller number lose their whole income, than that everyone loses some purchasing power?

Except unemployment may not rise.

In order for unemployment to rise substantially the "recession" will have to be deeper.

There are more people LEAVING the workforce now than are entering it.

Birthrates have been drifting down for decades. We are almost at negative population growth.

Immigration will soon turn into another regret the republicans will have (besides Roe being overturned). There are far too many people who are now willing to let immigration expand due to labor shortages.

I DO BELIEVE the FED can act a little less excessively with the proposed interest rate hike.

I'd rather see 25 instead of 75 this time around - but I certainly don't make those decisions

Republicans are pouring people over the borders. We only capture a small share. Why you fall for the immigration scam,Questionable post.

One of the charts reads “Postwar era” and starts in … 1954. The better part of a decade past the end of WWII. Shirley the “Postwar era” begins in 1946? The article text mentions the Korean War. Perhaps the chart should match.

No surprise, but immigration increased after Trump became president. Not only did it increase, but wage growth stopped for men. So called "refugees" are irrelevant. It's a invented statistic by government decree. You can say or in terms Trump Administration pov, ignore people.

The ignorant morons on this board are idiots. There ain't no labor shortage, but a refusal to pay the asking price in wages. Whether a large or small corporation. Whether a large or small noncorp business. The pandemic related retirements and labor cost associated with it spiked. It's slowly returning to precovid, but it will take years.

Interesting chart in this article

take note of Fig 2 showing birthrate

https://www.prb.org/resources/why-is-the-u-s-birth-rate-declining/

The labor situation will get worse if the economy stays in it's current job creation "mode". Those who were born in 1957 are now at 65 years old. According to that chart THAT was peak birth rate years!!!

It will only get worse

Raising interest rates sharply is only going to curb spending on everything that's *not* causing inflation right now, while leaving people to grapple with inelastic demand for the stuff that is, namely food prices. So what's going to happen when some construction worker is out of a job because the housing market has tanked, but still has to put food on the table? Food prices are remaining high because of drought, bird flu, and high transportation costs. The Fed can't fix that. But, as Kevin shows, it sure can make it a lot worse if it continues to obsess over inflation as if it's the 70s.

"And one other thing. Larry Summers says that no one really understands inflation, and at least in the modern US context he's right. In fact, it's worse than that."

And since Larry Summer also says we need to up the unemployment rate to 10 percent to bring down inflation, I've stop listening to what Larry Summers says, so have most policy makers and so should you. He's just another economist, no worse no better and he has opinions. Wonderful. So does the average barfly.

Slow and steady rate increases, nothing alarming or drastic should be the way to go to get the rate down to a politically acceptable 4-5 percent. Inflation was too low for too long. Now hopefully it can get back to a settled norm that works for everyone.

Look at the downward bend on that net worth line. It's even worse for billionaires. That's what the Fed bases its decisions on.

The 1970s inflation came when the Saudis raised oil prices. In response to those high prices for oil, Americans started drilling more. When the Saudis lost market share, they crashed the oil prices attempting to bankrupt the Americans. End of high inflation.

The way to end the current high inflation is more investment in supply.